Understanding Public Liability Insurance Costs in 2026

Public Liability Insurance is one of the essential types of business protection that has received considerable attention over the years, and its significance in 2026 is even higher. Over time, an increasing number of sole traders, small business owners, and service providers have ventured into public places and had direct contact with their clients. In such a scenario, the risk of the businesses being sued for property damage and personal injury is at a high level. A business owner can make well-informed judgments on how to safeguard their company by understanding the cost of public liability insurance and the factors that significantly influence those prices.

Key Takeaways

- The cost of coverage in 2026 will vary widely depending on your industry, turnover, location, and level of risk exposure.

- Small business owners, sole traders, and other businesses in higher-risk industries need to prioritise adequate coverage first and foremost.

- Finding the right providers for you and access coverage that suits your protection needs means that you will have the right balance of protection at the correct cost.

This blog explores public liability insurance, a type of insurance that benefits companies. The main description of the coverage, the factors affecting the premium, and the premium forecast for 2026 have also been discussed.

Why Businesses Need Public Liability Insurance

In any case, there are always possibilities of something going wrong with the public, even if you are operating carefully. Imagine that a customer falls on a wet and slippery floor, a contractor damages a client's property without realising it, or a minor mistake leads to a huge claim. These problems can escalate into money disasters if there is no insurance.

Protecting Against Financial Losses

Covers property damage and personal injury

If a customer, for instance, gets hurt at your business location or, by chance, your work damages someone else’s property, a claim resulting from these incidents might be costly. Public liability insurance protects the policyholder against such cases, paying the legal costs, may cover medical expenses if included in a successful third-party claim, and taking care of the repair without the amount being a burden on the business.

Essential for small business owners, sole traders, and construction companies

Smaller enterprises and individual traders usually lack the financial resources to cover significant claims. Companies in the building sector, workers in the trades, and similar professionals are particularly vulnerable due to the nature of their work.

Mitigates risks from negligent activities and legal liability.

Although all possible safeguards may be implemented, there is still a possibility that an accident or oversight may occur. It is also typical for courts to concentrate on the results rather than the motives, thus companies can still be held responsible. A company can protect itself with public liability insurance, which reduces the risk by covering not only damages but also legal defence costs. This way, management can focus on ensuring the business continues to function after such an event.

Who Should Get Public Liability Insurance?

Risks certainly differ among various businesses to some extent. However, any company that has contact with clients or the public will benefit from considering public liability insurance. The size of your business is less important than what you do. If you are involved in any kind of outdoor activity, then not only is the risk present, but also the need for protection.

- Businesses often occupy various public areas, including malls, construction worksites, and event venues.

- Some industries, such as professional services or trade, include advertising agencies, management consulting firms, and the skilled trades.

- Local small business entrepreneurs who have face-to-face interactions with customers and the public.

- Particular attention must focus on hazardous firms, such as those where a mistake, exposure to boiling liquid, or food poisoning could result in a series of claims.

- These are the businesses that pose a danger; for example, a mishap, hot liquid, or food contamination can lead to a chain of claims.

What Influences the Cost of Public Liability Insurance?

Insurance premiums are never uniform for all customers. The amount a café needs to pay for its insurance can be significantly different from what a plumbing contractor or a marketing agency needs to pay. The reason is that insurers consider multiple factors when determining your premium, including the size of your business and the associated risks within your industry.

Key Factors That Affect Premiums

- Business size and turnover: Larger businesses with higher revenue usually pay more, as their exposure is greater.

- Industry type: A marketing agency may pay less than a restaurant, where food poisoning claims are more common.

- Location: States such as Western Australia or the Northern Territory may have different pricing due to their unique risk environments.

- Level of cover: The higher the amount of public liability cover, the higher the premium. Adding extra insurance products will also influence cost.

Industry-Specific Risks

- Hospitality establishments must contend with the risk of burns from hot liquids or food safety issues.

- Workers in trades and contracting businesses are at risk of being exposed to claims for property damage and personal injury in the places where they work.

- Even service providers like consultants need insurance because visitors to offices or events where clients are present could get hurt.

How Much Does Public Liability Insurance Cost in 2026?

Public liability insurance costs in 2026 will be influenced by several factors, including the general rise in prices, changes in government regulations, and shifts in the risk environment, resulting in varying costs. Besides the differences in industries, firms will also experience changes in their locations due to the different states, insurance companies, and the share they want to cover.

Average Costs and Insurance Options

Although there is an excellent range of costs, a majority of small businesses in 2026 will be able to anticipate that their premiums may start at a few hundred dollars per year for the basic cover as a minimum. For industries with higher risks, the premium can reach several tens of thousands of dollars per year.

Several factors, like stamp duty, state taxes, and the amount of cover requested, determine the final number. Small business owners can select customised plans that match their financial condition, securing them without depleting their funds.

How to Get a Public Liability Insurance Quote

- Consult with experts – Business insurance specialists can assess your industry, risks, and needs.

- Compare policies online – Many insurers allow side-by-side comparisons of public liability policies.

- Request documentation – Always ask for complete details, including policy wording and the certificate of currency, to confirm coverage levels.

What Does Public Liability Insurance Cover?

Many business owners believe they have a solid grasp of the coverage provided by public liability, but then a situation arises, and they discover that several risks are not covered.

Knowing what a standard policy comprises allows you to stay covered in areas that may be costly if you have no insurance, and also gives you peace of mind when dealing with the public.

Third Party Claims

Policies generally cover:

- Property damage caused by your business activities

- Personal injury to members of the public

- Legal defence costs and associated expenses

Additional Insurance Options

Businesses often combine public liability with:

- Product liability (covering issues with goods sold)

- Trade insurance for contractors

- Workers’ compensation

- Home insurance or car insurance for business-related assets

- Income protection and life insurance for broader security

Choosing the Right Public Liability Policy

It is well known that multiple insurers offer public liability insurance, and numerous business insurance packages are available on the market. As a consequence, choosing the proper one can become an overwhelmingly difficult task. The most efficient approach is to analyse business needs first and then evaluate providers familiar with your field of work.

Assessing Business Needs

The right policy depends on your:

- Type of business and work environment

- Risk exposure from daily activities

- Financial situation and capacity to pay liability premiums

Although sole traders in the construction industry may require less insurance than large companies, it remains essential for both to have sufficient cover to avoid financial burden in the event of a claim.

Finding the Best Insurance Provider

It is not that every insurance company provides the same value. Investigate companies that specialise in small business packages or have experience with specific industries. Utilise the buying power of your group, such as a trade association, to access reasonably priced rates.

Looking for reliable public liability insurance that can truly safeguard your small business?

Licensed insurance brokers such as VIM Cover can assist with tailoring insurance that fits the unique needs of small businesses located anywhere in Australia. Whether you require only basic coverage or a comprehensive policy, our skilled brokers will guide you towards finding an ideal solution that suits both your needs and budget.

You can obtain quotes from licensed insurance brokers such as VIM Cover.

FAQs

Q1. What is the average public liability insurance cost for small businesses in 2026?

Small businesses typically allocate between a few hundred and a few thousand dollars annually to their budget. The risk exposure and coverage levels of the companies are the main factors affecting these amounts.

Q2. Does public liability insurance cover employee injuries?

Workers’ compensation insurance typically covers injuries to employees. Public liability insurance cannot cover the insured's employees.

Q3. Can sole traders get public liability insurance?

Definitely, a cover that shields sole traders from the occurrences of property damage or personal injury due to their business activities is the one they require.

Q4. How can I determine the amount of coverage my business needs?

You need to consider the potential danger elements in your business, check the acceptable insurance coverage in your line of business, and the cost of the claim. Consulting with insurance experts is essential to ensure you have the right cover for your business.

***This article provides general information only and does not take into account your specific circumstances. You should seek advice from a licensed insurance professional before making decisions.

Small Business Public Liability Insurance: Everything You Need to Know

Small businesses venture on a journey full of both opportunities and risks. A company will always aim for growth and customer satisfaction. However, it is equally essential to ensure that the business is protected against unexpected claims. Public liability insurance for small businesses is among the most significant protective measures that any small business owner should consider.

Such a policy provides protection against legal fees, claims from third parties, and unexpected financial difficulties. In this blog, we will explore the components of public liability insurance, its importance for small businesses, and how to select the right policy for your specific insurance needs.

Key Takeaways

- Small business public liability insurance covers third-party injury and property damage.

- It includes compensation, defence costs, and related legal fees.

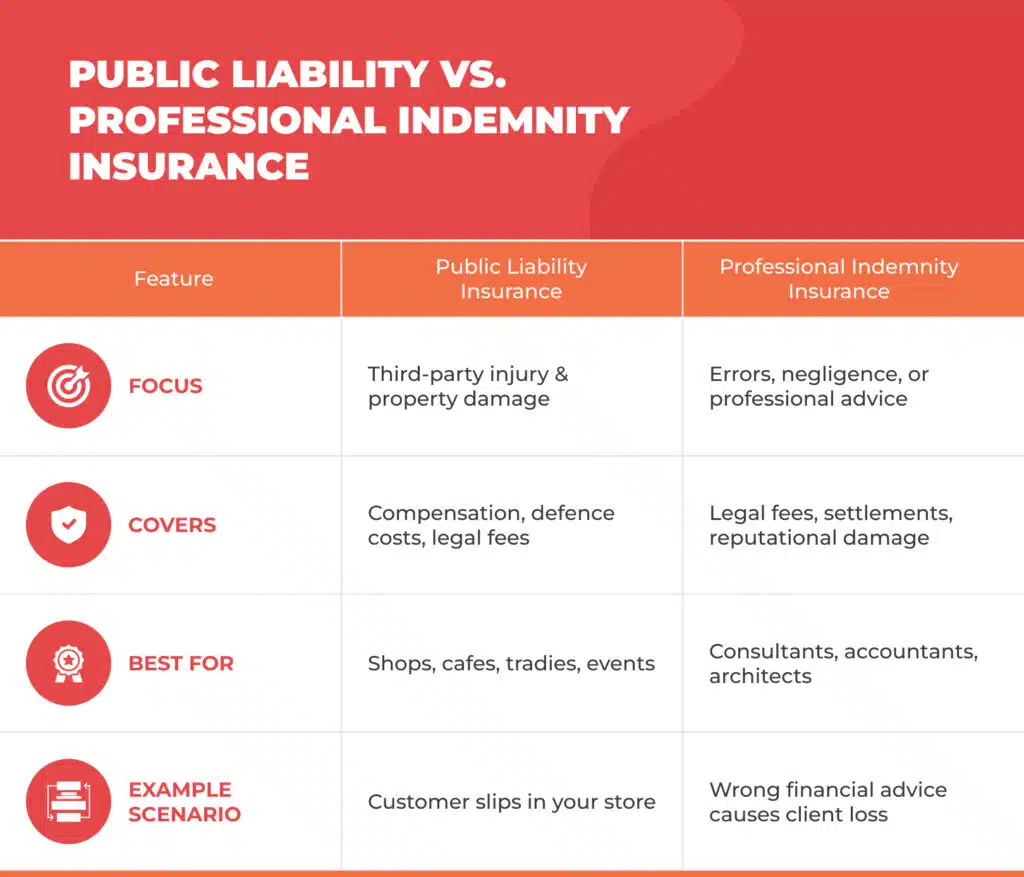

- Different from Professional Indemnity Insurance, it focuses on physical damage.

- Brokers and tailored insurance packages help small businesses get flexible cover.

What is Small Business Public Liability Insurance?

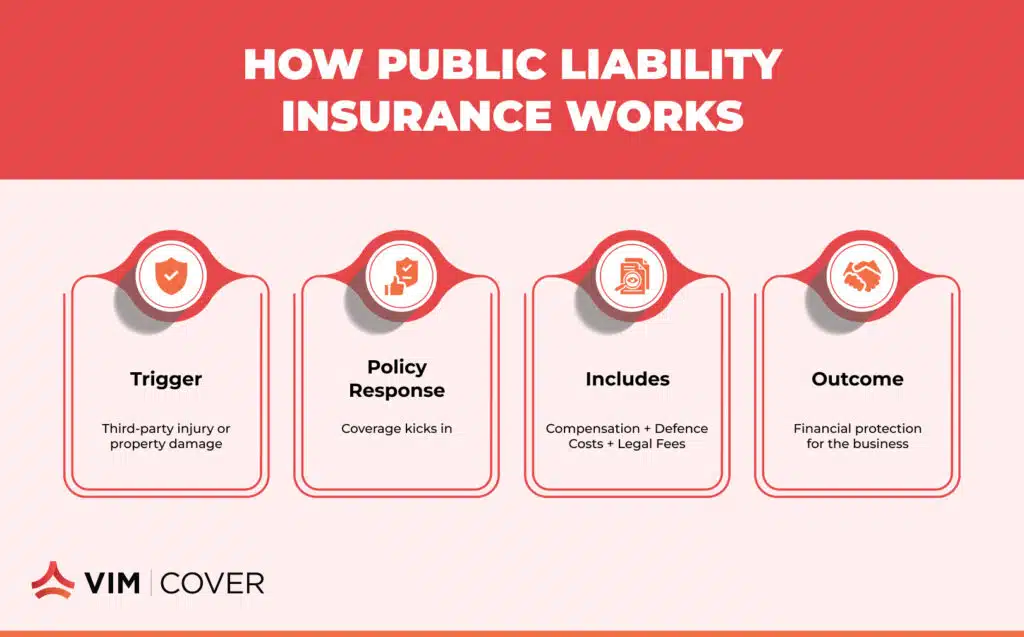

Small business public liability insurance covers your company if third parties make a complaint that they have suffered personal injury, property damage, or have received another type of loss due to your business operations.

To illustrate, if a customer falls on uneven flooring in your store and sustains an injury, your public liability insurance may provide coverage for their treatment costs, as well as any legal expenses incurred if they file a lawsuit.

No doubt, even the most careful business owners can be hit by accidents. This insurance protects you from having to pay massive compensation claims on your own.

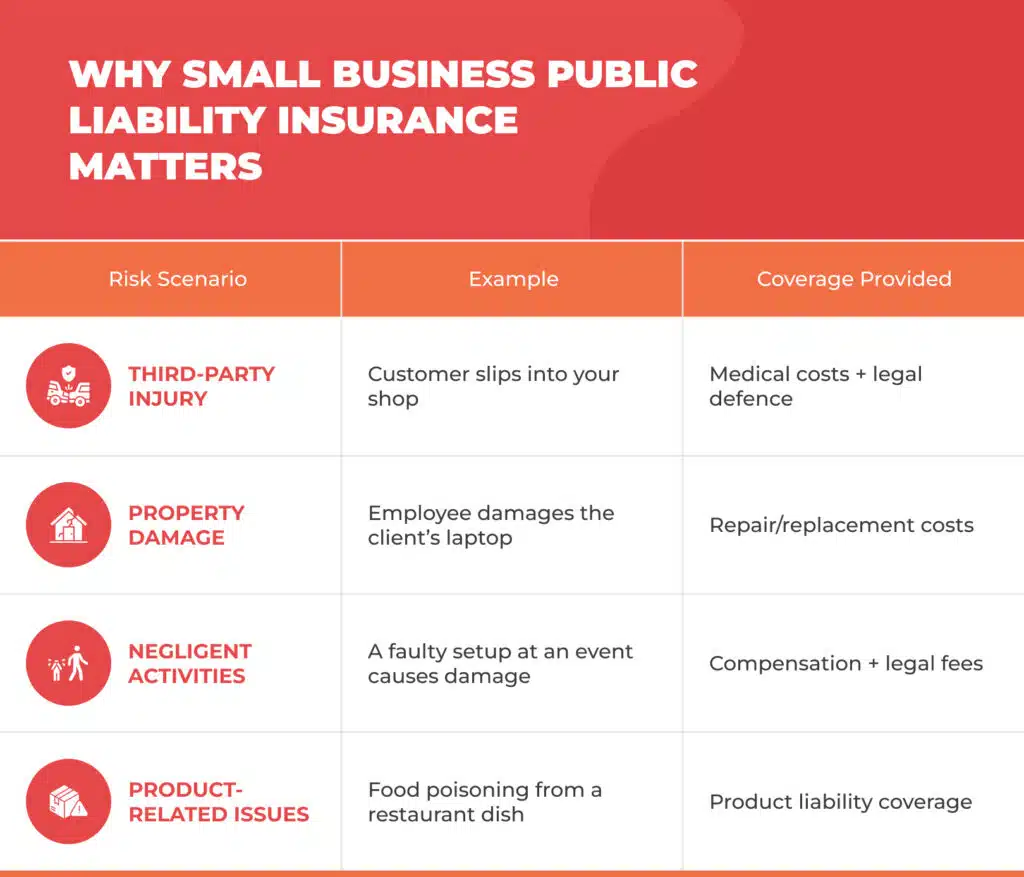

Why Public Liability Cover is Essential

Though the safest method is always preferred, accidents are sometimes inevitable. The aftermath of an incident for small businesses can be so huge and suffocating that it may be hard for them to recover. It is therefore not surprising that public and products liability insurance is regarded as one of the most essential types of insurance.

Protects Against Third-Party Injury and Property Damage Claims

Accidents can occur in any location, even if a person is extremely cautious. If someone slips, falls, or the property is damaged, and these incidents are related to your work, then the responsibility lies with your company.

Covers Legal Costs and Defence Expenses

Legal proceedings can be costly, no doubt. A policy of public liability insurance covers the expenses of the lawyer who will defend a case. It also provides coverage when the issue is not with you.

Supports Business Stability

Public liability insurance is often required when dealing with local authorities, landlords, or contractors, though requirements may vary by industry and region. Public Liability cover can afford you financial security, but it also creates a good impression of you.

How it Differs from Other Insurance Products

Business owners are often confused about the differences between public liability insurance and other types of policies. Recognising these differences will help you avoid being overwhelmed by extra coverage or losing the protection of your rights.

Public Liability vs Professional Indemnity Insurance

Public liability insurance covers only cases of physical injury and property damage directly caused to third parties. In contrast, professional indemnity insurance serves as a shield against financial losses resulting from the provision of professional advice, services, or negligence.

Consider a situation where a consultant gives incorrect advice. In this case, the consultant will then require an indemnity insurance policy. On the other hand, a café owner is required to have a public liability insurance policy to ensure the safety of customers.

Specialised Coverage for Premises and Negligent Activities

Public liability insurance typically includes coverage for events occurring at your location or resulting from your business's carelessness, which is often excluded from other types of insurance.

Product Liability and Recalls

Few auto insurance policies cover product liability resulting from claims due to a product that was sold or made by the insured that caused harm. This option is generally the most important one in the mentioned industries, such as food and electronics.

Key Features of Business Insurance Packages

A smaller business rarely requires just one policy. On the other hand, business insurance cover can be more effective when combined with other insurances that match their field of work, such as public liability insurance.

Types of Cover for Business Needs

- Sole traders typically pair public liability insurance with product liability insurance.

- Commercial car insurance is just the right solution for work vans, delivery trucks, and cars.

- Business premises insurance protects against the destruction of buildings.

For example, the hospitality sector might have packaged cover for food poisoning or injuries that occur during the administration of first aid.

Flexible Business Insurance Solutions

Insurers offer a range of cover options in terms of payments, policy details, and target audience identification. Not only can the cover be tailored to the client's specific requirements, but it can also be tailored to the client's particular compliance aspects and financial situations.

Common Public Liability Claims and Coverage

It is only after examining real-world instances that the significance of insurance sometimes becomes evident. Small businesses in various industries often face similar types of claims, and understanding these claims highlights the benefits of public liability insurance.

Examples of Typical Claims for Small Businesses

- Customer injuries on your premises: A shopper falls on a wet floor, a café customer is burned by spilled hot coffee, or a gym member trips over equipment.

- Damage to third-party property: A tradesperson destroys a client’s driveway by unloading the heavy equipment, or a contractor breaks a window during renovations.

- Negligent business activities: A defective product injures a consumer, or an employee’s careless performance leads to the injury or loss of a person outside the business.

Although these situations may appear minor, they have the potential to escalate into compensation claims of thousands of dollars quite rapidly.

Understanding Legal Fees and Defence Costs

It is surprisingly one of the small businesses for which the cost of a legal defence, even in a minor legal case, is a significant financial burden. Legal bills can grow large very quickly, and if you don't have insurance, they can be very costly. Small businesses often underestimate the number of legal processes they must follow.

- Coverage for Legal Liability: Public liability insurance provides coverage for lawyer fees, court costs, and settlements.

- Financial Loss Prevention: It eliminates the risk that your business may experience a cash flow issue due to the specified event.

- Extra Disbursements: Heavy industries may incur additional disbursements, such as safety investigations or regulatory penalties for non-compliance with safety standards.

How to Choose the Right Business Insurance Policy

Finding the right insurance policy for your business is more than just meeting the legal requirements. Such a business cover will guarantee your company's uninterrupted operation in times of unexpected events. The large number of insurance products has made it necessary for small business proprietors to perform a complete evaluation of what fits their businesses the best, including the potential risks and available amounts of money.

Factors to Consider for Your Business Type and Size

Every business must deal with unique types of risks that are specific to that particular business. A small café faces the risk of the disappearance of the coffee it sells. On the other hand, an IT consultancy has a completely different risk profile. A sole trader’s specific needs are entirely different from those of a multi-staffed company that is growing. When going through policies, it is essential to consider a number of factors, including:

- The type of business: Retail businesses most likely require product liability insurance, whereas more service-oriented companies may need professional indemnity insurance in addition to public liability.

- Business size: The potential risk increases with the number of customers, staff, or locations.

- Cover limits: Choose an amount of cover that represents the worst-case scenario your business can face. For instance, a tradesperson operating in residential homes might be allowed to have lower limits than a contractor working in big commercial spaces.

Working with a Business Insurance Broker

For instance, if you're unsure where to begin, a business insurance broker can simplify the process for you. Brokers assess your risks, compare policies from various companies, and recommend the most suitable solutions for you. Additionally, they can:

- Get an online quote that reflects the correct pricing for your insurance.

- Speak in simple terms about what is included in the cover.

- Ensure that you are fully covered and have your certificate of insurance ready for contracts or any other obligations.

The advice of a broker is highly beneficial for small businesses, especially when they are in a situation where they cannot afford to lack protection or pay an excessively high premium.

Protect Your Business with Public Liability Cover in 2025

The business environment will undoubtedly become increasingly complex in the future. Every year, rules become stricter, customers expect more, and new risks emerge. Public liability insurance must adapt to these changes.

Business owners of small businesses must ensure that their policies adequately cover the risks associated with their industry, possess the necessary policy documents, such as a certificate of currency, and comply with relevant insurance, tax, and legal requirements. This approach will equip your business to handle upcoming challenges better if adopted.

Not sure which cover best fits your small business? You can obtain tailored quotes from licensed insurance brokers such as VIM Cover and safeguard your business with public liability insurance. Get started today!

FAQs

Q1: Do all small businesses need public liability insurance?

Yes. A business of any size that has dealings with customers, suppliers, or the general public should have this cover.

Q2: How much cover for public liability do I require?

The level of cover is conditioned by your industry and the level of risk you are exposed to. The standard amount of coverage typically ranges from $5 million to $20 million.

Q3: Is public liability insurance a tax-deductible expense?

Yes. The payments for business insurance policies are typically deductible from the business's taxable income, classified as a business expense.

Q4: Do employees have protection under public liability?

No. Staff injury claims will be satisfied through the workers' compensation insurance scheme. Public liability is a safety net for the injured third party only.

This article provides general information only and does not take into account your specific circumstances. You should seek advice from a licensed insurance professional before making decisions.