Comprehensive Guide to Business Insurance Cost in 2026

Key Takeaways

- How much business insurance will cost in 2026 depends on the kind of business, the number of employees, the location, and the risk profile.

- The cost of public liability insurance, as well as other premiums, is affected by claims history, coverage limits, and industry risk levels.

- The contract terms and the insurance quote should be carefully reviewed to understand the available coverages.

- The data provided here is generic and doesn't account for the individual situations of the businesses.

Knowing what affects business insurance costs in 2026 is not as simple as looking at a pricing guide. Insurance prices depend on factors such as the nature and location of the business, and the types of risks the company may be exposed to over time. Instead of providing set prices or suggestions, this article examines the typical ways insurance costs are determined in Australia and what business owners typically consider when their insurance cover is due for review.

This information is of a general nature and does not take into consideration your personal situation. It should not be regarded as financial, legal, or insurance advice.

This article provides general information only and does not take into account your objectives, financial situation, or needs.

Key Factors That Affect Business Insurance Cost

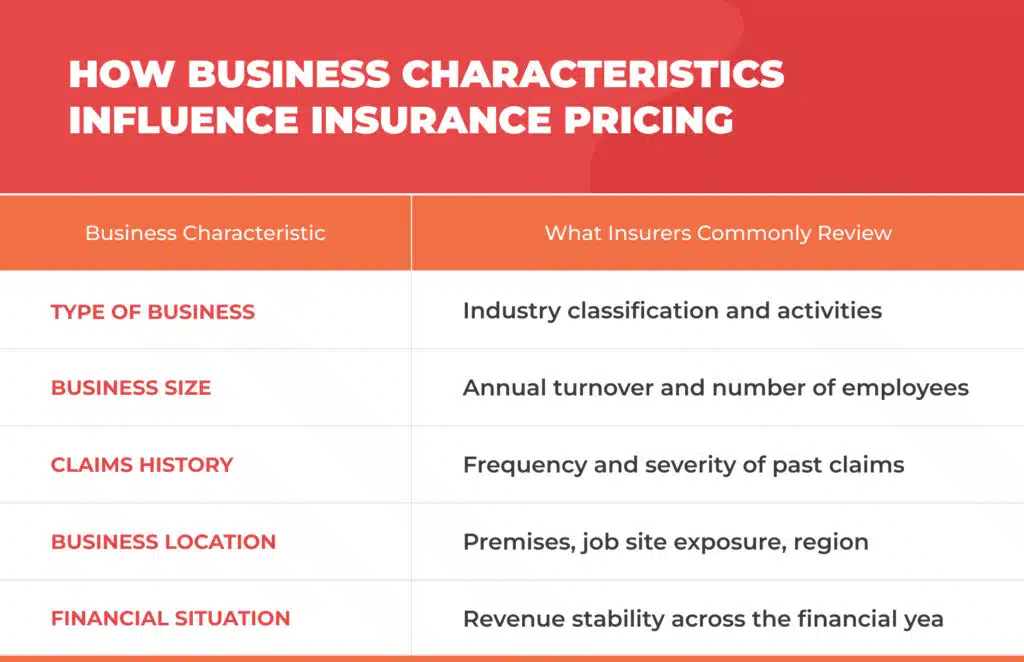

A single pricing rule does not determine business insurance cost. It is a result of various interconnected factors. In general, insurance companies evaluate business operational, financial, and risk-related information to determine insurance premiums that reflect the business’s total exposure.

Understanding these factors may help businesses better understand insurance offers and policy formats.

Understand the basics

It is always a good idea to get a grasp of the general concept of business insurance evaluation before one can name the exact cost factors. Insurance pricing reflects the probability of claims and the financial impact if a claim occurs during the business’s everyday operations.

Expenses are mostly figured out on an annual basis and may differ even for businesses in the same sector.

Type of business and business activities

One of the significant factors influencing business insurance costs is the type of business. Various industries have different levels of risk, especially if they involve physical work, interaction with the public, or specialised services.

Insurers analyse business operations to anticipate risks arising from routine activities. For instance, companies that work on job sites or come into contact with the public may face different liability risks than office-based professional services.

Business size, annual turnover, and number of employees

The size of an enterprise is most often determined by its annual turnover, annual revenue, and number of employees. These metrics help insurers estimate the potential size of claims and financial losses.

An individual self-employed person might have different insurance cost factors than a larger company with several employees, business premises, or commercial vehicles.

Claims history and risk profile

Insurance providers usually review a company's claims history as the first step in understanding its past insurance experience. Such records help build the overall risk profile, which insurers use to evaluate future risk levels.

Fewer claims usually result in the business being considered a lower risk; on the other hand, more frequent or substantial claims affect insurance rates and base premium calculations.

Business location, premises, and job site

A business’s location is considered when determining insurance costs because different areas pose different risks, such as weather conditions, climate, crime rates, and the frequency of insurance claims. Besides that, the type of business premises and the job site may also be factored into the risk assessment.

Location-related issues can also differ across states like New South Wales and South Australia, which in turn determines how insurers gauge the risk of exposure.

Financial situation and financial year considerations

The financial position of a business can come under scrutiny, especially if the insurance coverage is related to sales or turnover. Broadly speaking, changes over a financial year, for example, business expansion or restructuring, may be reflected in premium adjustments at renewal, subject to insurer assessment and policy terms.

How Risk Impacts Insurance Premiums

Risk assessment is vital to calculate insurance premiums. Generally, insurers determine the likelihood of certain events and the potential financial consequences if they occur.

Higher Risk Versus Lower Risk Industries

Specific industries are mostly labelled as high-risk, whereas others are kept in the lower-risk category. Such classification is primarily based on past claims data, injury rates, and types of business operations.

Segments that involve physical labour or customer-facing work might be charged more for insurance than those with little or no physical interaction or operational hazards.

Result of Your Business Activities on Liability Risks

Usually, liability risks depend on the effects of business activities. Insurance providers evaluate the ways your business could impact third parties, their property, or the public in general during your everyday business activities.

A company that frequently comes into contact with third parties or their property will face greater exposure to liability claims.

Member of the Public and Injury Claims

Companies that have face-to-face dealings with the public may be vulnerable to injury claims, including personal injuries, medical expenses, and legal costs. These possible outcomes are taken into account when pricing liability-related cover.

Types of Cover and Their Costs for Businesses

Different types of cover address different risk areas. Each cover type is assessed independently, with premiums influenced by coverage limits, exposure levels, and business characteristics.

Common Insurance Covers

Public Liability Insurance Cost and Coverage: Public liability insurance is often viewed as a necessary liability of businesses that have contact with customers, suppliers, or the public. Public liability insurance costs depend on factors such as the nature of business activities, claims history, and the amount of coverage chosen.

Usually, this type of insurance protects against third-party property damage or personal injury claims arising from the firm's operations.

Professional Liability Insurance for Professional Services: Any company that offers consulting or specialised services is likely to have professional liability insurance. Pricing is often associated with income level, contractual requirements, and the type of services provided.

Workers' Compensation Insurance: Workers' compensation insurance is a mandatory requirement for any business with a workforce. The cost is calculated based on payroll size, industry classification, and the number of workplace injury claims.

Business Interruption Insurance: Provides protection when the insured business experiences a loss of income due to the disruption of normal operations caused by insured events. The cost of the policy generally depends on a company's turnover, its reliance on physical premises, and the indemnity period selected.

Cyber Liability Insurance: Cyber insurance and cyber liability insurance are attracting more attention nowadays due to increased digital exposure. Pricing of a policy is largely dependent on data usage habits, the strength of system security, and the amount of reliance on online operations.

Commercial Property Insurance and Landlord Insurance: Commercial property insurance and Landlord Insurance apply to businesses that either own or lease property. The value of the property, the type of building, business contents, and location-related risks can affect the premium amount.

Additional Insurance Options

Apart from the main covers, some companies decide to get extra policies depending on their business, properties, etc.

Car Insurance and Commercial Vehicles: Companies that operate vehicles as part of their work may need commercial car insurance. Premiums depend on the type of vehicle, how it's used, and its claim history.

Equipment Insurance and Business Contents: Insurance for equipment and business contents may be of interest when the business uses tools, machinery, or portable assets that are essential to its operations. The item's value and whether it is portable can influence the charges.

Home Insurance for Sole Traders: Several sole traders work from their homes. In those instances, home insurance policies should be carefully reviewed to determine which business-related risks are covered.

Tax Audit Cover and Medical Expenses: Tax audit cover may be offered as an option within a Business Insurance Pack. Some insurance policies may even cover medical expenses; however, this is always subject to policy wording and exclusions.

How to Get Accurate Business Insurance Quotes

Getting insurance quotes is not just about looking for the cheapest price. A clear understanding of how insurance policies are constructed may help businesses make better comparisons.

Steps for Comparing Insurance Solutions

- Most businesses identify their insurance needs by considering the types of operations they engage in, their assets, and regulatory obligations.

- Different types of businesses often have other insurance needs. An evaluation of the type of insurance commonly associated with business activities may help filter the options.

- When requesting insurance quotes, including Instant Quotes if available, policy documentation, such as the Product Disclosure Statement, should be carefully reviewed to understand conditions, exclusions, and coverage limits.

- Insurance brokers may provide general explanations of available cover options and clarify how different insurance solutions are commonly structured. Soliciting professional advice may be the right choice when insurance needs are complicated.

Cost Considerations for Small Business Owners

Insurance premiums don't stay the same and may fluctuate when the business changes. Some small business owners periodically review their insurance policies to ensure they continue to reflect operational changes.

Typical things to think about include combining policies into a Business Insurance Pack, checking coverage limits, monitoring the claims history, and modifying the cover in line with business turnover or changes in operations.

Why VIM Cover Is Your Trusted Insurance Broker

Being clear about what an insurance broker does is one of the ways businesses can more effectively navigate insurance structures.

An insurance broker is generally someone who communicates between businesses and the insurance companies. They can help businesses by clarifying policy structures and coverage options and answering general insurance queries.

VIM Cover is an insurance broker that gives you access to a range of insurance options. Whether cover is offered, on what terms, and at what price is determined by the insurer, subject to underwriting assessment and policy conditions.

Insurance solutions are structured to suit businesses of different sizes, sectors, and operational models. The coverage a business receives can depend on the type of operations it conducts, its location, and the level of risk it faces. There is also support for companies that are extending their operations to other states, such as New South Wales and South Australia.

If you are seeking general information about business insurance structures or would like to view insurer-issued quotes, VIM Cover provides access to policy information and, where possible, Instant or Same Day Quotes. Any insurance decision should be made after reviewing the relevant Product Disclosure Statement and considering your own circumstances.

Frequently Asked Questions

Q1. How is business insurance cost calculated?

Insurers usually consider the type of business, turnover, claims history, number of employees, and the business's operational risks.

Q2. Does a sole trader usually pay less for insurance?

A sole trader might enjoy reduced premiums if their operations are small, but the expenses still depend on the type of business activities and risk exposure.

Q3. Is public liability insurance mandatory?

Not all businesses are required by law to have public liability insurance. However, there are cases where one must be insured due to contractual or industry requirements.

Q4. Can insurance premiums change each year?

Indeed, rates can go up and down depending on a variety of factors, including claims history, business growth, changes to the level of cover, or insurer pricing reviews.

Find the Perfect Business Insurance Quote for Your Needs

Key Takeaways

- An individualised business insurance quote shows your business activities, risks, and expansion plans.

- The response to the offer should be based on comparing the insurance cover accounts, the policy wording, and the support from the claims department, rather than price alone.

- The protection pillars comprise public liability, property, and business interruption insurance.

- Engaging with seasoned brokers gives you assurance, adherence to legal requirements, and value that lasts.

It is not only about the prices when looking for the right business insurance quote, but also about understanding the risks, the protection, and the stability in the long run. Every business faces the risk of losing its property to a fire, being sued, or losing income. The year 2025 is the year when the costs to operate a business are rising, and regulations are changing, so if you decide to buy insurance just because it is cheap, you will not be sufficiently protected.

This manual is a resource for small business owners and businesses expanding, helping them gain the confidence to explore their options. Once you understand the risks, the available options, and the way the quotes are prepared, you will be able to do business with a business insurance company without having to pay for a policy that you do not need and with which you are not familiar.

Why Every Business Needs the Right Business Insurance Quote

A personalised business insurance quote mirrors your business, factors that expose you to risks, and your plans for the future. Since companies differ in size, turnover, and the nature of their daily business activities, it follows that generic policies are often ineffective at providing meaningful protection.

A correct quote equips you to:

- Safeguard the business location against the risk of fire and theft through insurance

- Keep the business functioning during a period of crisis

- Handle business liabilities and third-party claims

- Ensure the availability of working capital after a loss covered by the policy

Insurance should be a source of strength for your business expansion instead of being a problem.

Understanding Key Business Risks

Each business has a different combination of challenges. Before you ask for quotes, it is essential to thoroughly understand the risks that could affect your business.

Protecting Property and Equipment

Destruction of the business place, Commercial Property, or General Property may not only be a very costly event, but can also completely and abruptly halt the entire business operations. Property Insurance and Property cover are means of protecting buildings, stock, and Electronic Equipment against the risks of damage or loss.

Operational and Financial Disruptions

Unexpected business downtime will not only harm the company's image but also reduce cash flow. Business Interruption Insurance helps businesses during this challenging moment, partially making up for lost income.

Liability and Operational Exposure

Customer or supplier lawsuits related to the business can be a significant source of expenses. Public Liability Insurance, as well as Products Liability Insurance, is a set of insurance policies that cover a company against costs arising from injuries to third parties or damage to third-party property caused by the company's activities.

Specialist Risks

Industries may come across the risk of Machinery Breakdown, a threat from the lack of Cyber Insurance, or risks that involve motor vehicles and Commercial motor & fleet insurance.

The Role of Trusted Business Insurance Specialists

Working with Business Insurance Brokers who are experienced can make the whole thing very easy. Agents evaluate your individual requirements, explain the insurance products, and ensure the Policy Wording reflects the real-world risks.

With VIM Cover, businesses can enjoy:

- Access to the most trusted insurance companies

- Customised Risk Solutions for complicated business activities

- Understanding the documents of the policy and meeting the requirements

By using a specialist, you can be sure that you have the right cover without any unnecessary additions.

Top Business Insurance Cover Options to Consider

Essential Insurance for Small Business Owners

Usually, Small Business Insurance packages cover the following:

- Public Liability Insurance and Product Liability Insurance

- Workers' Compensation Insurance and Employment Practices cover

- Professional Indemnity Insurance for professional services

- Motor Insurance, Car Insurance, and Motor Vehicle Insurance

- Commercial Property and General Property protection

Additional Insurance Solutions for Specific Needs

Depending on the nature of your business, you may also require:

- Contents Insurance for Business Property

- Farm Insurance or Tax Audit Insurance

- Personal Insurance, Life Insurance, and Travel Insurance

- Management Liability for directors and officers

- Product Recall and Tax Audit Insurance

Besides the policy schedule, Product Disclosure Statement, Target Market Determinations, and Certificate of Currency are the other key documents that provide transparency and compliance.

How to Compare Business Insurance Quotes Effectively

Comparing quotes goes beyond the premium.

What to Review Carefully

- Level of cover and insured limits

- Policy terms, exclusions, and endorsements

- Claims handling and claims service quality

- Payment options, including monthly installments or credit card payments

Check how quotes align with business turnover, risk exposure, and long-term business needs. A lower premium may lead to higher costs later.

The Benefits of Working with Business Insurance Brokers

Partnering with experienced Business Insurance Brokers provides clarity and control. Brokers:

- Structure insurance packages that match real risks

- Provide documentation, like a tax invoice and reference number

- Offer ongoing Customer Support throughout the policy lifecycle

Many reputable brokers are aligned with the National Insurance Brokers Association, ensuring professional standards and ethical advice, including for niche markets such as Torres Strait Islander businesses.

Securing the Best Business Insurance Quote in 2025

An appropriate business insurance quote entails a balance between the three elements: protection, affordability, and flexibility. After comprehending the risks, carefully examining the coverage, and partnering with reliable professionals, businesses will be able to safeguard their assets, income, and good name with certainty.

Through personalised insurance products, open advice and excellent customer service, your Business Insurance turns into a competitive advantage, just like any other asset in your business, rather than being a mere compliance requirement.

Each business has its own uniqueness, and the insurance you have should be in line with that. Rather than using a standard cover, obtain a business insurance quote that is specifically designed for your activities, location, and risk profile.

Have a consultation with experienced Business Insurance Brokers and get cover designed for your business. Get started today.

*Insurance broking services are administered by VIM Cover Pty Ltd ABN 84 664 655 449 as a Corporate Authorised Representative (CAR 001304833) of Oracle Group (Australia) Pty Ltd AFSL 363610. The information provided is of a general nature and does not take into account your objectives, financial situation, or needs. You should consider whether it is appropriate for your circumstances and read the relevant Product Disclosure Statement (PDS) and Target Market Determination (TMD) before deciding.

FAQs

1. What information is required to obtain a business insurance quote?

Descriptions of the business activities, turnover, location, and any existing risks.

2. How fast can I get a Certificate of Currency?

A Certificate of Currency is generally available right away after the binding of the cover.

3. Can I pay for my insurance every month?

Many insurance policies indeed offer flexible payment options, such as monthly instalments.

4. Is public liability insurance compulsory?

Although not always a legal requirement, Public Liability Insurance is practically a must for businesses that have contact with the public.

Complete Small Business Insurance Guide for 2026

Key Takeaways

- Small business insurance is commonly used to help protect your income, assets, and legal obligations.

- The right mix of coverage options may help reduce your financial worries and the risk of business interruption.

- Unambiguous policy wording and professional advice help you avoid coverage gaps.

- VIM Cover offers access to insurance solutions to match the growth of your business.

Running a small business in 2026 is every day a mix of juggling opportunity and risk. Along the way of serving customers and managing staff, to protecting cash flow and reputation, the businesses may face operational challenges. Just one unexpected event, an accident at your business premises, a cyber breach, or a liability claim, can be a cause of a hefty financial loss. This is the reason why having the right insurance is no longer a matter of choice; it is a vital part of business planning.

This guide covers the general information on small business insurance for small business owners. It starts with understanding the essential cover, then moves to choosing insurance solutions that really support long-term growth. If you are a sole trader, run professional services, or have physical premises, this guide aims to support general awareness of insurance considerations in 2026.

This article provides general information only and does not take into account individual objectives, financial situations, or needs. It does not constitute financial or insurance advice.

What is Small Business Insurance and Why Is It Important?

Essentially, small business insurance is designed to address different risks that may come up in the course of daily business activities. Such risks can include injury to a member of the public, damage to equipment, or even loss of income following an insured event.

An adequately drafted insurance policy may help protect your business assets, support business continuity, and reduce the anxiety that comes with the unknown. It is a promise that one unexpected problem will not undo the years you have worked hard. Besides, for many businesses in Western Australia, insurance may be required contractually when dealing with clients or suppliers.

Understanding Business Insurance Policies

Each business faces different risk profiles, and that is the reason business insurance policies are never standard for all. The type of your business will determine your scope of protection, how you operate, and your liability exposure.

Essential Coverage

- Security for business premises and tangible assets

- Cover for Public and Products Liability claims

- Support for legal costs, repairs, and loss of income

It is essential to have Clear Policy Wording. This document specifies precisely what is covered, how claims are handled, and the situations in which exclusions apply. Understanding this information can help businesses ensure their business insurance requirements are met without any unanticipated gaps.

Why Every Small Business Owner Needs Insurance

Usually, small business owners view insurance as a tool for managing uncertainty. With appropriate coverage, risks can be controlled without jeopardising the business's cash flow under challenging situations.

Main features of the policy often reviewed are:

- Less risk of being the target of a liability claim and having to pay the legal costs

- Coverage against involuntary damage and situations caused by a third party

- Business insurance that provides the right cover for the requirements of your business

Moreover, it can be a valuable tool for attracting customers and partners. They can be sure that your business is a professional one, follows the regulations, and is ready for any circumstances.

Essential Types of Business Insurance for Small Businesses

Knowing what business insurances are available can assist you in getting valuable coverage in which you will be protected without paying for useless or unnecessary coverage.

Commonly Discussed Insurances

- Public liability insurance: Generally designed to cover the costs resulting from injury or damage to the property of a third party due to your business or operations.

- Professional Indemnity Insurance: A product that is often considered by a professional service, as it shields the firm against allegations related to the provision of advice

- Product liability insurance: Typically applies to legal claims due to products that are unsafe and/or faulty

These core business policies often form the foundation for vibrant Business Insurance Pack choices.

Optional Cover Additions

- Workers' compensation insurance to cover injuries related to employees

- Cyber Liability cover to address specific cybersecurity threats and the loss of electronic equipment

- Business interruption insurance to assist with the loss of income during periods of forced business closure

In addition, optional covers, such as management liability insurance, contents insurance, and income protection, can provide additional strength and security.

Factors Affecting the Cost of Business Insurance

Business insurance expenses are influenced by various factors, among which are the kind of business you have, the risks of your industry, and your history of claims.

What Influences Premiums

- The way your business is set up (e.g., sole trader vs company)

- Are business vehicles part of your operations for which you need Car Insurance or third-party property cover?

- What type of cover do you have, and what limits are set within your insurance packages

Though it may seem that adding more coverage is just an additional cost, the lack of adequate protection can result in significantly more costly over time.

Getting a Business Insurance Quote That Fits Your Needs

An individualized Business Insurance quote typically reflects the risks that a business is exposed to and also the company's financial status. Moreover, being able to readily get a Certificate of Currency, which is a common requirement by landlords and clients, is equally important.

The procedure may be supported by a skilled insurance broker. Brokers evaluate the insurance business policies that you have, provide in-depth explanations of the options to you, and, if necessary, assist you in the claims department.

How VIM Cover Helps Small Business Owners

VIM Cover knows that different companies are different, and that is why their method is customer-specific insurance solutions instead of standard policies.

Reasons for Choosing VIM Cover

- Business Insurance Pack with modular options

- Honest advising based on actual risks

- Help with claims, renewals, and compliance

Besides that, Personal Insurance, like Life and Trauma insurance, can give you the security that you need while running your business to be able to face the unexpected situations confidently.

Secure Your Business with the Right Insurance in 2026

Deciding on the right insurance often involves protection needs, supporting your good name, security, and peace of mind. With the right combination of policies, your company can step into 2026 with confidence and be open to expansion without unnecessary risk.

Leading a business is all about expecting expansion and also being ready for the unforeseen. Having an appropriate small business insurance policy in place can help manage risks related to reputation, premises, and revenue.

Businesses may choose to obtain quotes from licensed insurance brokers such as VIM Cover. Get started today!

*Insurance broking services are administered by VIM Cover Pty Ltd ABN 84 664 655 449 as a Corporate Authorised Representative (CAR 001304833) of Oracle Group (Australia) Pty Ltd AFSL 363610. The information provided is of a general nature and does not take into account your objectives, financial situation, or needs. You should consider whether it is appropriate for your circumstances and read the relevant Product Disclosure Statement (PDS) and Target Market Determination (TMD) before deciding.

FAQs

- What insurance do most small businesses require?

The requirements change, but typically, public liability insurance and workers' compensation insurance are the two most required. - Should business insurance be taken by sole traders?

Absolutely. A sole trader is a one-person operation in which the trader is the only person responsible; hence, insurance is essential. - Is small business insurance, including cyber liability, necessary?

Yes. If customer data is stored and online operations are used, Cyber Liability protection is definitely a must-have. - How often is it necessary to look at my insurance policy?

It is good to take a look at the policy at least once a year or in the case that your business activities or location change.