Comprehensive Food Truck Insurance for 2026

Discover unparalleled protection for your food truck insurance needs with VIM Cover’s comprehensive food truck insurance policies. Designed for Australian truck owners, our policies ensure affordability and reliability, keeping you secure on every journey. We offer a rapid quote for approved applicants. Please fill out the form below to receive a fast quote.

Key Takeaways on Food Truck Insurance

- Food trucks face double exposure: road accidents + customer liability.

- A single food poisoning claim can cost thousands in legal fees.

- Equipment breakdowns or food spoilage can stop operations overnight.

- Tailored insurance helps protect cash flow and keeps you compliant.

- VIM Cover offers customised policies with fast claims support.

Food trucks face risks beyond the kitchen. A road accident can damage your vehicle and equipment, spoiled stock can wipe out profits, and legal fees can be incurred in cases of food poisoning or other allergies. Unlike restaurants, food trucks are exposed to both road mishaps and other safety liabilities. These uncertainties make it essential to have a more business-focused and personalised insurance, which allows you to run your business with minimal worry. The right cover not only protects your cash flow and keeps you compliant but also ensures your mobile business stays open after an unexpected setback.

Why Food Truck Insurance is Crucial for Your Business?

Unlike a fixed restaurant, your food truck is both your motor vehicle and your business premises, meaning you carry double the exposure on the road and in service. That's why the right food truck insurance isn't optional; it's essential. Also, it's equally important to have the right type of insurance that matches your business and its running.

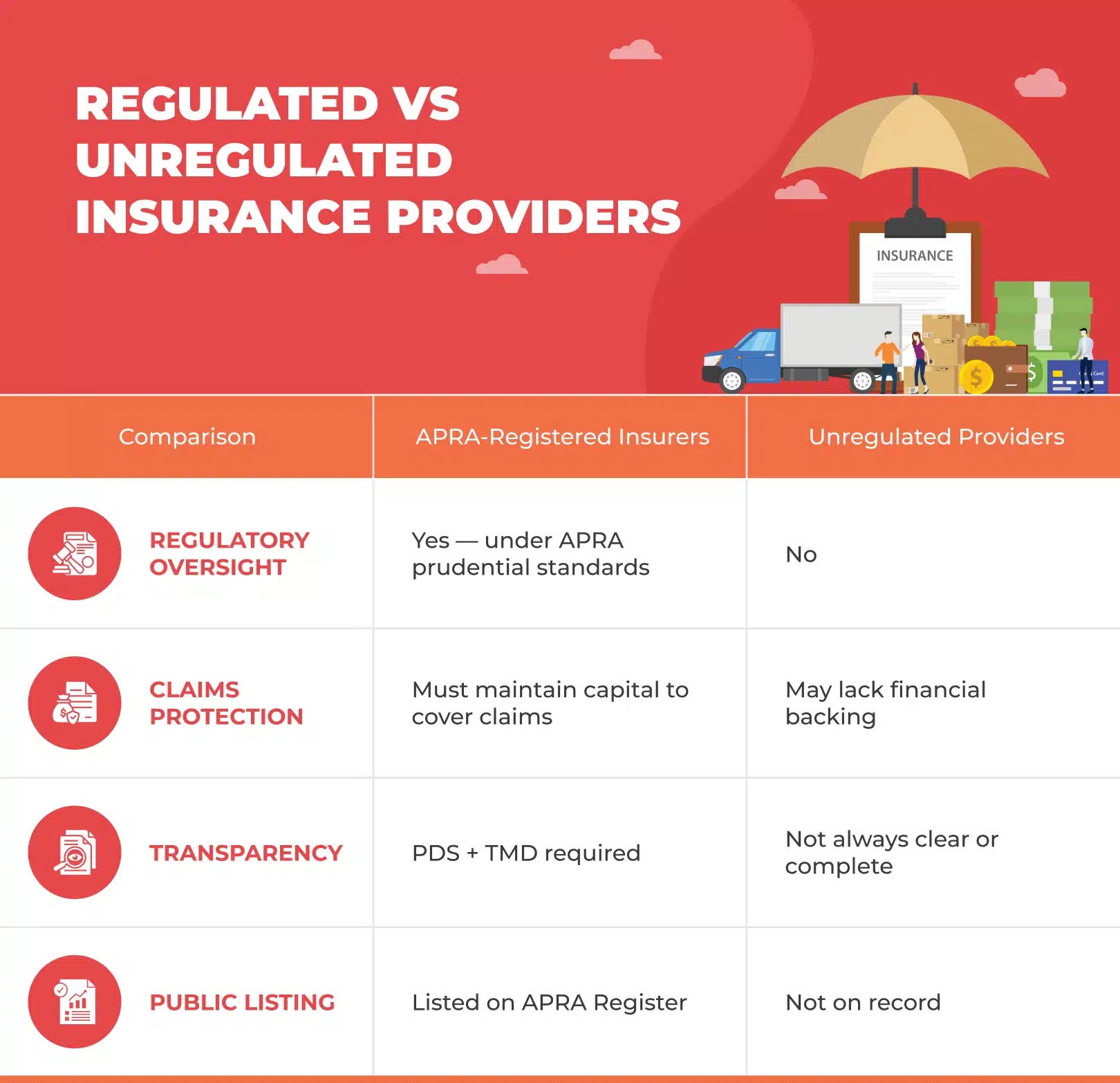

For operators, it’s worth noting that insurers in Australia must meet regulatory standards set by APRA (Australian Prudential Regulation Authority), ensuring you’re dealing with a licensed and compliant provider. This gives food truck owners confidence that their policy is backed by a regulated and trustworthy insurance company.

Unique Risks Food Trucks Face

It includes:

- Accidental damage - This includes vehicle damage, such as a minor prang, or even if a vehicle is written off, including accidental damage to cooking equipment, which prevents any immediate service.

- Food poisoning & personal injury – Costly legal claims can arise due to foodborne illness or a slip near your service window.

- Food spoilage & equipment breakdown – If your fridge fails overnight or your generator cuts out at a festival, spoiled stock is money lost.

- Legal liability – Every public interaction, from parking in crowded areas to serving hot food, exposes you to potential compensation claims.

- Optional covers – Extra protection, such as cash flow cover, can keep bills paid if downtime stops you from trading.

How Insurance Protects Operators?

Let's understand some of the standard insurances:

- Personal accident & workers' compensation covers truck owners and their staff in case of mishaps, which include burns, cuts, or other injuries sustained while at work.

- Medical expenses & legal costs – In case a customer sues over injury or illness, your business insurance policy can handle the hospital bills and lawyer fees.

- Insurance claim support – A good provider ensures that claims for insured events, such as theft, breakdowns, or accidents, are processed quickly, thereby reducing downtime.

- Peace of mind for operators – With cover in place, food truck owners can focus on what matters most: serving customers and growing the mobile business without the constant worry of "what if."

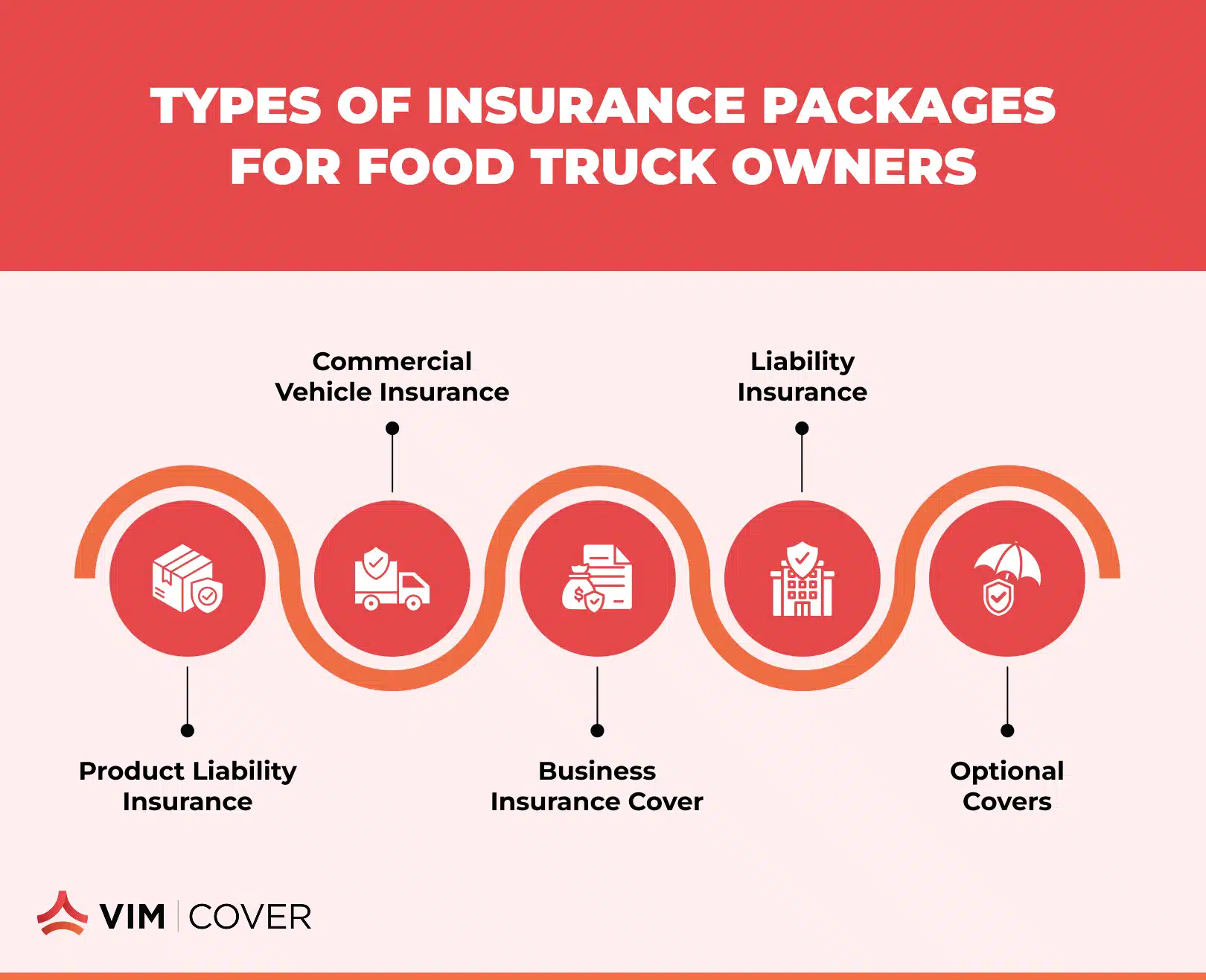

Types of Insurance Packages for Food Truck Owners

Product liability insurance protects against claims of:

- food poisoning

- allergic reactions

- Covering legal fees and compensation.

Commercial vehicle insurance covers:

- the truck itself,

- repairs after accidental damage,

- fit-out and cooking equipment inside.

Business insurance cover extends to:

- stock, cash

- portable equipment

- losses from theft, fire, or food spoilage.

Liability insurance protects against:

- Legal costs if a customer or third party suffers personal injury

- Property damage during the course of business activities.

Optional covers, such as equipment breakdown or downtime protection, help:

- stabilise income when generators fail

- fridges stop working

- You are unable to operate due to an insured event.

It's advisable to read and understand policy wordings and Product Disclosure Statements before signing up for any particular insurance cover to avoid claim issues.

How VIM Cover Provides Superior Insurance Solutions?

We understand that no two mobile food trucks are alike and have specific business needs. Irrespective of whether you run a coffee van, a gourmet burger truck, or a multi-vehicle fleet, customisable insurance packages allow you to pick and choose the level of accidental loss you would like to cover. We offer a rapid quote for approved applicants. Please fill out the form below to receive a fast quote.

Unlike one-size-fits-all insurance providers, we work through experienced insurance brokers who focus on understanding your day-to-day risks. Based on your business operations, we suggest that you opt for comprehensive cover that extends to business premises, staff, and broader business activities. Our flexible cover options let you choose the best for your business.

What sets us apart from many insurance companies is our fast and transparent claims process. Food truck operators don't have time for paperwork delays; their streamlined approach ensures you're back on the road as quickly as possible. The policy terms are written to reflect the realities of mobile businesses, avoiding unnecessary coverage and reducing higher premiums that other providers often charge.

Protect Your Mobile Food Business with the Right Coverage

A tailored business insurance quote from VIM Cover ensures you only pay for what truly matters — no unnecessary extras, just the right cover for the risks your food truck faces daily. Policies are designed around your actual operations, whether you run a coffee van with portable generators, a gourmet burger truck with high-value cooking equipment, or a fleet serving significant events.

Coverage can extend to:

- Breakdowns & spoilage – protection when fridges, freezers, or generators fail.

- Liability claims – cover for food poisoning, personal injury, or property damage caused during service.

- Business interruption – income support when an insured event forces you to stop trading.

By securing a plan built for your business model, you safeguard cash flow, meet legal liability requirements, and keep your mobile business operational with minimal disruption. Protection is not just compliance; it's a guarantee that you can stay on the road and serve customers with peace of mind.

FAQs About Food Truck Insurance with VIM Cover

- Does food truck insurance cover both the vehicle and kitchen equipment?

Yes. With VIM Cover, policies can bundle commercial vehicle insurance with coverage for cooking equipment, refrigeration, and fit-outs, ensuring your entire mobile setup is protected under one plan.

- What happens if food spoilage occurs due to a power failure?

Food spoilage caused by equipment breakdown or power outages can be included in your policy. VIM Cover helps you recover costs so your cash flow isn't disrupted.

- Can I insure multiple food trucks under one policy?

Absolutely. VIM Cover offers fleet policies for operators with multiple trucks, making it easier and often more affordable to manage insurance for your mobile business.

- How does VIM Cover handle claims for food poisoning incidents?

If a customer files a claim for food poisoning or personal injury, your liability coverage will take effect. VIM Cover ensures a transparent and fast claims process, minimising downtime and legal costs.

- Are there flexible insurance options if I only operate seasonally?

Yes. VIM Cover can tailor cover options for seasonal food truck operators, so you're only paying for the protection you need when your business is active.

**This article provides general information only and does not take into account your specific circumstances. You should seek advice from a licensed insurance professional before making decisions.

Comprehensive Commercial Truck Insurance Guide for 2026

Key Takeaways about Commercial Truck Insurance

- Protects business vehicles and drivers from major risks.

- Covers accidents, liability, downtime, and natural disasters.

- Flexible options: comprehensive, third-party, and add-ons.

- Extra cover: life, property, transit, and roadside support.

- VIM Cover delivers fast quotes and tailored solutions.

Running trucks for business isn’t simple. Breakdowns, accidents, and even weather events can affect businesses and their operations, often causing delays in deliveries and other regular activities. It also leads to a lot of back-and-forth to get things on track. That’s why having commercial truck insurance is more than just meeting a requirement on paper; it’s about protecting your people, your trucks, and your cash flow.

At VIM Cover, we work with businesses across Australia to make sure they’re not left exposed. The right cover means fewer worries and a faster recovery when things don’t go as planned.

Why Commercial Truck Insurance Matters?

Protecting Business Operations

If your trucks are on the road for business purposes, you’re carrying risk every kilometre. Good cover ensures:

- Business vehicles are protected if damaged or written off.

- Truck drivers and owner-operators can work with peace of mind.

- Major risks like accidental damage, public liability, or third-party property damage don’t turn into major financial losses.

Key Benefits of the Right Coverage

A firm insurance policy does more than replace a damaged truck. It helps your business stay steady when unexpected costs hit.

- Financial protection – Keeps your cash flow intact when repair or replacement bills arrive.

- Risk coverage – From natural disasters to accidents involving dangerous goods.

- Downtime cover – Helps with income loss if a truck is off the road.

- Business continuity – Support during claims so your operations don’t stall.

Types of Commercial Insurance for Trucking Businesses

Core Options

- Comprehensive or complete insurance – Covers physical damage, accidental damage, and total loss.

- Third Party Property Damage – Protects against damage claims from others.

- Roadside assistance – Reduces costly delays if a truck breaks down.

- Prime mover cover – Designed for high-value vehicles critical to freight.

Add-Ons and Extras

Depending on your setup, you may also need:

- Life insurance for owner-operators.

- Property insurance for depots or warehouses.

- Marine cargo insurance if your transport extends offshore.

- Custom options based on carrying capacity and mixed personal use.

How to Choose the Right Commercial Truck Insurance Policy for Your Business Needs

Step 1: Match Commercial Truck Insurance Cover to Your Business Activities

Think about:

- The risks in your line of work (long-haul, dangerous goods, interstate freight).

- What’s already included in your policy documents?

- Your driving history and financial situation both affect premiums.

Step 2: Pick a Reliable Insurance Provider

Not all insurance companies cover the requirements of truck insurance. Before you decide:

- Compare truck insurance quotes across providers.

- Look for insurers with experience in transport and strong claims support.

- Ask for clear Target Market Determination (TMD) documents to ensure the policy is designed for businesses like yours.

How Commercial Truck Insurance Protects Your Business

Comprehensive Risk Management Solutions

The right commercial truck insurance is a key component of innovative risk management. It:

- Shields you from compensation claims and third-party liability.

- Covers accidental damage or total loss.

- Keeps operations running with superior claims service and access to replacements.

- Provides tailored solutions so you don’t pay for cover you don’t need.

Compliance and Business Continuity

Insurance is about protection while your trucks are on the go, as well as staying compliant with state laws and avoiding unwanted losses. Policies that meet Target Market Determination guidelines and address specific business needs help keep you aligned with state regulations. This reduces legal risks while ensuring your trucks have the right insurance cover.

Why Partner with VIM Cover? Your Right Commercial Truck Insurance Partner

We specialize in policies that work for real businesses, not cookie-cutter solutions, and our insurance covers ensure adequate liability coverage for your trucks tailored to their specific needs. We help you:

- Find cover that fits your business use and vehicle types.

- Add extras like downtime cover or roadside assistance when needed.

- Get a truck insurance quote in just 60 minutes for eligible applicants. That means in case of emergencies, when you require the right coverage or comprehensive insurance for your truck, we are here to assist you.

- Rely on a team that supports you through the claims process.

Many business owners also wonder, Are business vehicles more expensive to insure? The answer depends on factors such as vehicle type, usage, and risk profile, which can significantly impact insurance costs.

We offer customised commercial truck insurance policies, flexible cover options, and, for approved applicants, a fast 60-minute quote service to keep your business moving without downtime.

FAQs – Commercial Truck Insurance with VIM Cover

Q: How quickly can I get a truck insurance quote with VIM Cover?

We know time matters in business. That’s why VIM Cover offers a rapid turnaround on most truck insurance quotes, so you’re not stuck waiting.

Q: Does VIM Cover provide cover for dangerous goods?

Yes. Our policies can be tailored for the transportation of dangerous goods, ensuring you stay protected while meeting compliance requirements.

Q: Can I insure a mixed fleet under one policy?

Absolutely. Whether you run prime movers, delivery vans, or light trucks, we can customise cover for a wide range of vehicle types and carrying capacities under a single policy.

Q: What if my truck breaks down or is off the road?

We offer downtime coverage and roadside assistance options, helping to reduce income loss and keep your business operations steady during unexpected repairs.

Q: Does VIM Cover only provide truck insurance?

No. Alongside comprehensive truck insurance, we also offer a range of additional products, including business insurance, property insurance, public liability insurance, and transit insurance, to provide you with complete protection for your business and personal needs.

Q: Why choose VIM Cover over other insurance providers?

Unlike generic insurance companies, we focus on the trucking industry. That means tailored advice for the type of insurance based on your requirements, flexible extras, fast quotes, and hands-on customer support during the claims process.

**This article provides general information only and does not take into account your specific circumstances. You should seek advice from a licensed insurance professional before making decisions.

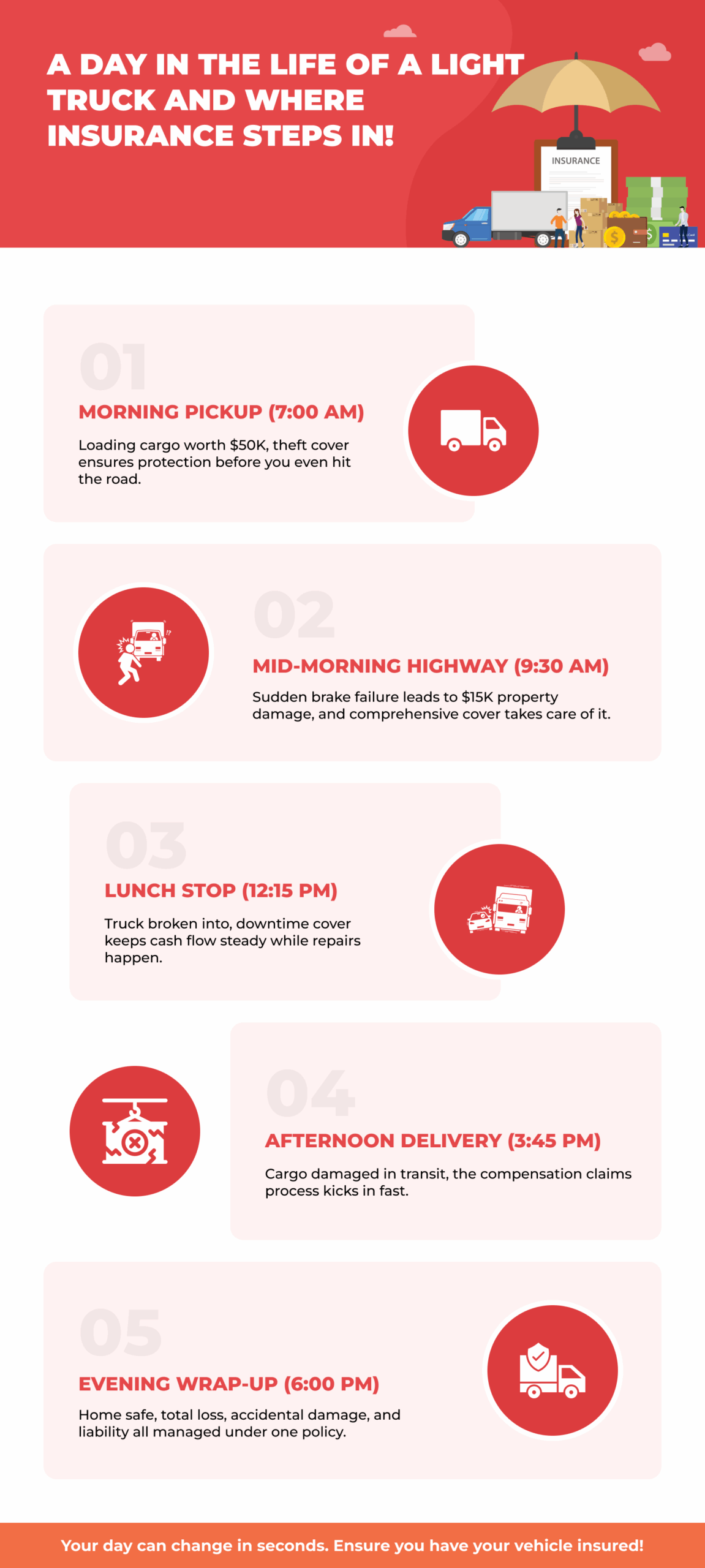

Comprehensive Light Truck Insurance Guide for 2026

At VIM Cover, we understand that every light truck operator has different needs, whether you’re moving goods across town, running a fleet of goods-carrying vehicles, or transporting dangerous goods. That’s why we offer customised light truck insurance policies, flexible cover options, and, for approved applicants, a fast 60-minute quote service to keep your business moving without downtime.

Key Takeaways:

- Light truck insurance is essential for goods-carrying vehicles up to 4.5 tonnes GVM, protecting against theft, damage, liability, and downtime losses.

- VIM Cover offers customised policies with optional add-ons like downtime cover, transit insurance, and dangerous goods protection.

- The right policy offers peace of mind with vehicle coverage, theft protection, accident liability, and business continuity support.

- Understanding your vehicle type, cargo value, and business operations is key to selecting the right level of coverage.

- VIM Cover’s 60-minute quote service ensures fast, tailored insurance solutions for businesses of all sizes.

- Bundling your truck insurance with life, travel, or home insurance can enhance your protection strategy.

- Opting for a provider like VIM Cover, known for transparency and strong support, can improve your claims experience.

What Is Light Truck Insurance?

Light truck insurance is designed for goods-carrying vehicles with a specific carrying capacity, which is often up to 4.5 tonnes GVM and can be personalised for business use or personal purposes. It protects you from accidental damage, theft, property damage to other people’s property, and even total loss of your vehicle.

For businesses, this type of cover isn’t just a compliance tick; it’s a safeguard that keeps business vehicles on the road and earning a stable income (in case of any mishap), even after an insured event.

Understanding Light Trucks and Insurance Needs

Light trucks are versatile workhorses (as they call it) that range from delivery vans to small tippers, and their insurance needs vary from heavy commercial trucks. Policies are built to reflect:

- The carrying capacity and type of vehicle.

- Frequency and nature of business activities.

- Whether they carry dangerous goods, operate as mobile plant, or are used for mixed personal and business purposes.

An effective truck insurance policy ensures you’re covered for real-world risks, not just what’s written on paper.

Key Features of Light Truck Insurance

A strong, comprehensive truck insurance policy can include:

- Comprehensive cover for your vehicle and your property.

- Theft cover and accidental loss protection.

- Downtime cover to support your cash flow while your truck is off the road.

- Compensation claims for personal injury or damage caused to others.

The level of cover you choose will determine how well you’re protected when it matters most.

Why Businesses Need Light Truck Insurance?

Supporting Business Vehicles and Operations

For transport operators and owners of goods-carrying vehicles, light truck insurance is more than a formality. It’s essential for keeping operations running, especially when dealing with dangerous goods or time-sensitive and/or perishable goods delivery.

During an insured event, having the right cover can help with repair costs, replacements, and even provide a temporary hire vehicle to keep jobs moving.

Small Business Insurance Benefits

Many insurers offer small business insurance packages that combine comprehensive coverage for trucks with other insurance products. These can be customised for:

- Specialised freight

- Mobile plant transport

- High-value goods

- Multi-vehicle fleets

It’s not just about protection, it’s about peace of mind for owners and employees.

Choosing the Right Light Truck Insurance Policy

Factors to Consider

Before selecting a truck insurance policy, weigh your:

- Type of vehicle and carrying capacity.

- Driving history and risk profile.

- Level of cover, including downtime cover and comprehensive coverage.

- Specific clauses in the Policy Wording and relevant Product Disclosure Statement.

Working with Insurance Brokers and Providers

An experienced insurance broker can help you clearly understand the aspects of the insurance, cut through the jargon, compare cover options, and match you with an insurance provider that fits your financial situation and specific needs. Choose providers with a clear Target Market Determination and responsive customer support to guide you through the claims process.

Additional Insurance Products to Consider

For businesses looking to protect more than just their trucks, pairing your commercial motor cover with other insurance products can strengthen your safety net:

- Home insurance – To protect personal property from damage or theft.

- Travel Insurance – For business or personal trips involving valuable goods.

- Boat Insurance – For commercial or personal watercraft.

- Life Insurance – Ensures financial stability for your family or business partners if the unexpected happens.

- Transit insurance – Covers goods in transit from pickup to delivery.

Ready to protect your business?

Get a customised VIM Cover light truck insurance quote in under *60 minutes. Speak to our team today for personalised cover recommendations.

Protecting Your Business with the Right Cover

The right policy cushions your business from costly disruptions and keeps operations running smoothly. It’s about matching insurance to the real risks you face, not paying for what you don’t need.

- Downtime cover to offset income loss during repairs

- Protection for high-value or sensitive cargo

- Add-ons for dangerous goods and mobile plant

- Policy terms that fit your vehicle type and workload

Learn more about how to get a truck insurance quote in 2026.

Why Choose VIM Cover for Light Truck Insurance?

When it comes to protecting your business vehicles, you need more than just a standard policy; you need a partner who understands the risks and challenges you face every day.

VIM Cover offers:

- Comprehensive truck insurance for a wide range of vehicle types and carrying capacities.

- Flexible extras like downtime cover, transit insurance, and customised policy wording for your specific needs.

- A proactive and responsive customer support.

- Our 60-minute turnaround for quotes for qualifying applicants.

Schedule an appointment with us today!

FAQs – Light Truck Insurance

Q: Can I get a light truck insurance quote quickly with VIM Cover?

Yes. In certain circumstances, VIM Cover offers a 60-minute rapid quote service so you can get insured without delays.

Q: Does VIM Cover offer cover for dangerous goods or mobile plant vehicles?

Absolutely. Our truck insurance policies can be tailored for dangerous goods, mobile plant, and other specialised uses.

Q: What makes VIM Cover different from other insurance providers?

We combine comprehensive coverage with personal service, flexible policy design, and fast turnaround times, all while ensuring your specific needs are met.

Q: Can I bundle my light truck insurance with other products at VIM Cover?

Yes. You can combine your truck cover with options like home insurance, travel insurance, or life insurance to protect more of what matters to you.

**This article provides general information only and does not take into account your specific circumstances. You should seek advice from a licensed insurance professional before making decisions.

How to Get a Truck Insurance Quote in 2026?

Key Takeaways:

- What’s included in a truck insurance quote (and what’s not).

- The difference between Comprehensive cover, Third Party Property Damage, and other policy types.

- How factors such as vehicle type, cargo, and business use affect your price.

- Add-ons like downtime cover and transit insurance can save you when things go wrong.

- How to compare insurance providers and read the fine print before you sign.

- What to expect during the claims process and how to avoid delays.

If you own a truck or manage a fleet, insurance isn’t optional; it’s essential. In 2026, getting a truck insurance quote is more than just filling out forms. Insurers assess what you drive, how you use it, and your claims history before offering cover. And you can compare offers only from APRA‑authorised insurance companies to make sure your provider meets national standards.

Want a Quote in 60 Minutes?

If you’re short on time, we offer a 60-minute rapid quote turnaround for eligible businesses. That means less waiting, more peace of mind, and faster protection for your truck or fleet.

Get your truck insurance quote in under 60 minutes here!

What is Included in a Truck Insurance Quote?

Most insurance companies include several critical components in your quote. Review the Insurance Council of Australia guidelines to understand industry best practices for commercial motor insurance, including how risks like property damage and liability are handled.

Most insurance companies will include the following in your truck insurance quote:

1. Type of Cover

You’ll typically choose from a few key policy types:

- Comprehensive cover – Covers your truck for theft, accidental damage, vandalism, and property damage to others, even if the accident was your fault.

- Third Party Property Damage – Protects you if your vehicle causes damage to someone else’s vehicle or property, but not your own.

- Third Party Fire and Theft – A balance between cost and protection, covers others' property, plus fire or theft damage to your vehicle.

You may also consider Public Liability Insurance, Compulsory Third Party (CTP), or Third Party Insurance, depending on your operations and state requirements.

2. Business Use and Specific Activities

Your quote reflects how and where you operate:

- Local, regional, or national transport

- Dangerous goods, refrigerated goods, or mobile plant operations

- Business-related storage or depot details

Your business use directly affects pricing and eligibility.

3. Vehicle Information

Insurers evaluate:

- Truck make, model, age

- Carrying capacity

- Whether you operate light trucks, rigid trucks, or prime movers

- Modifications like mobile cranes, tail lifts, or onboard computers

Accurate info ensures a valid quote and helps avoid policy disputes.

4. Driving & Claims History

Your driving history, past claims history, and even your financial situation play a role in determining premium levels and excess options.

Operators with strong safety records often access lower premiums or better coverage limits.

5. Optional Benefits and Add-On

Coverage options like Transit Insurance or Downtime Cover are standardised across the Australian insurance market. Understanding typical definitions and claims processes is easier when referring to the Insurance Council of Australia’s guidance.

6. Policy Inclusions, Costs, and Documentation

Every quote includes:

- A detailed premium (monthly or annually)

- Breakdown of inclusions and exclusions

- Every quote should point you to a Product Disclosure Statement and a Target Market Determination, as insurers must follow APRA’s prudential standards for general insurers regarding transparency and governance.

- A clear Target Market Determination

- Your rights to general and personal insurance advice

Understanding your policy wording and the full scope of your cover is essential before committing.

Understanding Truck Insurance Coverage

A truck insurance quote typically includes one or more of the following cover types:

Comprehensive Cover

Covers your truck for accidental damage, theft, fire, and property damage to others. It’s ideal if your truck is essential to your income or is of high value.

Third Party Property Damage & Public Liability

Essential if your truck damages someone else’s vehicle or property. Public liability insurance covers incidents involving injury or damage during loading, unloading, or delivery.

Add-Ons That Matter

Depending on your business, you can include:

- Downtime cover – income protection if your truck is off the road

- Transit insurance – protects your cargo during transport

- Windscreen, hire vehicle, and legal liability extras

Each policy can be customised to fit your business, from a single light truck to a fleet of prime movers.

Additional Insurance Types You May Need

Your truck insurance quote may cover the vehicle, but running a business often involves other risks. Depending on your operations, you might also need:

Travel Insurance for business-related trips

If you or your team regularly travel for work, whether interstate or regional, Travel Insurance can cover unexpected costs like trip cancellations, delays, or personal injury.

Boat Insurance for companies with marine operations

For transport companies that also operate near ports or on water, Boat Insurance protects vessels used for loading, delivery, or marine transport. It’s especially relevant for businesses involved in intermodal freight.

Life Insurance to protect business owners and employees

If you’re a business owner or employ drivers, Life Insurance adds a layer of security for families and teams. It helps protect income, manage business debts, or support succession planning, a valuable asset for small business operators.

Why Truck Insurance Protects Your Business Operations?

Things go wrong. Accidents happen. Trucks break down. A good truck insurance policy makes sure you’re not paying for it all out of pocket.

What the Right Policy Covers

- Covers repair costs and property damage

- Takes care of legal liability if you're at fault

- Downtime cover helps you manage lost income

- Gives owner-drivers and transport operators real peace of mind

What Kind of Vehicles Are Covered?

- Light trucks, rigid trucks, and prime movers

- Work trucks, vans, and business cars under Commercial Vehicle Insurance

- Trucks carrying dangerous goods or fitted with mobile plant

It’s all about keeping your trucks on the road and your business moving.

Factors That Impact Truck Insurance Cost

No two quotes are the same. Your truck insurance cost depends on a few key details that insurers use to assess your risk.

What Insurers Look At?

- Your driving and claims history, and your financial situation.

- The truck’s carrying capacity and how it's used for business activities

- The type of insurance you’re after, Comprehensive cover, Third Party Property Damage, or something in between

- Your financial situation, including the ability to absorb risk

Whether you’re an owner-driver or managing a fleet, these factors shape your premium.

Understanding the Fine Print

Before signing anything:

- Read the Product Disclosure Statement (PDS) for the full details

- Make sure the policy matches your business: check the Target Market Determination (TMD)

- Look into optional benefits that could improve your cover (and increase the cost)

Precise policy wording helps avoid headaches later, especially at claims time.

How to Find the Best Truck Insurance Providers?

With so many insurance companies out there, finding the right fit comes down to knowing what to look for and asking the right questions. You can read our comprehensive guide about Light Truck Insurance for 2026 here.

Steps to Get the Right Coverage

- Always choose insurers listed on APRA’s official register of authorised general insurers. This guarantees they are monitored for financial stability and regulatory compliance.

- Be ready with your personal information, vehicle details, and business needs

- Speak to an authorised representative who can give clear, tailored advice, not just a sales pitch

Insurance Options Beyond Truck Insurance

Depending on your setup, you might need:

- Fleet insurance for multiple trucks or vehicles

- Home Insurance or Landlord Insurance to protect business-related properties

- Home Buildings coverage for owner-operators running from home

Get cover that fits your life, not just your truck.

Tips for Navigating the Truck Insurance Claims Process

Accidents happen. When they do, understanding the claims process can save you time, stress, and money.

What to Expect During Claims?

- For events like accidental loss, total loss, or property damage, your insurer will walk you through the required steps.

- You may need to submit documents, evidence, or repair quotes, stay organised.

- Liability claims and compensation claims can take longer, especially if third parties are involved.

Many insurers now offer a streamlined process online, and some (like VIM Cover) even assign a dedicated claims team to support you.

Importance of General Advice and Customer Support

- Reliable Customer Support can make or break your experience, especially during stressful situations.

- Seek general advice before committing to a policy or during a claim if you're unsure of your next step.

- Go with a provider that offers a wide range of insurance solutions, so you’re not left uncovered when it matters most.

It’s not just about getting your truck fixed. It’s about getting back on the road with confidence.

Types of Trucks Covered Under Commercial Vehicle Insurance

Whether you're hauling freight across states or running tools between worksites, your policy should match your vehicle type.

Here's what most commercial truck insurance policies can cover:

- Light trucks – often used by tradies, couriers, and small business owners

- Rigid trucks – ideal for local deliveries, moving services, or specialist freight

- Prime movers – used for long-haul freight, heavy haulage, and intermodal operations

- Mobile plant & mobile cranes – often used in construction and industrial settings

- Vehicles carrying dangerous goods require more tailored risk assessments

A quality Truck Insurance Policy should reflect how your vehicles are used for business purposes and the risks they face day-to-day.

Transit Insurance: Do You Need It?

If your trucks are carrying cargo, Transit Insurance can be a game-changer.

It covers accidental damage, theft, or loss of goods while in transit, which is especially crucial for freight companies and owner-drivers transporting high-value cargo or working with fragile or perishable items.

You can also extend this cover to include:

- Natural disasters (flood, fire, storm)

- Theft while parked overnight

- Third-party Fire and Theft for high-risk routes

Is Fleet Insurance Better for Growing Businesses?

Running more than a few vehicles? Fleet Insurance can often provide:

- Bulk discounts across all registered vehicles

- Easier renewals with one policy, not ten

- Streamlined claims and admin

Fleet cover is ideal for transport operators, logistics businesses, and companies with business vehicle insurance needs across multiple locations or drivers.

Even small businesses with just three or four trucks can often access entry-level fleet solutions.

Do You Need Life Insurance as a Truck Operator?

It might not be the first thing on your mind, but if you're an owner-driver, business partner, or running a transport company, Life Insurance matters.

- It protects your family or business if something happens to you

- Can be bundled with other products (like Travel Insurance and Boat Insurance) if your operations involve different risk areas

Many insurance providers now offer business-focused life cover with flexible options based on your risk level and financial situation.

Secure the Right Truck Insurance Quote for Your Business

Getting the right truck insurance quote shouldn’t take hours or guesswork. At VIM Cover, we make the process fast, clear, and built for your business.

Whether you run one prime mover or manage a whole fleet, we’ll help you find the right balance of cost, coverage, and compliance. Our tailored options protect against accidental damage, property damage, lost income, and legal liability, with add-ons like Downtime Cover, Transit Insurance, and Fleet Insurance when needed.

We also know your time is valuable. That’s why we offer a 60-minute quote turnaround, no hassle, no hold-ups. Get started now.

FAQs

1. How fast can I get a quote from VIM Cover?

In certain circumstances, you’ll receive your quote in under 60 minutes, tailored to your vehicle type and business needs.

2. Is Downtime Cover worth it?

Yes, it helps you recover lost income while your truck is off the road due to repairs or damage.

3. What trucks can I insure?

We cover light trucks, rigid trucks, prime movers, and vehicles transporting dangerous goods or mobile plant.

4. What factors affect my insurance cost?

Your driving history, claims history, business use, and carrying capacity all influence your truck insurance cost.

5. What is a Target Market Determination?

It outlines the intended recipients of the policy. Always review the Target Market Determination and policy documents before making a purchase.

6. Can I insure multiple vehicles under one policy?

Yes, our Fleet Insurance solutions make it easy to manage cover for several trucks at once.

7. Will my policy cover legal fees?

Most policies cover legal liability, including third-party claims for property damage or personal injury.

8. Can I get help choosing a policy?

Absolutely. Our team offers general advice and support to help you make the right call. You can contact us by either filling out the form or giving us a call.

**This article provides general information only and does not take into account your specific circumstances. You should seek advice from a licensed insurance professional before making decisions.

Reviewing Truck Insurance: VIM Cover Importance Revealed

Reviewing Truck Insurance: VIM Cover Importance Revealed

Are you safeguarding your livelihood with the appropriate level of cover? Decisions here echo across your business's future stability.

In the intricate web of business insurance, navigating the right path is critical. Missteps can lead to disastrous financial consequences.

Selecting VIM Cover for your truck and business insurance isn't just about protection; it's investing in a partner who understands the nuances of your industry.

Comprehensive Coverage Tailored to Trucks

At VIM Cover, we acknowledge that trucks form the backbone of your logistics and distribution channels, requiring bespoke insurance solutions.

From the single-owner operator to vast fleets, our policies offer comprehensive protection against accidents, theft, and third-party liabilities, tailored to the unique risks faced by each client. This is the cornerstone of our commitment to truck insurance.

Our coverage ensures the continuity of your operations, minimising disruptions caused by unforeseen incidents to your essential transport assets.

Custom Policies for Unique Risks

Each business carries its distinct fingerprint of risk exposure that standard policies may not adequately cover. Blanket coverage is seldom sufficient for the nuanced risks inherent in trucking and logistics management.

Acknowledging this, VIM Cover constructs policies with precision, each a product of meticulous analysis geared towards your business's unique risk profile. We engage in a consultative approach to ensure your coverage is both comprehensive and specifically tuned to the demands of your operations.

Distinctive risks necessitate distinctive protections.

In choosing VIM Cover, you embrace an insurer that comprehends the fine details of truck and business insurance landscapes. You're not merely purchasing a policy; you're investing in tailor-made security that evolves with your business, ensuring resilience against the unforeseen with unwavering support. The peace of mind offered is priceless.

Inclusion of Additional Vehicle Types

Flexibility is at VIM Cover's core.

Recognising the diverse nature of transport operations, VIM Cover does not restrict its coverage to standard truck configurations alone. The policy ambitiously extends to include a variety of vehicle types, such as refrigerated transport units, tankers, flatbeds, and more. This adaptability ensures that regardless of the vehicle type that constitutes your fleet, you are comprehensively covered under VIM Cover's protective umbrella.

Diverse fleets require tailor-made insurance solutions.

Our policies accommodate unusual and specialised vehicles. With VIM Cover, niche transport vehicles—vital to specific operations—are not overlooked. Rather, they are an integral part of the bespoke insurance solutions we craft, adding another layer of reassurance for your multifaceted business.

Coverage that grows with your vehicle portfolio.

As your fleet diversifies or expands, VIM Cover adapts seamlessly. Additional vehicle types can be incorporated into your existing policy, without the need for complex adjustments or new policies. This ability to flex with your business needs is a hallmark of our commitment to providing enduring and comprehensive coverage.

Business Insurance that Supports Growth

Strategically structured, our insurance products bolster business confidence, fuelling growth with a strong risk management foundation.

In the realm of commerce, stability underpins expansion. VIM Cover's tailored insurance packages, designed to evolve alongside your business, eliminate the uncertainty that can hinder growth, allowing you to concentrate on scaling your operations with assurance.

We provide a "business growth partner" model, not just a "risk mitigator", enhancing your enterprise's potential for success.

Protection Against Business Disruption

Business continuity is a cornerstone of your success. For scenarios of unfortunate halts, VIM Cover's insurance ensures minimal disruptions to your operations. Our role extends beyond mere compensation—we strategise with you to prevent business interruption.

Restoration of operations post-incident is swifter with VIM Cover. Efficiencies arise from our tailored approach to claim resolution, aimed at rapid business recovery.

Our comprehensive coverage addresses direct losses and accounts for associated interruption costs. When an unforeseen event sidelines your trucks, our cover extends to lost income and additional operating expenses. This mitigates the financial strain and allows you to maintain client service continuity.

In transient and competitive markets, businesses face the inherent risk of disruption-induced losses. With VIM Cover, you gain access to support geared toward mitigating downtime and financial impacts. Whether it's due to vehicle damage or liability claims, our robust business interruption cover serves as a bulwark against the volatility of the transport sector. In essence, choosing VIM Cover is tantamount to fortifying your business against the ravages of unpredictability.

Flexible Options for Expanding Fleets

VIM Cover recognises the dynamic nature of the transport industry and the necessity for insurers to adapt to changing fleet sizes. With that in mind, we offer scalable policies to match your growth trajectory.

Our policies accommodate for fleet expansion, ensuring continuous protection. Seamlessly integrate additional vehicles and adjust cover as your business evolves.

When adding new trucks to your fleet, our policies can be modified to maintain a uniform level of protection across your assets. Whether it's increasing load capacities or expanding service areas, your insurance adjusts in parallel with your operational changes.

We understand that each truck in your fleet is pivotal to your business. As you bolster your operations with new vehicles, our adaptive coverage options serve to reinforce your resilience against unforeseen events. By selecting VIM Cover, you choose a partner capable of supporting your insurance needs comprehensively, making adjustments not just feasible, but effortlessly intrinsic to your business's progression.

VIM Cover's Competitive Edge

VIM Cover stands unrivalled in personalised policy crafting, expertly aligning to each business's unique insurance needs and risk profile.

In the landscape of truck and business insurance, VIM Cover distinguishes itself with industry-leading claims service and robust risk management solutions strategically designed to enhance operational resilience.

Our commitment to excellence and customer-centric approach ensures that VIM Cover is not just an insurer, but a trusted ally in protecting your business's future.

Claims Efficiency and Support

Our rapid response framework ensures that claims are managed swiftly and effectively, minimising disruption to your operations.

At VIM Cover, we dedicate ourselves to a meticulous claims process. We believe in providing personalised support, assisting you through every step with clarity, from lodging the claim to its resolution. Our proficient team utilises state-of-the-art technology and practices to ensure meticulous management of each claim, giving you peace of mind that your interests are protected to the highest standard.

Moreover, our passionate claims specialists are knowledgeable, approachable, and committed to your business continuity. By focusing on expedited claim resolutions, we aim to reduce downtime and help maintain your productivity, ensuring that your business remains operational even in the face of adversity.

Ultimately, at VIM Cover, we pride ourselves on transparent and efficient claims service. Our aim is to demystify the claims process, empowering you with information and support throughout. Providing you with a seamless claims experience, we help you navigate the complexities of insurance claims, thereby enabling you to focus on your core business functions with confidence.

Access to Industry Expertise

Choosing VIM Cover ensures access to unparalleled industry expertise in the truck and business insurance space.

- Dedicated Specialists: Our team comprises highly-qualified professionals with in-depth knowledge of the transport sector.

- Bespoke Solutions: We excel in crafting insurance policies tailored to the unique challenges and risks of your industry.

- Continuous Learning: VIM Cover is committed to staying abreast of industry changes, regulations, and emerging risks.

- Proactive Advisory: We provide regular updates and advice to help you adapt your insurance portfolio as your business evolves.Backed by years of experience, our experts offer guidance specific to your business needs.

Our proficiency translates into robust protection and proactive risk management for your enterprise.

Cost-Effective Solutions for Your Budget

At VIM Cover, we recognise that each business operates within its own financial constraints. Our approach is to balance comprehensive coverage with affordability, ensuring that you receive a cost-effective insurance solution without compromising on the essentials. We diligently compare different policies to identify those that offer the best combination of price and protection for your specific needs.

Tackling insurance costs requires a nuanced understanding of the delicate interplay between coverage limits, premiums, and deductibles. We are skilled at optimising these factors to align with your financial framework, which can significantly alleviate the pressure on your budget. By tailoring a policy to accommodate your financial considerations, we endeavour to contribute positively to your business's bottom line, while safeguarding against potential risks.

Transparent Pricing Structures

Understanding your insurance costs should not require a decoder ring. With VIM Cover, clarity is paramount.

- No Hidden Fees - We declare all costs upfront, ensuring no surprises.

- Tailored Instalment Plans - Customise how and when you pay, to help manage cash flow.

- Detailed Breakdowns - Comprehensive explanations of what you're paying for.

- Policy Transparency - Know the ins and outs of your coverage without the jargon.

Your budget deserves respect and your peace of mind, non-negotiable.

Our fee structure is designed to align with your financial needs, not to confound them.

With VIM Cover, transparency isn't just a promise; it's a principle we embed into your insurance experience.

Maximising Value with Bundle Deals

Consolidating insurance coverage can lead to substantial savings and management efficiencies.

- Assessment of Total Insurance Needs - Ensuring all risks are identified and appropriately covered.

- Customised Policy Bundling - Tailoring packages that dovetail neatly with your specific business and truck insurance requirements.

- Discounted Rates for Bundles - Providing financial incentives to choose comprehensive solutions.

- Streamlined Administrative Processes - Reducing complexity and saving time with a single point of contact for all insurance matters.

- Renewal Alignment - Facilitating renewal processes by synchronising policy dates.Streamlining coverage with a single insurer can be cost-effective.

Selecting a bundle deal from VIM Cover translates to a coordinated insurance strategy, enhancing your risk management profile.

Women in the Trucking Industry: Breaking Barriers and Shattering Stereotypes

Women in the Trucking Industry: Breaking Barriers and Shattering Stereotypes

The transport sector has long been a male-dominated industry, often perceiving trucking as a vocation unsuitable for women, fostering a culture resistant to change.

Yet today, paradigm shifts are underway, challenging outdated mindsets.

With each passing year, women are increasingly taking the wheel in the trucking industry, navigating through once impassable roads of gender bias and heralding a new era of diversity in logistics.

The Road Less Travelled

Historically, trucking was synonymous with grit and masculinity, an image ensconced within cultural narratives that sidelined women's participation. Presently, intrepid women are charting a new course, emerging as both drivers and industry leaders. They're not only mastering the rigours of long hauls but also invoking progressive changes in safety protocols, operational ethos, and equitable workplace practices. As they manoeuvre colossal road trains under the vast Australian sky, they dismantle preconceptions, embodying the spirit of innovation and resilience that is transforming the face of logistics.

Pioneering Women in Trucking

The trucking industry, once a bastion of male dominance, is witnessing a transformative surge led by tenacious women. As trailblazers, they are driving across the physical and metaphorical landscapes of a historically male-dominated realm, crafting a legacy of inclusivity and perseverance. Their journeys are punctuated by milestones that echo the evolving dynamics of the sector.

Fivefold increase in female truck licence holders over the past decade sharpens the focus on gender diversification within this critical industry. These pioneering women navigate heavy vehicles with confidence, fostering an environment that values skill and dedication above gendered stereotypes. Their presence is rewriting the narrative of trucking, serving as a beacon for future generations to follow.

Women are integral in revolutionising the traditionally male-centric trucking industry with audacity and expertise.

By championing safety initiatives and advocating for workplace equality, women in trucking are changing gears in leadership and operations. They are not only holding steering wheels but also steering committee meetings, contributing significantly to an inclusive and dynamic industry discourse. Their influence extends beyond the highway, as they become powerful voices for change within the logistics sector, reshaping industry dynamics with their unique insights and robust determination.

Diversity on the Open Road

Heavy Haulage meets Heavyweights in Inclusivity.

Dismantling the once-monolithic gender norms, women in trucking embody the transformative power of diversity. By embracing women’s contributions, the trucking industry elevates its operational efficacy. Moreover, increased female participation heralds a shift towards a more balanced industry, capable of generating innovative solutions to logistical challenges.

Women are driving change, quite literally.

In male-dominated convoys, female truckers stand out—not as anomalies but beacons. They pave the way, not merely in miles traveled but by setting benchmarks in safety, efficiency, and operational acumen, enhancing the credentials of the sector.

Inclusion fuels the engine of industry progression.

As gender diversity accelerates, the statistical landscape evolves. 2023 bears witness to an incline in female-led convoys, enriching the trucking tapestry with resilient prowess. Through mentorship and advocacy, these trailblazers create pathways for others, shaping an industry congruent with modern values of equality and opportunity.

Unpacking Industry Myths

The myth that trucking is innately a man's domain falters under scrutiny; women have shown equal competence. This stereotype is rapidly dissipating as women’s achievements in the industry garner recognition and respect.

Contrary to traditional belief, women exhibit exemplary driving safety records and a propensity for meticulous logistics management. Their capability breaks the glass ceiling of an outdated mindset, embedding gender inclusivity into the fabric of the trucking industry.

The notion of a "man's work" is being powerfully challenged by the surge of women in trucking, establishing a new normative in an evolving sector.

Combatting Gender Stereotypes

Embracing diversity, the trucking industry actively dismantles outdated gender biases.

-

Implementing Inclusive Policies: Championing procedures that encourage female participation.

-

Promoting Role Models: Showcasing successful women to inspire and motivate.

-

Educating Stakeholders: Informing about the benefits of gender diversity.

-

Challenging Misconceptions: Confronting and dispelling myths about women's capabilities.

-

Providing Support Networks: Establishing mentorships and forums for women's growth.

These initiatives are pivotal in fostering an equitable environment.

Deliberate actions are transforming the industry, making it a welcoming arena for women.

Debunking Skill Misconceptions

Contrary to dated views, physical prowess does not dictate a truck driver's success in the industry.

Since 2005, studies have consistently demonstrated that women excel in critical trucking skills like safety, compliance, and navigation, often outperforming their male counterparts.

Moreover, advancements in vehicle technology have lessened the relevance of brute strength, placing emphasis on precision, technical know-how, and adaptability—skills where women are equally proficient.

In fact, with the aid of ergonomic designs and automated systems, the playing field is levelled, leaving no room for baseless skill-based gender biases.

Thus, it is critical to appreciate the fact that adeptness in trucking is gender-neutral, shaped more by experience and training than by gender.

Challenges Behind the Wheel

Trucking, by virtue of its demands and dynamics, presents a constellation of challenges uniquely experienced by women. Considerations such as personal safety and the search for gender-specific facilities on long-haul routes are realities that female drivers must navigate. These extend beyond the control of the steering wheel, permeating into the social fabric of their work environment.

In response to these complexities, the industry must adopt a "protective ethos." Infrastructure that tends to the needs of women—ranging from secure parking and accommodation to respectful communication channels—is mandatory to ensure their inclusion is not mere tokenism. On the road, they encounter skepticism as to their competency, a baseless hurdle that they must persistently overcome, further establishing their right to an equal place at the helm of the transport sector.

Overcoming Workplace Obstacles

Women truck drivers often counter negative stereotypes with professionalism and competence, fostering a more inclusive atmosphere within the industry. Despite societal biases, they consistently demonstrate their proficiency and equal suitability for the profession.

Institutions are implementing mentorship programs to support women in their trucking careers. These initiatives provide invaluable guidance, building confidence and fostering growth.

Indeed, supportive networks are crucial for women truckers, offering advice and camaraderie amid male-dominated spaces. Such networks empower owners of these minority voices and facilitate the sharing of insights.

Training programs tailored to address gender-related challenges can equip women with unique tools for success. Such programs acknowledge and mitigate potential barriers, ensuring equal opportunities for advancement.

Establishing protocols that address harassment and promote equity is transforming the trucking industry. It's vital these measures remain strictly enforced, creating a respectful and secure environment for all drivers.

Ultimately, industry leaders are realising that diversity benefits the trucking sector. Investment in equitable practices reflects a commitment to excellence and an acknowledgment of the valuable contributions of women truckers.

The Balance of Family and Career

Navigating the often-complex dynamics of family life alongside a demanding trucking profession requires adept time-management and support.

For women in the trucking industry, striking this balance often involves multifaceted planning and the leveraging of a supportive network to allow for both professional responsibilities and family commitments. Such support may come from family, childcare services, or flexible scheduling offered by employers. As career progression in trucking generally demands significant on-road time, this can add an intricate layer of complexity in managing family life.

In this context, employer flexibility becomes a linchpin for female truck drivers. By acknowledging the unique family needs of their employees and providing adaptable work arrangements, companies can retain skilled female drivers who might otherwise be forced to choose between career and family.

Employment options that include part-time work, job sharing, or family-friendly scheduling are not simply concessions; they represent an evolution in human resources strategy. They underscore an understanding that women drivers are integral to the industry's success yet face distinct challenges needing bespoke solutions. Thus, by offering conditions that support work-life balance, employers create an atmosphere of inclusivity and demonstrate their commitment to nurturing a gender-diverse workforce.

Accelerating Change in Trucking

The trucking industry, traditionally steeped in masculine culture, is experiencing a dynamic shift as it becomes more inclusive. Spotlighting women in roles historically dominated by men not only challenges long-standing gender stereotypes but also enhances the talent pool. As society's perception of trucking changes, the industry's image is being progressively redefined, propelling a wave of fresh and diverse entrants.

In this era of rapid progression, mentorship programs tailored to women are vital in fostering an environment of support and growth. Such initiatives serve as a catalyst for change, amplifying the voices and experiences of women in trucking. This, along with robust policies aimed at ensuring safety and equality, helps to dismantle the barriers that have long hindered women's participation in the field. In a tangible sense, these advancements are not just about opening doors for women, but also about enhancing the industry's overall competence and resilience.

Policy Shifts for Inclusivity

Inclusive policies are becoming industry imperatives.

Organisational changes are essential to fostering gender inclusivity. Progressive organisations within the trucking industry are revamping their human resources policies, ensuring equal opportunities in recruitment, retention, and promotion of staff, irrespective of gender. Such reforms are set to alter the fabric of workplace dynamics, laying the groundwork for a more diverse and equitable industry. Companies that take the lead in these policy shifts cultivate a reputation for being forward-thinking and socially responsible entities.

Gender diversity must penetrate every echelon of trucking.

To this end, organisations are implementing strategic frameworks that address the unique challenges faced by women. This includes enhanced safety protocols, anti-harassment measures, and flexible working arrangements to accommodate for lifestyle needs. The focus is not merely on just recruiting women, but also on creating an environment in which they can thrive.

Insurance coverages must adapt to support inclusivity.

It is essential for insurance providers to align their products to support this evolving workforce. This includes offering insurance coverage that caters to the specific needs of women in the industry—covering aspects such as maternity leave, health concerns, and flexible working arrangements. Adoption of such tailor-made insurance solutions signals a commitment to inclusivity and substantively supports diversity in the workforce.

2023 marks a pivotal moment for regulatory conformity.

The Australian trucking sector anticipates significant regulatory shifts, reflecting the heightened focus on inclusivity. Regulatory bodies shall enforce compliance standards that bolster the rights and protections for women in trucking. This alignment between organisational intent and regulatory compliance facilitates a more inclusive landscape, substantially enriching the sphere of transport logistics.

Empowering the Next Generation

Within the trucking industry's diverse landscape, it is pivotal to champion the empowerment of women, building a foundation that secures their involvement for generations to come, thereby creating a self-sustaining cycle of inclusion and diversity.

The mentorship offered by seasoned professionals is key to fostering success stories amongst aspiring female truckers.

Leaders within the sector must advocate policy reforms and engage in dialogues centring on undoing prevailing biases, ensuring a level playing field for all genders.

Programmes meticulously designed to educate young women about the vibrant opportunities within the logistics sector must be promoted robustly.

Scholarships and grants specifically allocated for female entrants signal a robust commitment to nurturing talent, effectively bridging the gender gap within this tradition-steeped industry.

Not only must these initiatives be sustained, but they should also evolve dynamically with the shifting tectonic plates of societal norms and industry standards to maintain relevance and efficacy.

VIM Cover are specialty insurance brokers catering to the growing demands of the transport and logistics industry. Click here for a no obligation quality review of your truck and business insurances.

Truck Insurance 101: Essential Coverage for Truck Owners

Truck Insurance 101: Essential Coverage for Australian Truck Owners

Navigating Australian roads can present unpredictable challenges, especially for truck owners safeguarding their valuable assets.

Protecting your truck with comprehensive and affordable insurance is not just a necessity – it’s a strategic investment in your livelihood.

Understanding Truck Insurance Basics

In the realm of commercial transportation, truck insurance is a fundamental safeguard designed to protect your financial well-being. It encompasses various coverage options tailored to address specific risks associated with truck operation. From Compulsory Third Party (CTP), which is mandatory for all vehicles, to optional yet critical covers such as Motor Vehicle Insurance for damage or loss, and Public Liability Insurance to protect against injury or damage claims, selecting the appropriate policy is vital. Understanding the nuances of each insurance type, its benefits, and limitations are crucial in choosing a protective shield that aligns with your trucking needs.

Coverage Types Explained

Selecting the right insurance cover for your truck involves understanding the spectrum of available policies. It’s about aligning protection levels with the specific risks faced in daily operations. Third-party property, theft, and fire coverage can be pivotal in mitigating the financial impact of unforeseen incidents.

A comprehensive insurance policy, often referred to as “full cover”, provides extensive protection. It includes cover for accidental damage to your truck, as well as damage caused to other vehicles or property, securing your financial position.

A single vehicle accident can cost up to five times more than theft-related claims.

When it comes to specialised covers such as Marine Cargo Insurance or Downtime Insurance (which pays out when your truck is off the road), understanding the intricacies is critical. Customise your policy to not just meet legal requirements, but to also fortify your commercial viability.

Calculating Your Premium

Insurance premiums are influenced by various factors specific to the vehicle and its operations. The assessment of risk is paramount in determining the cost of your truck insurance coverage.

Considering elements such as the truck’s make and model, age, usage, and the driving history of those behind the wheel plays a critical role. The value of the truck, alongside the nature of goods transported, and the operating radius, are further considerations. Each aspect contributes to the risk profile, which in turn influences your premium. Additional safety features installed on your truck may mitigate risk and result in lower premiums.

Moreover, the level of deductible you choose is a key component of premium calculation. Higher deductibles can lower your premiums, as it signifies your willingness to absorb a greater share of loss in the event of a claim. This choice represents a trade-off between upfront premium savings and potential out-of-pocket costs down the line.

Ultimately, an expert assessment of risks tailored to your specific circumstances will inform the premium. It is paramount that the cover reflects the intrinsic and operational risks of your haulage business. Premiums that seem economical initially, may not provide comprehensive protection when most needed, underscoring the importance of expert advice in policy selection.

Cost-Cutting on Premiums

Aligning insurance coverage with actual usage patterns can lead to considerable savings on premiums. Articulate the specifics of your truck’s operation—low mileage can significantly reduce cost.

In a similar vein, bundling multiple policies through a single provider (fleet insurance) often results in favorable discounts. Moreover, insurers may offer lower rates to policyholders who demonstrate responsible risk management, such as investing in driver training programs.

Risk reassessment over time is equally crucial in optimising insurance expenses. Regular reviews can uncover opportunities for premium adjustments, reflecting changes in your business’s risk profile.

No-Claims Bonus Benefits

A no-claims bonus (NCB) acts as a tangible reward for safe driving practices.

-

Reduction in Renewal Premiums: Akin to a loyalty discount, the NCB can substantially lower the cost of your policy upon renewal.

-

Cumulative Benefits: The longer you go without a claim, the greater the discount grows, showcasing a cumulative advantage.

-

Transferable Perk: Should you decide to switch insurers, the NCB can usually be transferred to your new policy, maintaining its value.

-

Protection of NCB: Certain insurance products offer NCB protection features, shielding your bonus even after a claim is made.

Maintaining an unblemished claim record cultivates a beneficial NCB.

Harnessing a no-claims bonus can produce significant long-term savings, amplifying its allure for conscientious truck owners.

Policy Bundling Options

Bundling policies can streamline coverages while ensuring cohesive protection.

Exploring a multi-policy approach often unlocks discounts, amplifying cost-effectiveness across your insurance portfolio.

Bundling not only simplifies management but can also result in more tailored risk mitigation, with coherent strategies spanning multiple assets.

Integrating various insurance needs under one provider enhances service efficiency and can yield insights into comprehensive risk solutions.

Ultimately, policy bundling translates to financial prudence through structured, consolidated insurance arrangements.

Selecting the Right Insurer

Choosing an insurer demands a scrupulous evaluation of their financial solidity, claims history, and customer service ratings. Reputation is pivotal, serving as a beacon for reliability, and as such, reviews and testimonials should be meticulously assessed to ascertain an insurer’s credibility. Look for providers with a storied history in the truck insurance market, exemplary for their expertise and resilience in the face of claims.

The insurer’s experience in the trucking industry is vital, ensuring they have the specialised knowledge to tailor your coverage accurately. Determine their familiarity with industry-specific risks, as this expertise is critical when crafting a policy fit for your distinctive needs.

Comparing Insurer Reliability

Reliability assesses insurers beyond basic metrics.

When comparing reliability among insurers, one must consider a host of qualitative and quantitative factors. From the stability of their financial position to the efficacy of their claims process, these elements are catalysts for trust and assurance. Moreover, customer feedback and dispute resolution records serve as vital indicators of an insurer’s dependability in the face of adversity.

Claims settlement efficiency is a key reliability marker.

An insurer’s promptness in responding to inquiries and resolving claims is paramount. It reflects not only on their operational capacity but also on their commitment to client service and support. This is crucial in the truck insurance realm, where timely claims resolution can significantly impact your business continuity.

Assess their regulatory compliance and industry standing.

In analysing insurers, attention to their solvency and compliance with industry standards, including the rigorous expectations set by Australian Prudential Regulation Authority (APRA), provides a comprehensive picture of their operational reliability and their capacity to meet claims. Furthermore, insurers with a strong market presence and a track record of consistent policyholder support typically offer the most resilient protection.

Reading Customer Reviews

Evaluating client feedback is an insightful dimension of due diligence. These testimonials can reflect the insurer’s reputation, hinting at the customer experience one might anticipate.

Indeed, customer reviews can be a barometer of satisfaction with an insurance provider’s service quality and claims handling process. Past clients may divulge their experiences with policy clarity, support during stressful claims, and the overall ease of communication. These direct accounts can significantly influence one’s expectations and decision-making when choosing a truck insurance provider.

However, it’s imperative to discern the legitimacy of reviews. Look for patterns in feedback, distinguishing genuine experiences from potentially biased or anomalous critiques. A balanced view is essential to gauge the insurer’s consistent performance accurately.

Furthermore, reading reviews should complement your research; it should not be the sole determinant. Cross-validate customer insights with regulatory standings, claims resolutions statistics, and the insurer’s financial stability to form a well-rounded perspective. This multifaceted approach ensures that you opt for an insurer with a proven track record of reliable coverage and customer satisfaction.

Insurance Claims Simplified

Navigating the complexities of insurance claims need not be a daunting task. With a structured approach and clear communication channels, submitting a claim can transition from a laborious affair to a manageable process. Understanding the requisite documentation and engaging promptly with your insurer will pave the way for a smoother claims experience. Therefore, it is critical to familiarise yourself with your policy’s specific claims procedure and requirements to expedite settlements and reclaim your peace of mind post-haste.

Step-by-Step Claim Process

Initiating a claim can be a streamlined exercise when executed with precision and urgency.

-

Immediately Report the Incident: Contact your insurer as soon as possible following an incident involving your truck. Time is of the essence.

-

Provide Detailed Information: Furnish your insurer with all pertinent details of the incident, including photographs, if possible, and a police report for theft or major accidents.

-

Complete Claim Forms: Fill out the required claim forms accurately to ensure there are no delays in processing your claim.

-

Cooperate with Assessors: Work with any appointed insurance assessors or investigators to review the damage or circumstances of the incident.

-

Review Settlement Offer: Evaluate the compensation offer from your insurer and confirm it aligns with the coverage provisions outlined in your policy.

-

Finalise the Claim: On agreement, complete any additional paperwork to finalise the claim and receive the payment.

Subsequent to filing, maintain contact with your insurer to monitor claims progress.

Consistency and thoroughness are paramount for a timely and favourable settlement.

Avoiding Common Claim Pitfalls

Navigating the complexities of insurance claims can be fraught with challenges that may impede a smooth settlement process.

-

Immediate Notification: Delays can be detrimental; promptly inform your insurer of any incidents to enable swift action.

-

Accurate Documentation: Ensure all information related to the claim is correctly recorded; mistakes can lead to disputes or rejections.

-

Honest Communication: Misrepresentation or omission of facts constitutes fraud and can void your coverage.

-

Policy Understanding: Familiarise yourself with policy terms to ensure you meet the requirements for a successful claim. Lack of understanding can lead to misunderstandings and potential claim denials.

-

Engage with Assessors: Maintain cooperative and open communication with assessors to facilitate a fair evaluation.

Procedural astuteness significantly improves the likelihood of successfully navigating claim settlements.

Efficient claims management hinges upon attention to detail and adherence to the prescribed reporting protocols.

Grab a truck insurance quote with VIM Cover and let us help you protect your business assets, it is a critical step in safeguarding your commercial future.