Comprehensive Plant Insurance for Businesses in 2026

Key Takeaways: Plant Insurance

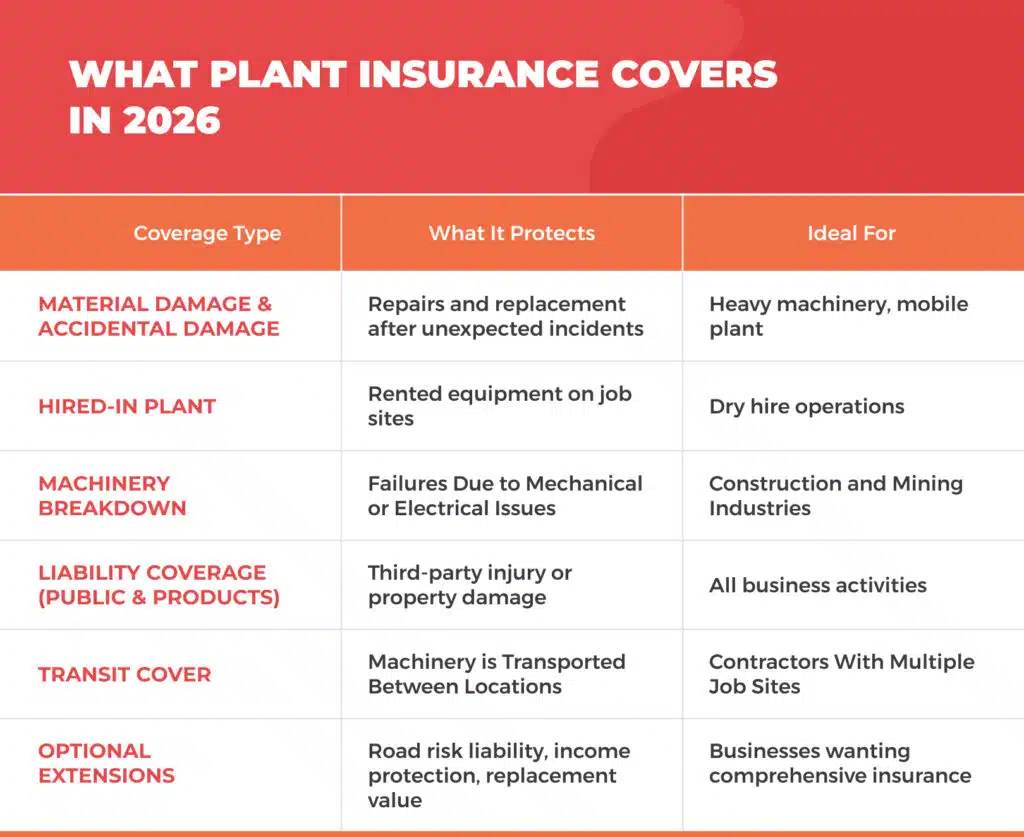

- Plant insurance is an excellent way to protect business assets and equipment from risks such as Material Damage, accidental damage, and total loss.

- The insurance policy covers various equipment, including bobcats, scissor lifts, earthmoving tools, and farming machinery.

- Businesses enjoy the advantages of tailor-made insurance cover, including Hired-in Plant, Machinery breakdown, and liability coverage.

- Plant insurance can help reduce disruptions, as it covers property damage, breakdown cover, road risk liability, and other such things.

Entrepreneurs all over Australia seem to be entering the year 2026 with the mentality of handling even more work than last year. They also have to meet more deadlines and manage the expansion of the sites where they operate. Constantly, it seems, heavy machinery and other mobile equipment are the leading actors of this expansion. Thus, the risk of machinery failure or property damage is even more significant. Plant insurance is thus the instrument that ensures the safety of the machinery with which your operations are carried out every day.

Here at VIM Cover, we often see our clients encounter insurance challenges that evolve as their businesses grow. Consequently, selecting the right insurance is more than just a decision of signing paperwork; it becomes an integral part of safeguarding your reputation, your investment, and your future.

Table of Contents

ToggleWhy Plant Insurance Is Essential for Your Business

Plant insurance can be an important form of equipment protection for many industrial or commercial businesses, depending on their needs.

Whatever the case may be with you, whether you provide crane hire services or are the manager of a fleet of heavy machinery, the assets of your business still require the safeguards that are effective across all job sites.

Such cover may protect mobile plant and equipment against Material Damage, accidental damage, and total loss, depending on the policy wording. The insurance may be available for earthmoving machines, bobcats, agricultural machinery, scissor lifts, and small portable tools, subject to insurer acceptance.

Moreover, a good Equipment Insurance Policy will have a component of public liability insurance and Products Liability that will offer you protection in case your plant item causes property damage or injures a person. Considering the machines are hardly ever at the same site for long and are continuously transported, Transit cover provides greater assurance that they will be there throughout the relocation. Note however that coverage during relocation is subject to policy terms, conditions, and limits.

Insurance Options for Plant & Equipment Owners

Since every business is unique, it is essential to have adaptable insurance options. You might require full insurance cover for your heavy machinery, while at the same time, you may want dry hire insurance if you are simply using the hired-in plant. Additionally, many business needs require the inclusion of cover options for Machinery breakdown so that you can remain operational in the event of a sudden equipment failure.

Specific policies may offer options such as market value or replacement value, depending on the product and insurer. In 2025, insurance companies are presenting fewer limitations and more options, such as road risk liability, breakdown cover, Broadform liability, income protection, and Optional extensions for single items or a wide range of equipment.

These decisions are instrumental in determining the kind of insurance program that is most suitable for your exact insurance needs, whether you are a small business or managing large-scale infrastructure projects.

Why Choose VIM Cover for Your Plant Insurance

Insurance specialists offer guidance based on experience in the Australian insurance market. They offer expert advice to those who understand the Australian insurance market. Companies rely on us to provide guidance on available insurance options – a policy that is based on their business, the risks of the industry, and the type of cover they prefer.

Our equipment policies can be tailored to cover a wide range of the business, from Mobile Plant and Machinery Insurance to dry hire insurance and crane hire operations. We help our clients select policies that ensure the sum insured aligns with the tangible business assets, so that every plant item is adequately protected.

How Plant Insurance Supports Business Owners

Therefore, plant insurance is one of the most valuable supports a business owner can have in his liability coverage concerns at active job sites. Especially where it is a known fact that heavy machinery is constantly used in such places, this insurance product facilitates the business’s operations by ensuring its assets are protected against rising value.

Therefore, your cover will stay relevant as risks evolve with insurers and brokers constantly communicating the latest insurance market news and updates. If you want machinery and equipment that are well protected, get in touch with a VIM Cover broker for tailored guidance and a business-built-around solution.

Is your business equipment setup ready for any eventuality? Get advice from an expert who is familiar not only with your industry but also with your risks and the equipment you use daily.

Make the most of the VIM Cover broker to design a custom plant insurance plan that may help protect your equipment and support your operations, subject to policy terms and eligibility. Contact us today!

Disclaimer: The information provided is general in nature and does not take into account your objectives, financial situation, or needs. Before making a decision, consider whether the product is appropriate for you and review the relevant Product Disclosure Statement (PDS) and Target Market Determination (TMD). Coverage is subject to the insurer’s terms, conditions, limits, and exclusions.

FAQs

1. What are the typical components of plant insurance?

Essentially, the policy insures Material Damage, accidental damage, total loss, liability coverage, and, optionally, a breakdown cover based on your policy.

2. Are the pieces of equipment covered while they are in a vehicle?

Indeed, the Transit cover can be added to the protection of machinery in transit between job sites.

3. Is the coverage extended to Hired-in Plant?

Several policy provisions allow for Hired-in Plant, a feature that helps the business to keep a protective shield even when the equipment is not owned.

4. What is the way to determine the correct policy?

Working with a broker can help you understand available options and obtain general information about insurance products.