Comprehensive Machinery Insurance for Your Business in 2025

Key Takeaways

- Machinery and Equipment Insurance covers the risks associated with the business's essential assets and protects them against breakdown, theft, and accidental damage.

- Insurance contracts may include Machinery Breakdown Insurance, Public Liability Insurance, and Business Interruption Insurance.

- VIM Cover offers convenient, reasonably priced solutions designed to fit your specific needs and business operations.

- So why not get in touch with us today for a quote? You can obtain quotes from licensed insurance brokers such as VIM Cover.

Machines are more than just metal and bolts in a business that is going well. They are the rhythm that keeps productivity alive. The loud excavators on construction sites or the forklifts steadily moving goods through warehouses: every piece of equipment is a tale of accuracy, might, and advancement. But what if that rhythm, suddenly, stopped?

An unexpected breakdown or accident can bring your whole operation to a halt, causing you to miss deadlines, incur costs, and leave you stressed. In this case, machine insurance is your business partner, quietly working in the background. It is the layer of security around the tools that are the core of the business.

As industries head into 2025 with more intelligent, connected machines, the risks have changed as well. Faulty machine parts or accidental damage can lead to the machine not working for some time, financial loss, and the loss of the chance to do business with someone.

We here at this guide want to show you the way VIM Cover’s insurance products can protect your business, help you keep productivity, and make it possible for you to plan for the future with confidence no matter if you face any challenges.

Why Machinery Insurance is Essential for Business Owners

It's quite a challenge to operate a business that is dependent on machinery. These, from forklifts to Bobcats, are essentially the backbone of your business's daily operations. If any of them were to suddenly break down, be damaged in an accident, or if there were an unexpected property damage, it could stop your productivity and cause you to lose money for a considerable period of time. This is where machine insurance comes into play, providing the business owner with the financial security and peace of mind they need.

Simply put, Machinery and Equipment Insurance is a type of insurance that covers a business's most valuable assets, its machinery and equipment, against the risks of damage, theft, and operational downtime. It gives your business a firm hand when facing repair or replacement costs, allowing it to keep going as usual even when challenges arise. It is more important than ever to have the right cover, as the construction and industrial sectors are changing so rapidly.

What is Machinery and Equipment Insurance?

Machinery and Equipment Insurance (or Machinery Breakdown Insurance) is a plan that relieves the worries of those who use a diverse range of tools and machines across different sectors. If you are the manager of heavy machinery and are interested in obtaining mobile plant and equipment insurance, or if you operate scissor lifts, the primary purpose is to protect your business from costly interruptions.

Such a policy provides comprehensive coverage options designed to minimise your business risks coverage for both the owners of the machinery and those with dry hire insurance. It also includes third-party protection in the event of property damage or personal injury caused by machine operation. Most business leaders view it not only as an expense but also as a strategic move to protect their businesses against unforeseen losses.

The main features are:

- Protection in the event of accidental damage, breakdown, or theft

- Downtime Cover to be able to continue business activities in case of interruptions

- Choices for replacement value or market value settlements

- Policies can be adjusted to meet the needs of a small business and owner-operators.

Key Benefits for Business Owners

One way to keep a business going smoothly is to have machine insurance. In difficult times, it will ensure there are no interruptions to your operations. It is also a strong signal that you are taking risk management seriously. This is something that clients and contractors are increasingly appreciating.

It works like that for business owners:

- It stops financial loss: Pays for unexpected machinery breakdown insurance events.

- It is a source of business activities: The policy with options designed for you can keep your projects on track.

- It is a shield for your business assets—from skid steers to heavy equipment—covering them under one equipment insurance policy.

- Tailored insurance solutions: Cover your tools of trade and machinery with one flexible plan.

Machine and Equipment Insurance is the source of the certainty that you can focus on getting more business instead of worrying about risks if you are running either a construction firm or a logistics company.

Understanding the Types of Machinery Insurance Policies

Every enterprise is different when it comes to operational risks. For this reason, VIM Cover offers adjustable cover options that reflect the risks you face. By adding Public Liability Insurance to Professional Indemnity Insurance, you can feel that your safety is fully ensured and have fewer worries.

Cover Options for Specific Needs

There are several different cover options, e.g. those listed below:

- Public liability cover: A protection layer that helps third-party claims caused by the injury of a person or property damage.

- Dry hire insurance: The best choice for contractors who need heavy equipment, such as a crane or an excavator, and decide to rent it.

- Business Interruption Insurance: The policy that is associated with, and therefore, the only logical companion of, equipment failure. The insured is paid to cover all income losses that result from the occurrence.

- Machinery Breakdown Insurance: It provides coverage when a machine is not functioning due to mechanical or electrical parts, whether it is a standard machine or a specially designed one.

These insurance contracts are designed to meet the needs of businesses across the construction, agriculture, and manufacturing sectors while providing a reasonable balance between costs and protection.

Policy Documents and Flexible Options

While going through policy documents, it is essential to factor in the insurance cost, level of cover and your overall insurance needs. VIM Cover understands that businesses operate differently, and therefore, we offer Flexible payment options and Competitive pricing for all machinery policies.

We can tailor your plant and equipment insurance policy to include:

- Downtime Cover for loss of income during repairs

- Choice of market value or replacement value settlement

- Options to add Business Interruption Insurance or Public Liability Insurance

- Support for compliance through the Financial Services Guide

By this arrangement, every machinery insurance policy is like a perfect match for your business activities, ranging from construction to logistics and more.

How to Choose the Right Machinery Insurance Policy

Choosing the right insurance can be staggering with lots of providers and tricky terms. First, evaluate your machinery type, business operations, and the likelihood of a risk event. The insurance price will vary depending on factors such as the use, type of cover, and the level of cover selected.

Get the correct and detailed advice from specialised Insurance Professionals who have a thorough knowledge of the Australian insurance markets. They will lead you through:

- Assessing the condition and the value of your machinery

- Figuring out whether replacement value or market value is more suitable for your case

- Matching coverage with your business requirements

With VIM Cover, you can access your policy documents, see transparent pricing, and receive clear direction, all backed by our supportive team and client-first approach.

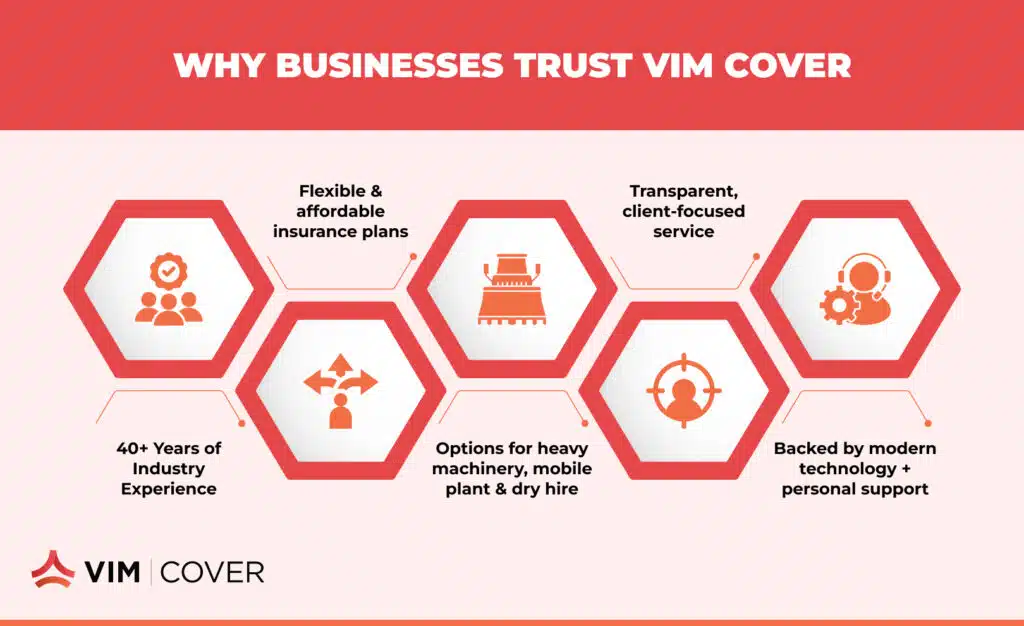

Why Trust VIM Cover for Your Machinery Insurance?

VIM Cover has been known for its reliability and honesty in the Australian insurance markets for more than 40 years, with a combined industry experience. Our team of experts is always ready to offer the best solutions to Owner Operators and small business owners, helping them handle insurance challenges on their own in no time.

We have:

- Flexible equipment insurance cover choices

- Individually tailored plans according to the requirements and business assets

- Access to Machinery Breakdown Insurance, mobile plant and equipment insurance, and dry hire insurance

- A pledge to safeguard your business through authentic, client-centred service

Modern technology, along with personal attention at VIM Cover, is the perfect combination to provide you with comprehensive coverage options designed to minimise your business risks, which should be your focus on growth rather than risk.

Find the Right Cover for Your Machinery Insurance in 2025

Having the appropriate equipment insurance cover is what separates a fast recovery from a loss that keeps you for a long time. Do not put your business in a risky situation. Cooperate with experts who understand the value of your business.

At VIM Cover, you can request an insurance quote, view policy documents, and select the best policy options for your business.

You can obtain a quote here. Our policies are designed to reduce downtime risks and support compliance with Australian business insurance requirements.

FAQs

1. What kind of damages are covered by Machinery and Equipment Insurance?

It covers rescuing situations when your mechanical devices, such as heavy equipment and tools of the trade, break down, are stolen, or are accidentally damaged.

2. Is Public Liability Insurance available in a machinery policy?

Yes, it may be coupled with a machinery policy to provide a safety net against third-party injury claims or property damage.

3. The question of the acquisition of Machinery Breakdown Insurance is raised.

Such a policy is necessary only for businesses that are heavily dependent on working machines. In particular, the construction industry and the transport sectors.

4. What are the reasons to pick up VIM Cover?

It is due to our excellent client service, professional advice, and dedication to comprehensive coverage options designed to minimise your business risks that make us a reliable partner across Australia.

The information provided is of a general nature and does not take into account your objectives, financial situation, or needs. You should consider whether it is appropriate for your circumstances and read the relevant Product Disclosure Statement (PDS) before deciding.

How to Get a Commercial Property Insurance Quote in 2025

Key Takeaways

- You can obtain quotes from licensed insurance brokers such as VIM Cover

- VIM Cover offers a range of insurance options designed to meet diverse business needs.

- A commercial property insurance quote helps maintain the safety of your business premises and the things that are valuable to you.

- Firstly, check your cover, Policy Wording, and sum insured thoroughly before making a purchase.

In 2025, the commercial insurance area is still changing due to brand-new property risks, digital tools, and the increasing complexity of business operations. Today, obtaining a commercial property insurance quote is more than just comparing prices. It is about ensuring the policy effectively protects your assets, is financially feasible for you, and aligns with your business goals.

It doesn't matter whether you are a property investor, a retailer, or a manufacturing company; knowing how to secure the right Commercial Property Insurance coverage is essential for your mental well-being and financial stability. We will figure out how to get you a quote that fits your exact needs and, at the same time, ensure your business is safe from unforeseen losses.

What Is Commercial Property Insurance?

Commercial Property Insurance is designed to safeguard your commercial building, its contents, and related assets from unforeseen events that could lead to financial losses. It typically includes insurance cover for incidents such as accidental damage, theft, storm damage, and water damage, ensuring your property and business operations are not disrupted.

For business owners, this insurance acts as a financial shield. Beyond protecting the office building or commercial premises, it may include compensation for business interruption cover, loss of rental income, or expenses required to repair or replace damaged assets.

Understanding Commercial Property Insurance Cover

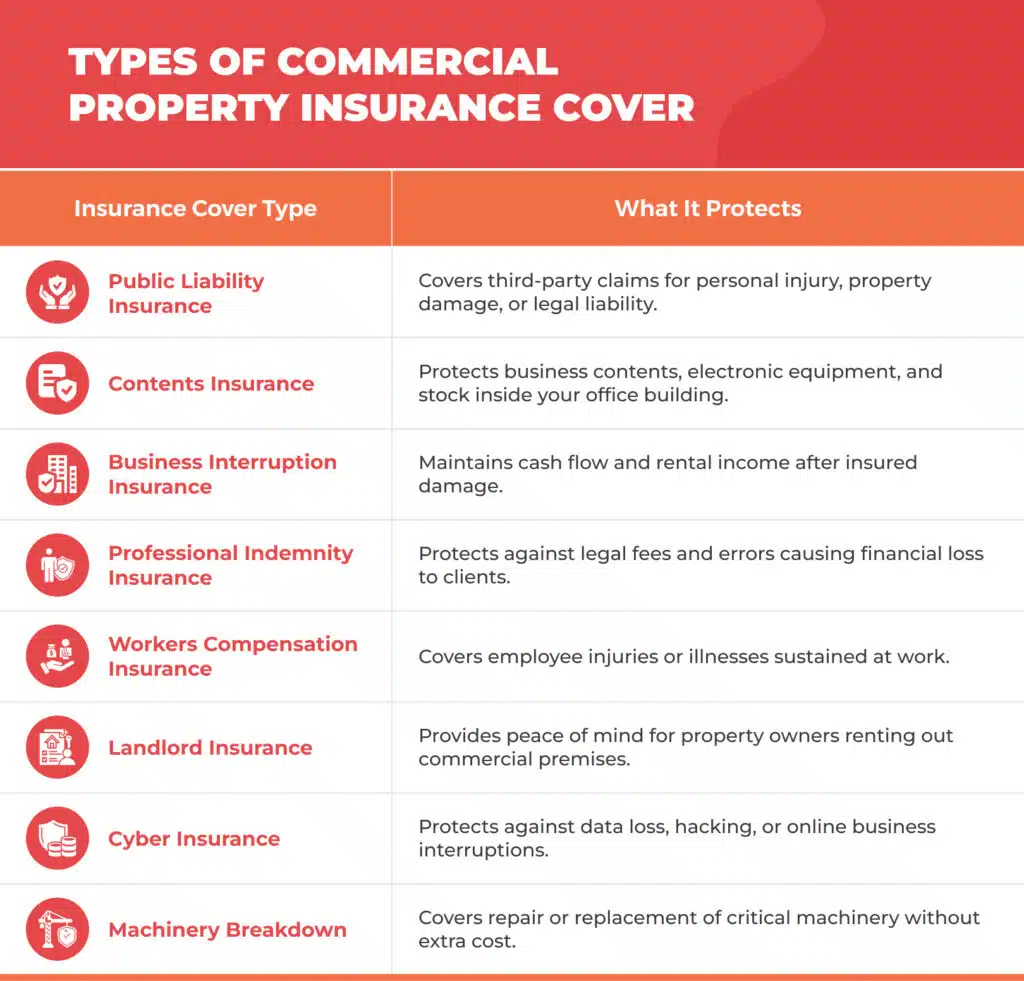

An effectively designed business insurance plan offers safeguards across various risk categories. Your insurance package may consist of:

- Public Liability Insurance – Covers the cost of a third-party claim resulting from personal injury, property damage, or legal liability due to your operations.

- Contents Insurance – Covers the business contents, electronic equipment, and other movable assets in your business premises.

- Business Interruption Insurance – It is a type of insurance that helps maintain cash flow when operations are temporarily halted due to a covered event.

- Professional Indemnity Insurance – This is a must for professionals who provide advice or services, and it covers them against legal fees and negligence claims.

- Workers' Compensation Insurance – It is the insurance that pays for employee injuries or illnesses caused by work and complies with the law's requirements.

Certain insurers also offer optional cover for Machinery Breakdown, Cyber Insurance, and landlord insurance. These additions not only broaden the coverage of your Business Insurance pack but also let you feel safe when handling possible interruptions.

Why Business Owners Need It

Having a commercial building is like inviting a series of property risks - fire and vandalism, as well as natural disasters and accidental damage. Just one incident without adequate protection can put your finances under severe pressure and may even disrupt your cash flow.

With a customised policy, Business Insurance is a great tool for business owners to get back on their feet quickly, keep their operations running, and still make a profit in the event of a contingency. Additionally, the coverage package includes a liability shield that protects against lawsuits from the general public, customers, or contractors. In this way, you not only ensure your professional reputation but also the continuity of your business.

How to Request a Commercial Property Insurance Quote

In the year 2025, if you want to get a precise commercial property insurance quote, you will need to have the correct information, be clear and know what level of cover you require. Present-day insurers provide both online quote systems and personalised consultations with a business insurance specialist.

Steps to Get Started

How to start the work:

- Clearly define your business and describe your primary business activities

- Perform a survey of your business premises describing the place, its size, and its intended use.

- Calculate the replacement cost and sum insured for your property and assets.

- Make a list of cover options that you require and possible optional covers that you may want (e.g., Theft cover, Public Liability cover, or business interruption insurance).

With such information at hand, you can contact trustworthy insurance providers. Vim Cover, for instance, provides an online quote form and an option to request a callback if you need personalised assistance.

Essential Information to Prepare

To get a detailed business insurance quote, you will have to provide:

- Details about the property of your commercial building or office building

- The policy documents of the current coverage (if there are any)

- Information on business vehicles, motor vehicles, or the use of commercial vehicles

- Claims history and risk management practices

- Approximate rental income and the business contents and electronic equipment details, if any

It is always a good practice to review the Product Disclosure Statement, Policy Wording, and Terms & Conditions related to your policy before confirming it. These documents describe the exclusions, the legal liability limits, and your policy schedule, thereby providing transparency and complying with the insurer's requirements.

Features of a Comprehensive Business Insurance Policy

Coverage Options Included

A comprehensive Business Insurance policy will typically cover a combination of different protection areas, including:

- Public Liability Insurance cover for third-party as well as Public & Products Liability claims

- Contents Insurance provides cover for property and electronic equipment

- Business interruption insurance offers the essential ongoing cash flow support

- Cover against storm damage, glass breakage, as well as accidental damage

Additional Cover for Enhanced Protection

Contemporary insurance companies are aware that customers require tailor-made solutions. You can upgrade your insurance plan by adding:

- Workers' Compensation Insurance to cover the welfare of employees

- Professional Indemnity Insurance to cover the risks associated with client-facing activities

- Cyber Insurance to cover the occurrence of data breaches or damage to the system

- Boat Insurance or Life Insurance to provide a more comprehensive portfolio protection

These optional components constitute a fully-fledged Business Insurance Pack that can be adjusted to your particular requirements and provides you with an extended period of peace of mind.

Comparing Commercial Property Insurance Quotes

When comparing policies from different insurers, focus on the level of cover, exclusions, and claim support, not just price. Be watchful of:

- Policy Wording, terms and conditions, and extent of cover

- Replacement cost and sum insured figures

- Any additional charges for tailor-made cover options

Expert advice from Business Insurance Specialists will assist you in understanding the small print, being in accordance with the rules, and making the process of the claim efficient in case you need to file one.

Why Choose VIM Cover for Your Business Insurance in 2025

VIM Cover is a licensed Insurance broker that business owners, sole traders, and small business insurance customers can depend on. With its comprehensive understanding of risk management and property damage claims, the company can offer you a tailored business insurance policy solution that matches your business needs.

The company's customer support team is always willing to help you with policy selection, renewal, and paperwork, providing support along the way. In case you are looking for a cover for your Commercial Property Insurance, Public Liability Insurance, or Workers Compensation Insurance, VIM Cover would be your partner in securing affordable protection that would genuinely give you peace of mind.

Property damage or an unpredicted claim should not be the reason that your business is disrupted. Obtain a personalised Commercial Property Insurance quote from VIM Cover now to ensure you are adequately covered. Note: Insurance cover is subject to underwriting approval and policy terms and conditions.

Get Your Free Quote Today. Contact our Business Insurance Specialists to find out the cover options that best fit your business.

FAQs

1. What are the components of a commercial property insurance quote?

The quote provides estimates for the coverage of your structure, its contents, and your liability protection. The estimates are based on your property's risk profile.

2. Is there a way to cut down the cost of my business insurance?

Keeping a spotless record of claims, enhancing security, and seeking cost-saving changes from Business Insurance Specialists will help you reduce your insurance premiums.

3. Is it possible to combine property and vehicle insurance?

Sure. Many insurers offer packages that combine commercial vehicle, Car, and property coverage.

4. What is the procedure in place for the claims?

The steps include submitting an insurance claim form, providing proof of loss, and collaborating with your insurer to promptly evaluate and resolve the claim.