What Is Public Liability Insurance and Why Does It Matter in 2026?

Public liability insurance aims to shield business owners from the ‘financial blows’ mentioned above. In 2026, with more stringent regulations in place and more willing customers regarding claims, such a policy is more than a nice-to-have. For many business owners, it is simply a matter of survival. Every business in Australia has to embrace growth and manage associated risks. It is always possible that something will go wrong, such as a customer slipping and falling on your foyer floor or a staff member accidentally damaging a client’s property. It is also possible that some products you sell might injure some customers. All these incidents can result in expensive litigation and compensation for the customer.

Key Takeaways:

- Public Liability Insurance helps businesses protect themselves from lawsuits and claims made by third parties for injury or damage to their property.

- It is a necessity for small businesses and professions, such as trades, hospitality, real estate, and beauty, which face customer risks and interaction daily.

- Every business should find the right policy by determining the business risks, coupled with coverage and other policies for added protection.

Understanding Public Liability Insurance

Public liability insurance covers any legal and compensation expenses arising from business activities that result in injury or property damage to third parties not involved in your business. The ‘third person’ can be a customer, a supplier, or even a bystander. Insurance brokers like VIM Cover specialise in providing essential coverage to protect your business from potential liabilities arising from third-party property damage or personal injury claims.

You can obtain quotes from licensed insurance brokers such as VIM Cove.

What Does Public Liability Insurance Cover?

- Third-party injury and property damage claims

If a person trips on a loose cable in your office or an employee scratches the client’s car while unloading the equipment, you will have to pay for the resulting expenses. These are specifically the expenses that Public Liability insurance covers. - Business activities leading to liability issues

Every industry carries risks. A carpenter might damage a wall while installing cabinets, or a beauty therapist might cause an allergic reaction during treatment. Cover ensures you don’t carry the full financial burden of these situations. - Risk exposure from products or services

A faulty product or service gone wrong can result in expensive claims. Even small businesses that think their risk is low can find themselves exposed when products reach the public.

How It Differs from Other Insurance Policies

- Comparison with indemnity insurance

Professional indemnity insurance covers mistakes and omissions in the advice and any other professional services rendered. More general in scope, public liability covers personal and property damages. - Relation to product liability and professional indemnity

Product liability often sits within public liability cover, while professional indemnity is sold separately. Together, they provide stronger protection. - Role in a comprehensive business insurance package

Many business owners bundle liability with other policies like workers' compensation, management liability, or cyber insurance. Public liability forms the backbone of these packages.

Why Business Owners Need Public Liability Insurance

Many business owners underestimate their exposure until it’s too late. A single claim can stretch into tens of thousands of dollars — a sum that can easily wipe out profits or, in extreme cases, shut a business down.

Who Should Consider This Coverage?

- Small business owners

Smaller operators rarely have the cash reserves to absorb large claims. Public liability cover provides security and allows them to operate with confidence. - Beauty professionals and real estate agents

Beauty services can lead to accidental injuries or skin reactions. Real estate agents frequently enter homes and run open inspections, exposing them to property damage claims. - Food-related businesses

Cafés, restaurants, and caterers carry a high risk when it comes to food poisoning or contamination. One claim can damage not just finances, but reputation as well.

Protecting Your Business Type and Activities

- Business premises and operations coverage

Liability cover protects you from incidents occurring at your premises or during everyday business operations. - Addressing unique business needs

Coverage can be tailored. A trades business might need higher limits than a freelance consultant, while event organisers may require additional protections. - Reducing property damage claims and liability risks

When a client’s laptop is damaged in an accident as minor as spilling a cup of coffee, a claim is immediately submitted. Having public liability insurance avoids these small vulnerabilities from turning into heavy losses.

How to Choose the Right Public Liability Insurance Policy

Not all insurance policies offer the same type of coverage. Business owners need to balance the coverage offered by the policy with the actual threats they face to obtain adequate protection. An insurance broker can help tailor a policy to your business needs.

Key Factors to Evaluate

- Understanding policy wording and coverage limits

Some policies offer exclusion clauses, while others have a variety of coverage limits. These clauses, along with the limits, have to be examined thoroughly to avoid unpleasant surprises at the time of a claim. - Assessing your business type and risk exposure

High-risk industries need higher coverage. A sole trader might get by with lower limits, but construction companies need more comprehensive protection. - Customising an insurance package

Public liability insurance can often be purchased along with other types of business insurance, tailoring your policy to fit the scope of your actual business activities.

Bundling Public Liability with Other Insurance Policies

- Including workers' compensation insurance

Essential for businesses with employees and often paired with liability cover for simplicity. - Adding product liability or cyber insurance

Product liability protects against defective goods, while your business may be subject to product liability claims, and cyber insurance addresses the widening scope of cyber attacks. Insurance addresses the growing threat of online attacks. - Considering management liability insurance

Protects directors and officers, complementing public liability cover. - Exploring income protection or life insurance

These personal covers give business owners and families an added layer of security.

Regional Considerations for Public Liability Insurance

Insurance obligations differ across states and territories, so business owners must ensure their policy complies locally.

Requirements Across Australia

- Australian Capital Territory

In the ACT, some industries must show proof of liability insurance before obtaining licences or permits. - Northern Territory

In the NT, stricter requirements often apply to the construction and hospitality sectors. - State-specific business insurance policies

Make sure your insurance covers all local regulations in the states of Queensland, Victoria and Western Australia.

Working with Trusted Providers

- Choosing an AAI Limited-backed policy

Providers with strong backing offer confidence that claims will be handled fairly. - Ensuring adequate insurance coverage

Businesses should review their policies regularly to keep pace with growth and new risks. - Protecting against liability claims and property damage

Reliable providers reduce stress, ensuring claims don’t derail business operations.

Maximising the Benefits of Public Liability Insurance

Public liability insurance enables businesses to operate without fear. It’s more than just an insurance policy; it’s an asset that empowers businesses to expand and take on new projects with confidence, ensuring compliance and peace of mind.

- Safeguard your business operations and premises.

Now that your policy is set up, you can focus on serving your clients selflessly without the fear of claims. - Minimise risks with a tailored business insurance package

Bundling other policies with liability cover helps ensure your protection is both complete and economical.

Frequently Asked Questions

- Public liability insurance for sole traders: is it a legal requirement in Australia?

Although it may not be a legal requirement for every business, coverage proof is often a precondition for commencing operations in many sectors, for several local government bodies, and for customers. - Public liability insurance cost: how much does it cost to be insured?

Most of the time, it is determined by the specific industry, the risks involved, and the coverage limits. A small consultancy will pay several hundred dollars in coverage, while firms in the construction or hospitality sectors will expect higher premiums. You can obtain quotes from licensed insurance brokers such as VIM Cover. - Public liability and professional indemnity insurance: what is the distinction?

Public liability covers third-party injury and property damage, whereas indemnity insurance is taken out to cover claims arising from negligence, error, or poor professional advice.

Public liability insurance is often required when dealing with local authorities, landlords, or contractors, though requirements may vary by industry and region.

What Does Public Liability Insurance Cover?

Key Takeaways

- Pubic liability insurance is intended to safeguard businesses from claims made by third parties for bodily injuries or damages to property caused by business activities.

- This is particularly important for self-employed professionals, small business proprietors, and individuals working in public environments, visiting clients, or having customers come to their location.

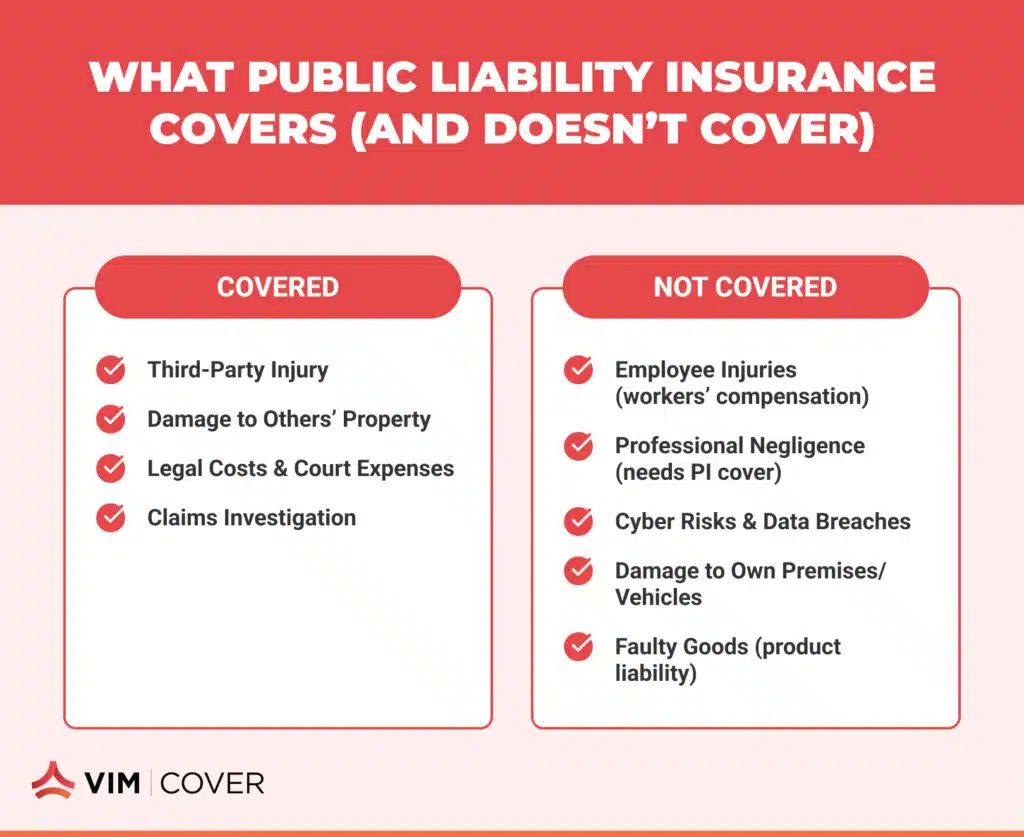

- Alongside compensation and the legal and claims investigation expenses, the policy cover excludes injuries to employees, poor quality, and cyber risks from coverage.

- Your line of work and contracts determine the cover amount needed, and the insurance may differ based on the business.

- Working with business insurance specialists helps you choose the right level of cover and avoid gaps.

- Insurance brokers like VIM Cover in Australia meet real-world business needs and contractual obligations with specially designed cover options.

Understanding Public Liability Insurance Coverage

What is Public Liability Insurance?

Every business, regardless of size, may be exposed to physical and financial harm to a third party. Public Liability Insurance protects the business against claims of personal injuries or property damages, which otherwise leaves the business to incur huge compensation expenses, along with the costly legal fees.

Picture a customer slipping in your shop in Sydney or a tradie accidentally damaging a client's property while working on-site in Melbourne. Without cover, you could be personally responsible for the cost of the claim. With a proper insurance policy, those expenses are managed for you.

VIM Cover offers policies designed for Australian businesses, so whether a small business owner running a café in Brisbane or operates as a contractor in Perth, your cover reflects the specific risks you face.

Who Needs Public Liability Insurance?

In Australia, a considerable number of small to medium-scale enterprises hold public liability insurance as a business requirement drafted by the landlords, councils, or contractors. The sole traders, freelancers, and small business operators who interact with customers directly are more susceptible to these risks.

It's essential for:

- Businesses operating in shopping centres or local markets.

- Trades working on construction job sites.

- Home office professionals who welcome clients to their property.

- Beauty professionals provide personal services to customers.

In some industries, proof of a Public Liability policy is a condition of getting work. Having cover in place shows you take responsibility for the safety of your customers and the wider public.

What Does Public Liability Insurance Cover?

Public liability insurance explained simply: it protects you if your work or premises cause harm to other people or their property.

Typical cover includes:

- Compensation for third-party injury.

- Repair or replacement costs for damaged business premises or personal belongings that don't belong to you.

- Legal action and the associated legal costs if a claim is taken to court.

Imagine a client who trips over an extension cord in your Adelaide office or who, in a meeting in Hobart, pours hot coffee on a customer’s lap. In both cases, public liability insurance may pay for these expenses. VIM Cover assists Australian businesses to tailor their Public Liability Insurance Cover to their specific needs, thereby eliminating the issues of overinsurance and gaps in cover.

What Isn't Covered by Public Liability Insurance?

Public liability insurance doesn't cover every type of risk. Some matters fall under different policies:

- Errors in advice or work that are dealt with through Professional Indemnity Insurance.

- Injuries to staff that require workers' compensation insurance under Australian law.

- Contractual liability or machinery breakdown.

- Cybercrime or data breaches, which need cyber insurance.

- Damage to your own business premises or motor vehicles.

- Faulty goods that require product liability insurance.

Exclusions are particularly relevant when it comes to Australia, given that different rules or insurance obligations may exist in its various states and territories. VIM Cover defines what is and isn't covered so that additional policies or protections can be arranged if necessary.

Choosing the Right Public Liability Policy for Your Business

Factors That Influence Policy Coverage

Required levels of cover may vary depending on the work, location, and any applicable contractual obligations. For instance, a council in New South Wales may mandate a certain minimum public liability insurance for market stallholders, whereas a landlord in Victoria may have different criteria.

Other factors include:

- The nature of your work and the potential liabilities involved.

- The policy wording and full details of what's covered.

- Your budget and cash flow.

- Any specific legal requirements in your industry?

Taking the time to compare options ensures you meet obligations without paying for unnecessary extras.

Why Seek Help From Business Insurance Specialists?

The last thing you would like to see is a policy misunderstanding during a claim. When it comes to business insurance specialists, they will guide you on what is appropriate for your financial situation. They clarify definitions, revealing the nuances, and see the value in additions like income protection or contents cover.

VIM Cover provides this guidance for Australian businesses, making sure your Public Liability policy fits your industry and keeps you compliant with local requirements.

How to File a Public Liability Insurance Claim

Steps to Ensure a Successful Claim

If you need to make a Public Liability claim in Australia, these steps can help:

- Record the incident immediately with photos, witness names, and medical or repair reports.

- Notify your insurer promptly for direction on what to do next.

- Submit all required documents, including your Public Liability Insurance cover details.

- Cooperate with investigations and keep communication clear and timely.

- Check your policy wording to confirm the incident is covered.

Common Challenges During Claims

Claims can take longer to resolve if documents are not filled out, or when the Public Liability Insurance Applied is not clear for the specific case. Also, disputes regarding contractual liability and disputes regarding cover limits are the most common issues.

Working with a responsive insurance broker like VIM Cover helps you navigate these hurdles. The clearer your policy is at the start, the smoother the claims process will be.

Key Insights on Public Liability Insurance

As for Australian businesses, Public Liability Insurance is a requirement. It offers protection from claims that emerge from ordinary interactions, including legal costs, compensation, and business disruption, which are costly.

Every business, even if it's a sole trader working at a local market or a developing business owning multiple sites, utilises Public Liability policies. With a reputable Australian insurance broker such as VIM Cover, you are able to attain both peace of mind and protection, letting you concentrate on your work and knowing that any unforeseen circumstances are covered.

FAQs About Public Liability Insurance

- Is public liability insurance mandatory in Australia?

Public liability insurance is not required by law for all businesses; however, several industries, landlords, and councils do make it part of their operating conditions. For instance, at some markets and on some construction sites, stallholders and contractors are required to obtain proof of insurance before they start work.

- How much public liability insurance do I need?

The business, the contract, and the evaluation of risk determine the correct value of insurance coverage. Some businesses only need a couple of million dollars of coverage, while others might need upwards of $20 million. Always make it a point to review the contracts and have a conversation with an insurance advisor to determine the most appropriate coverage.

- Does public liability insurance cover employees?

Public Liability Insurance does not cover employees. Injuries of employees are taken care of under workers' compensation insurance, which is compulsory in Australia. Public liability insurance only takes care of third parties, such as customers and guests.

- What’s the difference between public liability and professional indemnity insurance?

Public liability covers the injury or damage to the property of other people as a result of an accident. Professional indemnity covers financial losses resulting from advice given, services provided, or mistakes made, as well as losses of meritorious work. It is beneficial for many businesses to hold both types of insurance.

- How do I claim public liability insurance?

Insurers need to be notified as soon as possible. Alongside the notice, supporting documents need to be sent as well, which can include photographs, medical documents, and invoices related to the repairs. The claim has a better chance of getting approved if you collaborate with the insurance company regarding the needed documents and information for their investigation.

**This article provides general information only and does not take into account your specific circumstances. You should seek advice from a licensed insurance professional before making decisions.

Comprehensive Food Truck Insurance for 2026

Discover unparalleled protection for your food truck insurance needs with VIM Cover’s comprehensive food truck insurance policies. Designed for Australian truck owners, our policies ensure affordability and reliability, keeping you secure on every journey. We offer a rapid quote for approved applicants. Please fill out the form below to receive a fast quote.

Key Takeaways on Food Truck Insurance

- Food trucks face double exposure: road accidents + customer liability.

- A single food poisoning claim can cost thousands in legal fees.

- Equipment breakdowns or food spoilage can stop operations overnight.

- Tailored insurance helps protect cash flow and keeps you compliant.

- VIM Cover offers customised policies with fast claims support.

Food trucks face risks beyond the kitchen. A road accident can damage your vehicle and equipment, spoiled stock can wipe out profits, and legal fees can be incurred in cases of food poisoning or other allergies. Unlike restaurants, food trucks are exposed to both road mishaps and other safety liabilities. These uncertainties make it essential to have a more business-focused and personalised insurance, which allows you to run your business with minimal worry. The right cover not only protects your cash flow and keeps you compliant but also ensures your mobile business stays open after an unexpected setback.

Why Food Truck Insurance is Crucial for Your Business?

Unlike a fixed restaurant, your food truck is both your motor vehicle and your business premises, meaning you carry double the exposure on the road and in service. That's why the right food truck insurance isn't optional; it's essential. Also, it's equally important to have the right type of insurance that matches your business and its running.

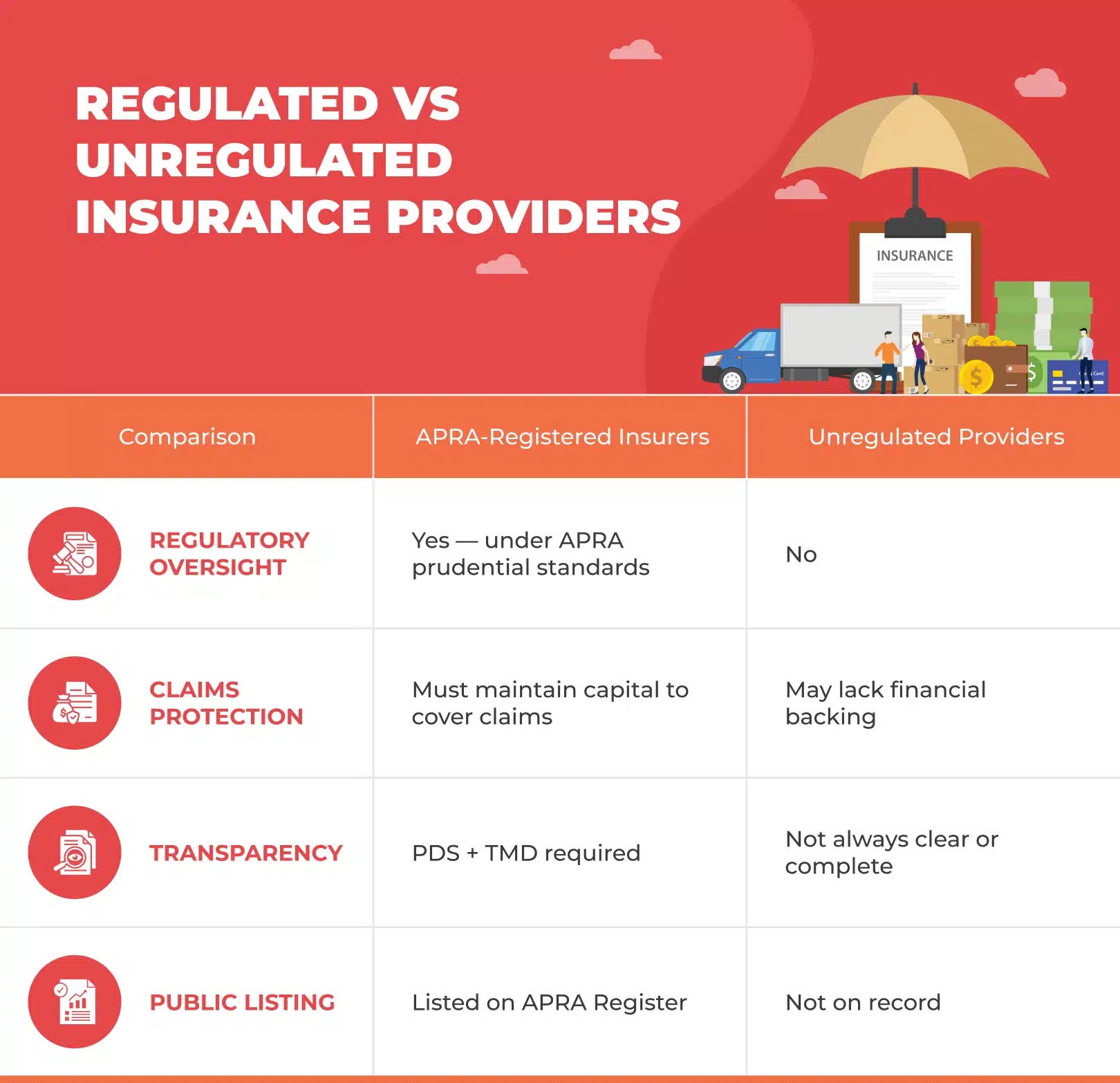

For operators, it’s worth noting that insurers in Australia must meet regulatory standards set by APRA (Australian Prudential Regulation Authority), ensuring you’re dealing with a licensed and compliant provider. This gives food truck owners confidence that their policy is backed by a regulated and trustworthy insurance company.

Unique Risks Food Trucks Face

It includes:

- Accidental damage - This includes vehicle damage, such as a minor prang, or even if a vehicle is written off, including accidental damage to cooking equipment, which prevents any immediate service.

- Food poisoning & personal injury – Costly legal claims can arise due to foodborne illness or a slip near your service window.

- Food spoilage & equipment breakdown – If your fridge fails overnight or your generator cuts out at a festival, spoiled stock is money lost.

- Legal liability – Every public interaction, from parking in crowded areas to serving hot food, exposes you to potential compensation claims.

- Optional covers – Extra protection, such as cash flow cover, can keep bills paid if downtime stops you from trading.

How Insurance Protects Operators?

Let's understand some of the standard insurances:

- Personal accident & workers' compensation covers truck owners and their staff in case of mishaps, which include burns, cuts, or other injuries sustained while at work.

- Medical expenses & legal costs – In case a customer sues over injury or illness, your business insurance policy can handle the hospital bills and lawyer fees.

- Insurance claim support – A good provider ensures that claims for insured events, such as theft, breakdowns, or accidents, are processed quickly, thereby reducing downtime.

- Peace of mind for operators – With cover in place, food truck owners can focus on what matters most: serving customers and growing the mobile business without the constant worry of "what if."

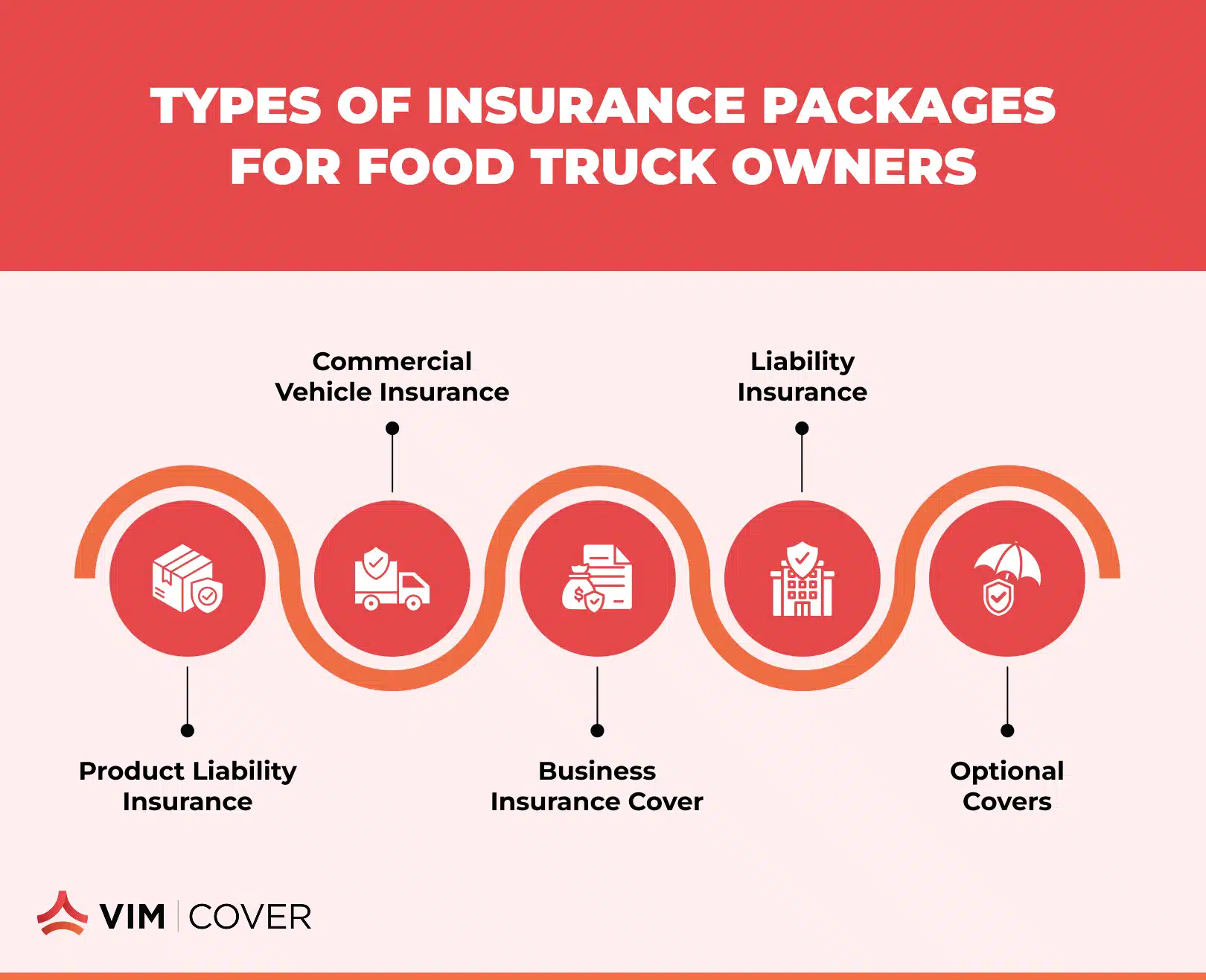

Types of Insurance Packages for Food Truck Owners

Product liability insurance protects against claims of:

- food poisoning

- allergic reactions

- Covering legal fees and compensation.

Commercial vehicle insurance covers:

- the truck itself,

- repairs after accidental damage,

- fit-out and cooking equipment inside.

Business insurance cover extends to:

- stock, cash

- portable equipment

- losses from theft, fire, or food spoilage.

Liability insurance protects against:

- Legal costs if a customer or third party suffers personal injury

- Property damage during the course of business activities.

Optional covers, such as equipment breakdown or downtime protection, help:

- stabilise income when generators fail

- fridges stop working

- You are unable to operate due to an insured event.

It's advisable to read and understand policy wordings and Product Disclosure Statements before signing up for any particular insurance cover to avoid claim issues.

How VIM Cover Provides Superior Insurance Solutions?

We understand that no two mobile food trucks are alike and have specific business needs. Irrespective of whether you run a coffee van, a gourmet burger truck, or a multi-vehicle fleet, customisable insurance packages allow you to pick and choose the level of accidental loss you would like to cover. We offer a rapid quote for approved applicants. Please fill out the form below to receive a fast quote.

Unlike one-size-fits-all insurance providers, we work through experienced insurance brokers who focus on understanding your day-to-day risks. Based on your business operations, we suggest that you opt for comprehensive cover that extends to business premises, staff, and broader business activities. Our flexible cover options let you choose the best for your business.

What sets us apart from many insurance companies is our fast and transparent claims process. Food truck operators don't have time for paperwork delays; their streamlined approach ensures you're back on the road as quickly as possible. The policy terms are written to reflect the realities of mobile businesses, avoiding unnecessary coverage and reducing higher premiums that other providers often charge.

Protect Your Mobile Food Business with the Right Coverage

A tailored business insurance quote from VIM Cover ensures you only pay for what truly matters — no unnecessary extras, just the right cover for the risks your food truck faces daily. Policies are designed around your actual operations, whether you run a coffee van with portable generators, a gourmet burger truck with high-value cooking equipment, or a fleet serving significant events.

Coverage can extend to:

- Breakdowns & spoilage – protection when fridges, freezers, or generators fail.

- Liability claims – cover for food poisoning, personal injury, or property damage caused during service.

- Business interruption – income support when an insured event forces you to stop trading.

By securing a plan built for your business model, you safeguard cash flow, meet legal liability requirements, and keep your mobile business operational with minimal disruption. Protection is not just compliance; it's a guarantee that you can stay on the road and serve customers with peace of mind.

FAQs About Food Truck Insurance with VIM Cover

- Does food truck insurance cover both the vehicle and kitchen equipment?

Yes. With VIM Cover, policies can bundle commercial vehicle insurance with coverage for cooking equipment, refrigeration, and fit-outs, ensuring your entire mobile setup is protected under one plan.

- What happens if food spoilage occurs due to a power failure?

Food spoilage caused by equipment breakdown or power outages can be included in your policy. VIM Cover helps you recover costs so your cash flow isn't disrupted.

- Can I insure multiple food trucks under one policy?

Absolutely. VIM Cover offers fleet policies for operators with multiple trucks, making it easier and often more affordable to manage insurance for your mobile business.

- How does VIM Cover handle claims for food poisoning incidents?

If a customer files a claim for food poisoning or personal injury, your liability coverage will take effect. VIM Cover ensures a transparent and fast claims process, minimising downtime and legal costs.

- Are there flexible insurance options if I only operate seasonally?

Yes. VIM Cover can tailor cover options for seasonal food truck operators, so you're only paying for the protection you need when your business is active.

**This article provides general information only and does not take into account your specific circumstances. You should seek advice from a licensed insurance professional before making decisions.

Comprehensive Commercial Truck Insurance Guide for 2026

Key Takeaways about Commercial Truck Insurance

- Protects business vehicles and drivers from major risks.

- Covers accidents, liability, downtime, and natural disasters.

- Flexible options: comprehensive, third-party, and add-ons.

- Extra cover: life, property, transit, and roadside support.

- VIM Cover delivers fast quotes and tailored solutions.

Running trucks for business isn’t simple. Breakdowns, accidents, and even weather events can affect businesses and their operations, often causing delays in deliveries and other regular activities. It also leads to a lot of back-and-forth to get things on track. That’s why having commercial truck insurance is more than just meeting a requirement on paper; it’s about protecting your people, your trucks, and your cash flow.

At VIM Cover, we work with businesses across Australia to make sure they’re not left exposed. The right cover means fewer worries and a faster recovery when things don’t go as planned.

Why Commercial Truck Insurance Matters?

Protecting Business Operations

If your trucks are on the road for business purposes, you’re carrying risk every kilometre. Good cover ensures:

- Business vehicles are protected if damaged or written off.

- Truck drivers and owner-operators can work with peace of mind.

- Major risks like accidental damage, public liability, or third-party property damage don’t turn into major financial losses.

Key Benefits of the Right Coverage

A firm insurance policy does more than replace a damaged truck. It helps your business stay steady when unexpected costs hit.

- Financial protection – Keeps your cash flow intact when repair or replacement bills arrive.

- Risk coverage – From natural disasters to accidents involving dangerous goods.

- Downtime cover – Helps with income loss if a truck is off the road.

- Business continuity – Support during claims so your operations don’t stall.

Types of Commercial Insurance for Trucking Businesses

Core Options

- Comprehensive or complete insurance – Covers physical damage, accidental damage, and total loss.

- Third Party Property Damage – Protects against damage claims from others.

- Roadside assistance – Reduces costly delays if a truck breaks down.

- Prime mover cover – Designed for high-value vehicles critical to freight.

Add-Ons and Extras

Depending on your setup, you may also need:

- Life insurance for owner-operators.

- Property insurance for depots or warehouses.

- Marine cargo insurance if your transport extends offshore.

- Custom options based on carrying capacity and mixed personal use.

How to Choose the Right Commercial Truck Insurance Policy for Your Business Needs

Step 1: Match Commercial Truck Insurance Cover to Your Business Activities

Think about:

- The risks in your line of work (long-haul, dangerous goods, interstate freight).

- What’s already included in your policy documents?

- Your driving history and financial situation both affect premiums.

Step 2: Pick a Reliable Insurance Provider

Not all insurance companies cover the requirements of truck insurance. Before you decide:

- Compare truck insurance quotes across providers.

- Look for insurers with experience in transport and strong claims support.

- Ask for clear Target Market Determination (TMD) documents to ensure the policy is designed for businesses like yours.

How Commercial Truck Insurance Protects Your Business

Comprehensive Risk Management Solutions

The right commercial truck insurance is a key component of innovative risk management. It:

- Shields you from compensation claims and third-party liability.

- Covers accidental damage or total loss.

- Keeps operations running with superior claims service and access to replacements.

- Provides tailored solutions so you don’t pay for cover you don’t need.

Compliance and Business Continuity

Insurance is about protection while your trucks are on the go, as well as staying compliant with state laws and avoiding unwanted losses. Policies that meet Target Market Determination guidelines and address specific business needs help keep you aligned with state regulations. This reduces legal risks while ensuring your trucks have the right insurance cover.

Why Partner with VIM Cover? Your Right Commercial Truck Insurance Partner

We specialize in policies that work for real businesses, not cookie-cutter solutions, and our insurance covers ensure adequate liability coverage for your trucks tailored to their specific needs. We help you:

- Find cover that fits your business use and vehicle types.

- Add extras like downtime cover or roadside assistance when needed.

- Get a truck insurance quote in just 60 minutes for eligible applicants. That means in case of emergencies, when you require the right coverage or comprehensive insurance for your truck, we are here to assist you.

- Rely on a team that supports you through the claims process.

Many business owners also wonder, Are business vehicles more expensive to insure? The answer depends on factors such as vehicle type, usage, and risk profile, which can significantly impact insurance costs.

We offer customised commercial truck insurance policies, flexible cover options, and, for approved applicants, a fast 60-minute quote service to keep your business moving without downtime.

FAQs – Commercial Truck Insurance with VIM Cover

Q: How quickly can I get a truck insurance quote with VIM Cover?

We know time matters in business. That’s why VIM Cover offers a rapid turnaround on most truck insurance quotes, so you’re not stuck waiting.

Q: Does VIM Cover provide cover for dangerous goods?

Yes. Our policies can be tailored for the transportation of dangerous goods, ensuring you stay protected while meeting compliance requirements.

Q: Can I insure a mixed fleet under one policy?

Absolutely. Whether you run prime movers, delivery vans, or light trucks, we can customise cover for a wide range of vehicle types and carrying capacities under a single policy.

Q: What if my truck breaks down or is off the road?

We offer downtime coverage and roadside assistance options, helping to reduce income loss and keep your business operations steady during unexpected repairs.

Q: Does VIM Cover only provide truck insurance?

No. Alongside comprehensive truck insurance, we also offer a range of additional products, including business insurance, property insurance, public liability insurance, and transit insurance, to provide you with complete protection for your business and personal needs.

Q: Why choose VIM Cover over other insurance providers?

Unlike generic insurance companies, we focus on the trucking industry. That means tailored advice for the type of insurance based on your requirements, flexible extras, fast quotes, and hands-on customer support during the claims process.

**This article provides general information only and does not take into account your specific circumstances. You should seek advice from a licensed insurance professional before making decisions.

Comprehensive Light Truck Insurance Guide for 2026

At VIM Cover, we understand that every light truck operator has different needs, whether you’re moving goods across town, running a fleet of goods-carrying vehicles, or transporting dangerous goods. That’s why we offer customised light truck insurance policies, flexible cover options, and, for approved applicants, a fast 60-minute quote service to keep your business moving without downtime.

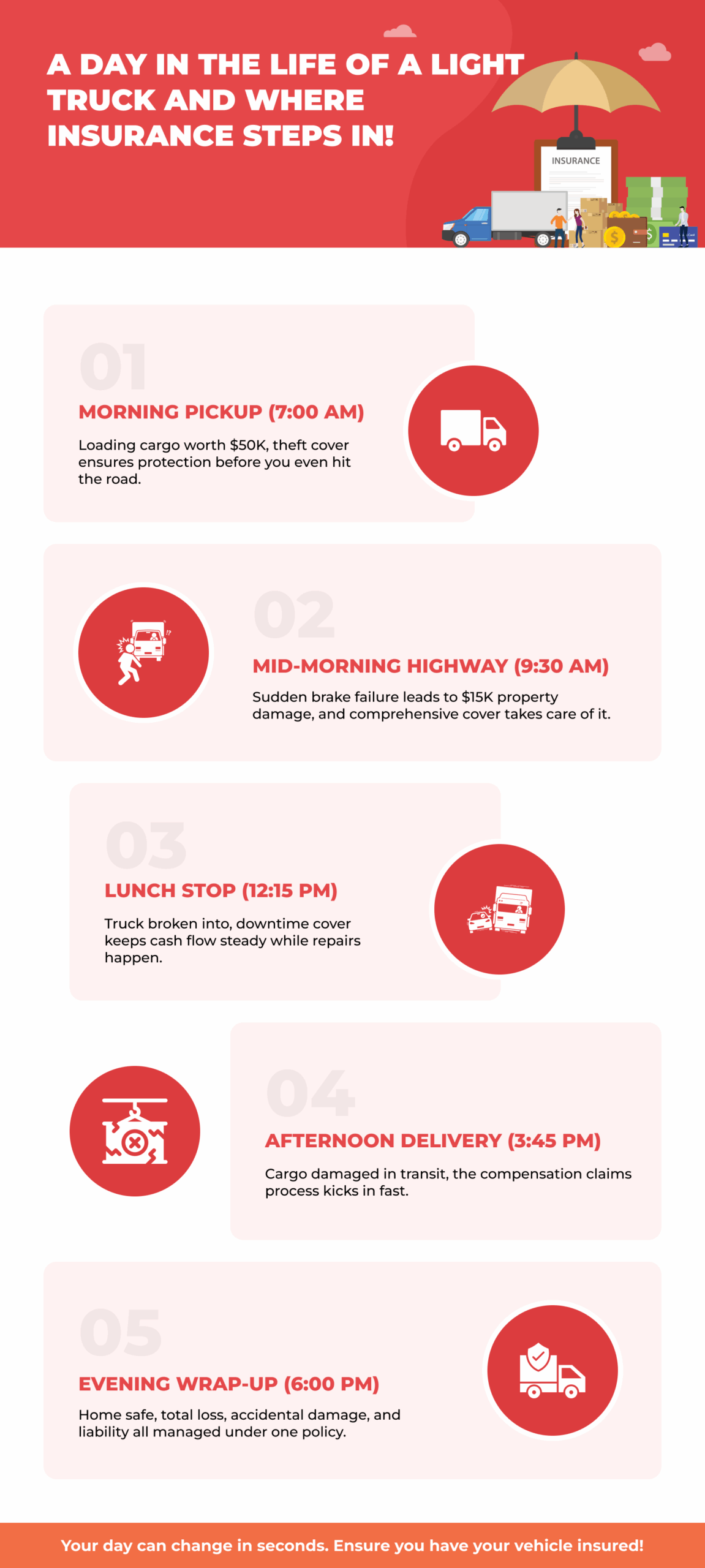

Key Takeaways:

- Light truck insurance is essential for goods-carrying vehicles up to 4.5 tonnes GVM, protecting against theft, damage, liability, and downtime losses.

- VIM Cover offers customised policies with optional add-ons like downtime cover, transit insurance, and dangerous goods protection.

- The right policy offers peace of mind with vehicle coverage, theft protection, accident liability, and business continuity support.

- Understanding your vehicle type, cargo value, and business operations is key to selecting the right level of coverage.

- VIM Cover’s 60-minute quote service ensures fast, tailored insurance solutions for businesses of all sizes.

- Bundling your truck insurance with life, travel, or home insurance can enhance your protection strategy.

- Opting for a provider like VIM Cover, known for transparency and strong support, can improve your claims experience.

What Is Light Truck Insurance?

Light truck insurance is designed for goods-carrying vehicles with a specific carrying capacity, which is often up to 4.5 tonnes GVM and can be personalised for business use or personal purposes. It protects you from accidental damage, theft, property damage to other people’s property, and even total loss of your vehicle.

For businesses, this type of cover isn’t just a compliance tick; it’s a safeguard that keeps business vehicles on the road and earning a stable income (in case of any mishap), even after an insured event.

Understanding Light Trucks and Insurance Needs

Light trucks are versatile workhorses (as they call it) that range from delivery vans to small tippers, and their insurance needs vary from heavy commercial trucks. Policies are built to reflect:

- The carrying capacity and type of vehicle.

- Frequency and nature of business activities.

- Whether they carry dangerous goods, operate as mobile plant, or are used for mixed personal and business purposes.

An effective truck insurance policy ensures you’re covered for real-world risks, not just what’s written on paper.

Key Features of Light Truck Insurance

A strong, comprehensive truck insurance policy can include:

- Comprehensive cover for your vehicle and your property.

- Theft cover and accidental loss protection.

- Downtime cover to support your cash flow while your truck is off the road.

- Compensation claims for personal injury or damage caused to others.

The level of cover you choose will determine how well you’re protected when it matters most.

Why Businesses Need Light Truck Insurance?

Supporting Business Vehicles and Operations

For transport operators and owners of goods-carrying vehicles, light truck insurance is more than a formality. It’s essential for keeping operations running, especially when dealing with dangerous goods or time-sensitive and/or perishable goods delivery.

During an insured event, having the right cover can help with repair costs, replacements, and even provide a temporary hire vehicle to keep jobs moving.

Small Business Insurance Benefits

Many insurers offer small business insurance packages that combine comprehensive coverage for trucks with other insurance products. These can be customised for:

- Specialised freight

- Mobile plant transport

- High-value goods

- Multi-vehicle fleets

It’s not just about protection, it’s about peace of mind for owners and employees.

Choosing the Right Light Truck Insurance Policy

Factors to Consider

Before selecting a truck insurance policy, weigh your:

- Type of vehicle and carrying capacity.

- Driving history and risk profile.

- Level of cover, including downtime cover and comprehensive coverage.

- Specific clauses in the Policy Wording and relevant Product Disclosure Statement.

Working with Insurance Brokers and Providers

An experienced insurance broker can help you clearly understand the aspects of the insurance, cut through the jargon, compare cover options, and match you with an insurance provider that fits your financial situation and specific needs. Choose providers with a clear Target Market Determination and responsive customer support to guide you through the claims process.

Additional Insurance Products to Consider

For businesses looking to protect more than just their trucks, pairing your commercial motor cover with other insurance products can strengthen your safety net:

- Home insurance – To protect personal property from damage or theft.

- Travel Insurance – For business or personal trips involving valuable goods.

- Boat Insurance – For commercial or personal watercraft.

- Life Insurance – Ensures financial stability for your family or business partners if the unexpected happens.

- Transit insurance – Covers goods in transit from pickup to delivery.

Ready to protect your business?

Get a customised VIM Cover light truck insurance quote in under *60 minutes. Speak to our team today for personalised cover recommendations.

Protecting Your Business with the Right Cover

The right policy cushions your business from costly disruptions and keeps operations running smoothly. It’s about matching insurance to the real risks you face, not paying for what you don’t need.

- Downtime cover to offset income loss during repairs

- Protection for high-value or sensitive cargo

- Add-ons for dangerous goods and mobile plant

- Policy terms that fit your vehicle type and workload

Learn more about how to get a truck insurance quote in 2026.

Why Choose VIM Cover for Light Truck Insurance?

When it comes to protecting your business vehicles, you need more than just a standard policy; you need a partner who understands the risks and challenges you face every day.

VIM Cover offers:

- Comprehensive truck insurance for a wide range of vehicle types and carrying capacities.

- Flexible extras like downtime cover, transit insurance, and customised policy wording for your specific needs.

- A proactive and responsive customer support.

- Our 60-minute turnaround for quotes for qualifying applicants.

Schedule an appointment with us today!

FAQs – Light Truck Insurance

Q: Can I get a light truck insurance quote quickly with VIM Cover?

Yes. In certain circumstances, VIM Cover offers a 60-minute rapid quote service so you can get insured without delays.

Q: Does VIM Cover offer cover for dangerous goods or mobile plant vehicles?

Absolutely. Our truck insurance policies can be tailored for dangerous goods, mobile plant, and other specialised uses.

Q: What makes VIM Cover different from other insurance providers?

We combine comprehensive coverage with personal service, flexible policy design, and fast turnaround times, all while ensuring your specific needs are met.

Q: Can I bundle my light truck insurance with other products at VIM Cover?

Yes. You can combine your truck cover with options like home insurance, travel insurance, or life insurance to protect more of what matters to you.

**This article provides general information only and does not take into account your specific circumstances. You should seek advice from a licensed insurance professional before making decisions.

How to Get a Truck Insurance Quote in 2026?

Key Takeaways:

- What’s included in a truck insurance quote (and what’s not).

- The difference between Comprehensive cover, Third Party Property Damage, and other policy types.

- How factors such as vehicle type, cargo, and business use affect your price.

- Add-ons like downtime cover and transit insurance can save you when things go wrong.

- How to compare insurance providers and read the fine print before you sign.

- What to expect during the claims process and how to avoid delays.

If you own a truck or manage a fleet, insurance isn’t optional; it’s essential. In 2026, getting a truck insurance quote is more than just filling out forms. Insurers assess what you drive, how you use it, and your claims history before offering cover. And you can compare offers only from APRA‑authorised insurance companies to make sure your provider meets national standards.

Want a Quote in 60 Minutes?

If you’re short on time, we offer a 60-minute rapid quote turnaround for eligible businesses. That means less waiting, more peace of mind, and faster protection for your truck or fleet.

Get your truck insurance quote in under 60 minutes here!

What is Included in a Truck Insurance Quote?

Most insurance companies include several critical components in your quote. Review the Insurance Council of Australia guidelines to understand industry best practices for commercial motor insurance, including how risks like property damage and liability are handled.

Most insurance companies will include the following in your truck insurance quote:

1. Type of Cover

You’ll typically choose from a few key policy types:

- Comprehensive cover – Covers your truck for theft, accidental damage, vandalism, and property damage to others, even if the accident was your fault.

- Third Party Property Damage – Protects you if your vehicle causes damage to someone else’s vehicle or property, but not your own.

- Third Party Fire and Theft – A balance between cost and protection, covers others' property, plus fire or theft damage to your vehicle.

You may also consider Public Liability Insurance, Compulsory Third Party (CTP), or Third Party Insurance, depending on your operations and state requirements.

2. Business Use and Specific Activities

Your quote reflects how and where you operate:

- Local, regional, or national transport

- Dangerous goods, refrigerated goods, or mobile plant operations

- Business-related storage or depot details

Your business use directly affects pricing and eligibility.

3. Vehicle Information

Insurers evaluate:

- Truck make, model, age

- Carrying capacity

- Whether you operate light trucks, rigid trucks, or prime movers

- Modifications like mobile cranes, tail lifts, or onboard computers

Accurate info ensures a valid quote and helps avoid policy disputes.

4. Driving & Claims History

Your driving history, past claims history, and even your financial situation play a role in determining premium levels and excess options.

Operators with strong safety records often access lower premiums or better coverage limits.

5. Optional Benefits and Add-On

Coverage options like Transit Insurance or Downtime Cover are standardised across the Australian insurance market. Understanding typical definitions and claims processes is easier when referring to the Insurance Council of Australia’s guidance.

6. Policy Inclusions, Costs, and Documentation

Every quote includes:

- A detailed premium (monthly or annually)

- Breakdown of inclusions and exclusions

- Every quote should point you to a Product Disclosure Statement and a Target Market Determination, as insurers must follow APRA’s prudential standards for general insurers regarding transparency and governance.

- A clear Target Market Determination

- Your rights to general and personal insurance advice

Understanding your policy wording and the full scope of your cover is essential before committing.

Understanding Truck Insurance Coverage

A truck insurance quote typically includes one or more of the following cover types:

Comprehensive Cover

Covers your truck for accidental damage, theft, fire, and property damage to others. It’s ideal if your truck is essential to your income or is of high value.

Third Party Property Damage & Public Liability

Essential if your truck damages someone else’s vehicle or property. Public liability insurance covers incidents involving injury or damage during loading, unloading, or delivery.

Add-Ons That Matter

Depending on your business, you can include:

- Downtime cover – income protection if your truck is off the road

- Transit insurance – protects your cargo during transport

- Windscreen, hire vehicle, and legal liability extras

Each policy can be customised to fit your business, from a single light truck to a fleet of prime movers.

Additional Insurance Types You May Need

Your truck insurance quote may cover the vehicle, but running a business often involves other risks. Depending on your operations, you might also need:

Travel Insurance for business-related trips

If you or your team regularly travel for work, whether interstate or regional, Travel Insurance can cover unexpected costs like trip cancellations, delays, or personal injury.

Boat Insurance for companies with marine operations

For transport companies that also operate near ports or on water, Boat Insurance protects vessels used for loading, delivery, or marine transport. It’s especially relevant for businesses involved in intermodal freight.

Life Insurance to protect business owners and employees

If you’re a business owner or employ drivers, Life Insurance adds a layer of security for families and teams. It helps protect income, manage business debts, or support succession planning, a valuable asset for small business operators.

Why Truck Insurance Protects Your Business Operations?

Things go wrong. Accidents happen. Trucks break down. A good truck insurance policy makes sure you’re not paying for it all out of pocket.

What the Right Policy Covers

- Covers repair costs and property damage

- Takes care of legal liability if you're at fault

- Downtime cover helps you manage lost income

- Gives owner-drivers and transport operators real peace of mind

What Kind of Vehicles Are Covered?

- Light trucks, rigid trucks, and prime movers

- Work trucks, vans, and business cars under Commercial Vehicle Insurance

- Trucks carrying dangerous goods or fitted with mobile plant

It’s all about keeping your trucks on the road and your business moving.

Factors That Impact Truck Insurance Cost

No two quotes are the same. Your truck insurance cost depends on a few key details that insurers use to assess your risk.

What Insurers Look At?

- Your driving and claims history, and your financial situation.

- The truck’s carrying capacity and how it's used for business activities

- The type of insurance you’re after, Comprehensive cover, Third Party Property Damage, or something in between

- Your financial situation, including the ability to absorb risk

Whether you’re an owner-driver or managing a fleet, these factors shape your premium.

Understanding the Fine Print

Before signing anything:

- Read the Product Disclosure Statement (PDS) for the full details

- Make sure the policy matches your business: check the Target Market Determination (TMD)

- Look into optional benefits that could improve your cover (and increase the cost)

Precise policy wording helps avoid headaches later, especially at claims time.

How to Find the Best Truck Insurance Providers?

With so many insurance companies out there, finding the right fit comes down to knowing what to look for and asking the right questions. You can read our comprehensive guide about Light Truck Insurance for 2026 here.

Steps to Get the Right Coverage

- Always choose insurers listed on APRA’s official register of authorised general insurers. This guarantees they are monitored for financial stability and regulatory compliance.

- Be ready with your personal information, vehicle details, and business needs

- Speak to an authorised representative who can give clear, tailored advice, not just a sales pitch

Insurance Options Beyond Truck Insurance

Depending on your setup, you might need:

- Fleet insurance for multiple trucks or vehicles

- Home Insurance or Landlord Insurance to protect business-related properties

- Home Buildings coverage for owner-operators running from home

Get cover that fits your life, not just your truck.

Tips for Navigating the Truck Insurance Claims Process

Accidents happen. When they do, understanding the claims process can save you time, stress, and money.

What to Expect During Claims?

- For events like accidental loss, total loss, or property damage, your insurer will walk you through the required steps.

- You may need to submit documents, evidence, or repair quotes, stay organised.

- Liability claims and compensation claims can take longer, especially if third parties are involved.

Many insurers now offer a streamlined process online, and some (like VIM Cover) even assign a dedicated claims team to support you.

Importance of General Advice and Customer Support

- Reliable Customer Support can make or break your experience, especially during stressful situations.

- Seek general advice before committing to a policy or during a claim if you're unsure of your next step.

- Go with a provider that offers a wide range of insurance solutions, so you’re not left uncovered when it matters most.

It’s not just about getting your truck fixed. It’s about getting back on the road with confidence.

Types of Trucks Covered Under Commercial Vehicle Insurance

Whether you're hauling freight across states or running tools between worksites, your policy should match your vehicle type.

Here's what most commercial truck insurance policies can cover:

- Light trucks – often used by tradies, couriers, and small business owners

- Rigid trucks – ideal for local deliveries, moving services, or specialist freight

- Prime movers – used for long-haul freight, heavy haulage, and intermodal operations

- Mobile plant & mobile cranes – often used in construction and industrial settings

- Vehicles carrying dangerous goods require more tailored risk assessments

A quality Truck Insurance Policy should reflect how your vehicles are used for business purposes and the risks they face day-to-day.

Transit Insurance: Do You Need It?

If your trucks are carrying cargo, Transit Insurance can be a game-changer.

It covers accidental damage, theft, or loss of goods while in transit, which is especially crucial for freight companies and owner-drivers transporting high-value cargo or working with fragile or perishable items.

You can also extend this cover to include:

- Natural disasters (flood, fire, storm)

- Theft while parked overnight

- Third-party Fire and Theft for high-risk routes

Is Fleet Insurance Better for Growing Businesses?

Running more than a few vehicles? Fleet Insurance can often provide:

- Bulk discounts across all registered vehicles

- Easier renewals with one policy, not ten

- Streamlined claims and admin

Fleet cover is ideal for transport operators, logistics businesses, and companies with business vehicle insurance needs across multiple locations or drivers.

Even small businesses with just three or four trucks can often access entry-level fleet solutions.

Do You Need Life Insurance as a Truck Operator?

It might not be the first thing on your mind, but if you're an owner-driver, business partner, or running a transport company, Life Insurance matters.

- It protects your family or business if something happens to you

- Can be bundled with other products (like Travel Insurance and Boat Insurance) if your operations involve different risk areas

Many insurance providers now offer business-focused life cover with flexible options based on your risk level and financial situation.

Secure the Right Truck Insurance Quote for Your Business

Getting the right truck insurance quote shouldn’t take hours or guesswork. At VIM Cover, we make the process fast, clear, and built for your business.

Whether you run one prime mover or manage a whole fleet, we’ll help you find the right balance of cost, coverage, and compliance. Our tailored options protect against accidental damage, property damage, lost income, and legal liability, with add-ons like Downtime Cover, Transit Insurance, and Fleet Insurance when needed.

We also know your time is valuable. That’s why we offer a 60-minute quote turnaround, no hassle, no hold-ups. Get started now.

FAQs

1. How fast can I get a quote from VIM Cover?

In certain circumstances, you’ll receive your quote in under 60 minutes, tailored to your vehicle type and business needs.

2. Is Downtime Cover worth it?

Yes, it helps you recover lost income while your truck is off the road due to repairs or damage.

3. What trucks can I insure?

We cover light trucks, rigid trucks, prime movers, and vehicles transporting dangerous goods or mobile plant.

4. What factors affect my insurance cost?

Your driving history, claims history, business use, and carrying capacity all influence your truck insurance cost.

5. What is a Target Market Determination?

It outlines the intended recipients of the policy. Always review the Target Market Determination and policy documents before making a purchase.

6. Can I insure multiple vehicles under one policy?

Yes, our Fleet Insurance solutions make it easy to manage cover for several trucks at once.

7. Will my policy cover legal fees?

Most policies cover legal liability, including third-party claims for property damage or personal injury.

8. Can I get help choosing a policy?

Absolutely. Our team offers general advice and support to help you make the right call. You can contact us by either filling out the form or giving us a call.

**This article provides general information only and does not take into account your specific circumstances. You should seek advice from a licensed insurance professional before making decisions.

Understanding Insurance for Service Businesses

Why Understanding Insurance Matters for Service Based Businesses

Whether you offer consulting, accounting, hairdressing, graphic design, IT support, or any kind of professional service, insurance forms a critical part of your business’s stability. Clients rely on your expertise, and you depend on a world of trust and relationships — but what protects you when things don’t go as planned? The answer is comprehensive, fit-for-purpose insurance.

Service businesses face unique risks. A wrong recommendation, unintended copyright infringement, or client dissatisfaction can quickly spiral into expensive legal battles. Even something as simple as a client slipping on your premises can threaten hard-earned revenue. An unexpected incident may disrupt your ability to deliver services altogether. Insurance helps you manage these uncertainties so you can focus on growing your reputation and serving your clientele without unnecessary worry.

Why service-based businesses need insurance

Professional agility is one thing; professional security is another entirely. No matter how skilled or careful, every services business is exposed to risk. It’s easy to assume that “insurance” is just for brick-and-mortar businesses who deal with inventory or physical products, but that view can leave service providers dangerously exposed.

A dissatisfied client could allege professional negligence. Sensitive client data could be hacked, resulting in a privacy breach. Someone could visit your office, trip on a loose carpet, and be injured. Without insurance, each of these examples could cause disruption, loss of income, and even legal liability that threatens your livelihood.

Consider these common misperceptions:

- “We just give advice, there’s nothing that can physically go wrong.”

- “My client base is loyal, I don’t expect them to sue.”

- “I work from home, so risk is minimal.”

Unfortunately, court cases and complaints don’t distinguish between intentions and outcomes. A single client misunderstanding, system hack, or oversight can bring intense financial stress. Insurance is about safeguarding your business so you can deliver professional services confidently.

Key types of insurance for service-based businesses

Just as no two service businesses are identical, insurance solutions aren’t one-size-fits-all. Here’s a rundown of the main types you should consider:

Professional indemnity insurance

This is the cornerstone for most consultants, advisors, and professionals. It protects you if a client alleges that your advice or service caused them financial loss, either through error, omission, or negligence.

Common claims covered:

- Advice deemed erroneous that leads to a client’s monetary loss

- Accidental breach of copyright or confidentiality

- Defamation related to your services

- Loss of client documents entrusted to you

Some industries require professional indemnity insurance by law or regulation — such as accountants, lawyers, financial advisors, and some allied health practitioners.

Public liability insurance

This covers third-party injury or property damage that occurs as a result of your business activities. For instance, a client might slip and hurt themselves at your workplace, or you accidentally damage something while visiting a client.

While public liability may seem like “retail business” cover, it’s vital for service businesses who engage with clients in person — even if only occasionally.

Cyber liability insurance

Service businesses often hold sensitive client data. Cyber liability deals with the risks of hacking, cyber-theft, or accidental release of private information.

Covers events like:

- Data breaches involving client records

- Ransomware and email scams

- Losses from unauthorised electronic fund transfers

General business insurance won’t typically cover cyber-related incidents, making this increasingly essential.

Business interruption insurance

Events beyond your control — like storm damage, fire, or theft — can prevent you from servicing clients, sometimes for weeks or months. Business interruption covers loss of income so your business survives while you get back on your feet.

Management liability insurance

This is relevant once your service business expands or you run a company structure with directors. It protects personal and company assets in the case of management-related claims, workplace disputes, or regulatory penalties.

Portable equipment insurance

Service professionals sometimes work with valuable tech, tools, or equipment outside the office — think laptops, cameras, or medical devices. Portable equipment cover insures these against loss, theft, or damage.

Typical insurance needs by service sector

Insurance priorities vary by profession, but some overlaps are universal. Here’s a simplified table to illustrate typical needs:

| Service Sector | Professional Indemnity | Public Liability | Cyber Liability | Business Interruption | Equipment Cover |

|---|---|---|---|---|---|

| Accounting/Finance | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ |

| Legal | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ |

| IT/Tech Support | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ |

| Creative/Design/Media | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ |

| Health & Wellness | ✔️ | ✔️ | ✖️ | ✔️ | ✔️ |

| Consultancy/Advisory | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ |

| Trades (Service-only) | ✔️ | ✔️ | ✖️ | ✔️ | ✔️ |

Not every business needs every type, but this provides a starting point for considering where your business faces greatest exposure.

Assessing your risks

Assessing which insurance you need starts with a careful look at your activities and obligations. No two businesses face identical risks, but common questions help clarify your unique profile:

- Who are my clients, and what promises do I make to them?

- Do I handle confidential information or client data?

- Do I work at client sites or welcome visitors?

- What technology or specialised equipment do I rely on?

- What would happen if my premises were inaccessible for a week?

- Am I exposed to claims about my work quality, accuracy, or conduct?

- Are there regulatory requirements or client contract terms mandating specific covers?

By mapping out the services you provide and the way you interact with clients, you paint a clear picture of where you may be vulnerable. It also helps avoid paying for unnecessary cover.

How much insurance cover is enough?

Under-insuring is risky, but over-insuring ties up capital unnecessarily. Finding the right balance requires thinking beyond headline policy limits. Some key factors include:

- The size and complexity of your contracts

- Industry standards or legal minimums

- Value of equipment and assets

- Potential legal defence and settlement costs

- Duration your business could survive a disruption without income

Ideally, insurance should be tailored. Discussing your specific risk factors with a broker or insurance adviser can help fine-tune levels, especially where clients or government expect set minimums.

Common pitfalls and how to avoid them

Insurance for service providers has plenty of nuances. Some common mistakes trip up even experienced operators:

- Ignoring contract terms: Many larger clients or government contracts specify insurance types and limits. Overlooking these can cost you contracts or expose you to claims.

- Assuming home-based businesses don’t need cover: Running a service business from your home doesn’t exempt you from risks — and most personal insurance policies exclude commercial use.

- Not updating insurance as the business grows: Expansion, new services, or hiring staff all change your risk profile. Annual reviews ensure your cover keeps pace.

- Failing to disclose full activities to insurers: Not telling your insurer exactly what you do (all the services you offer, where you operate, etc.) can void policies if you ever claim.

The relationship between risk management and insurance

Insurance is your financial backup; risk management is what prevents claims in the first place. They work hand in hand.

Service business owners should embed simple practices to reduce common exposures. These include:

- Clear, written client agreements spelling out what you’re responsible for

- Maintaining professional credentials and keeping skills sharp

- Regular technology and cybersecurity updates

- Confidentiality and document management protocols

- Procedures for safely greeting clients and visitors

Implementing practical controls can limit the likelihood of incidents and support your case if you do need to claim.

Adapting your cover as things change

Your business rarely stands still. Insurance needs shift as you:

- Diversify your services

- Hire more staff or contractors

- Invest in new technology

- Land bigger clients or contracts

- Move offices or go fully remote

Annual insurance checkups should become routine, just like tax or compliance reviews. These keep your cover fit for purpose so you’re not caught short if things go sideways.

Working with insurance advisers and brokers

Navigating insurance products and wordings can feel like a maze. For many service businesses, building a relationship with a broker or adviser is money well spent.

Brokers help identify gaps, explain policy conditions, and negotiate on your behalf — especially valuable if need to claim. Their insights into industry-specific risks are drawn from real-world experience, helping you avoid the most common (and costly) pitfalls.

Don’t be afraid to ask direct questions about exclusions, waiting periods, or policy conditions. A trustworthy adviser expects it. Their goal is to help your business thrive, not just sell insurance.

Key takeaways for service business owners

Being a service professional means people trust your knowledge, integrity, and expertise. The right insurance lets you back that up, with confidence. Always be proactive: review your exposure, tailor your policies, communicate openly with your broker or insurer, and update cover as you grow.

At its heart, insurance for service businesses is about more than ticking a compliance box. It provides the resilience you need to keep doing what you do best, even if the unexpected happens. As your business grows, make insurance part of your strategic toolkit — not just an afterthought.

Manufacturing and Engineering Insurance

Manufacturing and Engineering Insurance: Risk Management Essentials

Australian manufacturers and engineering firms operate in a world where progress and risk walk side by side. Machinery hums, innovation thrives, but so do hazards: equipment failures, supply interruptions, cyber threats, and complex liabilities. No matter how robust your systems or safety protocols, unexpected events can derail even the most seasoned operations.

Protecting the heart of your business isn’t just about ticking a regulatory box; it’s a strategic investment in continuity and resilience.

Why Traditional Insurance Falls Short

General insurance policies simply don’t cut it when it comes to the intricate world of manufacturing and engineering. These sectors face an interplay of physical, human, and digital risks that are often unique. Many insurance products were not designed with an advanced CNC facility or a 3D-printed medical device manufacturer in mind.

From precision tooling to global supply chains, the risks are multifaceted:

- Production lines can grind to a halt from mechanical or software failures.

- Intellectual property could be compromised during a cyber intrusion.

- An error in a single engineered component may affect hundreds of downstream users.

- Environmental and pollution incidents could trigger regulatory fines and third-party claims.

So, what does a tailored manufacturing and engineering insurance policy actually cover?

Core Components of a Robust Policy

At the foundation, specialist insurers target both tangible and intangible threats, making these products more sophisticated than standard business packages. Typical covers might include:

| Coverage Type | What It Protects | Why It Matters |

|---|---|---|

| Machinery Breakdown | Physical assets and income loss | Machines are business lifeblood |

| Product Liability | Legal costs, damages | Defective products can result in recalls |

| Business Interruption | Lost income, extra costs | Downtime has a cascading financial effect |

| Professional Indemnity | Errors in design, advice, or plans | Even the best engineers make mistakes |

| Cyber Liability | Data and networks | Attacks can halt operations instantly |

| Environmental Impairment Liability | Pollution events | Manufacturing accidents can be costly |

| Transit and Marine Cargo | Goods in transit | Supply chains often cross national borders |

| Property Damage | Buildings, contents, stock | Fires and weather events threaten assets |

This combination adapts as your business grows, automates, or integrates new technology.

Digging Deeper: Customised Protections

No two facilities or product lines look exactly alike. Insurance programs need to account for the nuance of your machinery, materials, and markets. For example:

- An electronics manufacturer may face acute risks around static discharge and temperature control. Their insurance should include specific endorsements for equipment breakdown and data restoration.

- A precision engineering firm providing components for automotive assembly lines must look at recall cover, protecting against the cost of pulling back defective products across a continent.

- Multi-site operators might require blanket coverage that flexes as stock is moved between locations in Australia or overseas.

These tailored policies are engineered not just to pay claims, but to help companies bounce back swiftly after a disruption.

The Modern Threatscape: Beyond Tangible Loss

Digitalisation reshapes the sector, and with it, fresh challenges. Australian engineering and manufacturing firms now face:

- Sophisticated ransomware attacks that lock down plant control systems.

- Intellectual property risk as design files are shared with global partners.

- Breach of contract disputes arising from software glitches in high-stakes projects.

Insurance now reaches beyond the warehouse floor to digital blueprints, data integrity, and global supply contracts. The sharp increase in cyber events, for instance, makes cyber liability cover non-negotiable for even mid-sized firms.

Case Study: When the Unexpected Happens

Picture a mid-sized manufacturer near Geelong. A power surge damages their main CNC lathe, leading to a three-week halt in production. While repairs are underway, pending orders pile up, overtime rises, and clients express their frustration.

If their insurance is narrowly focused, machinery repair costs may be covered, but the lost income, expedited shipping costs to placate angry clients, and penalty payments may fall outside the policy.

Comprehensive business interruption cover, however, transforms the outcome:

- Lost gross profit during downtime is covered.

- Extra expenses incurred to keep customers happy can be claimed.

- The business sustains its reputation and retains valuable contracts.

Commonly Overlooked Exposures

Many businesses think only in terms of fire, theft, and machinery breakdown. Yet experience shows the less visible risks can be even more damaging:

- A minor production error in an aluminium extrusion triggers a large-scale product recall.

- Environmental exposures from leaks or mistimed waste disposal prompt regulatory scrutiny.

- Contractual disputes arise when finished goods are late due to material shortages.

These scenarios underscore the need to periodically review your policy for exclusions and sub-limits, to avoid an underinsurance trap.

Emerging Coverage Trends for Australian Manufacturers

New legislative frameworks and technology adoption trends continue to reshape the insurance landscape:

- ESG (Environmental, Social & Governance) standards have led to stricter environmental liability requirements.

- The adoption of Industry 4.0 automation calls for breakdown covers that extend to robotics and IoT-integrated systems.

- Supply chain risk management tools are bundled with insurance, giving early warning of a brewing crisis overseas.

- Multinational operations are using master policies with local compliance overlays, harmonising coverage across multiple jurisdictions.

Insurance brokers working exclusively in the manufacturing and engineering sectors now harness data analytics, site risk mapping, and incident simulation tools to build adaptable policies. This arms decision-makers with the insights required to balance risk appetite with cost.

Cost-Saving Strategies Without Cutting Corners

Premiums for these advanced covers can be eye-watering, but there are effective ways to control costs without leaving yourself exposed:

- Invest in preventative maintenance and safety training, which can lower premiums through demonstrable risk reduction.

- Bundle multiple insurance types with one specialist provider for multibuy discounts and coverage clarity.

- Raise deductibles where appropriate, as long as you maintain sufficient liquidity to cover an initial loss.

- Engage periodically with your insurer to update them on equipment upgrades or process improvements—they may view you more favourably at renewal time.

A broker who understands both your business and your sector’s global risk profile is more likely to negotiate the right coverage at a fair rate.

Navigating Claims: How to Prepare Ahead

The difference between a smooth recovery and a drawn-out saga often lies in preparation. Forward-thinking firms:

- Keep digital and hard copies of critical documents such as invoices, maintenance logs, and certifications.

- Map key supply chain dependencies, so that loss adjusters understand business impact.

- Train key staff on claims notification protocols, ensuring all relevant evidence is collected promptly after an incident.

A little groundwork upfront can transform a frustrating experience into a quick and constructive claims resolution.

Top Mistakes to Watch Out For

Even sophisticated manufacturers sometimes get it wrong. Some of the most common pitfalls to avoid include:

- Assuming “one size fits all” business insurance policies are adequate.

- Failing to update policies after process changes or equipment upgrades.

- Overlooking cyber and environmental exposures.

- Ignoring contractual liability extensions demanded by clients or contractors.

Bringing an expert into your corner can provide crucial insight, often uncovering gaps that aren’t visible until a loss occurs.

Questions Business Owners Should Be Asking Themselves

Insurance is never a “set and forget” topic. It’s worthwhile to regularly challenge assumptions with questions like:

- Is my business interruption sum insured based on outdated financials?

- Have we accounted for all locations and their unique risks?

- If a new client requests a higher liability limit, can our current policy flex to meet it?

- Do our IT security protocols satisfy the terms for cyber insurance?

- Are there upcoming regulatory changes in the industries we supply that could leave us exposed?

Periodic reviews, particularly with specialist guidance, can make all the difference.

Industry Insights and Shaping the Future

Australian manufacturers are globalising, automating, and morphing into more data-driven businesses by the year. This modernisation has seen the insurance market respond with new products that reward proactive risk management and fast adaptation.

Firms embedding environmental sustainability, integrated IT controls, and world-class safety regimes are set to benefit with more attractive premiums and higher policy limits. Likewise, those that see insurance as a strategic partner rather than a cost find themselves better positioned to win complex tenders and attract global customers.

Success isn’t just about making things. It’s about safeguarding your ability to keep making, innovating, and delivering—even in the face of uncertainty.