What Is Public Liability Insurance and Why Does It Matter in 2026?

Public liability insurance aims to shield business owners from the ‘financial blows’ mentioned above. In 2026, with more stringent regulations in place and more willing customers regarding claims, such a policy is more than a nice-to-have. For many business owners, it is simply a matter of survival. Every business in Australia has to embrace growth and manage associated risks. It is always possible that something will go wrong, such as a customer slipping and falling on your foyer floor or a staff member accidentally damaging a client’s property. It is also possible that some products you sell might injure some customers. All these incidents can result in expensive litigation and compensation for the customer.

Key Takeaways:

- Public Liability Insurance helps businesses protect themselves from lawsuits and claims made by third parties for injury or damage to their property.

- It is a necessity for small businesses and professions, such as trades, hospitality, real estate, and beauty, which face customer risks and interaction daily.

- Every business should find the right policy by determining the business risks, coupled with coverage and other policies for added protection.

Understanding Public Liability Insurance

Public liability insurance covers any legal and compensation expenses arising from business activities that result in injury or property damage to third parties not involved in your business. The ‘third person’ can be a customer, a supplier, or even a bystander. Insurance brokers like VIM Cover specialise in providing essential coverage to protect your business from potential liabilities arising from third-party property damage or personal injury claims.

You can obtain quotes from licensed insurance brokers such as VIM Cove.

What Does Public Liability Insurance Cover?

- Third-party injury and property damage claims

If a person trips on a loose cable in your office or an employee scratches the client’s car while unloading the equipment, you will have to pay for the resulting expenses. These are specifically the expenses that Public Liability insurance covers. - Business activities leading to liability issues

Every industry carries risks. A carpenter might damage a wall while installing cabinets, or a beauty therapist might cause an allergic reaction during treatment. Cover ensures you don’t carry the full financial burden of these situations. - Risk exposure from products or services

A faulty product or service gone wrong can result in expensive claims. Even small businesses that think their risk is low can find themselves exposed when products reach the public.

How It Differs from Other Insurance Policies

- Comparison with indemnity insurance

Professional indemnity insurance covers mistakes and omissions in the advice and any other professional services rendered. More general in scope, public liability covers personal and property damages. - Relation to product liability and professional indemnity

Product liability often sits within public liability cover, while professional indemnity is sold separately. Together, they provide stronger protection. - Role in a comprehensive business insurance package

Many business owners bundle liability with other policies like workers' compensation, management liability, or cyber insurance. Public liability forms the backbone of these packages.

Why Business Owners Need Public Liability Insurance

Many business owners underestimate their exposure until it’s too late. A single claim can stretch into tens of thousands of dollars — a sum that can easily wipe out profits or, in extreme cases, shut a business down.

Who Should Consider This Coverage?

- Small business owners

Smaller operators rarely have the cash reserves to absorb large claims. Public liability cover provides security and allows them to operate with confidence. - Beauty professionals and real estate agents

Beauty services can lead to accidental injuries or skin reactions. Real estate agents frequently enter homes and run open inspections, exposing them to property damage claims. - Food-related businesses

Cafés, restaurants, and caterers carry a high risk when it comes to food poisoning or contamination. One claim can damage not just finances, but reputation as well.

Protecting Your Business Type and Activities

- Business premises and operations coverage

Liability cover protects you from incidents occurring at your premises or during everyday business operations. - Addressing unique business needs

Coverage can be tailored. A trades business might need higher limits than a freelance consultant, while event organisers may require additional protections. - Reducing property damage claims and liability risks

When a client’s laptop is damaged in an accident as minor as spilling a cup of coffee, a claim is immediately submitted. Having public liability insurance avoids these small vulnerabilities from turning into heavy losses.

How to Choose the Right Public Liability Insurance Policy

Not all insurance policies offer the same type of coverage. Business owners need to balance the coverage offered by the policy with the actual threats they face to obtain adequate protection. An insurance broker can help tailor a policy to your business needs.

Key Factors to Evaluate

- Understanding policy wording and coverage limits

Some policies offer exclusion clauses, while others have a variety of coverage limits. These clauses, along with the limits, have to be examined thoroughly to avoid unpleasant surprises at the time of a claim. - Assessing your business type and risk exposure

High-risk industries need higher coverage. A sole trader might get by with lower limits, but construction companies need more comprehensive protection. - Customising an insurance package

Public liability insurance can often be purchased along with other types of business insurance, tailoring your policy to fit the scope of your actual business activities.

Bundling Public Liability with Other Insurance Policies

- Including workers' compensation insurance

Essential for businesses with employees and often paired with liability cover for simplicity. - Adding product liability or cyber insurance

Product liability protects against defective goods, while your business may be subject to product liability claims, and cyber insurance addresses the widening scope of cyber attacks. Insurance addresses the growing threat of online attacks. - Considering management liability insurance

Protects directors and officers, complementing public liability cover. - Exploring income protection or life insurance

These personal covers give business owners and families an added layer of security.

Regional Considerations for Public Liability Insurance

Insurance obligations differ across states and territories, so business owners must ensure their policy complies locally.

Requirements Across Australia

- Australian Capital Territory

In the ACT, some industries must show proof of liability insurance before obtaining licences or permits. - Northern Territory

In the NT, stricter requirements often apply to the construction and hospitality sectors. - State-specific business insurance policies

Make sure your insurance covers all local regulations in the states of Queensland, Victoria and Western Australia.

Working with Trusted Providers

- Choosing an AAI Limited-backed policy

Providers with strong backing offer confidence that claims will be handled fairly. - Ensuring adequate insurance coverage

Businesses should review their policies regularly to keep pace with growth and new risks. - Protecting against liability claims and property damage

Reliable providers reduce stress, ensuring claims don’t derail business operations.

Maximising the Benefits of Public Liability Insurance

Public liability insurance enables businesses to operate without fear. It’s more than just an insurance policy; it’s an asset that empowers businesses to expand and take on new projects with confidence, ensuring compliance and peace of mind.

- Safeguard your business operations and premises.

Now that your policy is set up, you can focus on serving your clients selflessly without the fear of claims. - Minimise risks with a tailored business insurance package

Bundling other policies with liability cover helps ensure your protection is both complete and economical.

Frequently Asked Questions

- Public liability insurance for sole traders: is it a legal requirement in Australia?

Although it may not be a legal requirement for every business, coverage proof is often a precondition for commencing operations in many sectors, for several local government bodies, and for customers. - Public liability insurance cost: how much does it cost to be insured?

Most of the time, it is determined by the specific industry, the risks involved, and the coverage limits. A small consultancy will pay several hundred dollars in coverage, while firms in the construction or hospitality sectors will expect higher premiums. You can obtain quotes from licensed insurance brokers such as VIM Cover. - Public liability and professional indemnity insurance: what is the distinction?

Public liability covers third-party injury and property damage, whereas indemnity insurance is taken out to cover claims arising from negligence, error, or poor professional advice.

Public liability insurance is often required when dealing with local authorities, landlords, or contractors, though requirements may vary by industry and region.

What Does Public Liability Insurance Cover?

Key Takeaways

- Pubic liability insurance is intended to safeguard businesses from claims made by third parties for bodily injuries or damages to property caused by business activities.

- This is particularly important for self-employed professionals, small business proprietors, and individuals working in public environments, visiting clients, or having customers come to their location.

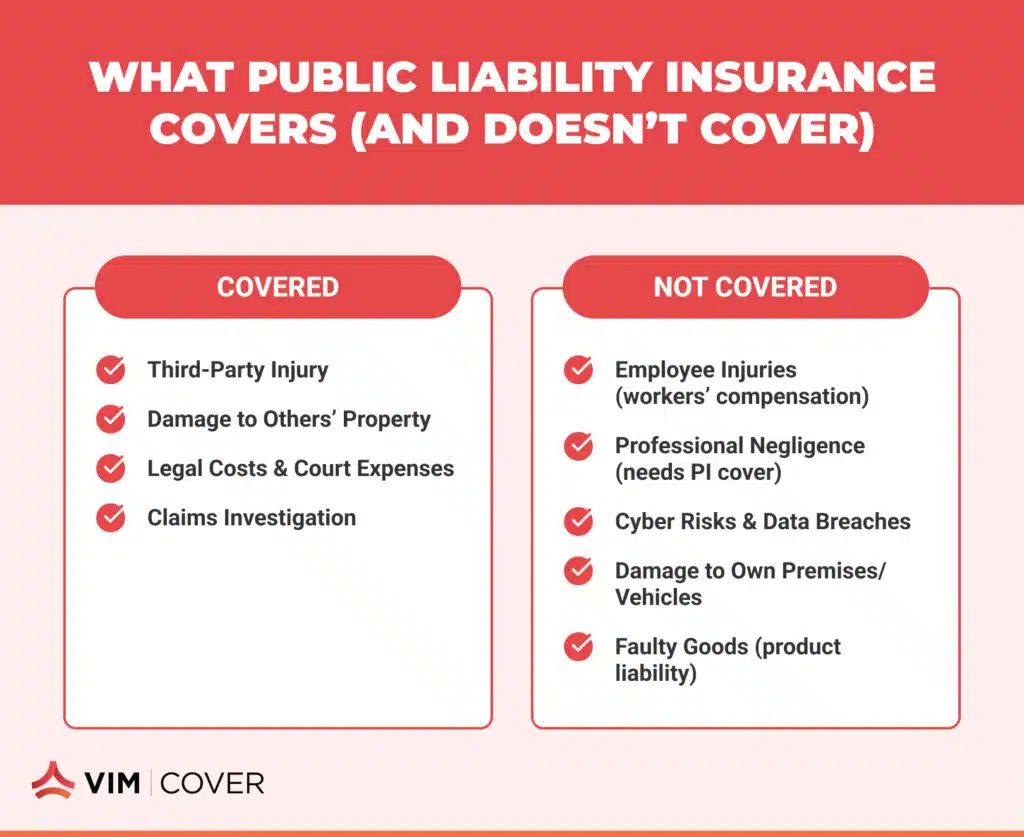

- Alongside compensation and the legal and claims investigation expenses, the policy cover excludes injuries to employees, poor quality, and cyber risks from coverage.

- Your line of work and contracts determine the cover amount needed, and the insurance may differ based on the business.

- Working with business insurance specialists helps you choose the right level of cover and avoid gaps.

- Insurance brokers like VIM Cover in Australia meet real-world business needs and contractual obligations with specially designed cover options.

Understanding Public Liability Insurance Coverage

What is Public Liability Insurance?

Every business, regardless of size, may be exposed to physical and financial harm to a third party. Public Liability Insurance protects the business against claims of personal injuries or property damages, which otherwise leaves the business to incur huge compensation expenses, along with the costly legal fees.

Picture a customer slipping in your shop in Sydney or a tradie accidentally damaging a client's property while working on-site in Melbourne. Without cover, you could be personally responsible for the cost of the claim. With a proper insurance policy, those expenses are managed for you.

VIM Cover offers policies designed for Australian businesses, so whether a small business owner running a café in Brisbane or operates as a contractor in Perth, your cover reflects the specific risks you face.

Who Needs Public Liability Insurance?

In Australia, a considerable number of small to medium-scale enterprises hold public liability insurance as a business requirement drafted by the landlords, councils, or contractors. The sole traders, freelancers, and small business operators who interact with customers directly are more susceptible to these risks.

It's essential for:

- Businesses operating in shopping centres or local markets.

- Trades working on construction job sites.

- Home office professionals who welcome clients to their property.

- Beauty professionals provide personal services to customers.

In some industries, proof of a Public Liability policy is a condition of getting work. Having cover in place shows you take responsibility for the safety of your customers and the wider public.

What Does Public Liability Insurance Cover?

Public liability insurance explained simply: it protects you if your work or premises cause harm to other people or their property.

Typical cover includes:

- Compensation for third-party injury.

- Repair or replacement costs for damaged business premises or personal belongings that don't belong to you.

- Legal action and the associated legal costs if a claim is taken to court.

Imagine a client who trips over an extension cord in your Adelaide office or who, in a meeting in Hobart, pours hot coffee on a customer’s lap. In both cases, public liability insurance may pay for these expenses. VIM Cover assists Australian businesses to tailor their Public Liability Insurance Cover to their specific needs, thereby eliminating the issues of overinsurance and gaps in cover.

What Isn't Covered by Public Liability Insurance?

Public liability insurance doesn't cover every type of risk. Some matters fall under different policies:

- Errors in advice or work that are dealt with through Professional Indemnity Insurance.

- Injuries to staff that require workers' compensation insurance under Australian law.

- Contractual liability or machinery breakdown.

- Cybercrime or data breaches, which need cyber insurance.

- Damage to your own business premises or motor vehicles.

- Faulty goods that require product liability insurance.

Exclusions are particularly relevant when it comes to Australia, given that different rules or insurance obligations may exist in its various states and territories. VIM Cover defines what is and isn't covered so that additional policies or protections can be arranged if necessary.

Choosing the Right Public Liability Policy for Your Business

Factors That Influence Policy Coverage

Required levels of cover may vary depending on the work, location, and any applicable contractual obligations. For instance, a council in New South Wales may mandate a certain minimum public liability insurance for market stallholders, whereas a landlord in Victoria may have different criteria.

Other factors include:

- The nature of your work and the potential liabilities involved.

- The policy wording and full details of what's covered.

- Your budget and cash flow.

- Any specific legal requirements in your industry?

Taking the time to compare options ensures you meet obligations without paying for unnecessary extras.

Why Seek Help From Business Insurance Specialists?

The last thing you would like to see is a policy misunderstanding during a claim. When it comes to business insurance specialists, they will guide you on what is appropriate for your financial situation. They clarify definitions, revealing the nuances, and see the value in additions like income protection or contents cover.

VIM Cover provides this guidance for Australian businesses, making sure your Public Liability policy fits your industry and keeps you compliant with local requirements.

How to File a Public Liability Insurance Claim

Steps to Ensure a Successful Claim

If you need to make a Public Liability claim in Australia, these steps can help:

- Record the incident immediately with photos, witness names, and medical or repair reports.

- Notify your insurer promptly for direction on what to do next.

- Submit all required documents, including your Public Liability Insurance cover details.

- Cooperate with investigations and keep communication clear and timely.

- Check your policy wording to confirm the incident is covered.

Common Challenges During Claims

Claims can take longer to resolve if documents are not filled out, or when the Public Liability Insurance Applied is not clear for the specific case. Also, disputes regarding contractual liability and disputes regarding cover limits are the most common issues.

Working with a responsive insurance broker like VIM Cover helps you navigate these hurdles. The clearer your policy is at the start, the smoother the claims process will be.

Key Insights on Public Liability Insurance

As for Australian businesses, Public Liability Insurance is a requirement. It offers protection from claims that emerge from ordinary interactions, including legal costs, compensation, and business disruption, which are costly.

Every business, even if it's a sole trader working at a local market or a developing business owning multiple sites, utilises Public Liability policies. With a reputable Australian insurance broker such as VIM Cover, you are able to attain both peace of mind and protection, letting you concentrate on your work and knowing that any unforeseen circumstances are covered.

FAQs About Public Liability Insurance

- Is public liability insurance mandatory in Australia?

Public liability insurance is not required by law for all businesses; however, several industries, landlords, and councils do make it part of their operating conditions. For instance, at some markets and on some construction sites, stallholders and contractors are required to obtain proof of insurance before they start work.

- How much public liability insurance do I need?

The business, the contract, and the evaluation of risk determine the correct value of insurance coverage. Some businesses only need a couple of million dollars of coverage, while others might need upwards of $20 million. Always make it a point to review the contracts and have a conversation with an insurance advisor to determine the most appropriate coverage.

- Does public liability insurance cover employees?

Public Liability Insurance does not cover employees. Injuries of employees are taken care of under workers' compensation insurance, which is compulsory in Australia. Public liability insurance only takes care of third parties, such as customers and guests.

- What’s the difference between public liability and professional indemnity insurance?

Public liability covers the injury or damage to the property of other people as a result of an accident. Professional indemnity covers financial losses resulting from advice given, services provided, or mistakes made, as well as losses of meritorious work. It is beneficial for many businesses to hold both types of insurance.

- How do I claim public liability insurance?

Insurers need to be notified as soon as possible. Alongside the notice, supporting documents need to be sent as well, which can include photographs, medical documents, and invoices related to the repairs. The claim has a better chance of getting approved if you collaborate with the insurance company regarding the needed documents and information for their investigation.

**This article provides general information only and does not take into account your specific circumstances. You should seek advice from a licensed insurance professional before making decisions.

Comprehensive Food Truck Insurance for 2026

Discover unparalleled protection for your food truck insurance needs with VIM Cover’s comprehensive food truck insurance policies. Designed for Australian truck owners, our policies ensure affordability and reliability, keeping you secure on every journey. We offer a rapid quote for approved applicants. Please fill out the form below to receive a fast quote.

Key Takeaways on Food Truck Insurance

- Food trucks face double exposure: road accidents + customer liability.

- A single food poisoning claim can cost thousands in legal fees.

- Equipment breakdowns or food spoilage can stop operations overnight.

- Tailored insurance helps protect cash flow and keeps you compliant.

- VIM Cover offers customised policies with fast claims support.

Food trucks face risks beyond the kitchen. A road accident can damage your vehicle and equipment, spoiled stock can wipe out profits, and legal fees can be incurred in cases of food poisoning or other allergies. Unlike restaurants, food trucks are exposed to both road mishaps and other safety liabilities. These uncertainties make it essential to have a more business-focused and personalised insurance, which allows you to run your business with minimal worry. The right cover not only protects your cash flow and keeps you compliant but also ensures your mobile business stays open after an unexpected setback.

Why Food Truck Insurance is Crucial for Your Business?

Unlike a fixed restaurant, your food truck is both your motor vehicle and your business premises, meaning you carry double the exposure on the road and in service. That's why the right food truck insurance isn't optional; it's essential. Also, it's equally important to have the right type of insurance that matches your business and its running.

For operators, it’s worth noting that insurers in Australia must meet regulatory standards set by APRA (Australian Prudential Regulation Authority), ensuring you’re dealing with a licensed and compliant provider. This gives food truck owners confidence that their policy is backed by a regulated and trustworthy insurance company.

Unique Risks Food Trucks Face

It includes:

- Accidental damage - This includes vehicle damage, such as a minor prang, or even if a vehicle is written off, including accidental damage to cooking equipment, which prevents any immediate service.

- Food poisoning & personal injury – Costly legal claims can arise due to foodborne illness or a slip near your service window.

- Food spoilage & equipment breakdown – If your fridge fails overnight or your generator cuts out at a festival, spoiled stock is money lost.

- Legal liability – Every public interaction, from parking in crowded areas to serving hot food, exposes you to potential compensation claims.

- Optional covers – Extra protection, such as cash flow cover, can keep bills paid if downtime stops you from trading.

How Insurance Protects Operators?

Let's understand some of the standard insurances:

- Personal accident & workers' compensation covers truck owners and their staff in case of mishaps, which include burns, cuts, or other injuries sustained while at work.

- Medical expenses & legal costs – In case a customer sues over injury or illness, your business insurance policy can handle the hospital bills and lawyer fees.

- Insurance claim support – A good provider ensures that claims for insured events, such as theft, breakdowns, or accidents, are processed quickly, thereby reducing downtime.

- Peace of mind for operators – With cover in place, food truck owners can focus on what matters most: serving customers and growing the mobile business without the constant worry of "what if."

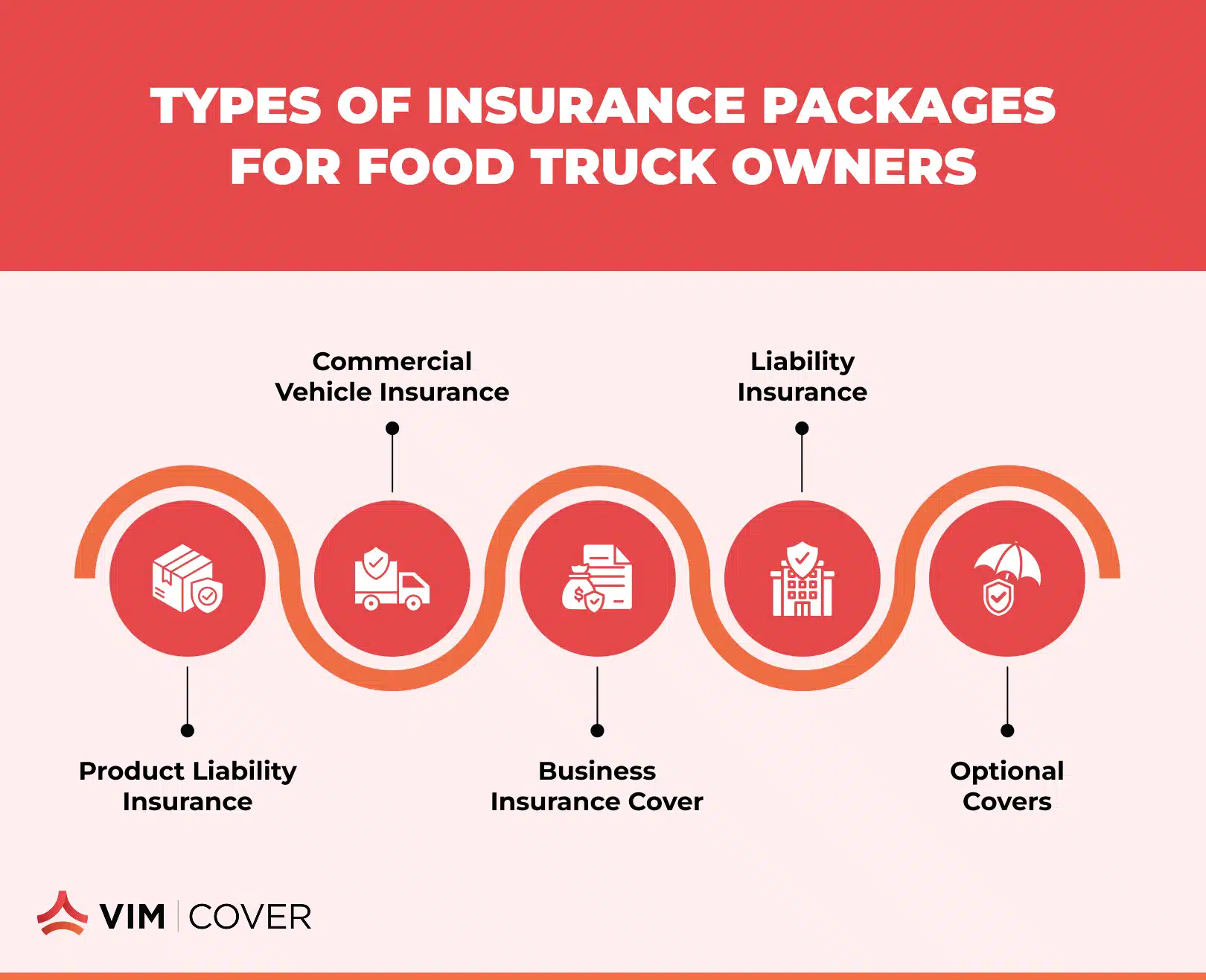

Types of Insurance Packages for Food Truck Owners

Product liability insurance protects against claims of:

- food poisoning

- allergic reactions

- Covering legal fees and compensation.

Commercial vehicle insurance covers:

- the truck itself,

- repairs after accidental damage,

- fit-out and cooking equipment inside.

Business insurance cover extends to:

- stock, cash

- portable equipment

- losses from theft, fire, or food spoilage.

Liability insurance protects against:

- Legal costs if a customer or third party suffers personal injury

- Property damage during the course of business activities.

Optional covers, such as equipment breakdown or downtime protection, help:

- stabilise income when generators fail

- fridges stop working

- You are unable to operate due to an insured event.

It's advisable to read and understand policy wordings and Product Disclosure Statements before signing up for any particular insurance cover to avoid claim issues.

How VIM Cover Provides Superior Insurance Solutions?

We understand that no two mobile food trucks are alike and have specific business needs. Irrespective of whether you run a coffee van, a gourmet burger truck, or a multi-vehicle fleet, customisable insurance packages allow you to pick and choose the level of accidental loss you would like to cover. We offer a rapid quote for approved applicants. Please fill out the form below to receive a fast quote.

Unlike one-size-fits-all insurance providers, we work through experienced insurance brokers who focus on understanding your day-to-day risks. Based on your business operations, we suggest that you opt for comprehensive cover that extends to business premises, staff, and broader business activities. Our flexible cover options let you choose the best for your business.

What sets us apart from many insurance companies is our fast and transparent claims process. Food truck operators don't have time for paperwork delays; their streamlined approach ensures you're back on the road as quickly as possible. The policy terms are written to reflect the realities of mobile businesses, avoiding unnecessary coverage and reducing higher premiums that other providers often charge.

Protect Your Mobile Food Business with the Right Coverage

A tailored business insurance quote from VIM Cover ensures you only pay for what truly matters — no unnecessary extras, just the right cover for the risks your food truck faces daily. Policies are designed around your actual operations, whether you run a coffee van with portable generators, a gourmet burger truck with high-value cooking equipment, or a fleet serving significant events.

Coverage can extend to:

- Breakdowns & spoilage – protection when fridges, freezers, or generators fail.

- Liability claims – cover for food poisoning, personal injury, or property damage caused during service.

- Business interruption – income support when an insured event forces you to stop trading.

By securing a plan built for your business model, you safeguard cash flow, meet legal liability requirements, and keep your mobile business operational with minimal disruption. Protection is not just compliance; it's a guarantee that you can stay on the road and serve customers with peace of mind.

FAQs About Food Truck Insurance with VIM Cover

- Does food truck insurance cover both the vehicle and kitchen equipment?

Yes. With VIM Cover, policies can bundle commercial vehicle insurance with coverage for cooking equipment, refrigeration, and fit-outs, ensuring your entire mobile setup is protected under one plan.

- What happens if food spoilage occurs due to a power failure?

Food spoilage caused by equipment breakdown or power outages can be included in your policy. VIM Cover helps you recover costs so your cash flow isn't disrupted.

- Can I insure multiple food trucks under one policy?

Absolutely. VIM Cover offers fleet policies for operators with multiple trucks, making it easier and often more affordable to manage insurance for your mobile business.

- How does VIM Cover handle claims for food poisoning incidents?

If a customer files a claim for food poisoning or personal injury, your liability coverage will take effect. VIM Cover ensures a transparent and fast claims process, minimising downtime and legal costs.

- Are there flexible insurance options if I only operate seasonally?

Yes. VIM Cover can tailor cover options for seasonal food truck operators, so you're only paying for the protection you need when your business is active.

**This article provides general information only and does not take into account your specific circumstances. You should seek advice from a licensed insurance professional before making decisions.