Comprehensive Light Truck Insurance Guide for 2026

At VIM Cover, we understand that every light truck operator has different needs, whether you’re moving goods across town, running a fleet of goods-carrying vehicles, or transporting dangerous goods. That’s why we offer customised light truck insurance policies, flexible cover options, and, for approved applicants, a fast 60-minute quote service to keep your business moving without downtime.

Key Takeaways:

- Light truck insurance is essential for goods-carrying vehicles up to 4.5 tonnes GVM, protecting against theft, damage, liability, and downtime losses.

- VIM Cover offers customised policies with optional add-ons like downtime cover, transit insurance, and dangerous goods protection.

- The right policy offers peace of mind with vehicle coverage, theft protection, accident liability, and business continuity support.

- Understanding your vehicle type, cargo value, and business operations is key to selecting the right level of coverage.

- VIM Cover’s 60-minute quote service ensures fast, tailored insurance solutions for businesses of all sizes.

- Bundling your truck insurance with life, travel, or home insurance can enhance your protection strategy.

- Opting for a provider like VIM Cover, known for transparency and strong support, can improve your claims experience.

Table of Contents

ToggleWhat Is Light Truck Insurance?

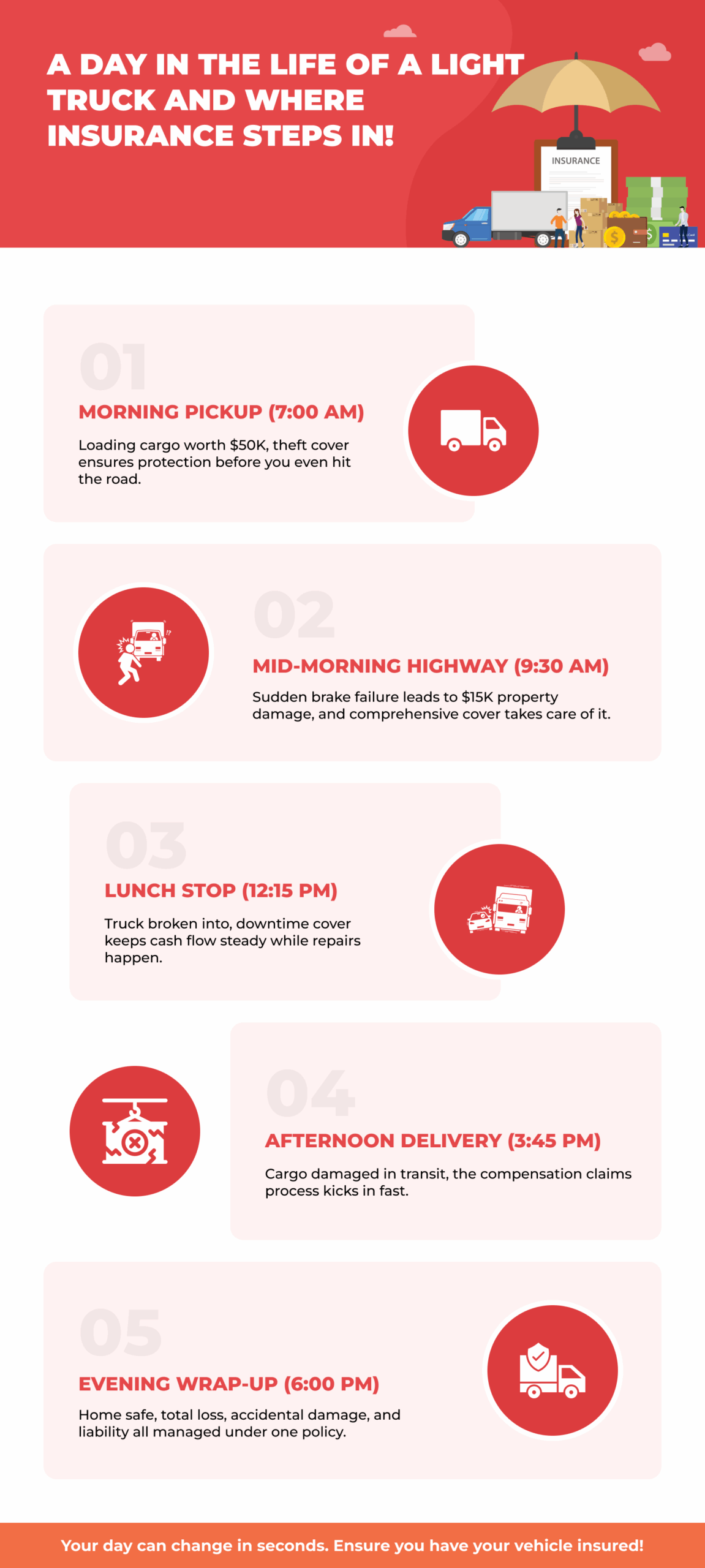

Light truck insurance is designed for goods-carrying vehicles with a specific carrying capacity, which is often up to 4.5 tonnes GVM and can be personalised for business use or personal purposes. It protects you from accidental damage, theft, property damage to other people’s property, and even total loss of your vehicle.

For businesses, this type of cover isn’t just a compliance tick; it’s a safeguard that keeps business vehicles on the road and earning a stable income (in case of any mishap), even after an insured event.

Understanding Light Trucks and Insurance Needs

Light trucks are versatile workhorses (as they call it) that range from delivery vans to small tippers, and their insurance needs vary from heavy commercial trucks. Policies are built to reflect:

- The carrying capacity and type of vehicle.

- Frequency and nature of business activities.

- Whether they carry dangerous goods, operate as mobile plant, or are used for mixed personal and business purposes.

An effective truck insurance policy ensures you’re covered for real-world risks, not just what’s written on paper.

Key Features of Light Truck Insurance

A strong, comprehensive truck insurance policy can include:

- Comprehensive cover for your vehicle and your property.

- Theft cover and accidental loss protection.

- Downtime cover to support your cash flow while your truck is off the road.

- Compensation claims for personal injury or damage caused to others.

The level of cover you choose will determine how well you’re protected when it matters most.

Why Businesses Need Light Truck Insurance?

Supporting Business Vehicles and Operations

For transport operators and owners of goods-carrying vehicles, light truck insurance is more than a formality. It’s essential for keeping operations running, especially when dealing with dangerous goods or time-sensitive and/or perishable goods delivery.

During an insured event, having the right cover can help with repair costs, replacements, and even provide a temporary hire vehicle to keep jobs moving.

Small Business Insurance Benefits

Many insurers offer small business insurance packages that combine comprehensive coverage for trucks with other insurance products. These can be customised for:

- Specialised freight

- Mobile plant transport

- High-value goods

- Multi-vehicle fleets

It’s not just about protection, it’s about peace of mind for owners and employees.

Choosing the Right Light Truck Insurance Policy

Factors to Consider

Before selecting a truck insurance policy, weigh your:

- Type of vehicle and carrying capacity.

- Driving history and risk profile.

- Level of cover, including downtime cover and comprehensive coverage.

- Specific clauses in the Policy Wording and relevant Product Disclosure Statement.

Working with Insurance Brokers and Providers

An experienced insurance broker can help you clearly understand the aspects of the insurance, cut through the jargon, compare cover options, and match you with an insurance provider that fits your financial situation and specific needs. Choose providers with a clear Target Market Determination and responsive customer support to guide you through the claims process.

Additional Insurance Products to Consider

For businesses looking to protect more than just their trucks, pairing your commercial motor cover with other insurance products can strengthen your safety net:

- Home insurance – To protect personal property from damage or theft.

- Travel Insurance – For business or personal trips involving valuable goods.

- Boat Insurance – For commercial or personal watercraft.

- Life Insurance – Ensures financial stability for your family or business partners if the unexpected happens.

- Transit insurance – Covers goods in transit from pickup to delivery.

Ready to protect your business?

Get a customised VIM Cover light truck insurance quote in under *60 minutes. Speak to our team today for personalised cover recommendations.

Protecting Your Business with the Right Cover

The right policy cushions your business from costly disruptions and keeps operations running smoothly. It’s about matching insurance to the real risks you face, not paying for what you don’t need.

- Downtime cover to offset income loss during repairs

- Protection for high-value or sensitive cargo

- Add-ons for dangerous goods and mobile plant

- Policy terms that fit your vehicle type and workload

Learn more about how to get a truck insurance quote in 2026.

Why Choose VIM Cover for Light Truck Insurance?

When it comes to protecting your business vehicles, you need more than just a standard policy; you need a partner who understands the risks and challenges you face every day.

VIM Cover offers:

- Comprehensive truck insurance for a wide range of vehicle types and carrying capacities.

- Flexible extras like downtime cover, transit insurance, and customised policy wording for your specific needs.

- A proactive and responsive customer support.

- Our 60-minute turnaround for quotes for qualifying applicants.

Schedule an appointment with us today!

FAQs – Light Truck Insurance

Q: Can I get a light truck insurance quote quickly with VIM Cover?

Yes. In certain circumstances, VIM Cover offers a 60-minute rapid quote service so you can get insured without delays.

Q: Does VIM Cover offer cover for dangerous goods or mobile plant vehicles?

Absolutely. Our truck insurance policies can be tailored for dangerous goods, mobile plant, and other specialised uses.

Q: What makes VIM Cover different from other insurance providers?

We combine comprehensive coverage with personal service, flexible policy design, and fast turnaround times, all while ensuring your specific needs are met.

Q: Can I bundle my light truck insurance with other products at VIM Cover?

Yes. You can combine your truck cover with options like home insurance, travel insurance, or life insurance to protect more of what matters to you.

**This article provides general information only and does not take into account your specific circumstances. You should seek advice from a licensed insurance professional before making decisions.