Comprehensive Guide to Residential Strata Insurance in QLD

Key Takeaways

- Residential strata insurance in QLD is mainly about insulating common property and shared building elements in strata schemes.

- Insurance policies can offer different coverage, so it is a good idea to check the relevant Product Disclosure Statement and Target Market documents.

- Strata insurance is not simply a type of Home Insurance or Landlord Insurance; it differs in both its make-up and its aims.

- Industry participants may provide general information about types of general insurance without taking into account individual circumstances.

Residential strata insurance plays an established role in protecting and managing shared living environments throughout Queensland. Sometimes, even a small-unit complex or a multi-storey residential development can be a strata property. Besides multiple owners, it involves shared responsibilities, common risks, and key differences from single-family homes.

Understanding residential strata insurance in QLD helps strata owners understand the framework. It also explains the cover and exclusions.

This guide provides general information only. It is not financial product advice and does not take into account individual goals, financial situations, or needs.

Readers should refer to the relevant Product Disclosure Statement (PDS), Target Market Determination (TMD), and Financial Services Guide (FSG) before choosing an insurance product. They should also seek independent professional advice if necessary.

What Is Residential Strata Insurance?

A Body Corporate usually organises residential strata insurance for strata-titled properties such as apartments, duplexes, and townhouses. Instead of a single dwelling, this insurance usually covers the strata building, common areas, and shared facilities. These facilities are used by multiple occupants.

Residential strata insurance in Queensland generally refers to insurance for strata properties regulated under the Body Corporate and Community Management Act. This act sets out the insurance requirements for strata schemes. Even though coverage varies, policies are usually for the property insured, not for the personal belongings of individual lot owners.

Understanding Strata Insurance Basics

A key characteristic of residential strata insurance QLD is that it generally insures common property and areas. Examples include hallways, lifts, stairwells, gardens, driveways, and shared amenities such as swimming pools. The idea is to protect collectively owned and maintained places, even though individuals do not privately hold them.

Depending on the policy wording, strata insurance may cover insured events such as accidental damage, storm damage, and water damage. The extent of cover is determined by the inclusions and exclusions listed in the policy documents.

In fact, most strata insurance policies include a public liability section that covers injuries or property damage in common areas. Consequently, this kind of cover is especially necessary when visitors, residents, or even volunteers use shared facilities.

Why Residential Strata Insurance Is Relevant for Strata Title Properties

Queensland legislation imposes a general obligation on bodies corporate to ensure appropriate insurance is in place for their strata schemes. This insurance mandate reflects the co-ownership aspect of strata buildings and the consequent need to manage risk collectively in Australian strata settings.

Typically, residential strata insurance covers the risks of the physical building, including permanent fixtures and contents in common areas. In contrast, it differs from the content insurance policy arrangements held by individual lot owners.

Although strata insurance applies to communal property, individual lot owners may hold separate Home Insurance or Landlord Insurance policies. These policies can cover personal contents, floating floors, or alterations not classified as common property under strata legislation and scheme by-laws.

Key Inclusions Commonly Found in a Strata Insurance Policy

Coverage for Strata Properties

Typical inclusions might generally be:

- The physical structure of the building and the specified building sum

- Contents in the common area, like lights, fixtures, or communal equipment

- Rent loss due to an insured event that disrupts tenancy arrangements

Additionally, certain insurance policies can highlight Office Bearers' cover or safeguards. This protects committee members when they perform their official duties.

Additional Coverage Areas

Optional sections may concern the following, depending on the insurance products:

- A machinery breakdown that affects the shared systems

- Property damage cover is limited to the involvement of shared facilities

- Clearly defined liability issues relating to voluntary workers

The availability of coverage depends on the policy terms and the insurer's Target Market.

How Insurance Premiums Are Commonly Influenced

Factors Influencing Insurance Premiums

One factor alone is rarely the reason behind the increase or decrease of insurance premiums for residential strata in QLD. The insurance company may consider the claims made on the strata property over the last few years, the strata's risk profile, and the value of your home as part of the whole building.

Moreover, factors such as points of cover, previous loss events, claims history, and building characteristics may also be assessed. For this reason, premium rates differ between insurers and policy types.

Reading the Product Disclosure Statement

The relevant PDS would cover what is included and excluded, the limits, and the claims procedure. Going over this piece helps the parties involved clarify the definition of the cover and when it applies.

On the other hand, the Financial Services Guide and the like clarify the delivery of insurance services and the role of intermediaries. Collectively, such documents constitute the wider disclosure framework under Australian financial services law.

Strata Management and Insurance Responsibilities

Role of Strata Managers and Committees

Strata management is a system usually composed of a strata manager, the strata committee, and the owners of individual lots. They share several responsibilities, including ensuring the body corporate has insurance, complying with strata scheme regulations, and handling collective decision-making processes.

In most cases, good strata management is a matter of committee members and residents talking regularly about insurance options, claims, and any changes introduced by a new policy.

Secure Your Strata Property with the Right Insurance

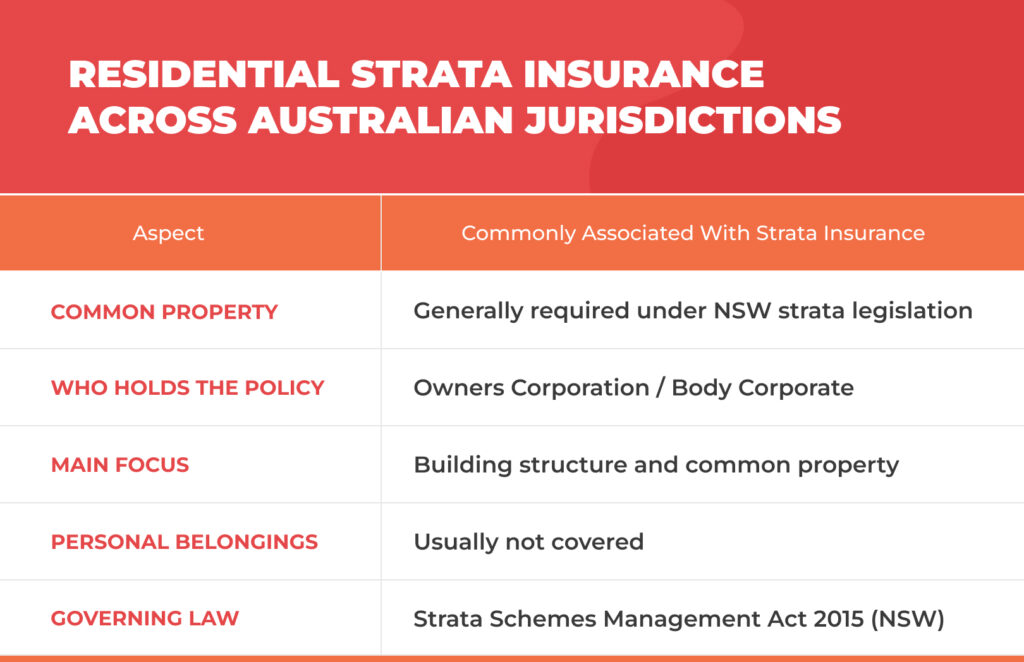

This guide focuses on Queensland. However, residential strata insurance frameworks in New South Wales and South Australia may differ due to variations in legislation and regulations.

The specific needs and characteristics of local areas, building types, and the use of strata-titled properties influence insurance arrangements.

This content does not constitute financial product advice and does not take into account individual objectives, financial situations, or needs.

FAQs

Is residential strata insurance the same as a Home Insurance policy?

No. A Home Insurance policy usually covers a single dwelling, while strata insurance generally covers shared building elements.

Does strata insurance cover personal items?

Personal items and belongings are typically covered under individual contents insurance, not strata insurance.

Who arranges residential strata insurance in QLD?

The Body Corporate generally arranges it on behalf of the strata schemes.

Are all events automatically covered?

Coverage depends on policy terms, insured events, and exclusions outlined in the Product Disclosure Statement.

Comprehensive Guide to Business Insurance Cost in 2026

Key Takeaways

- How much business insurance will cost in 2026 depends on the kind of business, the number of employees, the location, and the risk profile.

- The cost of public liability insurance, as well as other premiums, is affected by claims history, coverage limits, and industry risk levels.

- The contract terms and the insurance quote should be carefully reviewed to understand the available coverages.

- The data provided here is generic and doesn't account for the individual situations of the businesses.

Knowing what affects business insurance costs in 2026 is not as simple as looking at a pricing guide. Insurance prices depend on factors such as the nature and location of the business, and the types of risks the company may be exposed to over time. Instead of providing set prices or suggestions, this article examines the typical ways insurance costs are determined in Australia and what business owners typically consider when their insurance cover is due for review.

This information is of a general nature and does not take into consideration your personal situation. It should not be regarded as financial, legal, or insurance advice.

This article provides general information only and does not take into account your objectives, financial situation, or needs.

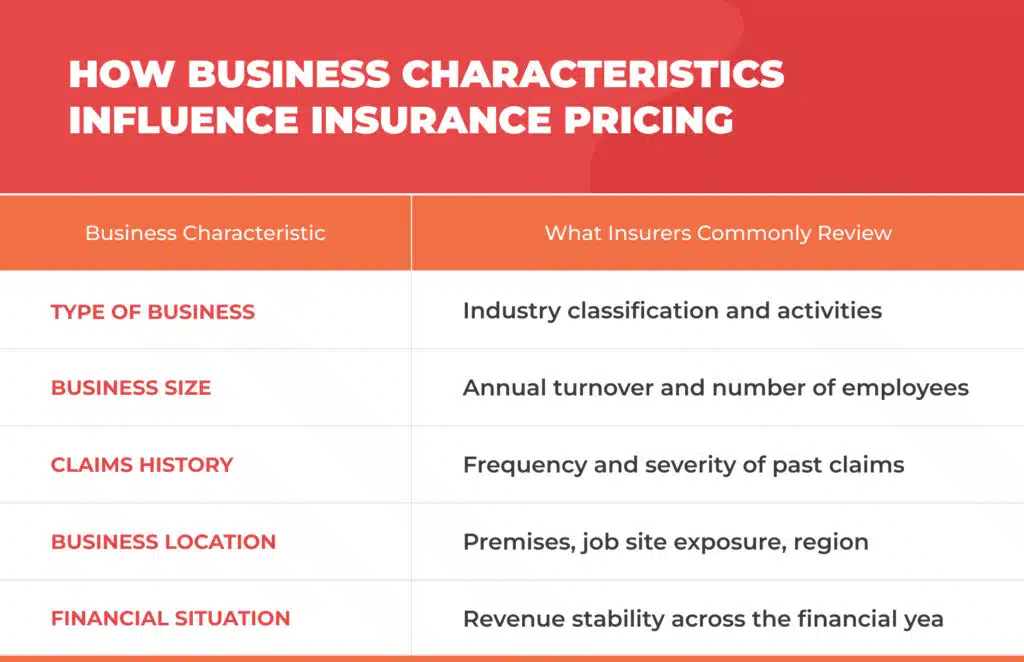

Key Factors That Affect Business Insurance Cost

A single pricing rule does not determine business insurance cost. It is a result of various interconnected factors. In general, insurance companies evaluate business operational, financial, and risk-related information to determine insurance premiums that reflect the business’s total exposure.

Understanding these factors may help businesses better understand insurance offers and policy formats.

Understand the basics

It is always a good idea to get a grasp of the general concept of business insurance evaluation before one can name the exact cost factors. Insurance pricing reflects the probability of claims and the financial impact if a claim occurs during the business’s everyday operations.

Expenses are mostly figured out on an annual basis and may differ even for businesses in the same sector.

Type of business and business activities

One of the significant factors influencing business insurance costs is the type of business. Various industries have different levels of risk, especially if they involve physical work, interaction with the public, or specialised services.

Insurers analyse business operations to anticipate risks arising from routine activities. For instance, companies that work on job sites or come into contact with the public may face different liability risks than office-based professional services.

Business size, annual turnover, and number of employees

The size of an enterprise is most often determined by its annual turnover, annual revenue, and number of employees. These metrics help insurers estimate the potential size of claims and financial losses.

An individual self-employed person might have different insurance cost factors than a larger company with several employees, business premises, or commercial vehicles.

Claims history and risk profile

Insurance providers usually review a company's claims history as the first step in understanding its past insurance experience. Such records help build the overall risk profile, which insurers use to evaluate future risk levels.

Fewer claims usually result in the business being considered a lower risk; on the other hand, more frequent or substantial claims affect insurance rates and base premium calculations.

Business location, premises, and job site

A business’s location is considered when determining insurance costs because different areas pose different risks, such as weather conditions, climate, crime rates, and the frequency of insurance claims. Besides that, the type of business premises and the job site may also be factored into the risk assessment.

Location-related issues can also differ across states like New South Wales and South Australia, which in turn determines how insurers gauge the risk of exposure.

Financial situation and financial year considerations

The financial position of a business can come under scrutiny, especially if the insurance coverage is related to sales or turnover. Broadly speaking, changes over a financial year, for example, business expansion or restructuring, may be reflected in premium adjustments at renewal, subject to insurer assessment and policy terms.

How Risk Impacts Insurance Premiums

Risk assessment is vital to calculate insurance premiums. Generally, insurers determine the likelihood of certain events and the potential financial consequences if they occur.

Higher Risk Versus Lower Risk Industries

Specific industries are mostly labelled as high-risk, whereas others are kept in the lower-risk category. Such classification is primarily based on past claims data, injury rates, and types of business operations.

Segments that involve physical labour or customer-facing work might be charged more for insurance than those with little or no physical interaction or operational hazards.

Result of Your Business Activities on Liability Risks

Usually, liability risks depend on the effects of business activities. Insurance providers evaluate the ways your business could impact third parties, their property, or the public in general during your everyday business activities.

A company that frequently comes into contact with third parties or their property will face greater exposure to liability claims.

Member of the Public and Injury Claims

Companies that have face-to-face dealings with the public may be vulnerable to injury claims, including personal injuries, medical expenses, and legal costs. These possible outcomes are taken into account when pricing liability-related cover.

Types of Cover and Their Costs for Businesses

Different types of cover address different risk areas. Each cover type is assessed independently, with premiums influenced by coverage limits, exposure levels, and business characteristics.

Common Insurance Covers

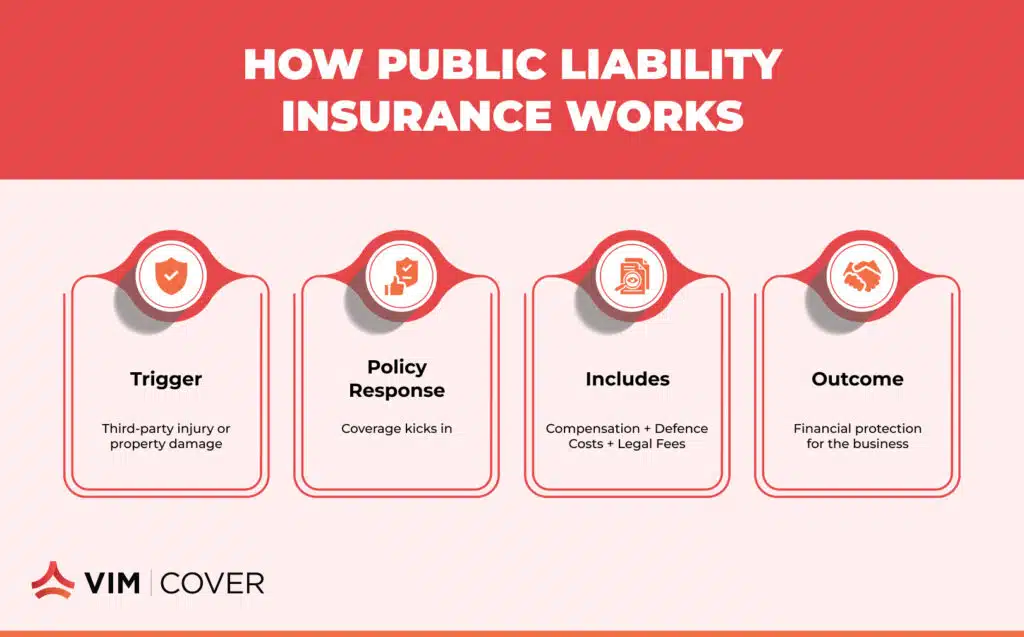

Public Liability Insurance Cost and Coverage: Public liability insurance is often viewed as a necessary liability of businesses that have contact with customers, suppliers, or the public. Public liability insurance costs depend on factors such as the nature of business activities, claims history, and the amount of coverage chosen.

Usually, this type of insurance protects against third-party property damage or personal injury claims arising from the firm's operations.

Professional Liability Insurance for Professional Services: Any company that offers consulting or specialised services is likely to have professional liability insurance. Pricing is often associated with income level, contractual requirements, and the type of services provided.

Workers' Compensation Insurance: Workers' compensation insurance is a mandatory requirement for any business with a workforce. The cost is calculated based on payroll size, industry classification, and the number of workplace injury claims.

Business Interruption Insurance: Provides protection when the insured business experiences a loss of income due to the disruption of normal operations caused by insured events. The cost of the policy generally depends on a company's turnover, its reliance on physical premises, and the indemnity period selected.

Cyber Liability Insurance: Cyber insurance and cyber liability insurance are attracting more attention nowadays due to increased digital exposure. Pricing of a policy is largely dependent on data usage habits, the strength of system security, and the amount of reliance on online operations.

Commercial Property Insurance and Landlord Insurance: Commercial property insurance and Landlord Insurance apply to businesses that either own or lease property. The value of the property, the type of building, business contents, and location-related risks can affect the premium amount.

Additional Insurance Options

Apart from the main covers, some companies decide to get extra policies depending on their business, properties, etc.

Car Insurance and Commercial Vehicles: Companies that operate vehicles as part of their work may need commercial car insurance. Premiums depend on the type of vehicle, how it's used, and its claim history.

Equipment Insurance and Business Contents: Insurance for equipment and business contents may be of interest when the business uses tools, machinery, or portable assets that are essential to its operations. The item's value and whether it is portable can influence the charges.

Home Insurance for Sole Traders: Several sole traders work from their homes. In those instances, home insurance policies should be carefully reviewed to determine which business-related risks are covered.

Tax Audit Cover and Medical Expenses: Tax audit cover may be offered as an option within a Business Insurance Pack. Some insurance policies may even cover medical expenses; however, this is always subject to policy wording and exclusions.

How to Get Accurate Business Insurance Quotes

Getting insurance quotes is not just about looking for the cheapest price. A clear understanding of how insurance policies are constructed may help businesses make better comparisons.

Steps for Comparing Insurance Solutions

- Most businesses identify their insurance needs by considering the types of operations they engage in, their assets, and regulatory obligations.

- Different types of businesses often have other insurance needs. An evaluation of the type of insurance commonly associated with business activities may help filter the options.

- When requesting insurance quotes, including Instant Quotes if available, policy documentation, such as the Product Disclosure Statement, should be carefully reviewed to understand conditions, exclusions, and coverage limits.

- Insurance brokers may provide general explanations of available cover options and clarify how different insurance solutions are commonly structured. Soliciting professional advice may be the right choice when insurance needs are complicated.

Cost Considerations for Small Business Owners

Insurance premiums don't stay the same and may fluctuate when the business changes. Some small business owners periodically review their insurance policies to ensure they continue to reflect operational changes.

Typical things to think about include combining policies into a Business Insurance Pack, checking coverage limits, monitoring the claims history, and modifying the cover in line with business turnover or changes in operations.

Why VIM Cover Is Your Trusted Insurance Broker

Being clear about what an insurance broker does is one of the ways businesses can more effectively navigate insurance structures.

An insurance broker is generally someone who communicates between businesses and the insurance companies. They can help businesses by clarifying policy structures and coverage options and answering general insurance queries.

VIM Cover is an insurance broker that gives you access to a range of insurance options. Whether cover is offered, on what terms, and at what price is determined by the insurer, subject to underwriting assessment and policy conditions.

Insurance solutions are structured to suit businesses of different sizes, sectors, and operational models. The coverage a business receives can depend on the type of operations it conducts, its location, and the level of risk it faces. There is also support for companies that are extending their operations to other states, such as New South Wales and South Australia.

If you are seeking general information about business insurance structures or would like to view insurer-issued quotes, VIM Cover provides access to policy information and, where possible, Instant or Same Day Quotes. Any insurance decision should be made after reviewing the relevant Product Disclosure Statement and considering your own circumstances.

Frequently Asked Questions

Q1. How is business insurance cost calculated?

Insurers usually consider the type of business, turnover, claims history, number of employees, and the business's operational risks.

Q2. Does a sole trader usually pay less for insurance?

A sole trader might enjoy reduced premiums if their operations are small, but the expenses still depend on the type of business activities and risk exposure.

Q3. Is public liability insurance mandatory?

Not all businesses are required by law to have public liability insurance. However, there are cases where one must be insured due to contractual or industry requirements.

Q4. Can insurance premiums change each year?

Indeed, rates can go up and down depending on a variety of factors, including claims history, business growth, changes to the level of cover, or insurer pricing reviews.

Find the Perfect Business Insurance Quote for Your Needs

Key Takeaways

- An individualised business insurance quote shows your business activities, risks, and expansion plans.

- The response to the offer should be based on comparing the insurance cover accounts, the policy wording, and the support from the claims department, rather than price alone.

- The protection pillars comprise public liability, property, and business interruption insurance.

- Engaging with seasoned brokers gives you assurance, adherence to legal requirements, and value that lasts.

It is not only about the prices when looking for the right business insurance quote, but also about understanding the risks, the protection, and the stability in the long run. Every business faces the risk of losing its property to a fire, being sued, or losing income. The year 2025 is the year when the costs to operate a business are rising, and regulations are changing, so if you decide to buy insurance just because it is cheap, you will not be sufficiently protected.

This manual is a resource for small business owners and businesses expanding, helping them gain the confidence to explore their options. Once you understand the risks, the available options, and the way the quotes are prepared, you will be able to do business with a business insurance company without having to pay for a policy that you do not need and with which you are not familiar.

Why Every Business Needs the Right Business Insurance Quote

A personalised business insurance quote mirrors your business, factors that expose you to risks, and your plans for the future. Since companies differ in size, turnover, and the nature of their daily business activities, it follows that generic policies are often ineffective at providing meaningful protection.

A correct quote equips you to:

- Safeguard the business location against the risk of fire and theft through insurance

- Keep the business functioning during a period of crisis

- Handle business liabilities and third-party claims

- Ensure the availability of working capital after a loss covered by the policy

Insurance should be a source of strength for your business expansion instead of being a problem.

Understanding Key Business Risks

Each business has a different combination of challenges. Before you ask for quotes, it is essential to thoroughly understand the risks that could affect your business.

Protecting Property and Equipment

Destruction of the business place, Commercial Property, or General Property may not only be a very costly event, but can also completely and abruptly halt the entire business operations. Property Insurance and Property cover are means of protecting buildings, stock, and Electronic Equipment against the risks of damage or loss.

Operational and Financial Disruptions

Unexpected business downtime will not only harm the company's image but also reduce cash flow. Business Interruption Insurance helps businesses during this challenging moment, partially making up for lost income.

Liability and Operational Exposure

Customer or supplier lawsuits related to the business can be a significant source of expenses. Public Liability Insurance, as well as Products Liability Insurance, is a set of insurance policies that cover a company against costs arising from injuries to third parties or damage to third-party property caused by the company's activities.

Specialist Risks

Industries may come across the risk of Machinery Breakdown, a threat from the lack of Cyber Insurance, or risks that involve motor vehicles and Commercial motor & fleet insurance.

The Role of Trusted Business Insurance Specialists

Working with Business Insurance Brokers who are experienced can make the whole thing very easy. Agents evaluate your individual requirements, explain the insurance products, and ensure the Policy Wording reflects the real-world risks.

With VIM Cover, businesses can enjoy:

- Access to the most trusted insurance companies

- Customised Risk Solutions for complicated business activities

- Understanding the documents of the policy and meeting the requirements

By using a specialist, you can be sure that you have the right cover without any unnecessary additions.

Top Business Insurance Cover Options to Consider

Essential Insurance for Small Business Owners

Usually, Small Business Insurance packages cover the following:

- Public Liability Insurance and Product Liability Insurance

- Workers' Compensation Insurance and Employment Practices cover

- Professional Indemnity Insurance for professional services

- Motor Insurance, Car Insurance, and Motor Vehicle Insurance

- Commercial Property and General Property protection

Additional Insurance Solutions for Specific Needs

Depending on the nature of your business, you may also require:

- Contents Insurance for Business Property

- Farm Insurance or Tax Audit Insurance

- Personal Insurance, Life Insurance, and Travel Insurance

- Management Liability for directors and officers

- Product Recall and Tax Audit Insurance

Besides the policy schedule, Product Disclosure Statement, Target Market Determinations, and Certificate of Currency are the other key documents that provide transparency and compliance.

How to Compare Business Insurance Quotes Effectively

Comparing quotes goes beyond the premium.

What to Review Carefully

- Level of cover and insured limits

- Policy terms, exclusions, and endorsements

- Claims handling and claims service quality

- Payment options, including monthly installments or credit card payments

Check how quotes align with business turnover, risk exposure, and long-term business needs. A lower premium may lead to higher costs later.

The Benefits of Working with Business Insurance Brokers

Partnering with experienced Business Insurance Brokers provides clarity and control. Brokers:

- Structure insurance packages that match real risks

- Provide documentation, like a tax invoice and reference number

- Offer ongoing Customer Support throughout the policy lifecycle

Many reputable brokers are aligned with the National Insurance Brokers Association, ensuring professional standards and ethical advice, including for niche markets such as Torres Strait Islander businesses.

Securing the Best Business Insurance Quote in 2025

An appropriate business insurance quote entails a balance between the three elements: protection, affordability, and flexibility. After comprehending the risks, carefully examining the coverage, and partnering with reliable professionals, businesses will be able to safeguard their assets, income, and good name with certainty.

Through personalised insurance products, open advice and excellent customer service, your Business Insurance turns into a competitive advantage, just like any other asset in your business, rather than being a mere compliance requirement.

Each business has its own uniqueness, and the insurance you have should be in line with that. Rather than using a standard cover, obtain a business insurance quote that is specifically designed for your activities, location, and risk profile.

Have a consultation with experienced Business Insurance Brokers and get cover designed for your business. Get started today.

*Insurance broking services are administered by VIM Cover Pty Ltd ABN 84 664 655 449 as a Corporate Authorised Representative (CAR 001304833) of Oracle Group (Australia) Pty Ltd AFSL 363610. The information provided is of a general nature and does not take into account your objectives, financial situation, or needs. You should consider whether it is appropriate for your circumstances and read the relevant Product Disclosure Statement (PDS) and Target Market Determination (TMD) before deciding.

FAQs

1. What information is required to obtain a business insurance quote?

Descriptions of the business activities, turnover, location, and any existing risks.

2. How fast can I get a Certificate of Currency?

A Certificate of Currency is generally available right away after the binding of the cover.

3. Can I pay for my insurance every month?

Many insurance policies indeed offer flexible payment options, such as monthly instalments.

4. Is public liability insurance compulsory?

Although not always a legal requirement, Public Liability Insurance is practically a must for businesses that have contact with the public.

Complete Small Business Insurance Guide for 2026

Key Takeaways

- Small business insurance is commonly used to help protect your income, assets, and legal obligations.

- The right mix of coverage options may help reduce your financial worries and the risk of business interruption.

- Unambiguous policy wording and professional advice help you avoid coverage gaps.

- VIM Cover offers access to insurance solutions to match the growth of your business.

Running a small business in 2026 is every day a mix of juggling opportunity and risk. Along the way of serving customers and managing staff, to protecting cash flow and reputation, the businesses may face operational challenges. Just one unexpected event, an accident at your business premises, a cyber breach, or a liability claim, can be a cause of a hefty financial loss. This is the reason why having the right insurance is no longer a matter of choice; it is a vital part of business planning.

This guide covers the general information on small business insurance for small business owners. It starts with understanding the essential cover, then moves to choosing insurance solutions that really support long-term growth. If you are a sole trader, run professional services, or have physical premises, this guide aims to support general awareness of insurance considerations in 2026.

This article provides general information only and does not take into account individual objectives, financial situations, or needs. It does not constitute financial or insurance advice.

What is Small Business Insurance and Why Is It Important?

Essentially, small business insurance is designed to address different risks that may come up in the course of daily business activities. Such risks can include injury to a member of the public, damage to equipment, or even loss of income following an insured event.

An adequately drafted insurance policy may help protect your business assets, support business continuity, and reduce the anxiety that comes with the unknown. It is a promise that one unexpected problem will not undo the years you have worked hard. Besides, for many businesses in Western Australia, insurance may be required contractually when dealing with clients or suppliers.

Understanding Business Insurance Policies

Each business faces different risk profiles, and that is the reason business insurance policies are never standard for all. The type of your business will determine your scope of protection, how you operate, and your liability exposure.

Essential Coverage

- Security for business premises and tangible assets

- Cover for Public and Products Liability claims

- Support for legal costs, repairs, and loss of income

It is essential to have Clear Policy Wording. This document specifies precisely what is covered, how claims are handled, and the situations in which exclusions apply. Understanding this information can help businesses ensure their business insurance requirements are met without any unanticipated gaps.

Why Every Small Business Owner Needs Insurance

Usually, small business owners view insurance as a tool for managing uncertainty. With appropriate coverage, risks can be controlled without jeopardising the business's cash flow under challenging situations.

Main features of the policy often reviewed are:

- Less risk of being the target of a liability claim and having to pay the legal costs

- Coverage against involuntary damage and situations caused by a third party

- Business insurance that provides the right cover for the requirements of your business

Moreover, it can be a valuable tool for attracting customers and partners. They can be sure that your business is a professional one, follows the regulations, and is ready for any circumstances.

Essential Types of Business Insurance for Small Businesses

Knowing what business insurances are available can assist you in getting valuable coverage in which you will be protected without paying for useless or unnecessary coverage.

Commonly Discussed Insurances

- Public liability insurance: Generally designed to cover the costs resulting from injury or damage to the property of a third party due to your business or operations.

- Professional Indemnity Insurance: A product that is often considered by a professional service, as it shields the firm against allegations related to the provision of advice

- Product liability insurance: Typically applies to legal claims due to products that are unsafe and/or faulty

These core business policies often form the foundation for vibrant Business Insurance Pack choices.

Optional Cover Additions

- Workers' compensation insurance to cover injuries related to employees

- Cyber Liability cover to address specific cybersecurity threats and the loss of electronic equipment

- Business interruption insurance to assist with the loss of income during periods of forced business closure

In addition, optional covers, such as management liability insurance, contents insurance, and income protection, can provide additional strength and security.

Factors Affecting the Cost of Business Insurance

Business insurance expenses are influenced by various factors, among which are the kind of business you have, the risks of your industry, and your history of claims.

What Influences Premiums

- The way your business is set up (e.g., sole trader vs company)

- Are business vehicles part of your operations for which you need Car Insurance or third-party property cover?

- What type of cover do you have, and what limits are set within your insurance packages

Though it may seem that adding more coverage is just an additional cost, the lack of adequate protection can result in significantly more costly over time.

Getting a Business Insurance Quote That Fits Your Needs

An individualized Business Insurance quote typically reflects the risks that a business is exposed to and also the company's financial status. Moreover, being able to readily get a Certificate of Currency, which is a common requirement by landlords and clients, is equally important.

The procedure may be supported by a skilled insurance broker. Brokers evaluate the insurance business policies that you have, provide in-depth explanations of the options to you, and, if necessary, assist you in the claims department.

How VIM Cover Helps Small Business Owners

VIM Cover knows that different companies are different, and that is why their method is customer-specific insurance solutions instead of standard policies.

Reasons for Choosing VIM Cover

- Business Insurance Pack with modular options

- Honest advising based on actual risks

- Help with claims, renewals, and compliance

Besides that, Personal Insurance, like Life and Trauma insurance, can give you the security that you need while running your business to be able to face the unexpected situations confidently.

Secure Your Business with the Right Insurance in 2026

Deciding on the right insurance often involves protection needs, supporting your good name, security, and peace of mind. With the right combination of policies, your company can step into 2026 with confidence and be open to expansion without unnecessary risk.

Leading a business is all about expecting expansion and also being ready for the unforeseen. Having an appropriate small business insurance policy in place can help manage risks related to reputation, premises, and revenue.

Businesses may choose to obtain quotes from licensed insurance brokers such as VIM Cover. Get started today!

*Insurance broking services are administered by VIM Cover Pty Ltd ABN 84 664 655 449 as a Corporate Authorised Representative (CAR 001304833) of Oracle Group (Australia) Pty Ltd AFSL 363610. The information provided is of a general nature and does not take into account your objectives, financial situation, or needs. You should consider whether it is appropriate for your circumstances and read the relevant Product Disclosure Statement (PDS) and Target Market Determination (TMD) before deciding.

FAQs

- What insurance do most small businesses require?

The requirements change, but typically, public liability insurance and workers' compensation insurance are the two most required. - Should business insurance be taken by sole traders?

Absolutely. A sole trader is a one-person operation in which the trader is the only person responsible; hence, insurance is essential. - Is small business insurance, including cyber liability, necessary?

Yes. If customer data is stored and online operations are used, Cyber Liability protection is definitely a must-have. - How often is it necessary to look at my insurance policy?

It is good to take a look at the policy at least once a year or in the case that your business activities or location change.

Comprehensive Plant Insurance for Businesses in 2026

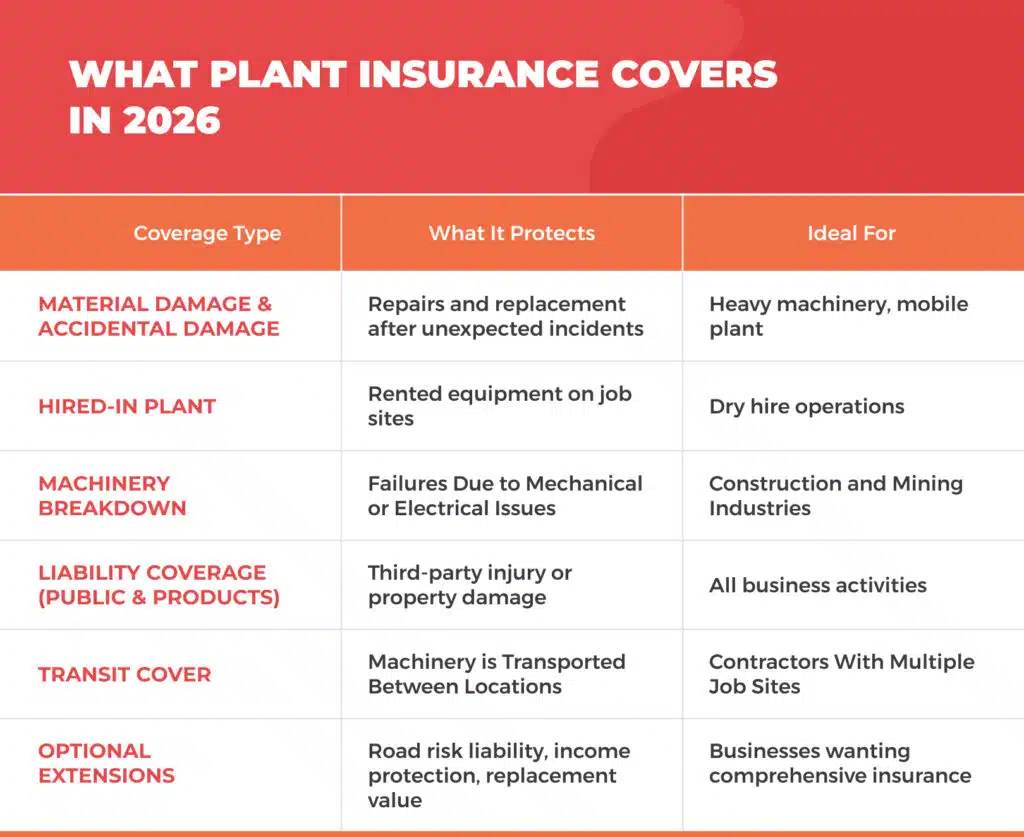

Key Takeaways: Plant Insurance

- Plant insurance is an excellent way to protect business assets and equipment from risks such as Material Damage, accidental damage, and total loss.

- The insurance policy covers various equipment, including bobcats, scissor lifts, earthmoving tools, and farming machinery.

- Businesses enjoy the advantages of tailor-made insurance cover, including Hired-in Plant, Machinery breakdown, and liability coverage.

- Plant insurance can help reduce disruptions, as it covers property damage, breakdown cover, road risk liability, and other such things.

Entrepreneurs all over Australia seem to be entering the year 2026 with the mentality of handling even more work than last year. They also have to meet more deadlines and manage the expansion of the sites where they operate. Constantly, it seems, heavy machinery and other mobile equipment are the leading actors of this expansion. Thus, the risk of machinery failure or property damage is even more significant. Plant insurance is thus the instrument that ensures the safety of the machinery with which your operations are carried out every day.

Here at VIM Cover, we often see our clients encounter insurance challenges that evolve as their businesses grow. Consequently, selecting the right insurance is more than just a decision of signing paperwork; it becomes an integral part of safeguarding your reputation, your investment, and your future.

Why Plant Insurance Is Essential for Your Business

Plant insurance can be an important form of equipment protection for many industrial or commercial businesses, depending on their needs.

Whatever the case may be with you, whether you provide crane hire services or are the manager of a fleet of heavy machinery, the assets of your business still require the safeguards that are effective across all job sites.

Such cover may protect mobile plant and equipment against Material Damage, accidental damage, and total loss, depending on the policy wording. The insurance may be available for earthmoving machines, bobcats, agricultural machinery, scissor lifts, and small portable tools, subject to insurer acceptance.

Moreover, a good Equipment Insurance Policy will have a component of public liability insurance and Products Liability that will offer you protection in case your plant item causes property damage or injures a person. Considering the machines are hardly ever at the same site for long and are continuously transported, Transit cover provides greater assurance that they will be there throughout the relocation. Note however that coverage during relocation is subject to policy terms, conditions, and limits.

Insurance Options for Plant & Equipment Owners

Since every business is unique, it is essential to have adaptable insurance options. You might require full insurance cover for your heavy machinery, while at the same time, you may want dry hire insurance if you are simply using the hired-in plant. Additionally, many business needs require the inclusion of cover options for Machinery breakdown so that you can remain operational in the event of a sudden equipment failure.

Specific policies may offer options such as market value or replacement value, depending on the product and insurer. In 2025, insurance companies are presenting fewer limitations and more options, such as road risk liability, breakdown cover, Broadform liability, income protection, and Optional extensions for single items or a wide range of equipment.

These decisions are instrumental in determining the kind of insurance program that is most suitable for your exact insurance needs, whether you are a small business or managing large-scale infrastructure projects.

Why Choose VIM Cover for Your Plant Insurance

Insurance specialists offer guidance based on experience in the Australian insurance market. They offer expert advice to those who understand the Australian insurance market. Companies rely on us to provide guidance on available insurance options - a policy that is based on their business, the risks of the industry, and the type of cover they prefer.

Our equipment policies can be tailored to cover a wide range of the business, from Mobile Plant and Machinery Insurance to dry hire insurance and crane hire operations. We help our clients select policies that ensure the sum insured aligns with the tangible business assets, so that every plant item is adequately protected.

How Plant Insurance Supports Business Owners

Therefore, plant insurance is one of the most valuable supports a business owner can have in his liability coverage concerns at active job sites. Especially where it is a known fact that heavy machinery is constantly used in such places, this insurance product facilitates the business's operations by ensuring its assets are protected against rising value.

Therefore, your cover will stay relevant as risks evolve with insurers and brokers constantly communicating the latest insurance market news and updates. If you want machinery and equipment that are well protected, get in touch with a VIM Cover broker for tailored guidance and a business-built-around solution.

Is your business equipment setup ready for any eventuality? Get advice from an expert who is familiar not only with your industry but also with your risks and the equipment you use daily.

Make the most of the VIM Cover broker to design a custom plant insurance plan that may help protect your equipment and support your operations, subject to policy terms and eligibility. Contact us today!

Disclaimer: The information provided is general in nature and does not take into account your objectives, financial situation, or needs. Before making a decision, consider whether the product is appropriate for you and review the relevant Product Disclosure Statement (PDS) and Target Market Determination (TMD). Coverage is subject to the insurer’s terms, conditions, limits, and exclusions.

FAQs

1. What are the typical components of plant insurance?

Essentially, the policy insures Material Damage, accidental damage, total loss, liability coverage, and, optionally, a breakdown cover based on your policy.

2. Are the pieces of equipment covered while they are in a vehicle?

Indeed, the Transit cover can be added to the protection of machinery in transit between job sites.

3. Is the coverage extended to Hired-in Plant?

Several policy provisions allow for Hired-in Plant, a feature that helps the business to keep a protective shield even when the equipment is not owned.

4. What is the way to determine the correct policy?

Working with a broker can help you understand available options and obtain general information about insurance products.

Comprehensive Equipment Insurance for All Your Business Needs

Key Takeaways

- Equipment insurance can help reduce financial impacts arising from accidental loss, material damage, or theft of essential tools and machinery.

- Ideal for businesses operating construction, industrial, mobile plant, and machinery across multiple locations.

- Cover options may include Public Liability, Business Interruption, and optional Management Liability.

- Licensed insurance brokers such as VIM Cover can assist with policy documentation, payment options, and guidance throughout your insurance process.

Businesses rely on a wide range of tools and machinery, from small equipment and portable tools to larger plant and heavy machinery to keep their operations running smoothly. An unexpected breakdown, accident, or theft can interrupt work and affect cash flow. Equipment insurance can help protect your business against these types of unforeseen events.

At VIM Cover, we aim to support businesses that depend on machinery and equipment by arranging insurance solutions that offer clarity, flexibility and value. Our approach focuses on providing tailored options that help safeguard your assets and assist in maintaining continuity across your projects and job sites.

What Is Equipment Insurance and Why Is It Important?

Equipment insurance is designed to help protect your business from financial loss relating to your tools, machinery, and other essential operational equipment. This type of cover may apply across industries such as construction, manufacturing, logistics, and trades, particularly where equipment plays a critical role in project delivery.

Depending on the specific policy, equipment insurance may help cover:

- Accidental loss or material damage

- Theft or vandalism

- Breakdown of machinery (subject to policy terms)

- Disruption to business operations caused by equipment failure

Because cash flow and operational continuity are vital, having suitable cover may assist in reducing downtime and unexpected expenses.

Understanding What Equipment Insurance Covers

Policies vary by insurer, so ensure your policy fits the way you do business and the kind of equipment you use. A properly designed policy may include the following:

- Accidental loss and material damage, thus minimising the loss caused by sudden and unforeseen events.

- Property damage on or off the work sites, that is, if it is an incident involving machinery, tools, or motor vehicles.

- Public Liability Insurance protects against claims arising from third-party injury or damage.

- Business Interruption, which in essence is the loss of income when the business is required to shut down temporarily.

- Optional add-ons, such as Management Liability, Contents Insurance, or Indemnity Insurance, to name a few, assist in tailoring a policy to your needs.

Your Policy Wording and PDS detail all inclusions, exclusions, conditions, and limits. We recommend reviewing these documents carefully before selecting a policy. We operate with complete honesty and openness, thus you are always aware of the extent of your insurance coverage.

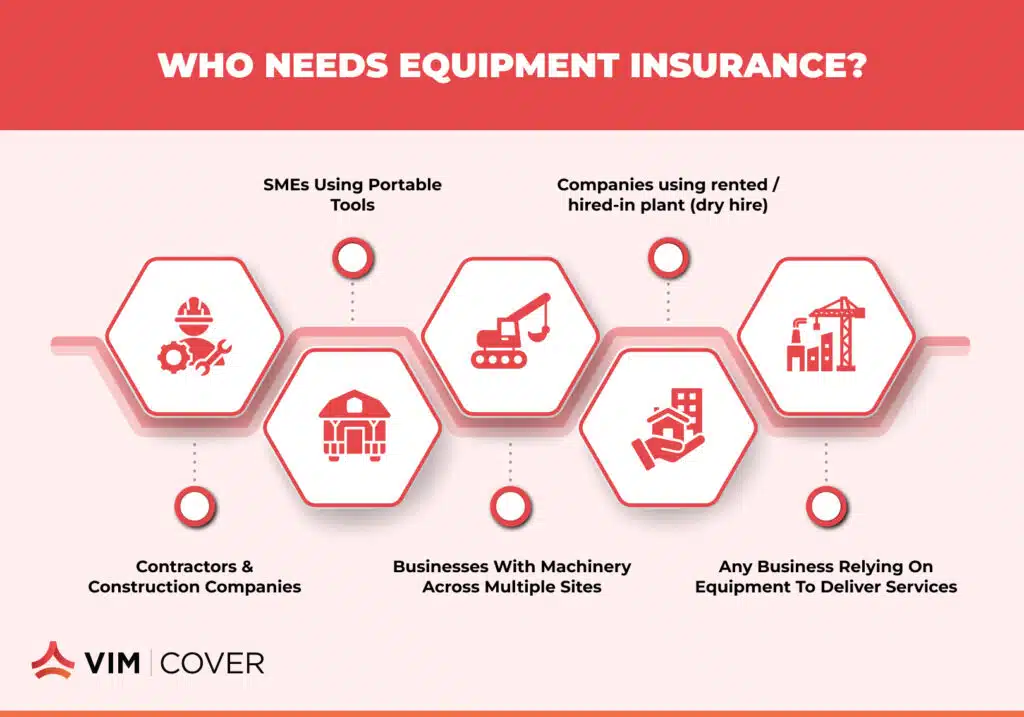

Who Needs Equipment Insurance?

Machinery and Equipment Insurance is a policy often misunderstood as reserved for big companies. However, these policies can apply to a diverse range of businesses, such as:

- Contractors and construction companies utilise mobile plant and heavy machinery.

- Small and medium enterprises that have portable tools or mobile phones, which are essential for their daily operations.

- Businesses that either own or lease the vehicles or machinery used for multiple job sites.

- Companies that depend on hired-in plant for short-term projects or dry hire insurance for rentals.

Regardless of what industry you are in, the act of protecting the tools and machinery that you utilise is, in essence, the protection of your productivity and reputation.

Key Features of Equipment Insurance Policies

- Clear Policy Documents and simple Policy Wording to make it easy for you to understand exclusions and limits.

- Choices to cover mobile plant, hired-in plant, and dry hire insurance arrangements. Cover for both owned equipment and a hired-in plant, including a certificate of currency as proof of cover.

- Flexible payment options and documentation to provide the information you need to make the right financial decision.

- Additional features for Management Liability, Public Liability Insurance, or Business Interruption to help safeguard your business.

What Does Equipment Insurance Cover?

Equipment insurance generally includes:

- Accidental loss, material damage, and property damage - the cost of the repair or replacement of the equipment that has been damaged either on the job site or off.

- Machinery Breakdown and accidental damage cover for mechanical failure beyond normal wear and tear (it is worth noting that wear-and-tear exclusions are often applicable).

- Business Interruption cover that can be used to replace lost business income due to a standstill in projects resulting from equipment failure.

- Public Liability Insurance, as well as Management Liability, can be used to protect the insured against claims from third parties arising from the use of the equipment.

- Support options such as Contents Insurance, Personal Accident, and financial hardship assistance are available.

Types of Cover Available

- Machinery and Equipment Insurance: specifically for the machines used in the construction works or operations of the likes of heavy machinery, excavators, loaders, and mobile plant.

- Mobile plant and equipment insurance: designed specifically for equipment that is regularly moved between sites or driven on public roads.

- Hired-in plant / Dry hire insurance: Helps protect rented equipment and lessens the risk of hire cost.

- Indemnity Insurance & Business Insurance Pack: single combine covers (e.g., Public Liability + Equipment + Commercial Vehicles) for broader protection.

- Portable tools include the essential gear, such as power tools and mobile phones, used on the site.

How to Choose the Right Equipment Insurance Policy

When choosing the kind of cover that you want, you mustn't just consider the price. Review the Policy Wording, the policy terms, and the sum insured to ensure your assets are valued correctly. In addition to that, consider:

- Whether your policy has flexible payment options that can fit into your financial situation.

- Confirmation of your coverage through a Certificate of Currency.

- The value of your equipment on the market and how it will affect your rental costs if you lodge a claim.

- Guidance in VIM Cover's Financial Services Guide and access to experienced brokers to help explain your options.

Request a Quote Online for Equipment Insurance

Getting started with VIM Cover is as easy as it gets. You can request a quote online that's customised to your field and the type of insurance you want. If it is safeguarding for bobcats, a mobile plant, or your business premises, we can source the cover options that fit your precise needs.

First, our specialists understand how you work, ensuring that every policy provides the right protection. So, this is how we help keep your business assets safe while you focus on growing.

Protect Your Business with VIM Cover in 2026

The machines and equipment you use are not only your means of work; they are the base on which your success is built. VIM Cover can assist you in navigating available insurance options, reviewing product documentation, and selecting a cover that aligns with your operational requirements.

VIM Cover will assist you in understanding the various policy choices and negotiating reasonably priced insurance backed by a team that has real knowledge of your industry. Make your equipment safe today and keep your enterprise going at full power.

You can obtain quotes from licensed insurance brokers such as VIM Cover.

FAQs

1. What kind of losses are covered by equipment insurance? In general, policies may cover at least part of accidental loss, material damage, and theft, as well as the breakdown of machinery and tools needed for your business.

2. Is it possible to ensure hired or rented equipment?

Yes. In the case of a dry hire insurance or hired-in plant cover, you can make borrowed or leased equipment a safe place against any harm or loss.

3. Is such a policy valid for machinery that is used on public roads?

Yes, insurance programs may be extended to cover mobile plant or machinery that is used on or off a public road.

4. How can I obtain an insurance certificate?

You will get a Certificate of Currency showing your coverage when your policy is in force.

General Advice Warning:

The information in this article is of a general nature only and does not take into account your objectives, financial situation or needs. You should consider whether this information is appropriate for you and read the relevant Product Disclosure Statement (PDS), Policy Wording and our Financial Services Guide (FSG) before making any decision about insurance products.

Comprehensive Machinery Insurance for Your Business in 2025

Key Takeaways

- Machinery and Equipment Insurance covers the risks associated with the business's essential assets and protects them against breakdown, theft, and accidental damage.

- Insurance contracts may include Machinery Breakdown Insurance, Public Liability Insurance, and Business Interruption Insurance.

- VIM Cover offers convenient, reasonably priced solutions designed to fit your specific needs and business operations.

- So why not get in touch with us today for a quote? You can obtain quotes from licensed insurance brokers such as VIM Cover.

Machines are more than just metal and bolts in a business that is going well. They are the rhythm that keeps productivity alive. The loud excavators on construction sites or the forklifts steadily moving goods through warehouses: every piece of equipment is a tale of accuracy, might, and advancement. But what if that rhythm, suddenly, stopped?

An unexpected breakdown or accident can bring your whole operation to a halt, causing you to miss deadlines, incur costs, and leave you stressed. In this case, machine insurance is your business partner, quietly working in the background. It is the layer of security around the tools that are the core of the business.

As industries head into 2025 with more intelligent, connected machines, the risks have changed as well. Faulty machine parts or accidental damage can lead to the machine not working for some time, financial loss, and the loss of the chance to do business with someone.

We here at this guide want to show you the way VIM Cover’s insurance products can protect your business, help you keep productivity, and make it possible for you to plan for the future with confidence no matter if you face any challenges.

Why Machinery Insurance is Essential for Business Owners

It's quite a challenge to operate a business that is dependent on machinery. These, from forklifts to Bobcats, are essentially the backbone of your business's daily operations. If any of them were to suddenly break down, be damaged in an accident, or if there were an unexpected property damage, it could stop your productivity and cause you to lose money for a considerable period of time. This is where machine insurance comes into play, providing the business owner with the financial security and peace of mind they need.

Simply put, Machinery and Equipment Insurance is a type of insurance that covers a business's most valuable assets, its machinery and equipment, against the risks of damage, theft, and operational downtime. It gives your business a firm hand when facing repair or replacement costs, allowing it to keep going as usual even when challenges arise. It is more important than ever to have the right cover, as the construction and industrial sectors are changing so rapidly.

What is Machinery and Equipment Insurance?

Machinery and Equipment Insurance (or Machinery Breakdown Insurance) is a plan that relieves the worries of those who use a diverse range of tools and machines across different sectors. If you are the manager of heavy machinery and are interested in obtaining mobile plant and equipment insurance, or if you operate scissor lifts, the primary purpose is to protect your business from costly interruptions.

Such a policy provides comprehensive coverage options designed to minimise your business risks coverage for both the owners of the machinery and those with dry hire insurance. It also includes third-party protection in the event of property damage or personal injury caused by machine operation. Most business leaders view it not only as an expense but also as a strategic move to protect their businesses against unforeseen losses.

The main features are:

- Protection in the event of accidental damage, breakdown, or theft

- Downtime Cover to be able to continue business activities in case of interruptions

- Choices for replacement value or market value settlements

- Policies can be adjusted to meet the needs of a small business and owner-operators.

Key Benefits for Business Owners

One way to keep a business going smoothly is to have machine insurance. In difficult times, it will ensure there are no interruptions to your operations. It is also a strong signal that you are taking risk management seriously. This is something that clients and contractors are increasingly appreciating.

It works like that for business owners:

- It stops financial loss: Pays for unexpected machinery breakdown insurance events.

- It is a source of business activities: The policy with options designed for you can keep your projects on track.

- It is a shield for your business assets—from skid steers to heavy equipment—covering them under one equipment insurance policy.

- Tailored insurance solutions: Cover your tools of trade and machinery with one flexible plan.

Machine and Equipment Insurance is the source of the certainty that you can focus on getting more business instead of worrying about risks if you are running either a construction firm or a logistics company.

Understanding the Types of Machinery Insurance Policies

Every enterprise is different when it comes to operational risks. For this reason, VIM Cover offers adjustable cover options that reflect the risks you face. By adding Public Liability Insurance to Professional Indemnity Insurance, you can feel that your safety is fully ensured and have fewer worries.

Cover Options for Specific Needs

There are several different cover options, e.g. those listed below:

- Public liability cover: A protection layer that helps third-party claims caused by the injury of a person or property damage.

- Dry hire insurance: The best choice for contractors who need heavy equipment, such as a crane or an excavator, and decide to rent it.

- Business Interruption Insurance: The policy that is associated with, and therefore, the only logical companion of, equipment failure. The insured is paid to cover all income losses that result from the occurrence.

- Machinery Breakdown Insurance: It provides coverage when a machine is not functioning due to mechanical or electrical parts, whether it is a standard machine or a specially designed one.

These insurance contracts are designed to meet the needs of businesses across the construction, agriculture, and manufacturing sectors while providing a reasonable balance between costs and protection.

Policy Documents and Flexible Options

While going through policy documents, it is essential to factor in the insurance cost, level of cover and your overall insurance needs. VIM Cover understands that businesses operate differently, and therefore, we offer Flexible payment options and Competitive pricing for all machinery policies.

We can tailor your plant and equipment insurance policy to include:

- Downtime Cover for loss of income during repairs

- Choice of market value or replacement value settlement

- Options to add Business Interruption Insurance or Public Liability Insurance

- Support for compliance through the Financial Services Guide

By this arrangement, every machinery insurance policy is like a perfect match for your business activities, ranging from construction to logistics and more.

How to Choose the Right Machinery Insurance Policy

Choosing the right insurance can be staggering with lots of providers and tricky terms. First, evaluate your machinery type, business operations, and the likelihood of a risk event. The insurance price will vary depending on factors such as the use, type of cover, and the level of cover selected.

Get the correct and detailed advice from specialised Insurance Professionals who have a thorough knowledge of the Australian insurance markets. They will lead you through:

- Assessing the condition and the value of your machinery

- Figuring out whether replacement value or market value is more suitable for your case

- Matching coverage with your business requirements

With VIM Cover, you can access your policy documents, see transparent pricing, and receive clear direction, all backed by our supportive team and client-first approach.

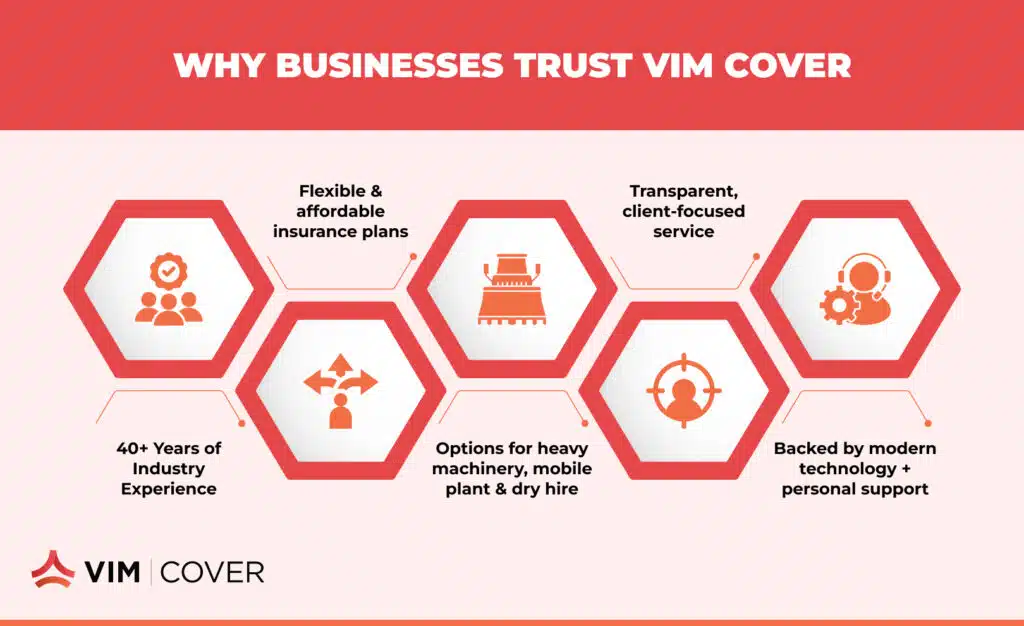

Why Trust VIM Cover for Your Machinery Insurance?

VIM Cover has been known for its reliability and honesty in the Australian insurance markets for more than 40 years, with a combined industry experience. Our team of experts is always ready to offer the best solutions to Owner Operators and small business owners, helping them handle insurance challenges on their own in no time.

We have:

- Flexible equipment insurance cover choices

- Individually tailored plans according to the requirements and business assets

- Access to Machinery Breakdown Insurance, mobile plant and equipment insurance, and dry hire insurance

- A pledge to safeguard your business through authentic, client-centred service

Modern technology, along with personal attention at VIM Cover, is the perfect combination to provide you with comprehensive coverage options designed to minimise your business risks, which should be your focus on growth rather than risk.

Find the Right Cover for Your Machinery Insurance in 2025

Having the appropriate equipment insurance cover is what separates a fast recovery from a loss that keeps you for a long time. Do not put your business in a risky situation. Cooperate with experts who understand the value of your business.

At VIM Cover, you can request an insurance quote, view policy documents, and select the best policy options for your business.

You can obtain a quote here. Our policies are designed to reduce downtime risks and support compliance with Australian business insurance requirements.

FAQs

1. What kind of damages are covered by Machinery and Equipment Insurance?

It covers rescuing situations when your mechanical devices, such as heavy equipment and tools of the trade, break down, are stolen, or are accidentally damaged.

2. Is Public Liability Insurance available in a machinery policy?

Yes, it may be coupled with a machinery policy to provide a safety net against third-party injury claims or property damage.

3. The question of the acquisition of Machinery Breakdown Insurance is raised.

Such a policy is necessary only for businesses that are heavily dependent on working machines. In particular, the construction industry and the transport sectors.

4. What are the reasons to pick up VIM Cover?

It is due to our excellent client service, professional advice, and dedication to comprehensive coverage options designed to minimise your business risks that make us a reliable partner across Australia.

The information provided is of a general nature and does not take into account your objectives, financial situation, or needs. You should consider whether it is appropriate for your circumstances and read the relevant Product Disclosure Statement (PDS) before deciding.

How to Get a Commercial Property Insurance Quote in 2025

Key Takeaways

- You can obtain quotes from licensed insurance brokers such as VIM Cover

- VIM Cover offers a range of insurance options designed to meet diverse business needs.

- A commercial property insurance quote helps maintain the safety of your business premises and the things that are valuable to you.

- Firstly, check your cover, Policy Wording, and sum insured thoroughly before making a purchase.

In 2025, the commercial insurance area is still changing due to brand-new property risks, digital tools, and the increasing complexity of business operations. Today, obtaining a commercial property insurance quote is more than just comparing prices. It is about ensuring the policy effectively protects your assets, is financially feasible for you, and aligns with your business goals.

It doesn't matter whether you are a property investor, a retailer, or a manufacturing company; knowing how to secure the right Commercial Property Insurance coverage is essential for your mental well-being and financial stability. We will figure out how to get you a quote that fits your exact needs and, at the same time, ensure your business is safe from unforeseen losses.

What Is Commercial Property Insurance?

Commercial Property Insurance is designed to safeguard your commercial building, its contents, and related assets from unforeseen events that could lead to financial losses. It typically includes insurance cover for incidents such as accidental damage, theft, storm damage, and water damage, ensuring your property and business operations are not disrupted.

For business owners, this insurance acts as a financial shield. Beyond protecting the office building or commercial premises, it may include compensation for business interruption cover, loss of rental income, or expenses required to repair or replace damaged assets.

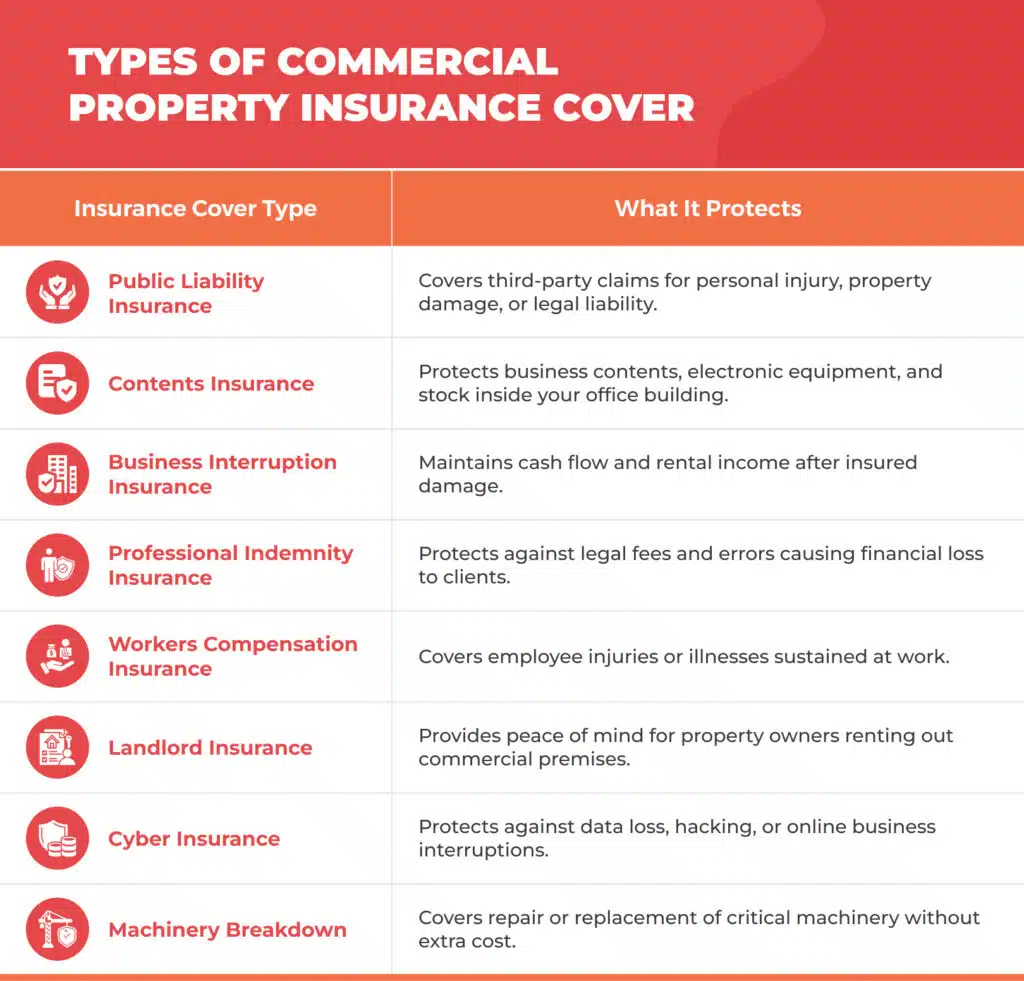

Understanding Commercial Property Insurance Cover

An effectively designed business insurance plan offers safeguards across various risk categories. Your insurance package may consist of:

- Public Liability Insurance – Covers the cost of a third-party claim resulting from personal injury, property damage, or legal liability due to your operations.

- Contents Insurance – Covers the business contents, electronic equipment, and other movable assets in your business premises.

- Business Interruption Insurance – It is a type of insurance that helps maintain cash flow when operations are temporarily halted due to a covered event.

- Professional Indemnity Insurance – This is a must for professionals who provide advice or services, and it covers them against legal fees and negligence claims.

- Workers' Compensation Insurance – It is the insurance that pays for employee injuries or illnesses caused by work and complies with the law's requirements.

Certain insurers also offer optional cover for Machinery Breakdown, Cyber Insurance, and landlord insurance. These additions not only broaden the coverage of your Business Insurance pack but also let you feel safe when handling possible interruptions.

Why Business Owners Need It

Having a commercial building is like inviting a series of property risks - fire and vandalism, as well as natural disasters and accidental damage. Just one incident without adequate protection can put your finances under severe pressure and may even disrupt your cash flow.

With a customised policy, Business Insurance is a great tool for business owners to get back on their feet quickly, keep their operations running, and still make a profit in the event of a contingency. Additionally, the coverage package includes a liability shield that protects against lawsuits from the general public, customers, or contractors. In this way, you not only ensure your professional reputation but also the continuity of your business.

How to Request a Commercial Property Insurance Quote

In the year 2025, if you want to get a precise commercial property insurance quote, you will need to have the correct information, be clear and know what level of cover you require. Present-day insurers provide both online quote systems and personalised consultations with a business insurance specialist.

Steps to Get Started

How to start the work:

- Clearly define your business and describe your primary business activities

- Perform a survey of your business premises describing the place, its size, and its intended use.

- Calculate the replacement cost and sum insured for your property and assets.

- Make a list of cover options that you require and possible optional covers that you may want (e.g., Theft cover, Public Liability cover, or business interruption insurance).

With such information at hand, you can contact trustworthy insurance providers. Vim Cover, for instance, provides an online quote form and an option to request a callback if you need personalised assistance.

Essential Information to Prepare

To get a detailed business insurance quote, you will have to provide:

- Details about the property of your commercial building or office building

- The policy documents of the current coverage (if there are any)

- Information on business vehicles, motor vehicles, or the use of commercial vehicles

- Claims history and risk management practices

- Approximate rental income and the business contents and electronic equipment details, if any

It is always a good practice to review the Product Disclosure Statement, Policy Wording, and Terms & Conditions related to your policy before confirming it. These documents describe the exclusions, the legal liability limits, and your policy schedule, thereby providing transparency and complying with the insurer's requirements.

Features of a Comprehensive Business Insurance Policy

Coverage Options Included

A comprehensive Business Insurance policy will typically cover a combination of different protection areas, including:

- Public Liability Insurance cover for third-party as well as Public & Products Liability claims

- Contents Insurance provides cover for property and electronic equipment

- Business interruption insurance offers the essential ongoing cash flow support

- Cover against storm damage, glass breakage, as well as accidental damage

Additional Cover for Enhanced Protection

Contemporary insurance companies are aware that customers require tailor-made solutions. You can upgrade your insurance plan by adding:

- Workers' Compensation Insurance to cover the welfare of employees

- Professional Indemnity Insurance to cover the risks associated with client-facing activities

- Cyber Insurance to cover the occurrence of data breaches or damage to the system

- Boat Insurance or Life Insurance to provide a more comprehensive portfolio protection

These optional components constitute a fully-fledged Business Insurance Pack that can be adjusted to your particular requirements and provides you with an extended period of peace of mind.

Comparing Commercial Property Insurance Quotes

When comparing policies from different insurers, focus on the level of cover, exclusions, and claim support, not just price. Be watchful of:

- Policy Wording, terms and conditions, and extent of cover

- Replacement cost and sum insured figures

- Any additional charges for tailor-made cover options

Expert advice from Business Insurance Specialists will assist you in understanding the small print, being in accordance with the rules, and making the process of the claim efficient in case you need to file one.

Why Choose VIM Cover for Your Business Insurance in 2025

VIM Cover is a licensed Insurance broker that business owners, sole traders, and small business insurance customers can depend on. With its comprehensive understanding of risk management and property damage claims, the company can offer you a tailored business insurance policy solution that matches your business needs.

The company's customer support team is always willing to help you with policy selection, renewal, and paperwork, providing support along the way. In case you are looking for a cover for your Commercial Property Insurance, Public Liability Insurance, or Workers Compensation Insurance, VIM Cover would be your partner in securing affordable protection that would genuinely give you peace of mind.

Property damage or an unpredicted claim should not be the reason that your business is disrupted. Obtain a personalised Commercial Property Insurance quote from VIM Cover now to ensure you are adequately covered. Note: Insurance cover is subject to underwriting approval and policy terms and conditions.

Get Your Free Quote Today. Contact our Business Insurance Specialists to find out the cover options that best fit your business.

FAQs

1. What are the components of a commercial property insurance quote?

The quote provides estimates for the coverage of your structure, its contents, and your liability protection. The estimates are based on your property's risk profile.

2. Is there a way to cut down the cost of my business insurance?

Keeping a spotless record of claims, enhancing security, and seeking cost-saving changes from Business Insurance Specialists will help you reduce your insurance premiums.

3. Is it possible to combine property and vehicle insurance?

Sure. Many insurers offer packages that combine commercial vehicle, Car, and property coverage.

4. What is the procedure in place for the claims?

The steps include submitting an insurance claim form, providing proof of loss, and collaborating with your insurer to promptly evaluate and resolve the claim.

Understanding Public Liability Insurance Costs in 2026

Public Liability Insurance is one of the essential types of business protection that has received considerable attention over the years, and its significance in 2026 is even higher. Over time, an increasing number of sole traders, small business owners, and service providers have ventured into public places and had direct contact with their clients. In such a scenario, the risk of the businesses being sued for property damage and personal injury is at a high level. A business owner can make well-informed judgments on how to safeguard their company by understanding the cost of public liability insurance and the factors that significantly influence those prices.

Key Takeaways

- The cost of coverage in 2026 will vary widely depending on your industry, turnover, location, and level of risk exposure.

- Small business owners, sole traders, and other businesses in higher-risk industries need to prioritise adequate coverage first and foremost.

- Finding the right providers for you and access coverage that suits your protection needs means that you will have the right balance of protection at the correct cost.

This blog explores public liability insurance, a type of insurance that benefits companies. The main description of the coverage, the factors affecting the premium, and the premium forecast for 2026 have also been discussed.

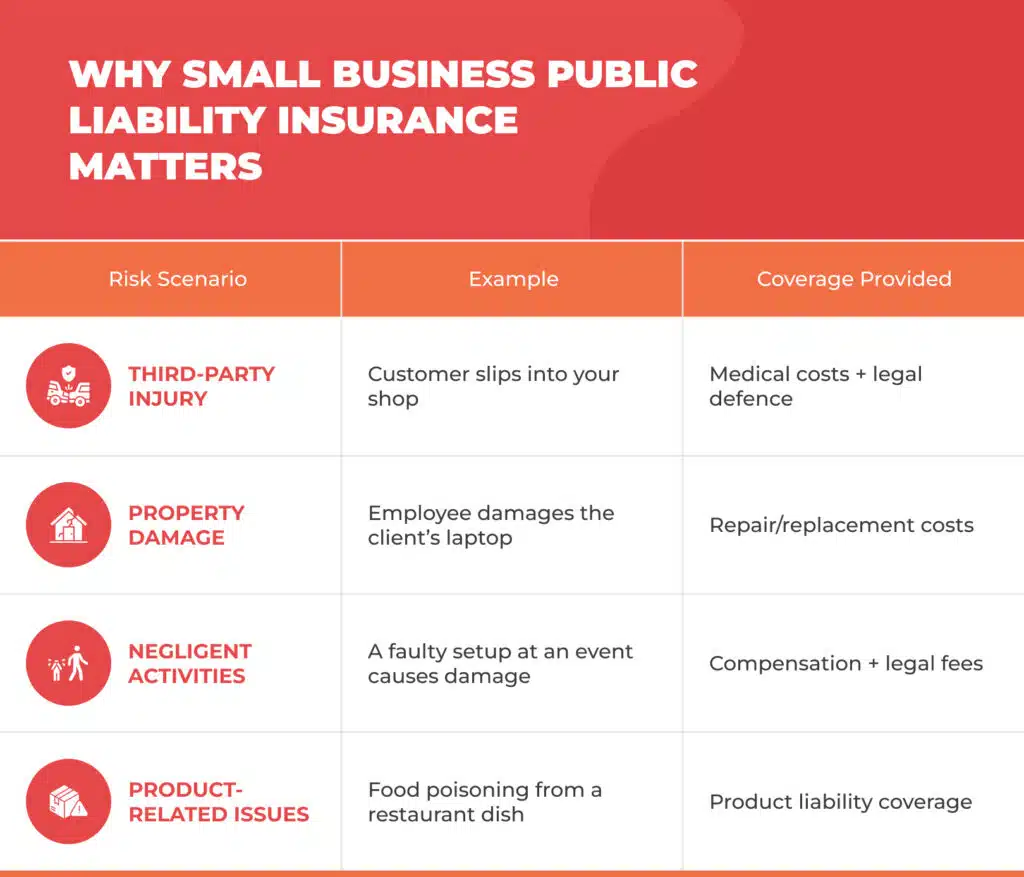

Why Businesses Need Public Liability Insurance

In any case, there are always possibilities of something going wrong with the public, even if you are operating carefully. Imagine that a customer falls on a wet and slippery floor, a contractor damages a client's property without realising it, or a minor mistake leads to a huge claim. These problems can escalate into money disasters if there is no insurance.

Protecting Against Financial Losses

Covers property damage and personal injury

If a customer, for instance, gets hurt at your business location or, by chance, your work damages someone else’s property, a claim resulting from these incidents might be costly. Public liability insurance protects the policyholder against such cases, paying the legal costs, may cover medical expenses if included in a successful third-party claim, and taking care of the repair without the amount being a burden on the business.

Essential for small business owners, sole traders, and construction companies

Smaller enterprises and individual traders usually lack the financial resources to cover significant claims. Companies in the building sector, workers in the trades, and similar professionals are particularly vulnerable due to the nature of their work.

Mitigates risks from negligent activities and legal liability.