Comprehensive Commercial Truck Insurance Guide for 2026

Key Takeaways about Commercial Truck Insurance

- Protects business vehicles and drivers from major risks.

- Covers accidents, liability, downtime, and natural disasters.

- Flexible options: comprehensive, third-party, and add-ons.

- Extra cover: life, property, transit, and roadside support.

- VIM Cover delivers fast quotes and tailored solutions.

Running trucks for business isn’t simple. Breakdowns, accidents, and even weather events can affect businesses and their operations, often causing delays in deliveries and other regular activities. It also leads to a lot of back-and-forth to get things on track. That’s why having commercial truck insurance is more than just meeting a requirement on paper; it’s about protecting your people, your trucks, and your cash flow.

At VIM Cover, we work with businesses across Australia to make sure they’re not left exposed. The right cover means fewer worries and a faster recovery when things don’t go as planned.

Why Commercial Truck Insurance Matters?

Protecting Business Operations

If your trucks are on the road for business purposes, you’re carrying risk every kilometre. Good cover ensures:

- Business vehicles are protected if damaged or written off.

- Truck drivers and owner-operators can work with peace of mind.

- Major risks like accidental damage, public liability, or third-party property damage don’t turn into major financial losses.

Key Benefits of the Right Coverage

A firm insurance policy does more than replace a damaged truck. It helps your business stay steady when unexpected costs hit.

- Financial protection – Keeps your cash flow intact when repair or replacement bills arrive.

- Risk coverage – From natural disasters to accidents involving dangerous goods.

- Downtime cover – Helps with income loss if a truck is off the road.

- Business continuity – Support during claims so your operations don’t stall.

Types of Commercial Insurance for Trucking Businesses

Core Options

- Comprehensive or complete insurance – Covers physical damage, accidental damage, and total loss.

- Third Party Property Damage – Protects against damage claims from others.

- Roadside assistance – Reduces costly delays if a truck breaks down.

- Prime mover cover – Designed for high-value vehicles critical to freight.

Add-Ons and Extras

Depending on your setup, you may also need:

- Life insurance for owner-operators.

- Property insurance for depots or warehouses.

- Marine cargo insurance if your transport extends offshore.

- Custom options based on carrying capacity and mixed personal use.

How to Choose the Right Commercial Truck Insurance Policy for Your Business Needs

Step 1: Match Commercial Truck Insurance Cover to Your Business Activities

Think about:

- The risks in your line of work (long-haul, dangerous goods, interstate freight).

- What’s already included in your policy documents?

- Your driving history and financial situation both affect premiums.

Step 2: Pick a Reliable Insurance Provider

Not all insurance companies cover the requirements of truck insurance. Before you decide:

- Compare truck insurance quotes across providers.

- Look for insurers with experience in transport and strong claims support.

- Ask for clear Target Market Determination (TMD) documents to ensure the policy is designed for businesses like yours.

How Commercial Truck Insurance Protects Your Business

Comprehensive Risk Management Solutions

The right commercial truck insurance is a key component of innovative risk management. It:

- Shields you from compensation claims and third-party liability.

- Covers accidental damage or total loss.

- Keeps operations running with superior claims service and access to replacements.

- Provides tailored solutions so you don’t pay for cover you don’t need.

Compliance and Business Continuity

Insurance is about protection while your trucks are on the go, as well as staying compliant with state laws and avoiding unwanted losses. Policies that meet Target Market Determination guidelines and address specific business needs help keep you aligned with state regulations. This reduces legal risks while ensuring your trucks have the right insurance cover.

Why Partner with VIM Cover? Your Right Commercial Truck Insurance Partner

We specialize in policies that work for real businesses, not cookie-cutter solutions, and our insurance covers ensure adequate liability coverage for your trucks tailored to their specific needs. We help you:

- Find cover that fits your business use and vehicle types.

- Add extras like downtime cover or roadside assistance when needed.

- Get a truck insurance quote in just 60 minutes for eligible applicants. That means in case of emergencies, when you require the right coverage or comprehensive insurance for your truck, we are here to assist you.

- Rely on a team that supports you through the claims process.

Many business owners also wonder, Are business vehicles more expensive to insure? The answer depends on factors such as vehicle type, usage, and risk profile, which can significantly impact insurance costs.

We offer customised commercial truck insurance policies, flexible cover options, and, for approved applicants, a fast 60-minute quote service to keep your business moving without downtime.

FAQs – Commercial Truck Insurance with VIM Cover

Q: How quickly can I get a truck insurance quote with VIM Cover?

We know time matters in business. That’s why VIM Cover offers a rapid turnaround on most truck insurance quotes, so you’re not stuck waiting.

Q: Does VIM Cover provide cover for dangerous goods?

Yes. Our policies can be tailored for the transportation of dangerous goods, ensuring you stay protected while meeting compliance requirements.

Q: Can I insure a mixed fleet under one policy?

Absolutely. Whether you run prime movers, delivery vans, or light trucks, we can customise cover for a wide range of vehicle types and carrying capacities under a single policy.

Q: What if my truck breaks down or is off the road?

We offer downtime coverage and roadside assistance options, helping to reduce income loss and keep your business operations steady during unexpected repairs.

Q: Does VIM Cover only provide truck insurance?

No. Alongside comprehensive truck insurance, we also offer a range of additional products, including business insurance, property insurance, public liability insurance, and transit insurance, to provide you with complete protection for your business and personal needs.

Q: Why choose VIM Cover over other insurance providers?

Unlike generic insurance companies, we focus on the trucking industry. That means tailored advice for the type of insurance based on your requirements, flexible extras, fast quotes, and hands-on customer support during the claims process.

**This article provides general information only and does not take into account your specific circumstances. You should seek advice from a licensed insurance professional before making decisions.

Comprehensive Light Truck Insurance Guide for 2026

At VIM Cover, we understand that every light truck operator has different needs, whether you’re moving goods across town, running a fleet of goods-carrying vehicles, or transporting dangerous goods. That’s why we offer customised light truck insurance policies, flexible cover options, and, for approved applicants, a fast 60-minute quote service to keep your business moving without downtime.

Key Takeaways:

- Light truck insurance is essential for goods-carrying vehicles up to 4.5 tonnes GVM, protecting against theft, damage, liability, and downtime losses.

- VIM Cover offers customised policies with optional add-ons like downtime cover, transit insurance, and dangerous goods protection.

- The right policy offers peace of mind with vehicle coverage, theft protection, accident liability, and business continuity support.

- Understanding your vehicle type, cargo value, and business operations is key to selecting the right level of coverage.

- VIM Cover’s 60-minute quote service ensures fast, tailored insurance solutions for businesses of all sizes.

- Bundling your truck insurance with life, travel, or home insurance can enhance your protection strategy.

- Opting for a provider like VIM Cover, known for transparency and strong support, can improve your claims experience.

What Is Light Truck Insurance?

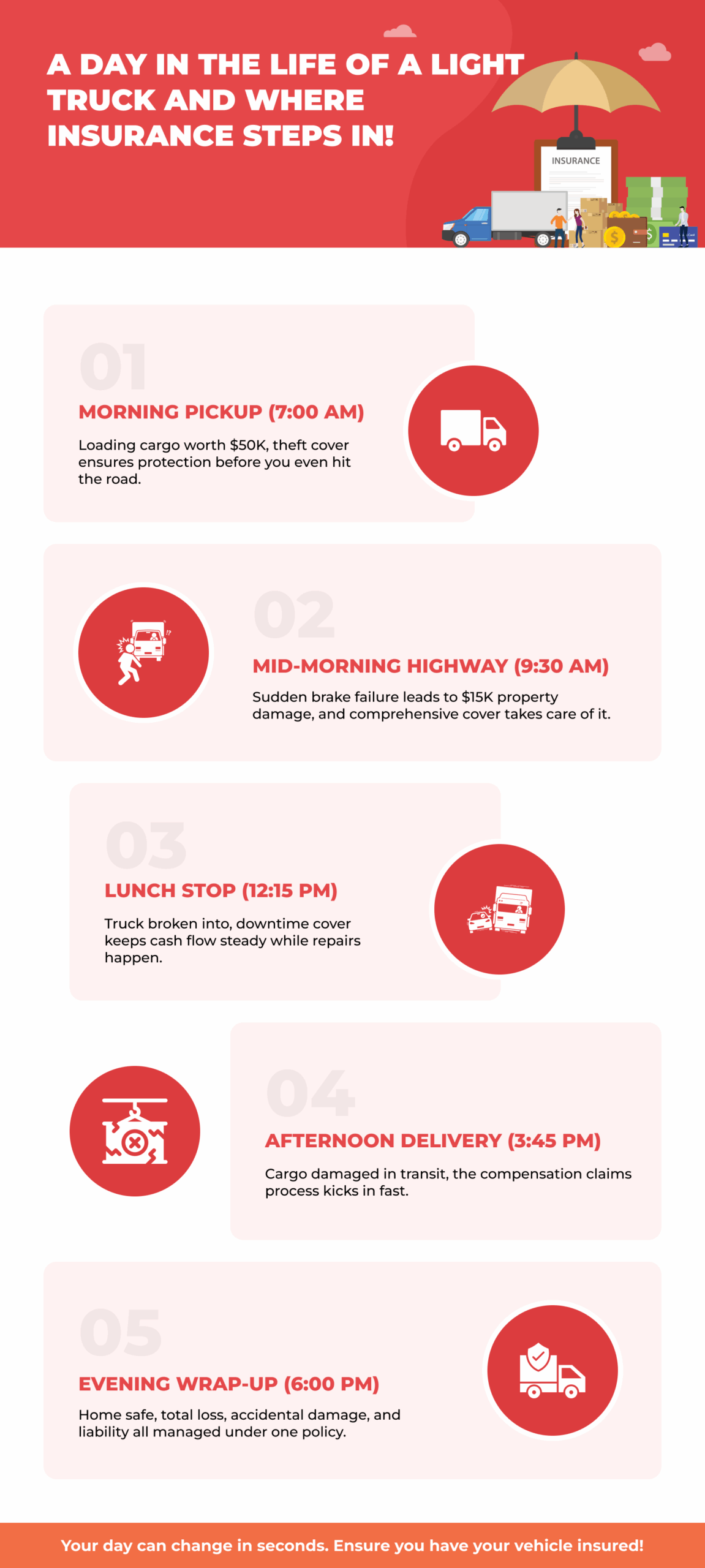

Light truck insurance is designed for goods-carrying vehicles with a specific carrying capacity, which is often up to 4.5 tonnes GVM and can be personalised for business use or personal purposes. It protects you from accidental damage, theft, property damage to other people’s property, and even total loss of your vehicle.

For businesses, this type of cover isn’t just a compliance tick; it’s a safeguard that keeps business vehicles on the road and earning a stable income (in case of any mishap), even after an insured event.

Understanding Light Trucks and Insurance Needs

Light trucks are versatile workhorses (as they call it) that range from delivery vans to small tippers, and their insurance needs vary from heavy commercial trucks. Policies are built to reflect:

- The carrying capacity and type of vehicle.

- Frequency and nature of business activities.

- Whether they carry dangerous goods, operate as mobile plant, or are used for mixed personal and business purposes.

An effective truck insurance policy ensures you’re covered for real-world risks, not just what’s written on paper.

Key Features of Light Truck Insurance

A strong, comprehensive truck insurance policy can include:

- Comprehensive cover for your vehicle and your property.

- Theft cover and accidental loss protection.

- Downtime cover to support your cash flow while your truck is off the road.

- Compensation claims for personal injury or damage caused to others.

The level of cover you choose will determine how well you’re protected when it matters most.

Why Businesses Need Light Truck Insurance?

Supporting Business Vehicles and Operations

For transport operators and owners of goods-carrying vehicles, light truck insurance is more than a formality. It’s essential for keeping operations running, especially when dealing with dangerous goods or time-sensitive and/or perishable goods delivery.

During an insured event, having the right cover can help with repair costs, replacements, and even provide a temporary hire vehicle to keep jobs moving.

Small Business Insurance Benefits

Many insurers offer small business insurance packages that combine comprehensive coverage for trucks with other insurance products. These can be customised for:

- Specialised freight

- Mobile plant transport

- High-value goods

- Multi-vehicle fleets

It’s not just about protection, it’s about peace of mind for owners and employees.

Choosing the Right Light Truck Insurance Policy

Factors to Consider

Before selecting a truck insurance policy, weigh your:

- Type of vehicle and carrying capacity.

- Driving history and risk profile.

- Level of cover, including downtime cover and comprehensive coverage.

- Specific clauses in the Policy Wording and relevant Product Disclosure Statement.

Working with Insurance Brokers and Providers

An experienced insurance broker can help you clearly understand the aspects of the insurance, cut through the jargon, compare cover options, and match you with an insurance provider that fits your financial situation and specific needs. Choose providers with a clear Target Market Determination and responsive customer support to guide you through the claims process.

Additional Insurance Products to Consider

For businesses looking to protect more than just their trucks, pairing your commercial motor cover with other insurance products can strengthen your safety net:

- Home insurance – To protect personal property from damage or theft.

- Travel Insurance – For business or personal trips involving valuable goods.

- Boat Insurance – For commercial or personal watercraft.

- Life Insurance – Ensures financial stability for your family or business partners if the unexpected happens.

- Transit insurance – Covers goods in transit from pickup to delivery.

Ready to protect your business?

Get a customised VIM Cover light truck insurance quote in under *60 minutes. Speak to our team today for personalised cover recommendations.

Protecting Your Business with the Right Cover

The right policy cushions your business from costly disruptions and keeps operations running smoothly. It’s about matching insurance to the real risks you face, not paying for what you don’t need.

- Downtime cover to offset income loss during repairs

- Protection for high-value or sensitive cargo

- Add-ons for dangerous goods and mobile plant

- Policy terms that fit your vehicle type and workload

Learn more about how to get a truck insurance quote in 2026.

Why Choose VIM Cover for Light Truck Insurance?

When it comes to protecting your business vehicles, you need more than just a standard policy; you need a partner who understands the risks and challenges you face every day.

VIM Cover offers:

- Comprehensive truck insurance for a wide range of vehicle types and carrying capacities.

- Flexible extras like downtime cover, transit insurance, and customised policy wording for your specific needs.

- A proactive and responsive customer support.

- Our 60-minute turnaround for quotes for qualifying applicants.

Schedule an appointment with us today!

FAQs – Light Truck Insurance

Q: Can I get a light truck insurance quote quickly with VIM Cover?

Yes. In certain circumstances, VIM Cover offers a 60-minute rapid quote service so you can get insured without delays.

Q: Does VIM Cover offer cover for dangerous goods or mobile plant vehicles?

Absolutely. Our truck insurance policies can be tailored for dangerous goods, mobile plant, and other specialised uses.

Q: What makes VIM Cover different from other insurance providers?

We combine comprehensive coverage with personal service, flexible policy design, and fast turnaround times, all while ensuring your specific needs are met.

Q: Can I bundle my light truck insurance with other products at VIM Cover?

Yes. You can combine your truck cover with options like home insurance, travel insurance, or life insurance to protect more of what matters to you.

**This article provides general information only and does not take into account your specific circumstances. You should seek advice from a licensed insurance professional before making decisions.

How to Get a Truck Insurance Quote in 2026?

Key Takeaways:

- What’s included in a truck insurance quote (and what’s not).

- The difference between Comprehensive cover, Third Party Property Damage, and other policy types.

- How factors such as vehicle type, cargo, and business use affect your price.

- Add-ons like downtime cover and transit insurance can save you when things go wrong.

- How to compare insurance providers and read the fine print before you sign.

- What to expect during the claims process and how to avoid delays.

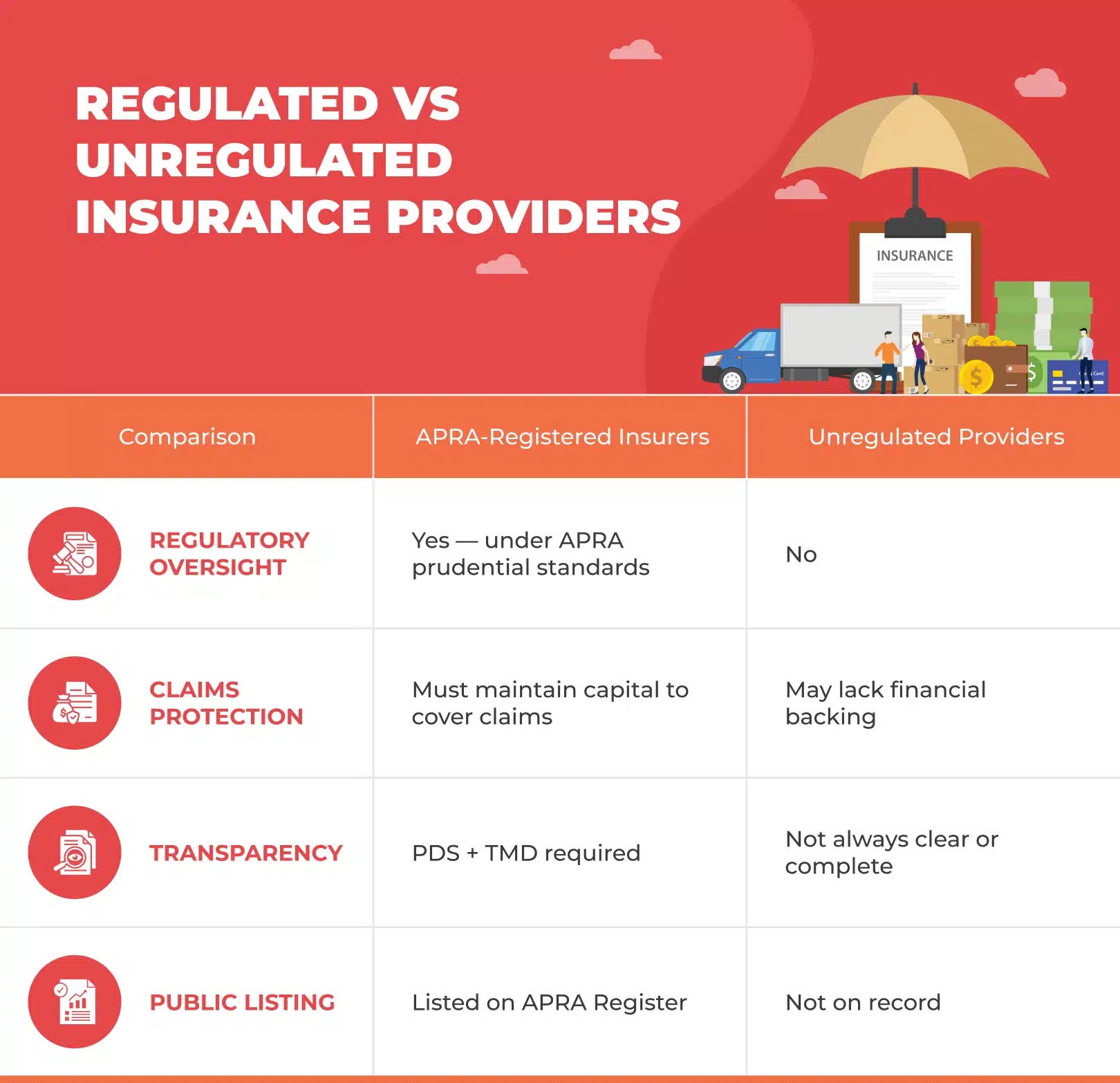

If you own a truck or manage a fleet, insurance isn’t optional; it’s essential. In 2026, getting a truck insurance quote is more than just filling out forms. Insurers assess what you drive, how you use it, and your claims history before offering cover. And you can compare offers only from APRA‑authorised insurance companies to make sure your provider meets national standards.

Want a Quote in 60 Minutes?

If you’re short on time, we offer a 60-minute rapid quote turnaround for eligible businesses. That means less waiting, more peace of mind, and faster protection for your truck or fleet.

Get your truck insurance quote in under 60 minutes here!

What is Included in a Truck Insurance Quote?

Most insurance companies include several critical components in your quote. Review the Insurance Council of Australia guidelines to understand industry best practices for commercial motor insurance, including how risks like property damage and liability are handled.

Most insurance companies will include the following in your truck insurance quote:

1. Type of Cover

You’ll typically choose from a few key policy types:

- Comprehensive cover – Covers your truck for theft, accidental damage, vandalism, and property damage to others, even if the accident was your fault.

- Third Party Property Damage – Protects you if your vehicle causes damage to someone else’s vehicle or property, but not your own.

- Third Party Fire and Theft – A balance between cost and protection, covers others' property, plus fire or theft damage to your vehicle.

You may also consider Public Liability Insurance, Compulsory Third Party (CTP), or Third Party Insurance, depending on your operations and state requirements.

2. Business Use and Specific Activities

Your quote reflects how and where you operate:

- Local, regional, or national transport

- Dangerous goods, refrigerated goods, or mobile plant operations

- Business-related storage or depot details

Your business use directly affects pricing and eligibility.

3. Vehicle Information

Insurers evaluate:

- Truck make, model, age

- Carrying capacity

- Whether you operate light trucks, rigid trucks, or prime movers

- Modifications like mobile cranes, tail lifts, or onboard computers

Accurate info ensures a valid quote and helps avoid policy disputes.

4. Driving & Claims History

Your driving history, past claims history, and even your financial situation play a role in determining premium levels and excess options.

Operators with strong safety records often access lower premiums or better coverage limits.

5. Optional Benefits and Add-On

Coverage options like Transit Insurance or Downtime Cover are standardised across the Australian insurance market. Understanding typical definitions and claims processes is easier when referring to the Insurance Council of Australia’s guidance.

6. Policy Inclusions, Costs, and Documentation

Every quote includes:

- A detailed premium (monthly or annually)

- Breakdown of inclusions and exclusions

- Every quote should point you to a Product Disclosure Statement and a Target Market Determination, as insurers must follow APRA’s prudential standards for general insurers regarding transparency and governance.

- A clear Target Market Determination

- Your rights to general and personal insurance advice

Understanding your policy wording and the full scope of your cover is essential before committing.

Understanding Truck Insurance Coverage

A truck insurance quote typically includes one or more of the following cover types:

Comprehensive Cover

Covers your truck for accidental damage, theft, fire, and property damage to others. It’s ideal if your truck is essential to your income or is of high value.

Third Party Property Damage & Public Liability

Essential if your truck damages someone else’s vehicle or property. Public liability insurance covers incidents involving injury or damage during loading, unloading, or delivery.

Add-Ons That Matter

Depending on your business, you can include:

- Downtime cover – income protection if your truck is off the road

- Transit insurance – protects your cargo during transport

- Windscreen, hire vehicle, and legal liability extras

Each policy can be customised to fit your business, from a single light truck to a fleet of prime movers.

Additional Insurance Types You May Need

Your truck insurance quote may cover the vehicle, but running a business often involves other risks. Depending on your operations, you might also need:

Travel Insurance for business-related trips

If you or your team regularly travel for work, whether interstate or regional, Travel Insurance can cover unexpected costs like trip cancellations, delays, or personal injury.

Boat Insurance for companies with marine operations

For transport companies that also operate near ports or on water, Boat Insurance protects vessels used for loading, delivery, or marine transport. It’s especially relevant for businesses involved in intermodal freight.

Life Insurance to protect business owners and employees

If you’re a business owner or employ drivers, Life Insurance adds a layer of security for families and teams. It helps protect income, manage business debts, or support succession planning, a valuable asset for small business operators.

Why Truck Insurance Protects Your Business Operations?

Things go wrong. Accidents happen. Trucks break down. A good truck insurance policy makes sure you’re not paying for it all out of pocket.

What the Right Policy Covers

- Covers repair costs and property damage

- Takes care of legal liability if you're at fault

- Downtime cover helps you manage lost income

- Gives owner-drivers and transport operators real peace of mind

What Kind of Vehicles Are Covered?

- Light trucks, rigid trucks, and prime movers

- Work trucks, vans, and business cars under Commercial Vehicle Insurance

- Trucks carrying dangerous goods or fitted with mobile plant

It’s all about keeping your trucks on the road and your business moving.

Factors That Impact Truck Insurance Cost

No two quotes are the same. Your truck insurance cost depends on a few key details that insurers use to assess your risk.

What Insurers Look At?

- Your driving and claims history, and your financial situation.

- The truck’s carrying capacity and how it's used for business activities

- The type of insurance you’re after, Comprehensive cover, Third Party Property Damage, or something in between

- Your financial situation, including the ability to absorb risk

Whether you’re an owner-driver or managing a fleet, these factors shape your premium.

Understanding the Fine Print

Before signing anything:

- Read the Product Disclosure Statement (PDS) for the full details

- Make sure the policy matches your business: check the Target Market Determination (TMD)

- Look into optional benefits that could improve your cover (and increase the cost)

Precise policy wording helps avoid headaches later, especially at claims time.

How to Find the Best Truck Insurance Providers?

With so many insurance companies out there, finding the right fit comes down to knowing what to look for and asking the right questions. You can read our comprehensive guide about Light Truck Insurance for 2026 here.

Steps to Get the Right Coverage

- Always choose insurers listed on APRA’s official register of authorised general insurers. This guarantees they are monitored for financial stability and regulatory compliance.

- Be ready with your personal information, vehicle details, and business needs

- Speak to an authorised representative who can give clear, tailored advice, not just a sales pitch

Insurance Options Beyond Truck Insurance

Depending on your setup, you might need:

- Fleet insurance for multiple trucks or vehicles

- Home Insurance or Landlord Insurance to protect business-related properties

- Home Buildings coverage for owner-operators running from home

Get cover that fits your life, not just your truck.

Tips for Navigating the Truck Insurance Claims Process

Accidents happen. When they do, understanding the claims process can save you time, stress, and money.

What to Expect During Claims?

- For events like accidental loss, total loss, or property damage, your insurer will walk you through the required steps.

- You may need to submit documents, evidence, or repair quotes, stay organised.

- Liability claims and compensation claims can take longer, especially if third parties are involved.

Many insurers now offer a streamlined process online, and some (like VIM Cover) even assign a dedicated claims team to support you.

Importance of General Advice and Customer Support

- Reliable Customer Support can make or break your experience, especially during stressful situations.

- Seek general advice before committing to a policy or during a claim if you're unsure of your next step.

- Go with a provider that offers a wide range of insurance solutions, so you’re not left uncovered when it matters most.

It’s not just about getting your truck fixed. It’s about getting back on the road with confidence.

Types of Trucks Covered Under Commercial Vehicle Insurance

Whether you're hauling freight across states or running tools between worksites, your policy should match your vehicle type.

Here's what most commercial truck insurance policies can cover:

- Light trucks – often used by tradies, couriers, and small business owners

- Rigid trucks – ideal for local deliveries, moving services, or specialist freight

- Prime movers – used for long-haul freight, heavy haulage, and intermodal operations

- Mobile plant & mobile cranes – often used in construction and industrial settings

- Vehicles carrying dangerous goods require more tailored risk assessments

A quality Truck Insurance Policy should reflect how your vehicles are used for business purposes and the risks they face day-to-day.

Transit Insurance: Do You Need It?

If your trucks are carrying cargo, Transit Insurance can be a game-changer.

It covers accidental damage, theft, or loss of goods while in transit, which is especially crucial for freight companies and owner-drivers transporting high-value cargo or working with fragile or perishable items.

You can also extend this cover to include:

- Natural disasters (flood, fire, storm)

- Theft while parked overnight

- Third-party Fire and Theft for high-risk routes

Is Fleet Insurance Better for Growing Businesses?

Running more than a few vehicles? Fleet Insurance can often provide:

- Bulk discounts across all registered vehicles

- Easier renewals with one policy, not ten

- Streamlined claims and admin

Fleet cover is ideal for transport operators, logistics businesses, and companies with business vehicle insurance needs across multiple locations or drivers.

Even small businesses with just three or four trucks can often access entry-level fleet solutions.

Do You Need Life Insurance as a Truck Operator?

It might not be the first thing on your mind, but if you're an owner-driver, business partner, or running a transport company, Life Insurance matters.

- It protects your family or business if something happens to you

- Can be bundled with other products (like Travel Insurance and Boat Insurance) if your operations involve different risk areas

Many insurance providers now offer business-focused life cover with flexible options based on your risk level and financial situation.

Secure the Right Truck Insurance Quote for Your Business

Getting the right truck insurance quote shouldn’t take hours or guesswork. At VIM Cover, we make the process fast, clear, and built for your business.

Whether you run one prime mover or manage a whole fleet, we’ll help you find the right balance of cost, coverage, and compliance. Our tailored options protect against accidental damage, property damage, lost income, and legal liability, with add-ons like Downtime Cover, Transit Insurance, and Fleet Insurance when needed.

We also know your time is valuable. That’s why we offer a 60-minute quote turnaround, no hassle, no hold-ups. Get started now.

FAQs

1. How fast can I get a quote from VIM Cover?

In certain circumstances, you’ll receive your quote in under 60 minutes, tailored to your vehicle type and business needs.

2. Is Downtime Cover worth it?

Yes, it helps you recover lost income while your truck is off the road due to repairs or damage.

3. What trucks can I insure?

We cover light trucks, rigid trucks, prime movers, and vehicles transporting dangerous goods or mobile plant.

4. What factors affect my insurance cost?

Your driving history, claims history, business use, and carrying capacity all influence your truck insurance cost.

5. What is a Target Market Determination?

It outlines the intended recipients of the policy. Always review the Target Market Determination and policy documents before making a purchase.

6. Can I insure multiple vehicles under one policy?

Yes, our Fleet Insurance solutions make it easy to manage cover for several trucks at once.

7. Will my policy cover legal fees?

Most policies cover legal liability, including third-party claims for property damage or personal injury.

8. Can I get help choosing a policy?

Absolutely. Our team offers general advice and support to help you make the right call. You can contact us by either filling out the form or giving us a call.

**This article provides general information only and does not take into account your specific circumstances. You should seek advice from a licensed insurance professional before making decisions.