Complete Small Business Insurance Guide for 2026

Key Takeaways

- Small business insurance is commonly used to help protect your income, assets, and legal obligations.

- The right mix of coverage options may help reduce your financial worries and the risk of business interruption.

- Unambiguous policy wording and professional advice help you avoid coverage gaps.

- VIM Cover offers access to insurance solutions to match the growth of your business.

Running a small business in 2026 is every day a mix of juggling opportunity and risk. Along the way of serving customers and managing staff, to protecting cash flow and reputation, the businesses may face operational challenges. Just one unexpected event, an accident at your business premises, a cyber breach, or a liability claim, can be a cause of a hefty financial loss. This is the reason why having the right insurance is no longer a matter of choice; it is a vital part of business planning.

This guide covers the general information on small business insurance for small business owners. It starts with understanding the essential cover, then moves to choosing insurance solutions that really support long-term growth. If you are a sole trader, run professional services, or have physical premises, this guide aims to support general awareness of insurance considerations in 2026.

This article provides general information only and does not take into account individual objectives, financial situations, or needs. It does not constitute financial or insurance advice.

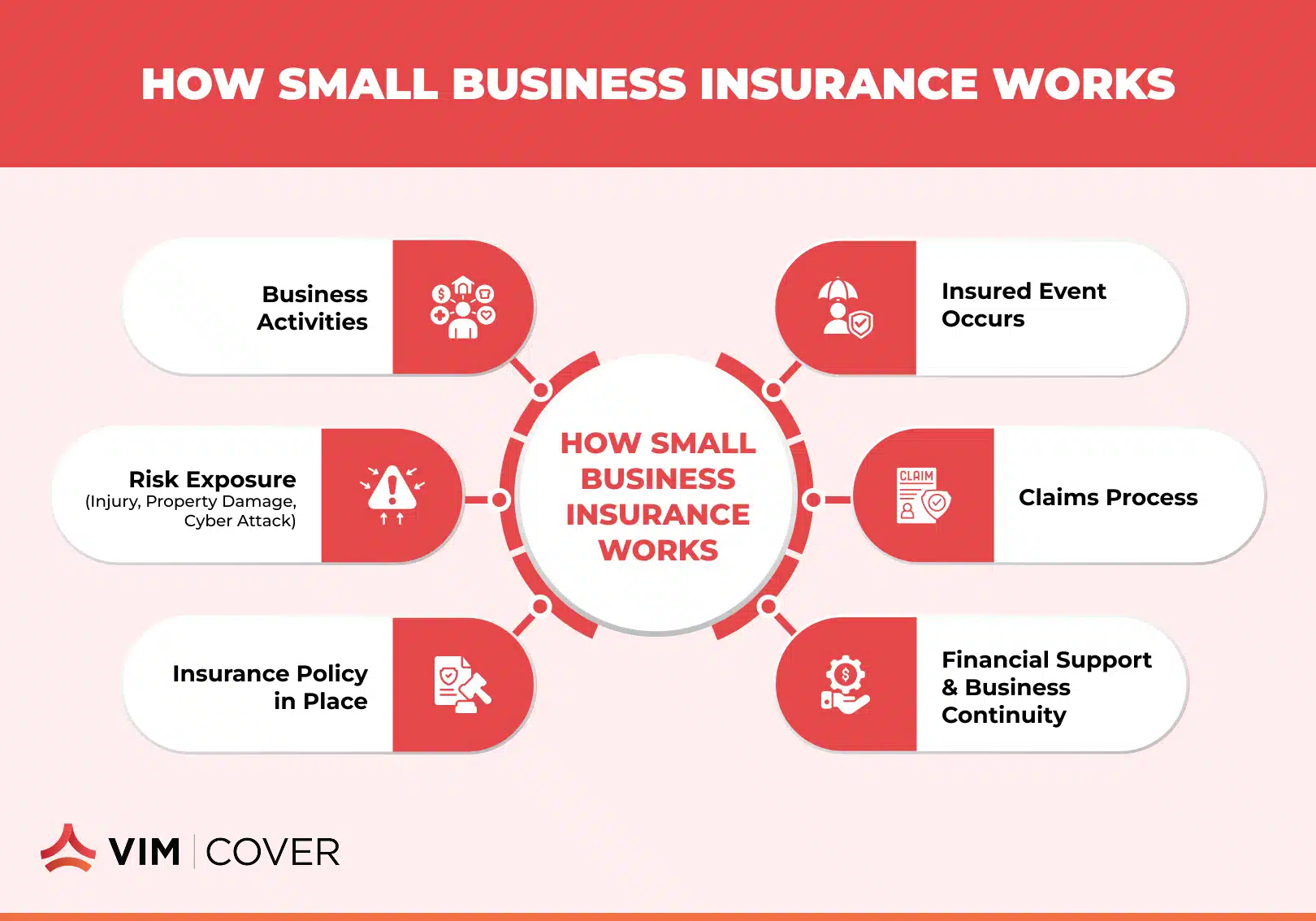

What is Small Business Insurance and Why Is It Important?

Essentially, small business insurance is designed to address different risks that may come up in the course of daily business activities. Such risks can include injury to a member of the public, damage to equipment, or even loss of income following an insured event.

An adequately drafted insurance policy may help protect your business assets, support business continuity, and reduce the anxiety that comes with the unknown. It is a promise that one unexpected problem will not undo the years you have worked hard. Besides, for many businesses in Western Australia, insurance may be required contractually when dealing with clients or suppliers.

Understanding Business Insurance Policies

Each business faces different risk profiles, and that is the reason business insurance policies are never standard for all. The type of your business will determine your scope of protection, how you operate, and your liability exposure.

Essential Coverage

- Security for business premises and tangible assets

- Cover for Public and Products Liability claims

- Support for legal costs, repairs, and loss of income

It is essential to have Clear Policy Wording. This document specifies precisely what is covered, how claims are handled, and the situations in which exclusions apply. Understanding this information can help businesses ensure their business insurance requirements are met without any unanticipated gaps.

Why Every Small Business Owner Needs Insurance

Usually, small business owners view insurance as a tool for managing uncertainty. With appropriate coverage, risks can be controlled without jeopardising the business's cash flow under challenging situations.

Main features of the policy often reviewed are:

- Less risk of being the target of a liability claim and having to pay the legal costs

- Coverage against involuntary damage and situations caused by a third party

- Business insurance that provides the right cover for the requirements of your business

Moreover, it can be a valuable tool for attracting customers and partners. They can be sure that your business is a professional one, follows the regulations, and is ready for any circumstances.

Essential Types of Business Insurance for Small Businesses

Knowing what business insurances are available can assist you in getting valuable coverage in which you will be protected without paying for useless or unnecessary coverage.

Commonly Discussed Insurances

- Public liability insurance: Generally designed to cover the costs resulting from injury or damage to the property of a third party due to your business or operations.

- Professional Indemnity Insurance: A product that is often considered by a professional service, as it shields the firm against allegations related to the provision of advice

- Product liability insurance: Typically applies to legal claims due to products that are unsafe and/or faulty

These core business policies often form the foundation for vibrant Business Insurance Pack choices.

Optional Cover Additions

- Workers' compensation insurance to cover injuries related to employees

- Cyber Liability cover to address specific cybersecurity threats and the loss of electronic equipment

- Business interruption insurance to assist with the loss of income during periods of forced business closure

In addition, optional covers, such as management liability insurance, contents insurance, and income protection, can provide additional strength and security.

Factors Affecting the Cost of Business Insurance

Business insurance expenses are influenced by various factors, among which are the kind of business you have, the risks of your industry, and your history of claims.

What Influences Premiums

- The way your business is set up (e.g., sole trader vs company)

- Are business vehicles part of your operations for which you need Car Insurance or third-party property cover?

- What type of cover do you have, and what limits are set within your insurance packages

Though it may seem that adding more coverage is just an additional cost, the lack of adequate protection can result in significantly more costly over time.

Getting a Business Insurance Quote That Fits Your Needs

An individualized Business Insurance quote typically reflects the risks that a business is exposed to and also the company's financial status. Moreover, being able to readily get a Certificate of Currency, which is a common requirement by landlords and clients, is equally important.

The procedure may be supported by a skilled insurance broker. Brokers evaluate the insurance business policies that you have, provide in-depth explanations of the options to you, and, if necessary, assist you in the claims department.

How VIM Cover Helps Small Business Owners

VIM Cover knows that different companies are different, and that is why their method is customer-specific insurance solutions instead of standard policies.

Reasons for Choosing VIM Cover

- Business Insurance Pack with modular options

- Honest advising based on actual risks

- Help with claims, renewals, and compliance

Besides that, Personal Insurance, like Life and Trauma insurance, can give you the security that you need while running your business to be able to face the unexpected situations confidently.

Secure Your Business with the Right Insurance in 2026

Deciding on the right insurance often involves protection needs, supporting your good name, security, and peace of mind. With the right combination of policies, your company can step into 2026 with confidence and be open to expansion without unnecessary risk.

Leading a business is all about expecting expansion and also being ready for the unforeseen. Having an appropriate small business insurance policy in place can help manage risks related to reputation, premises, and revenue.

Businesses may choose to obtain quotes from licensed insurance brokers such as VIM Cover. Get started today!

*Insurance broking services are administered by VIM Cover Pty Ltd ABN 84 664 655 449 as a Corporate Authorised Representative (CAR 001304833) of Oracle Group (Australia) Pty Ltd AFSL 363610. The information provided is of a general nature and does not take into account your objectives, financial situation, or needs. You should consider whether it is appropriate for your circumstances and read the relevant Product Disclosure Statement (PDS) and Target Market Determination (TMD) before deciding.

FAQs

- What insurance do most small businesses require?

The requirements change, but typically, public liability insurance and workers' compensation insurance are the two most required. - Should business insurance be taken by sole traders?

Absolutely. A sole trader is a one-person operation in which the trader is the only person responsible; hence, insurance is essential. - Is small business insurance, including cyber liability, necessary?

Yes. If customer data is stored and online operations are used, Cyber Liability protection is definitely a must-have. - How often is it necessary to look at my insurance policy?

It is good to take a look at the policy at least once a year or in the case that your business activities or location change.

Comprehensive Plant Insurance for Businesses in 2026

Key Takeaways: Plant Insurance

- Plant insurance is an excellent way to protect business assets and equipment from risks such as Material Damage, accidental damage, and total loss.

- The insurance policy covers various equipment, including bobcats, scissor lifts, earthmoving tools, and farming machinery.

- Businesses enjoy the advantages of tailor-made insurance cover, including Hired-in Plant, Machinery breakdown, and liability coverage.

- Plant insurance can help reduce disruptions, as it covers property damage, breakdown cover, road risk liability, and other such things.

Entrepreneurs all over Australia seem to be entering the year 2026 with the mentality of handling even more work than last year. They also have to meet more deadlines and manage the expansion of the sites where they operate. Constantly, it seems, heavy machinery and other mobile equipment are the leading actors of this expansion. Thus, the risk of machinery failure or property damage is even more significant. Plant insurance is thus the instrument that ensures the safety of the machinery with which your operations are carried out every day.

Here at VIM Cover, we often see our clients encounter insurance challenges that evolve as their businesses grow. Consequently, selecting the right insurance is more than just a decision of signing paperwork; it becomes an integral part of safeguarding your reputation, your investment, and your future.

Why Plant Insurance Is Essential for Your Business

Plant insurance can be an important form of equipment protection for many industrial or commercial businesses, depending on their needs.

Whatever the case may be with you, whether you provide crane hire services or are the manager of a fleet of heavy machinery, the assets of your business still require the safeguards that are effective across all job sites.

Such cover may protect mobile plant and equipment against Material Damage, accidental damage, and total loss, depending on the policy wording. The insurance may be available for earthmoving machines, bobcats, agricultural machinery, scissor lifts, and small portable tools, subject to insurer acceptance.

Moreover, a good Equipment Insurance Policy will have a component of public liability insurance and Products Liability that will offer you protection in case your plant item causes property damage or injures a person. Considering the machines are hardly ever at the same site for long and are continuously transported, Transit cover provides greater assurance that they will be there throughout the relocation. Note however that coverage during relocation is subject to policy terms, conditions, and limits.

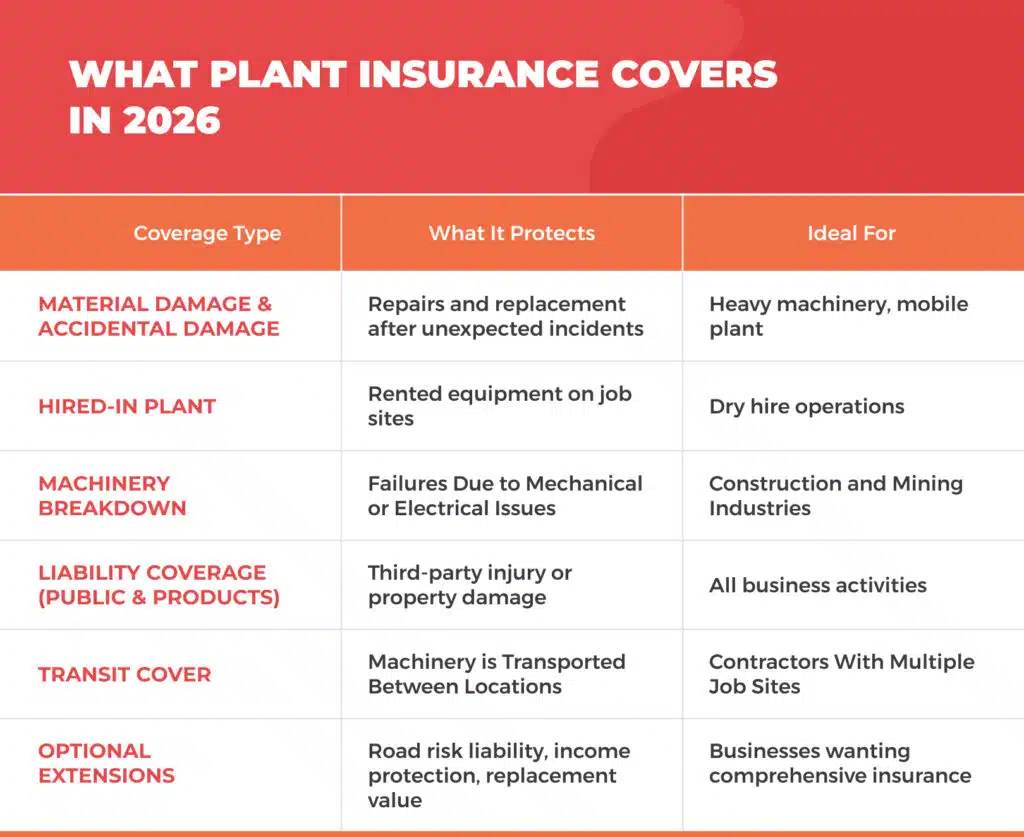

Insurance Options for Plant & Equipment Owners

Since every business is unique, it is essential to have adaptable insurance options. You might require full insurance cover for your heavy machinery, while at the same time, you may want dry hire insurance if you are simply using the hired-in plant. Additionally, many business needs require the inclusion of cover options for Machinery breakdown so that you can remain operational in the event of a sudden equipment failure.

Specific policies may offer options such as market value or replacement value, depending on the product and insurer. In 2025, insurance companies are presenting fewer limitations and more options, such as road risk liability, breakdown cover, Broadform liability, income protection, and Optional extensions for single items or a wide range of equipment.

These decisions are instrumental in determining the kind of insurance program that is most suitable for your exact insurance needs, whether you are a small business or managing large-scale infrastructure projects.

Why Choose VIM Cover for Your Plant Insurance

Insurance specialists offer guidance based on experience in the Australian insurance market. They offer expert advice to those who understand the Australian insurance market. Companies rely on us to provide guidance on available insurance options - a policy that is based on their business, the risks of the industry, and the type of cover they prefer.

Our equipment policies can be tailored to cover a wide range of the business, from Mobile Plant and Machinery Insurance to dry hire insurance and crane hire operations. We help our clients select policies that ensure the sum insured aligns with the tangible business assets, so that every plant item is adequately protected.

How Plant Insurance Supports Business Owners

Therefore, plant insurance is one of the most valuable supports a business owner can have in his liability coverage concerns at active job sites. Especially where it is a known fact that heavy machinery is constantly used in such places, this insurance product facilitates the business's operations by ensuring its assets are protected against rising value.

Therefore, your cover will stay relevant as risks evolve with insurers and brokers constantly communicating the latest insurance market news and updates. If you want machinery and equipment that are well protected, get in touch with a VIM Cover broker for tailored guidance and a business-built-around solution.

Is your business equipment setup ready for any eventuality? Get advice from an expert who is familiar not only with your industry but also with your risks and the equipment you use daily.

Make the most of the VIM Cover broker to design a custom plant insurance plan that may help protect your equipment and support your operations, subject to policy terms and eligibility. Contact us today!

Disclaimer: The information provided is general in nature and does not take into account your objectives, financial situation, or needs. Before making a decision, consider whether the product is appropriate for you and review the relevant Product Disclosure Statement (PDS) and Target Market Determination (TMD). Coverage is subject to the insurer’s terms, conditions, limits, and exclusions.

FAQs

1. What are the typical components of plant insurance?

Essentially, the policy insures Material Damage, accidental damage, total loss, liability coverage, and, optionally, a breakdown cover based on your policy.

2. Are the pieces of equipment covered while they are in a vehicle?

Indeed, the Transit cover can be added to the protection of machinery in transit between job sites.

3. Is the coverage extended to Hired-in Plant?

Several policy provisions allow for Hired-in Plant, a feature that helps the business to keep a protective shield even when the equipment is not owned.

4. What is the way to determine the correct policy?

Working with a broker can help you understand available options and obtain general information about insurance products.

Comprehensive Equipment Insurance for All Your Business Needs

Key Takeaways

- Equipment insurance can help reduce financial impacts arising from accidental loss, material damage, or theft of essential tools and machinery.

- Ideal for businesses operating construction, industrial, mobile plant, and machinery across multiple locations.

- Cover options may include Public Liability, Business Interruption, and optional Management Liability.

- Licensed insurance brokers such as VIM Cover can assist with policy documentation, payment options, and guidance throughout your insurance process.

Businesses rely on a wide range of tools and machinery, from small equipment and portable tools to larger plant and heavy machinery to keep their operations running smoothly. An unexpected breakdown, accident, or theft can interrupt work and affect cash flow. Equipment insurance can help protect your business against these types of unforeseen events.

At VIM Cover, we aim to support businesses that depend on machinery and equipment by arranging insurance solutions that offer clarity, flexibility and value. Our approach focuses on providing tailored options that help safeguard your assets and assist in maintaining continuity across your projects and job sites.

What Is Equipment Insurance and Why Is It Important?

Equipment insurance is designed to help protect your business from financial loss relating to your tools, machinery, and other essential operational equipment. This type of cover may apply across industries such as construction, manufacturing, logistics, and trades, particularly where equipment plays a critical role in project delivery.

Depending on the specific policy, equipment insurance may help cover:

- Accidental loss or material damage

- Theft or vandalism

- Breakdown of machinery (subject to policy terms)

- Disruption to business operations caused by equipment failure

Because cash flow and operational continuity are vital, having suitable cover may assist in reducing downtime and unexpected expenses.

Understanding What Equipment Insurance Covers

Policies vary by insurer, so ensure your policy fits the way you do business and the kind of equipment you use. A properly designed policy may include the following:

- Accidental loss and material damage, thus minimising the loss caused by sudden and unforeseen events.

- Property damage on or off the work sites, that is, if it is an incident involving machinery, tools, or motor vehicles.

- Public Liability Insurance protects against claims arising from third-party injury or damage.

- Business Interruption, which in essence is the loss of income when the business is required to shut down temporarily.

- Optional add-ons, such as Management Liability, Contents Insurance, or Indemnity Insurance, to name a few, assist in tailoring a policy to your needs.

Your Policy Wording and PDS detail all inclusions, exclusions, conditions, and limits. We recommend reviewing these documents carefully before selecting a policy. We operate with complete honesty and openness, thus you are always aware of the extent of your insurance coverage.

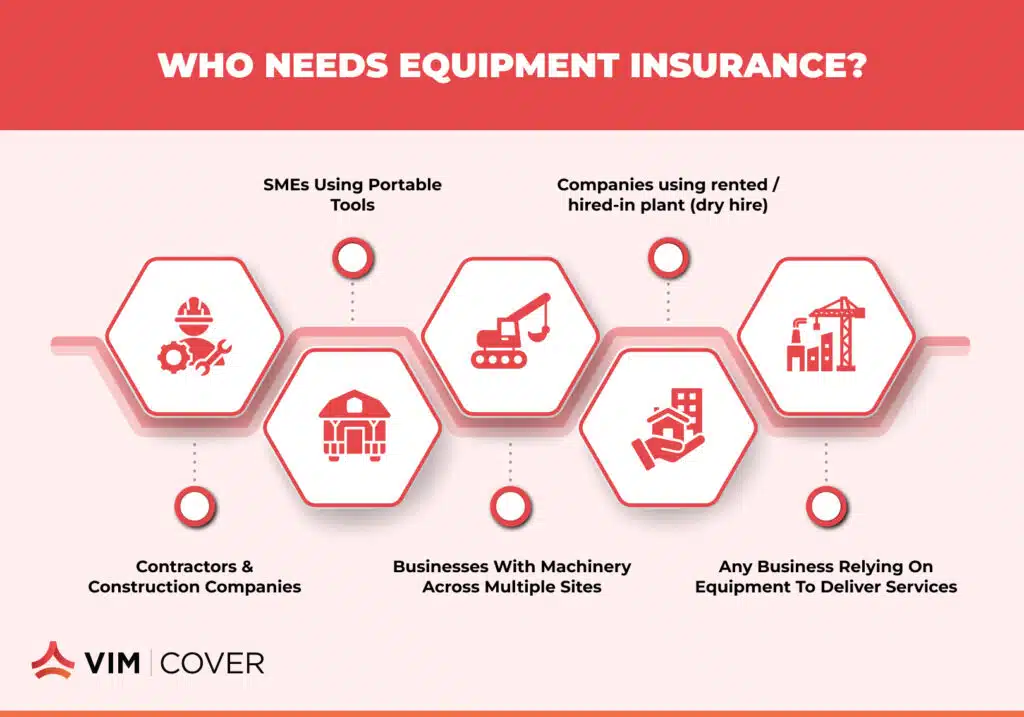

Who Needs Equipment Insurance?

Machinery and Equipment Insurance is a policy often misunderstood as reserved for big companies. However, these policies can apply to a diverse range of businesses, such as:

- Contractors and construction companies utilise mobile plant and heavy machinery.

- Small and medium enterprises that have portable tools or mobile phones, which are essential for their daily operations.

- Businesses that either own or lease the vehicles or machinery used for multiple job sites.

- Companies that depend on hired-in plant for short-term projects or dry hire insurance for rentals.

Regardless of what industry you are in, the act of protecting the tools and machinery that you utilise is, in essence, the protection of your productivity and reputation.

Key Features of Equipment Insurance Policies

- Clear Policy Documents and simple Policy Wording to make it easy for you to understand exclusions and limits.

- Choices to cover mobile plant, hired-in plant, and dry hire insurance arrangements. Cover for both owned equipment and a hired-in plant, including a certificate of currency as proof of cover.

- Flexible payment options and documentation to provide the information you need to make the right financial decision.

- Additional features for Management Liability, Public Liability Insurance, or Business Interruption to help safeguard your business.

What Does Equipment Insurance Cover?

Equipment insurance generally includes:

- Accidental loss, material damage, and property damage - the cost of the repair or replacement of the equipment that has been damaged either on the job site or off.

- Machinery Breakdown and accidental damage cover for mechanical failure beyond normal wear and tear (it is worth noting that wear-and-tear exclusions are often applicable).

- Business Interruption cover that can be used to replace lost business income due to a standstill in projects resulting from equipment failure.

- Public Liability Insurance, as well as Management Liability, can be used to protect the insured against claims from third parties arising from the use of the equipment.

- Support options such as Contents Insurance, Personal Accident, and financial hardship assistance are available.

Types of Cover Available

- Machinery and Equipment Insurance: specifically for the machines used in the construction works or operations of the likes of heavy machinery, excavators, loaders, and mobile plant.

- Mobile plant and equipment insurance: designed specifically for equipment that is regularly moved between sites or driven on public roads.

- Hired-in plant / Dry hire insurance: Helps protect rented equipment and lessens the risk of hire cost.

- Indemnity Insurance & Business Insurance Pack: single combine covers (e.g., Public Liability + Equipment + Commercial Vehicles) for broader protection.

- Portable tools include the essential gear, such as power tools and mobile phones, used on the site.

How to Choose the Right Equipment Insurance Policy

When choosing the kind of cover that you want, you mustn't just consider the price. Review the Policy Wording, the policy terms, and the sum insured to ensure your assets are valued correctly. In addition to that, consider:

- Whether your policy has flexible payment options that can fit into your financial situation.

- Confirmation of your coverage through a Certificate of Currency.

- The value of your equipment on the market and how it will affect your rental costs if you lodge a claim.

- Guidance in VIM Cover's Financial Services Guide and access to experienced brokers to help explain your options.

Request a Quote Online for Equipment Insurance

Getting started with VIM Cover is as easy as it gets. You can request a quote online that's customised to your field and the type of insurance you want. If it is safeguarding for bobcats, a mobile plant, or your business premises, we can source the cover options that fit your precise needs.

First, our specialists understand how you work, ensuring that every policy provides the right protection. So, this is how we help keep your business assets safe while you focus on growing.

Protect Your Business with VIM Cover in 2026

The machines and equipment you use are not only your means of work; they are the base on which your success is built. VIM Cover can assist you in navigating available insurance options, reviewing product documentation, and selecting a cover that aligns with your operational requirements.

VIM Cover will assist you in understanding the various policy choices and negotiating reasonably priced insurance backed by a team that has real knowledge of your industry. Make your equipment safe today and keep your enterprise going at full power.

You can obtain quotes from licensed insurance brokers such as VIM Cover.

FAQs

1. What kind of losses are covered by equipment insurance? In general, policies may cover at least part of accidental loss, material damage, and theft, as well as the breakdown of machinery and tools needed for your business.

2. Is it possible to ensure hired or rented equipment?

Yes. In the case of a dry hire insurance or hired-in plant cover, you can make borrowed or leased equipment a safe place against any harm or loss.

3. Is such a policy valid for machinery that is used on public roads?

Yes, insurance programs may be extended to cover mobile plant or machinery that is used on or off a public road.

4. How can I obtain an insurance certificate?

You will get a Certificate of Currency showing your coverage when your policy is in force.

General Advice Warning:

The information in this article is of a general nature only and does not take into account your objectives, financial situation or needs. You should consider whether this information is appropriate for you and read the relevant Product Disclosure Statement (PDS), Policy Wording and our Financial Services Guide (FSG) before making any decision about insurance products.