What Does Public Liability Insurance Cover?

Table of Contents

ToggleKey Takeaways

- Pubic liability insurance is intended to safeguard businesses from claims made by third parties for bodily injuries or damages to property caused by business activities.

- This is particularly important for self-employed professionals, small business proprietors, and individuals working in public environments, visiting clients, or having customers come to their location.

- Alongside compensation and the legal and claims investigation expenses, the policy cover excludes injuries to employees, poor quality, and cyber risks from coverage.

- Your line of work and contracts determine the cover amount needed, and the insurance may differ based on the business.

- Working with business insurance specialists helps you choose the right level of cover and avoid gaps.

- Insurance brokers like VIM Cover in Australia meet real-world business needs and contractual obligations with specially designed cover options.

Understanding Public Liability Insurance Coverage

What is Public Liability Insurance?

Every business, regardless of size, may be exposed to physical and financial harm to a third party. Public Liability Insurance protects the business against claims of personal injuries or property damages, which otherwise leaves the business to incur huge compensation expenses, along with the costly legal fees.

Picture a customer slipping in your shop in Sydney or a tradie accidentally damaging a client’s property while working on-site in Melbourne. Without cover, you could be personally responsible for the cost of the claim. With a proper insurance policy, those expenses are managed for you.

VIM Cover offers policies designed for Australian businesses, so whether a small business owner running a café in Brisbane or operates as a contractor in Perth, your cover reflects the specific risks you face.

Who Needs Public Liability Insurance?

In Australia, a considerable number of small to medium-scale enterprises hold public liability insurance as a business requirement drafted by the landlords, councils, or contractors. The sole traders, freelancers, and small business operators who interact with customers directly are more susceptible to these risks.

It’s essential for:

- Businesses operating in shopping centres or local markets.

- Trades working on construction job sites.

- Home office professionals who welcome clients to their property.

- Beauty professionals provide personal services to customers.

In some industries, proof of a Public Liability policy is a condition of getting work. Having cover in place shows you take responsibility for the safety of your customers and the wider public.

What Does Public Liability Insurance Cover?

Public liability insurance explained simply: it protects you if your work or premises cause harm to other people or their property.

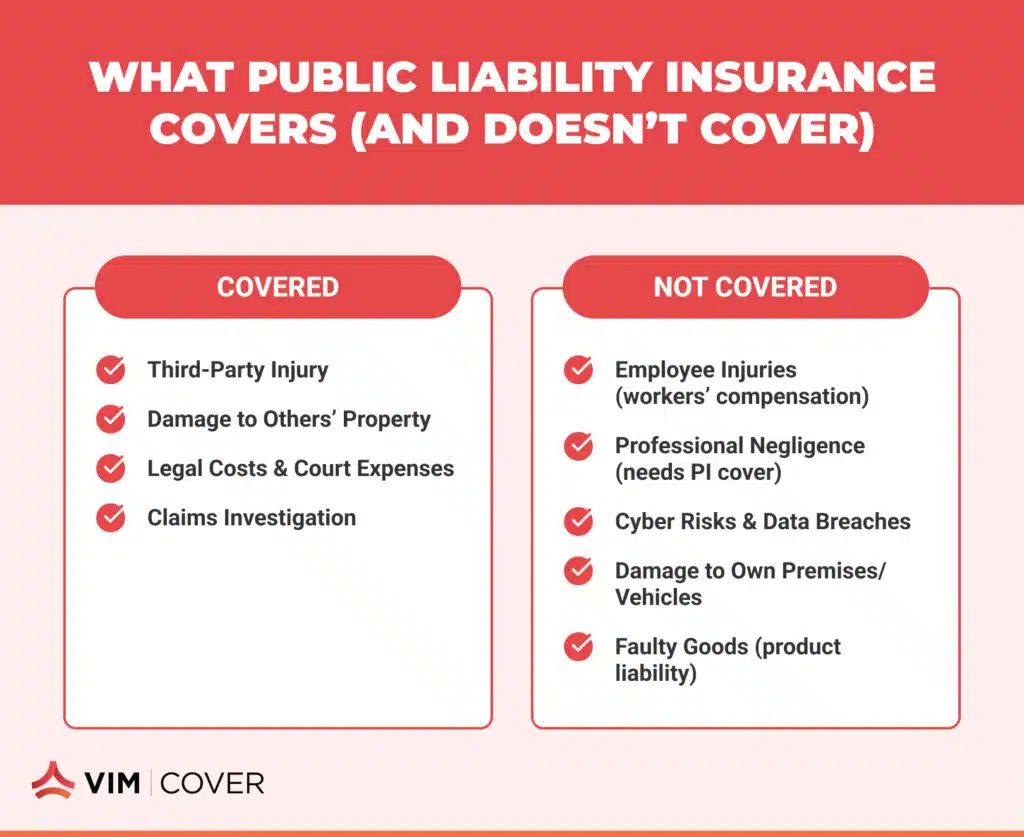

Typical cover includes:

- Compensation for third-party injury.

- Repair or replacement costs for damaged business premises or personal belongings that don’t belong to you.

- Legal action and the associated legal costs if a claim is taken to court.

Imagine a client who trips over an extension cord in your Adelaide office or who, in a meeting in Hobart, pours hot coffee on a customer’s lap. In both cases, public liability insurance may pay for these expenses. VIM Cover assists Australian businesses to tailor their Public Liability Insurance Cover to their specific needs, thereby eliminating the issues of overinsurance and gaps in cover.

What Isn’t Covered by Public Liability Insurance?

Public liability insurance doesn’t cover every type of risk. Some matters fall under different policies:

- Errors in advice or work that are dealt with through Professional Indemnity Insurance.

- Injuries to staff that require workers’ compensation insurance under Australian law.

- Contractual liability or machinery breakdown.

- Cybercrime or data breaches, which need cyber insurance.

- Damage to your own business premises or motor vehicles.

- Faulty goods that require product liability insurance.

Exclusions are particularly relevant when it comes to Australia, given that different rules or insurance obligations may exist in its various states and territories. VIM Cover defines what is and isn’t covered so that additional policies or protections can be arranged if necessary.

Choosing the Right Public Liability Policy for Your Business

Factors That Influence Policy Coverage

Required levels of cover may vary depending on the work, location, and any applicable contractual obligations. For instance, a council in New South Wales may mandate a certain minimum public liability insurance for market stallholders, whereas a landlord in Victoria may have different criteria.

Other factors include:

- The nature of your work and the potential liabilities involved.

- The policy wording and full details of what’s covered.

- Your budget and cash flow.

- Any specific legal requirements in your industry?

Taking the time to compare options ensures you meet obligations without paying for unnecessary extras.

Why Seek Help From Business Insurance Specialists?

The last thing you would like to see is a policy misunderstanding during a claim. When it comes to business insurance specialists, they will guide you on what is appropriate for your financial situation. They clarify definitions, revealing the nuances, and see the value in additions like income protection or contents cover.

VIM Cover provides this guidance for Australian businesses, making sure your Public Liability policy fits your industry and keeps you compliant with local requirements.

How to File a Public Liability Insurance Claim

Steps to Ensure a Successful Claim

If you need to make a Public Liability claim in Australia, these steps can help:

- Record the incident immediately with photos, witness names, and medical or repair reports.

- Notify your insurer promptly for direction on what to do next.

- Submit all required documents, including your Public Liability Insurance cover details.

- Cooperate with investigations and keep communication clear and timely.

- Check your policy wording to confirm the incident is covered.

Common Challenges During Claims

Claims can take longer to resolve if documents are not filled out, or when the Public Liability Insurance Applied is not clear for the specific case. Also, disputes regarding contractual liability and disputes regarding cover limits are the most common issues.

Working with a responsive insurance broker like VIM Cover helps you navigate these hurdles. The clearer your policy is at the start, the smoother the claims process will be.

Key Insights on Public Liability Insurance

As for Australian businesses, Public Liability Insurance is a requirement. It offers protection from claims that emerge from ordinary interactions, including legal costs, compensation, and business disruption, which are costly.

Every business, even if it’s a sole trader working at a local market or a developing business owning multiple sites, utilises Public Liability policies. With a reputable Australian insurance broker such as VIM Cover, you are able to attain both peace of mind and protection, letting you concentrate on your work and knowing that any unforeseen circumstances are covered.

FAQs About Public Liability Insurance

- Is public liability insurance mandatory in Australia?

Public liability insurance is not required by law for all businesses; however, several industries, landlords, and councils do make it part of their operating conditions. For instance, at some markets and on some construction sites, stallholders and contractors are required to obtain proof of insurance before they start work.

- How much public liability insurance do I need?

The business, the contract, and the evaluation of risk determine the correct value of insurance coverage. Some businesses only need a couple of million dollars of coverage, while others might need upwards of $20 million. Always make it a point to review the contracts and have a conversation with an insurance advisor to determine the most appropriate coverage.

- Does public liability insurance cover employees?

Public Liability Insurance does not cover employees. Injuries of employees are taken care of under workers’ compensation insurance, which is compulsory in Australia. Public liability insurance only takes care of third parties, such as customers and guests.

- What’s the difference between public liability and professional indemnity insurance?

Public liability covers the injury or damage to the property of other people as a result of an accident. Professional indemnity covers financial losses resulting from advice given, services provided, or mistakes made, as well as losses of meritorious work. It is beneficial for many businesses to hold both types of insurance.

- How do I claim public liability insurance?

Insurers need to be notified as soon as possible. Alongside the notice, supporting documents need to be sent as well, which can include photographs, medical documents, and invoices related to the repairs. The claim has a better chance of getting approved if you collaborate with the insurance company regarding the needed documents and information for their investigation.

**This article provides general information only and does not take into account your specific circumstances. You should seek advice from a licensed insurance professional before making decisions.