How to Get a Commercial Property Insurance Quote in 2025

Key Takeaways

- You can obtain quotes from licensed insurance brokers such as VIM Cover

- VIM Cover offers a range of insurance options designed to meet diverse business needs.

- A commercial property insurance quote helps maintain the safety of your business premises and the things that are valuable to you.

- Firstly, check your cover, Policy Wording, and sum insured thoroughly before making a purchase.

In 2025, the commercial insurance area is still changing due to brand-new property risks, digital tools, and the increasing complexity of business operations. Today, obtaining a commercial property insurance quote is more than just comparing prices. It is about ensuring the policy effectively protects your assets, is financially feasible for you, and aligns with your business goals.

It doesn't matter whether you are a property investor, a retailer, or a manufacturing company; knowing how to secure the right Commercial Property Insurance coverage is essential for your mental well-being and financial stability. We will figure out how to get you a quote that fits your exact needs and, at the same time, ensure your business is safe from unforeseen losses.

What Is Commercial Property Insurance?

Commercial Property Insurance is designed to safeguard your commercial building, its contents, and related assets from unforeseen events that could lead to financial losses. It typically includes insurance cover for incidents such as accidental damage, theft, storm damage, and water damage, ensuring your property and business operations are not disrupted.

For business owners, this insurance acts as a financial shield. Beyond protecting the office building or commercial premises, it may include compensation for business interruption cover, loss of rental income, or expenses required to repair or replace damaged assets.

Understanding Commercial Property Insurance Cover

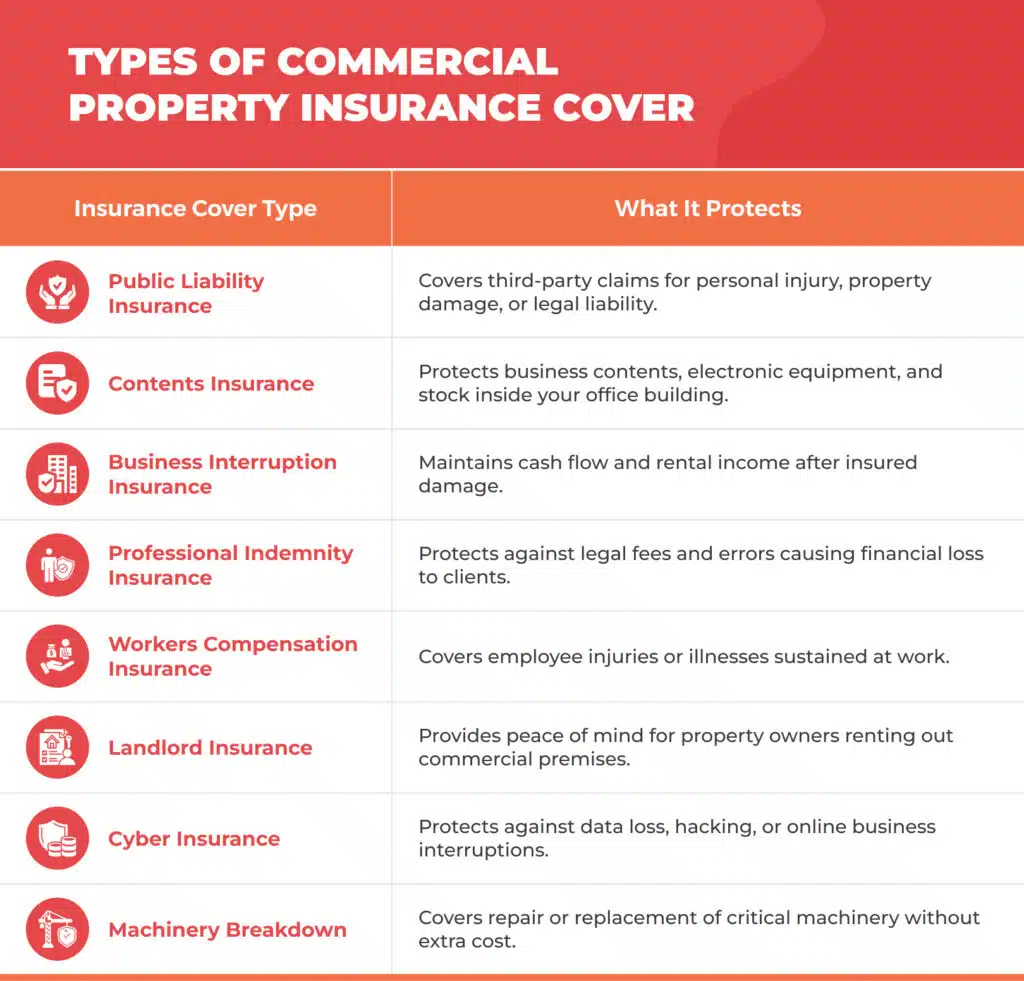

An effectively designed business insurance plan offers safeguards across various risk categories. Your insurance package may consist of:

- Public Liability Insurance – Covers the cost of a third-party claim resulting from personal injury, property damage, or legal liability due to your operations.

- Contents Insurance – Covers the business contents, electronic equipment, and other movable assets in your business premises.

- Business Interruption Insurance – It is a type of insurance that helps maintain cash flow when operations are temporarily halted due to a covered event.

- Professional Indemnity Insurance – This is a must for professionals who provide advice or services, and it covers them against legal fees and negligence claims.

- Workers' Compensation Insurance – It is the insurance that pays for employee injuries or illnesses caused by work and complies with the law's requirements.

Certain insurers also offer optional cover for Machinery Breakdown, Cyber Insurance, and landlord insurance. These additions not only broaden the coverage of your Business Insurance pack but also let you feel safe when handling possible interruptions.

Why Business Owners Need It

Having a commercial building is like inviting a series of property risks - fire and vandalism, as well as natural disasters and accidental damage. Just one incident without adequate protection can put your finances under severe pressure and may even disrupt your cash flow.

With a customised policy, Business Insurance is a great tool for business owners to get back on their feet quickly, keep their operations running, and still make a profit in the event of a contingency. Additionally, the coverage package includes a liability shield that protects against lawsuits from the general public, customers, or contractors. In this way, you not only ensure your professional reputation but also the continuity of your business.

How to Request a Commercial Property Insurance Quote

In the year 2025, if you want to get a precise commercial property insurance quote, you will need to have the correct information, be clear and know what level of cover you require. Present-day insurers provide both online quote systems and personalised consultations with a business insurance specialist.

Steps to Get Started

How to start the work:

- Clearly define your business and describe your primary business activities

- Perform a survey of your business premises describing the place, its size, and its intended use.

- Calculate the replacement cost and sum insured for your property and assets.

- Make a list of cover options that you require and possible optional covers that you may want (e.g., Theft cover, Public Liability cover, or business interruption insurance).

With such information at hand, you can contact trustworthy insurance providers. Vim Cover, for instance, provides an online quote form and an option to request a callback if you need personalised assistance.

Essential Information to Prepare

To get a detailed business insurance quote, you will have to provide:

- Details about the property of your commercial building or office building

- The policy documents of the current coverage (if there are any)

- Information on business vehicles, motor vehicles, or the use of commercial vehicles

- Claims history and risk management practices

- Approximate rental income and the business contents and electronic equipment details, if any

It is always a good practice to review the Product Disclosure Statement, Policy Wording, and Terms & Conditions related to your policy before confirming it. These documents describe the exclusions, the legal liability limits, and your policy schedule, thereby providing transparency and complying with the insurer's requirements.

Features of a Comprehensive Business Insurance Policy

Coverage Options Included

A comprehensive Business Insurance policy will typically cover a combination of different protection areas, including:

- Public Liability Insurance cover for third-party as well as Public & Products Liability claims

- Contents Insurance provides cover for property and electronic equipment

- Business interruption insurance offers the essential ongoing cash flow support

- Cover against storm damage, glass breakage, as well as accidental damage

Additional Cover for Enhanced Protection

Contemporary insurance companies are aware that customers require tailor-made solutions. You can upgrade your insurance plan by adding:

- Workers' Compensation Insurance to cover the welfare of employees

- Professional Indemnity Insurance to cover the risks associated with client-facing activities

- Cyber Insurance to cover the occurrence of data breaches or damage to the system

- Boat Insurance or Life Insurance to provide a more comprehensive portfolio protection

These optional components constitute a fully-fledged Business Insurance Pack that can be adjusted to your particular requirements and provides you with an extended period of peace of mind.

Comparing Commercial Property Insurance Quotes

When comparing policies from different insurers, focus on the level of cover, exclusions, and claim support, not just price. Be watchful of:

- Policy Wording, terms and conditions, and extent of cover

- Replacement cost and sum insured figures

- Any additional charges for tailor-made cover options

Expert advice from Business Insurance Specialists will assist you in understanding the small print, being in accordance with the rules, and making the process of the claim efficient in case you need to file one.

Why Choose VIM Cover for Your Business Insurance in 2025

VIM Cover is a licensed Insurance broker that business owners, sole traders, and small business insurance customers can depend on. With its comprehensive understanding of risk management and property damage claims, the company can offer you a tailored business insurance policy solution that matches your business needs.

The company's customer support team is always willing to help you with policy selection, renewal, and paperwork, providing support along the way. In case you are looking for a cover for your Commercial Property Insurance, Public Liability Insurance, or Workers Compensation Insurance, VIM Cover would be your partner in securing affordable protection that would genuinely give you peace of mind.

Property damage or an unpredicted claim should not be the reason that your business is disrupted. Obtain a personalised Commercial Property Insurance quote from VIM Cover now to ensure you are adequately covered. Note: Insurance cover is subject to underwriting approval and policy terms and conditions.

Get Your Free Quote Today. Contact our Business Insurance Specialists to find out the cover options that best fit your business.

FAQs

1. What are the components of a commercial property insurance quote?

The quote provides estimates for the coverage of your structure, its contents, and your liability protection. The estimates are based on your property's risk profile.

2. Is there a way to cut down the cost of my business insurance?

Keeping a spotless record of claims, enhancing security, and seeking cost-saving changes from Business Insurance Specialists will help you reduce your insurance premiums.

3. Is it possible to combine property and vehicle insurance?

Sure. Many insurers offer packages that combine commercial vehicle, Car, and property coverage.

4. What is the procedure in place for the claims?

The steps include submitting an insurance claim form, providing proof of loss, and collaborating with your insurer to promptly evaluate and resolve the claim.

Understanding Public Liability Insurance Costs in 2026

Public Liability Insurance is one of the essential types of business protection that has received considerable attention over the years, and its significance in 2026 is even higher. Over time, an increasing number of sole traders, small business owners, and service providers have ventured into public places and had direct contact with their clients. In such a scenario, the risk of the businesses being sued for property damage and personal injury is at a high level. A business owner can make well-informed judgments on how to safeguard their company by understanding the cost of public liability insurance and the factors that significantly influence those prices.

Key Takeaways

- The cost of coverage in 2026 will vary widely depending on your industry, turnover, location, and level of risk exposure.

- Small business owners, sole traders, and other businesses in higher-risk industries need to prioritise adequate coverage first and foremost.

- Finding the right providers for you and access coverage that suits your protection needs means that you will have the right balance of protection at the correct cost.

This blog explores public liability insurance, a type of insurance that benefits companies. The main description of the coverage, the factors affecting the premium, and the premium forecast for 2026 have also been discussed.

Why Businesses Need Public Liability Insurance

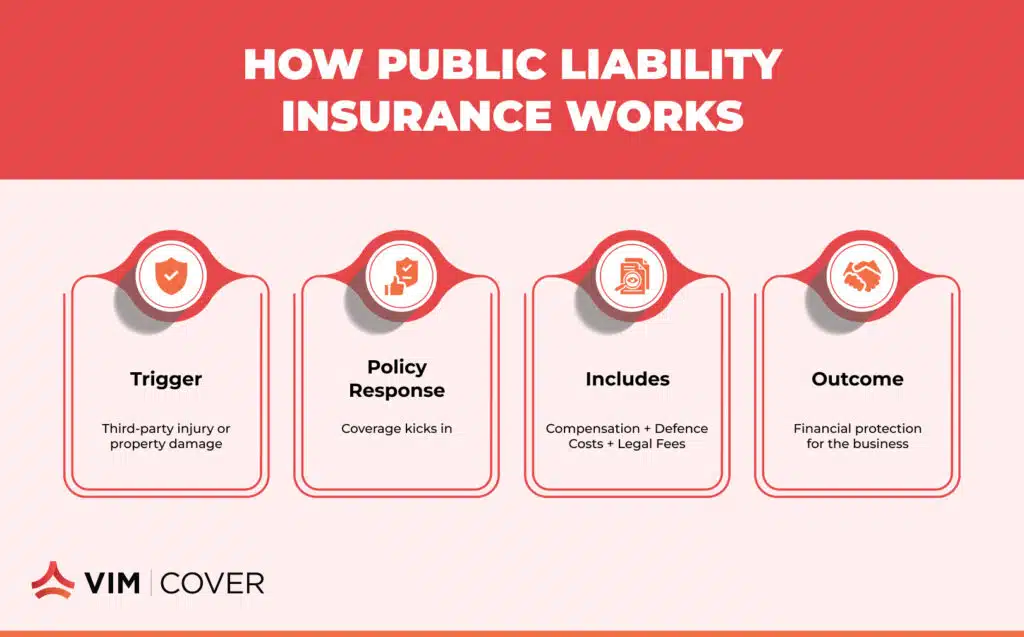

In any case, there are always possibilities of something going wrong with the public, even if you are operating carefully. Imagine that a customer falls on a wet and slippery floor, a contractor damages a client's property without realising it, or a minor mistake leads to a huge claim. These problems can escalate into money disasters if there is no insurance.

Protecting Against Financial Losses

Covers property damage and personal injury

If a customer, for instance, gets hurt at your business location or, by chance, your work damages someone else’s property, a claim resulting from these incidents might be costly. Public liability insurance protects the policyholder against such cases, paying the legal costs, may cover medical expenses if included in a successful third-party claim, and taking care of the repair without the amount being a burden on the business.

Essential for small business owners, sole traders, and construction companies

Smaller enterprises and individual traders usually lack the financial resources to cover significant claims. Companies in the building sector, workers in the trades, and similar professionals are particularly vulnerable due to the nature of their work.

Mitigates risks from negligent activities and legal liability.

Although all possible safeguards may be implemented, there is still a possibility that an accident or oversight may occur. It is also typical for courts to concentrate on the results rather than the motives, thus companies can still be held responsible. A company can protect itself with public liability insurance, which reduces the risk by covering not only damages but also legal defence costs. This way, management can focus on ensuring the business continues to function after such an event.

Who Should Get Public Liability Insurance?

Risks certainly differ among various businesses to some extent. However, any company that has contact with clients or the public will benefit from considering public liability insurance. The size of your business is less important than what you do. If you are involved in any kind of outdoor activity, then not only is the risk present, but also the need for protection.

- Businesses often occupy various public areas, including malls, construction worksites, and event venues.

- Some industries, such as professional services or trade, include advertising agencies, management consulting firms, and the skilled trades.

- Local small business entrepreneurs who have face-to-face interactions with customers and the public.

- Particular attention must focus on hazardous firms, such as those where a mistake, exposure to boiling liquid, or food poisoning could result in a series of claims.

- These are the businesses that pose a danger; for example, a mishap, hot liquid, or food contamination can lead to a chain of claims.

What Influences the Cost of Public Liability Insurance?

Insurance premiums are never uniform for all customers. The amount a café needs to pay for its insurance can be significantly different from what a plumbing contractor or a marketing agency needs to pay. The reason is that insurers consider multiple factors when determining your premium, including the size of your business and the associated risks within your industry.

Key Factors That Affect Premiums

- Business size and turnover: Larger businesses with higher revenue usually pay more, as their exposure is greater.

- Industry type: A marketing agency may pay less than a restaurant, where food poisoning claims are more common.

- Location: States such as Western Australia or the Northern Territory may have different pricing due to their unique risk environments.

- Level of cover: The higher the amount of public liability cover, the higher the premium. Adding extra insurance products will also influence cost.

Industry-Specific Risks

- Hospitality establishments must contend with the risk of burns from hot liquids or food safety issues.

- Workers in trades and contracting businesses are at risk of being exposed to claims for property damage and personal injury in the places where they work.

- Even service providers like consultants need insurance because visitors to offices or events where clients are present could get hurt.

How Much Does Public Liability Insurance Cost in 2026?

Public liability insurance costs in 2026 will be influenced by several factors, including the general rise in prices, changes in government regulations, and shifts in the risk environment, resulting in varying costs. Besides the differences in industries, firms will also experience changes in their locations due to the different states, insurance companies, and the share they want to cover.

Average Costs and Insurance Options

Although there is an excellent range of costs, a majority of small businesses in 2026 will be able to anticipate that their premiums may start at a few hundred dollars per year for the basic cover as a minimum. For industries with higher risks, the premium can reach several tens of thousands of dollars per year.

Several factors, like stamp duty, state taxes, and the amount of cover requested, determine the final number. Small business owners can select customised plans that match their financial condition, securing them without depleting their funds.

How to Get a Public Liability Insurance Quote

- Consult with experts – Business insurance specialists can assess your industry, risks, and needs.

- Compare policies online – Many insurers allow side-by-side comparisons of public liability policies.

- Request documentation – Always ask for complete details, including policy wording and the certificate of currency, to confirm coverage levels.

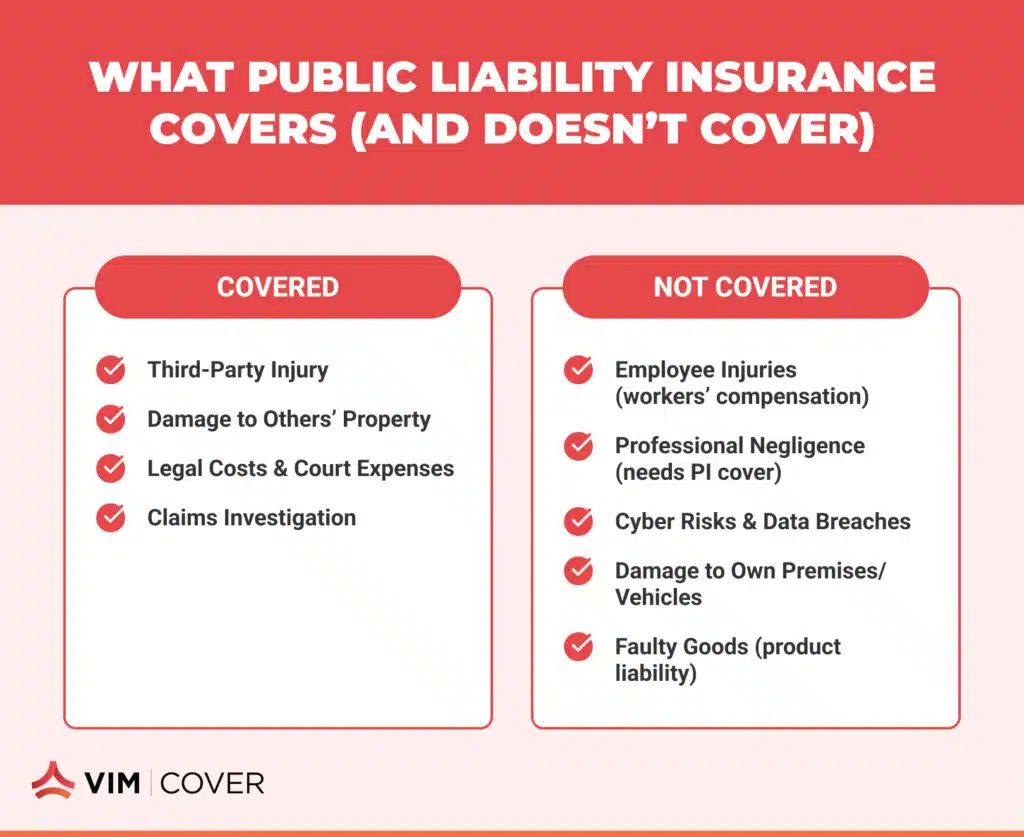

What Does Public Liability Insurance Cover?

Many business owners believe they have a solid grasp of the coverage provided by public liability, but then a situation arises, and they discover that several risks are not covered.

Knowing what a standard policy comprises allows you to stay covered in areas that may be costly if you have no insurance, and also gives you peace of mind when dealing with the public.

Third Party Claims

Policies generally cover:

- Property damage caused by your business activities

- Personal injury to members of the public

- Legal defence costs and associated expenses

Additional Insurance Options

Businesses often combine public liability with:

- Product liability (covering issues with goods sold)

- Trade insurance for contractors

- Workers’ compensation

- Home insurance or car insurance for business-related assets

- Income protection and life insurance for broader security

Choosing the Right Public Liability Policy

It is well known that multiple insurers offer public liability insurance, and numerous business insurance packages are available on the market. As a consequence, choosing the proper one can become an overwhelmingly difficult task. The most efficient approach is to analyse business needs first and then evaluate providers familiar with your field of work.

Assessing Business Needs

The right policy depends on your:

- Type of business and work environment

- Risk exposure from daily activities

- Financial situation and capacity to pay liability premiums

Although sole traders in the construction industry may require less insurance than large companies, it remains essential for both to have sufficient cover to avoid financial burden in the event of a claim.

Finding the Best Insurance Provider

It is not that every insurance company provides the same value. Investigate companies that specialise in small business packages or have experience with specific industries. Utilise the buying power of your group, such as a trade association, to access reasonably priced rates.

Looking for reliable public liability insurance that can truly safeguard your small business?

Licensed insurance brokers such as VIM Cover can assist with tailoring insurance that fits the unique needs of small businesses located anywhere in Australia. Whether you require only basic coverage or a comprehensive policy, our skilled brokers will guide you towards finding an ideal solution that suits both your needs and budget.

You can obtain quotes from licensed insurance brokers such as VIM Cover.

FAQs

Q1. What is the average public liability insurance cost for small businesses in 2026?

Small businesses typically allocate between a few hundred and a few thousand dollars annually to their budget. The risk exposure and coverage levels of the companies are the main factors affecting these amounts.

Q2. Does public liability insurance cover employee injuries?

Workers’ compensation insurance typically covers injuries to employees. Public liability insurance cannot cover the insured's employees.

Q3. Can sole traders get public liability insurance?

Definitely, a cover that shields sole traders from the occurrences of property damage or personal injury due to their business activities is the one they require.

Q4. How can I determine the amount of coverage my business needs?

You need to consider the potential danger elements in your business, check the acceptable insurance coverage in your line of business, and the cost of the claim. Consulting with insurance experts is essential to ensure you have the right cover for your business.

***This article provides general information only and does not take into account your specific circumstances. You should seek advice from a licensed insurance professional before making decisions.

Small Business Public Liability Insurance: Everything You Need to Know

Small businesses venture on a journey full of both opportunities and risks. A company will always aim for growth and customer satisfaction. However, it is equally essential to ensure that the business is protected against unexpected claims. Public liability insurance for small businesses is among the most significant protective measures that any small business owner should consider.

Such a policy provides protection against legal fees, claims from third parties, and unexpected financial difficulties. In this blog, we will explore the components of public liability insurance, its importance for small businesses, and how to select the right policy for your specific insurance needs.

Key Takeaways

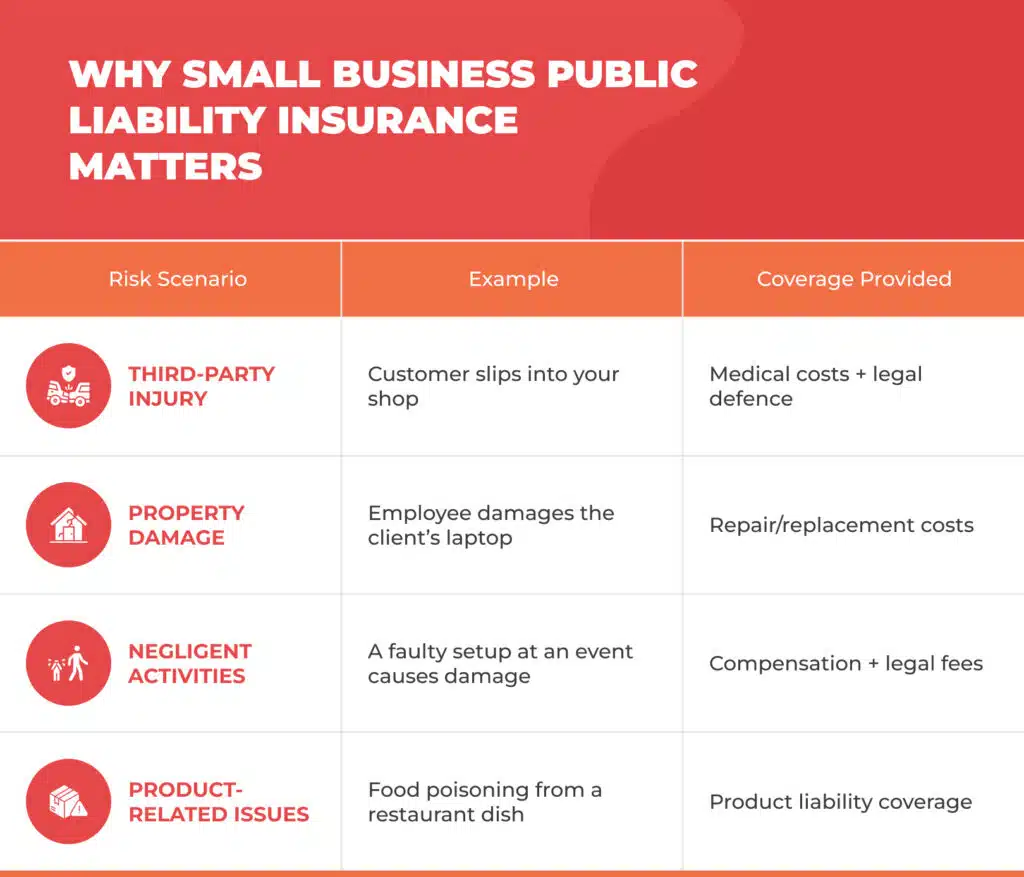

- Small business public liability insurance covers third-party injury and property damage.

- It includes compensation, defence costs, and related legal fees.

- Different from Professional Indemnity Insurance, it focuses on physical damage.

- Brokers and tailored insurance packages help small businesses get flexible cover.

What is Small Business Public Liability Insurance?

Small business public liability insurance covers your company if third parties make a complaint that they have suffered personal injury, property damage, or have received another type of loss due to your business operations.

To illustrate, if a customer falls on uneven flooring in your store and sustains an injury, your public liability insurance may provide coverage for their treatment costs, as well as any legal expenses incurred if they file a lawsuit.

No doubt, even the most careful business owners can be hit by accidents. This insurance protects you from having to pay massive compensation claims on your own.

Why Public Liability Cover is Essential

Though the safest method is always preferred, accidents are sometimes inevitable. The aftermath of an incident for small businesses can be so huge and suffocating that it may be hard for them to recover. It is therefore not surprising that public and products liability insurance is regarded as one of the most essential types of insurance.

Protects Against Third-Party Injury and Property Damage Claims

Accidents can occur in any location, even if a person is extremely cautious. If someone slips, falls, or the property is damaged, and these incidents are related to your work, then the responsibility lies with your company.

Covers Legal Costs and Defence Expenses

Legal proceedings can be costly, no doubt. A policy of public liability insurance covers the expenses of the lawyer who will defend a case. It also provides coverage when the issue is not with you.

Supports Business Stability

Public liability insurance is often required when dealing with local authorities, landlords, or contractors, though requirements may vary by industry and region. Public Liability cover can afford you financial security, but it also creates a good impression of you.

How it Differs from Other Insurance Products

Business owners are often confused about the differences between public liability insurance and other types of policies. Recognising these differences will help you avoid being overwhelmed by extra coverage or losing the protection of your rights.

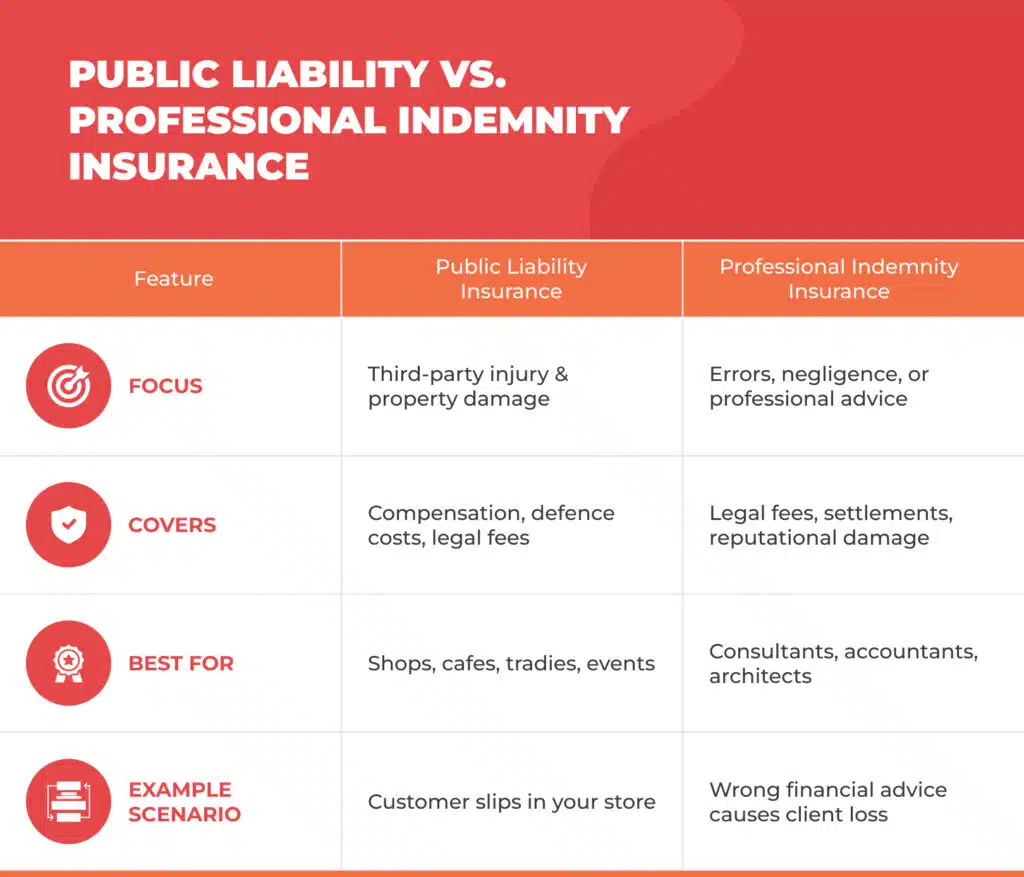

Public Liability vs Professional Indemnity Insurance

Public liability insurance covers only cases of physical injury and property damage directly caused to third parties. In contrast, professional indemnity insurance serves as a shield against financial losses resulting from the provision of professional advice, services, or negligence.

Consider a situation where a consultant gives incorrect advice. In this case, the consultant will then require an indemnity insurance policy. On the other hand, a café owner is required to have a public liability insurance policy to ensure the safety of customers.

Specialised Coverage for Premises and Negligent Activities

Public liability insurance typically includes coverage for events occurring at your location or resulting from your business's carelessness, which is often excluded from other types of insurance.

Product Liability and Recalls

Few auto insurance policies cover product liability resulting from claims due to a product that was sold or made by the insured that caused harm. This option is generally the most important one in the mentioned industries, such as food and electronics.

Key Features of Business Insurance Packages

A smaller business rarely requires just one policy. On the other hand, business insurance cover can be more effective when combined with other insurances that match their field of work, such as public liability insurance.

Types of Cover for Business Needs

- Sole traders typically pair public liability insurance with product liability insurance.

- Commercial car insurance is just the right solution for work vans, delivery trucks, and cars.

- Business premises insurance protects against the destruction of buildings.

For example, the hospitality sector might have packaged cover for food poisoning or injuries that occur during the administration of first aid.

Flexible Business Insurance Solutions

Insurers offer a range of cover options in terms of payments, policy details, and target audience identification. Not only can the cover be tailored to the client's specific requirements, but it can also be tailored to the client's particular compliance aspects and financial situations.

Common Public Liability Claims and Coverage

It is only after examining real-world instances that the significance of insurance sometimes becomes evident. Small businesses in various industries often face similar types of claims, and understanding these claims highlights the benefits of public liability insurance.

Examples of Typical Claims for Small Businesses

- Customer injuries on your premises: A shopper falls on a wet floor, a café customer is burned by spilled hot coffee, or a gym member trips over equipment.

- Damage to third-party property: A tradesperson destroys a client’s driveway by unloading the heavy equipment, or a contractor breaks a window during renovations.

- Negligent business activities: A defective product injures a consumer, or an employee’s careless performance leads to the injury or loss of a person outside the business.

Although these situations may appear minor, they have the potential to escalate into compensation claims of thousands of dollars quite rapidly.

Understanding Legal Fees and Defence Costs

It is surprisingly one of the small businesses for which the cost of a legal defence, even in a minor legal case, is a significant financial burden. Legal bills can grow large very quickly, and if you don't have insurance, they can be very costly. Small businesses often underestimate the number of legal processes they must follow.

- Coverage for Legal Liability: Public liability insurance provides coverage for lawyer fees, court costs, and settlements.

- Financial Loss Prevention: It eliminates the risk that your business may experience a cash flow issue due to the specified event.

- Extra Disbursements: Heavy industries may incur additional disbursements, such as safety investigations or regulatory penalties for non-compliance with safety standards.

How to Choose the Right Business Insurance Policy

Finding the right insurance policy for your business is more than just meeting the legal requirements. Such a business cover will guarantee your company's uninterrupted operation in times of unexpected events. The large number of insurance products has made it necessary for small business proprietors to perform a complete evaluation of what fits their businesses the best, including the potential risks and available amounts of money.

Factors to Consider for Your Business Type and Size

Every business must deal with unique types of risks that are specific to that particular business. A small café faces the risk of the disappearance of the coffee it sells. On the other hand, an IT consultancy has a completely different risk profile. A sole trader’s specific needs are entirely different from those of a multi-staffed company that is growing. When going through policies, it is essential to consider a number of factors, including:

- The type of business: Retail businesses most likely require product liability insurance, whereas more service-oriented companies may need professional indemnity insurance in addition to public liability.

- Business size: The potential risk increases with the number of customers, staff, or locations.

- Cover limits: Choose an amount of cover that represents the worst-case scenario your business can face. For instance, a tradesperson operating in residential homes might be allowed to have lower limits than a contractor working in big commercial spaces.

Working with a Business Insurance Broker

For instance, if you're unsure where to begin, a business insurance broker can simplify the process for you. Brokers assess your risks, compare policies from various companies, and recommend the most suitable solutions for you. Additionally, they can:

- Get an online quote that reflects the correct pricing for your insurance.

- Speak in simple terms about what is included in the cover.

- Ensure that you are fully covered and have your certificate of insurance ready for contracts or any other obligations.

The advice of a broker is highly beneficial for small businesses, especially when they are in a situation where they cannot afford to lack protection or pay an excessively high premium.

Protect Your Business with Public Liability Cover in 2025

The business environment will undoubtedly become increasingly complex in the future. Every year, rules become stricter, customers expect more, and new risks emerge. Public liability insurance must adapt to these changes.

Business owners of small businesses must ensure that their policies adequately cover the risks associated with their industry, possess the necessary policy documents, such as a certificate of currency, and comply with relevant insurance, tax, and legal requirements. This approach will equip your business to handle upcoming challenges better if adopted.

Not sure which cover best fits your small business? You can obtain tailored quotes from licensed insurance brokers such as VIM Cover and safeguard your business with public liability insurance. Get started today!

FAQs

Q1: Do all small businesses need public liability insurance?

Yes. A business of any size that has dealings with customers, suppliers, or the general public should have this cover.

Q2: How much cover for public liability do I require?

The level of cover is conditioned by your industry and the level of risk you are exposed to. The standard amount of coverage typically ranges from $5 million to $20 million.

Q3: Is public liability insurance a tax-deductible expense?

Yes. The payments for business insurance policies are typically deductible from the business's taxable income, classified as a business expense.

Q4: Do employees have protection under public liability?

No. Staff injury claims will be satisfied through the workers' compensation insurance scheme. Public liability is a safety net for the injured third party only.

This article provides general information only and does not take into account your specific circumstances. You should seek advice from a licensed insurance professional before making decisions.

What Is Public Liability Insurance and Why Does It Matter in 2026?

Public liability insurance aims to shield business owners from the ‘financial blows’ mentioned above. In 2026, with more stringent regulations in place and more willing customers regarding claims, such a policy is more than a nice-to-have. For many business owners, it is simply a matter of survival. Every business in Australia has to embrace growth and manage associated risks. It is always possible that something will go wrong, such as a customer slipping and falling on your foyer floor or a staff member accidentally damaging a client’s property. It is also possible that some products you sell might injure some customers. All these incidents can result in expensive litigation and compensation for the customer.

Key Takeaways:

- Public Liability Insurance helps businesses protect themselves from lawsuits and claims made by third parties for injury or damage to their property.

- It is a necessity for small businesses and professions, such as trades, hospitality, real estate, and beauty, which face customer risks and interaction daily.

- Every business should find the right policy by determining the business risks, coupled with coverage and other policies for added protection.

Understanding Public Liability Insurance

Public liability insurance covers any legal and compensation expenses arising from business activities that result in injury or property damage to third parties not involved in your business. The ‘third person’ can be a customer, a supplier, or even a bystander. Insurance brokers like VIM Cover specialise in providing essential coverage to protect your business from potential liabilities arising from third-party property damage or personal injury claims.

You can obtain quotes from licensed insurance brokers such as VIM Cove.

What Does Public Liability Insurance Cover?

- Third-party injury and property damage claims

If a person trips on a loose cable in your office or an employee scratches the client’s car while unloading the equipment, you will have to pay for the resulting expenses. These are specifically the expenses that Public Liability insurance covers. - Business activities leading to liability issues

Every industry carries risks. A carpenter might damage a wall while installing cabinets, or a beauty therapist might cause an allergic reaction during treatment. Cover ensures you don’t carry the full financial burden of these situations. - Risk exposure from products or services

A faulty product or service gone wrong can result in expensive claims. Even small businesses that think their risk is low can find themselves exposed when products reach the public.

How It Differs from Other Insurance Policies

- Comparison with indemnity insurance

Professional indemnity insurance covers mistakes and omissions in the advice and any other professional services rendered. More general in scope, public liability covers personal and property damages. - Relation to product liability and professional indemnity

Product liability often sits within public liability cover, while professional indemnity is sold separately. Together, they provide stronger protection. - Role in a comprehensive business insurance package

Many business owners bundle liability with other policies like workers' compensation, management liability, or cyber insurance. Public liability forms the backbone of these packages.

Why Business Owners Need Public Liability Insurance

Many business owners underestimate their exposure until it’s too late. A single claim can stretch into tens of thousands of dollars — a sum that can easily wipe out profits or, in extreme cases, shut a business down.

Who Should Consider This Coverage?

- Small business owners

Smaller operators rarely have the cash reserves to absorb large claims. Public liability cover provides security and allows them to operate with confidence. - Beauty professionals and real estate agents

Beauty services can lead to accidental injuries or skin reactions. Real estate agents frequently enter homes and run open inspections, exposing them to property damage claims. - Food-related businesses

Cafés, restaurants, and caterers carry a high risk when it comes to food poisoning or contamination. One claim can damage not just finances, but reputation as well.

Protecting Your Business Type and Activities

- Business premises and operations coverage

Liability cover protects you from incidents occurring at your premises or during everyday business operations. - Addressing unique business needs

Coverage can be tailored. A trades business might need higher limits than a freelance consultant, while event organisers may require additional protections. - Reducing property damage claims and liability risks

When a client’s laptop is damaged in an accident as minor as spilling a cup of coffee, a claim is immediately submitted. Having public liability insurance avoids these small vulnerabilities from turning into heavy losses.

How to Choose the Right Public Liability Insurance Policy

Not all insurance policies offer the same type of coverage. Business owners need to balance the coverage offered by the policy with the actual threats they face to obtain adequate protection. An insurance broker can help tailor a policy to your business needs.

Key Factors to Evaluate

- Understanding policy wording and coverage limits

Some policies offer exclusion clauses, while others have a variety of coverage limits. These clauses, along with the limits, have to be examined thoroughly to avoid unpleasant surprises at the time of a claim. - Assessing your business type and risk exposure

High-risk industries need higher coverage. A sole trader might get by with lower limits, but construction companies need more comprehensive protection. - Customising an insurance package

Public liability insurance can often be purchased along with other types of business insurance, tailoring your policy to fit the scope of your actual business activities.

Bundling Public Liability with Other Insurance Policies

- Including workers' compensation insurance

Essential for businesses with employees and often paired with liability cover for simplicity. - Adding product liability or cyber insurance

Product liability protects against defective goods, while your business may be subject to product liability claims, and cyber insurance addresses the widening scope of cyber attacks. Insurance addresses the growing threat of online attacks. - Considering management liability insurance

Protects directors and officers, complementing public liability cover. - Exploring income protection or life insurance

These personal covers give business owners and families an added layer of security.

Regional Considerations for Public Liability Insurance

Insurance obligations differ across states and territories, so business owners must ensure their policy complies locally.

Requirements Across Australia

- Australian Capital Territory

In the ACT, some industries must show proof of liability insurance before obtaining licences or permits. - Northern Territory

In the NT, stricter requirements often apply to the construction and hospitality sectors. - State-specific business insurance policies

Make sure your insurance covers all local regulations in the states of Queensland, Victoria and Western Australia.

Working with Trusted Providers

- Choosing an AAI Limited-backed policy

Providers with strong backing offer confidence that claims will be handled fairly. - Ensuring adequate insurance coverage

Businesses should review their policies regularly to keep pace with growth and new risks. - Protecting against liability claims and property damage

Reliable providers reduce stress, ensuring claims don’t derail business operations.

Maximising the Benefits of Public Liability Insurance

Public liability insurance enables businesses to operate without fear. It’s more than just an insurance policy; it’s an asset that empowers businesses to expand and take on new projects with confidence, ensuring compliance and peace of mind.

- Safeguard your business operations and premises.

Now that your policy is set up, you can focus on serving your clients selflessly without the fear of claims. - Minimise risks with a tailored business insurance package

Bundling other policies with liability cover helps ensure your protection is both complete and economical.

Frequently Asked Questions

- Public liability insurance for sole traders: is it a legal requirement in Australia?

Although it may not be a legal requirement for every business, coverage proof is often a precondition for commencing operations in many sectors, for several local government bodies, and for customers. - Public liability insurance cost: how much does it cost to be insured?

Most of the time, it is determined by the specific industry, the risks involved, and the coverage limits. A small consultancy will pay several hundred dollars in coverage, while firms in the construction or hospitality sectors will expect higher premiums. You can obtain quotes from licensed insurance brokers such as VIM Cover. - Public liability and professional indemnity insurance: what is the distinction?

Public liability covers third-party injury and property damage, whereas indemnity insurance is taken out to cover claims arising from negligence, error, or poor professional advice.

Public liability insurance is often required when dealing with local authorities, landlords, or contractors, though requirements may vary by industry and region.

What Does Public Liability Insurance Cover?

Key Takeaways

- Pubic liability insurance is intended to safeguard businesses from claims made by third parties for bodily injuries or damages to property caused by business activities.

- This is particularly important for self-employed professionals, small business proprietors, and individuals working in public environments, visiting clients, or having customers come to their location.

- Alongside compensation and the legal and claims investigation expenses, the policy cover excludes injuries to employees, poor quality, and cyber risks from coverage.

- Your line of work and contracts determine the cover amount needed, and the insurance may differ based on the business.

- Working with business insurance specialists helps you choose the right level of cover and avoid gaps.

- Insurance brokers like VIM Cover in Australia meet real-world business needs and contractual obligations with specially designed cover options.

Understanding Public Liability Insurance Coverage

What is Public Liability Insurance?

Every business, regardless of size, may be exposed to physical and financial harm to a third party. Public Liability Insurance protects the business against claims of personal injuries or property damages, which otherwise leaves the business to incur huge compensation expenses, along with the costly legal fees.

Picture a customer slipping in your shop in Sydney or a tradie accidentally damaging a client's property while working on-site in Melbourne. Without cover, you could be personally responsible for the cost of the claim. With a proper insurance policy, those expenses are managed for you.

VIM Cover offers policies designed for Australian businesses, so whether a small business owner running a café in Brisbane or operates as a contractor in Perth, your cover reflects the specific risks you face.

Who Needs Public Liability Insurance?

In Australia, a considerable number of small to medium-scale enterprises hold public liability insurance as a business requirement drafted by the landlords, councils, or contractors. The sole traders, freelancers, and small business operators who interact with customers directly are more susceptible to these risks.

It's essential for:

- Businesses operating in shopping centres or local markets.

- Trades working on construction job sites.

- Home office professionals who welcome clients to their property.

- Beauty professionals provide personal services to customers.

In some industries, proof of a Public Liability policy is a condition of getting work. Having cover in place shows you take responsibility for the safety of your customers and the wider public.

What Does Public Liability Insurance Cover?

Public liability insurance explained simply: it protects you if your work or premises cause harm to other people or their property.

Typical cover includes:

- Compensation for third-party injury.

- Repair or replacement costs for damaged business premises or personal belongings that don't belong to you.

- Legal action and the associated legal costs if a claim is taken to court.

Imagine a client who trips over an extension cord in your Adelaide office or who, in a meeting in Hobart, pours hot coffee on a customer’s lap. In both cases, public liability insurance may pay for these expenses. VIM Cover assists Australian businesses to tailor their Public Liability Insurance Cover to their specific needs, thereby eliminating the issues of overinsurance and gaps in cover.

What Isn't Covered by Public Liability Insurance?

Public liability insurance doesn't cover every type of risk. Some matters fall under different policies:

- Errors in advice or work that are dealt with through Professional Indemnity Insurance.

- Injuries to staff that require workers' compensation insurance under Australian law.

- Contractual liability or machinery breakdown.

- Cybercrime or data breaches, which need cyber insurance.

- Damage to your own business premises or motor vehicles.

- Faulty goods that require product liability insurance.

Exclusions are particularly relevant when it comes to Australia, given that different rules or insurance obligations may exist in its various states and territories. VIM Cover defines what is and isn't covered so that additional policies or protections can be arranged if necessary.

Choosing the Right Public Liability Policy for Your Business

Factors That Influence Policy Coverage

Required levels of cover may vary depending on the work, location, and any applicable contractual obligations. For instance, a council in New South Wales may mandate a certain minimum public liability insurance for market stallholders, whereas a landlord in Victoria may have different criteria.

Other factors include:

- The nature of your work and the potential liabilities involved.

- The policy wording and full details of what's covered.

- Your budget and cash flow.

- Any specific legal requirements in your industry?

Taking the time to compare options ensures you meet obligations without paying for unnecessary extras.

Why Seek Help From Business Insurance Specialists?

The last thing you would like to see is a policy misunderstanding during a claim. When it comes to business insurance specialists, they will guide you on what is appropriate for your financial situation. They clarify definitions, revealing the nuances, and see the value in additions like income protection or contents cover.

VIM Cover provides this guidance for Australian businesses, making sure your Public Liability policy fits your industry and keeps you compliant with local requirements.

How to File a Public Liability Insurance Claim

Steps to Ensure a Successful Claim

If you need to make a Public Liability claim in Australia, these steps can help:

- Record the incident immediately with photos, witness names, and medical or repair reports.

- Notify your insurer promptly for direction on what to do next.

- Submit all required documents, including your Public Liability Insurance cover details.

- Cooperate with investigations and keep communication clear and timely.

- Check your policy wording to confirm the incident is covered.

Common Challenges During Claims

Claims can take longer to resolve if documents are not filled out, or when the Public Liability Insurance Applied is not clear for the specific case. Also, disputes regarding contractual liability and disputes regarding cover limits are the most common issues.

Working with a responsive insurance broker like VIM Cover helps you navigate these hurdles. The clearer your policy is at the start, the smoother the claims process will be.

Key Insights on Public Liability Insurance

As for Australian businesses, Public Liability Insurance is a requirement. It offers protection from claims that emerge from ordinary interactions, including legal costs, compensation, and business disruption, which are costly.

Every business, even if it's a sole trader working at a local market or a developing business owning multiple sites, utilises Public Liability policies. With a reputable Australian insurance broker such as VIM Cover, you are able to attain both peace of mind and protection, letting you concentrate on your work and knowing that any unforeseen circumstances are covered.

FAQs About Public Liability Insurance

- Is public liability insurance mandatory in Australia?

Public liability insurance is not required by law for all businesses; however, several industries, landlords, and councils do make it part of their operating conditions. For instance, at some markets and on some construction sites, stallholders and contractors are required to obtain proof of insurance before they start work.

- How much public liability insurance do I need?

The business, the contract, and the evaluation of risk determine the correct value of insurance coverage. Some businesses only need a couple of million dollars of coverage, while others might need upwards of $20 million. Always make it a point to review the contracts and have a conversation with an insurance advisor to determine the most appropriate coverage.

- Does public liability insurance cover employees?

Public Liability Insurance does not cover employees. Injuries of employees are taken care of under workers' compensation insurance, which is compulsory in Australia. Public liability insurance only takes care of third parties, such as customers and guests.

- What’s the difference between public liability and professional indemnity insurance?

Public liability covers the injury or damage to the property of other people as a result of an accident. Professional indemnity covers financial losses resulting from advice given, services provided, or mistakes made, as well as losses of meritorious work. It is beneficial for many businesses to hold both types of insurance.

- How do I claim public liability insurance?

Insurers need to be notified as soon as possible. Alongside the notice, supporting documents need to be sent as well, which can include photographs, medical documents, and invoices related to the repairs. The claim has a better chance of getting approved if you collaborate with the insurance company regarding the needed documents and information for their investigation.

**This article provides general information only and does not take into account your specific circumstances. You should seek advice from a licensed insurance professional before making decisions.