Comprehensive Food Truck Insurance for 2026

Discover unparalleled protection for your food truck insurance needs with VIM Cover’s comprehensive food truck insurance policies. Designed for Australian truck owners, our policies ensure affordability and reliability, keeping you secure on every journey. We offer a rapid quote for approved applicants. Please fill out the form below to receive a fast quote.

Table of Contents

ToggleKey Takeaways on Food Truck Insurance

- Food trucks face double exposure: road accidents + customer liability.

- A single food poisoning claim can cost thousands in legal fees.

- Equipment breakdowns or food spoilage can stop operations overnight.

- Tailored insurance helps protect cash flow and keeps you compliant.

- VIM Cover offers customised policies with fast claims support.

Food trucks face risks beyond the kitchen. A road accident can damage your vehicle and equipment, spoiled stock can wipe out profits, and legal fees can be incurred in cases of food poisoning or other allergies. Unlike restaurants, food trucks are exposed to both road mishaps and other safety liabilities. These uncertainties make it essential to have a more business-focused and personalised insurance, which allows you to run your business with minimal worry. The right cover not only protects your cash flow and keeps you compliant but also ensures your mobile business stays open after an unexpected setback.

Why Food Truck Insurance is Crucial for Your Business?

Unlike a fixed restaurant, your food truck is both your motor vehicle and your business premises, meaning you carry double the exposure on the road and in service. That’s why the right food truck insurance isn’t optional; it’s essential. Also, it’s equally important to have the right type of insurance that matches your business and its running.

For operators, it’s worth noting that insurers in Australia must meet regulatory standards set by APRA (Australian Prudential Regulation Authority), ensuring you’re dealing with a licensed and compliant provider. This gives food truck owners confidence that their policy is backed by a regulated and trustworthy insurance company.

Unique Risks Food Trucks Face

It includes:

- Accidental damage – This includes vehicle damage, such as a minor prang, or even if a vehicle is written off, including accidental damage to cooking equipment, which prevents any immediate service.

- Food poisoning & personal injury – Costly legal claims can arise due to foodborne illness or a slip near your service window.

- Food spoilage & equipment breakdown – If your fridge fails overnight or your generator cuts out at a festival, spoiled stock is money lost.

- Legal liability – Every public interaction, from parking in crowded areas to serving hot food, exposes you to potential compensation claims.

- Optional covers – Extra protection, such as cash flow cover, can keep bills paid if downtime stops you from trading.

How Insurance Protects Operators?

Let’s understand some of the standard insurances:

- Personal accident & workers’ compensation covers truck owners and their staff in case of mishaps, which include burns, cuts, or other injuries sustained while at work.

- Medical expenses & legal costs – In case a customer sues over injury or illness, your business insurance policy can handle the hospital bills and lawyer fees.

- Insurance claim support – A good provider ensures that claims for insured events, such as theft, breakdowns, or accidents, are processed quickly, thereby reducing downtime.

- Peace of mind for operators – With cover in place, food truck owners can focus on what matters most: serving customers and growing the mobile business without the constant worry of “what if.”

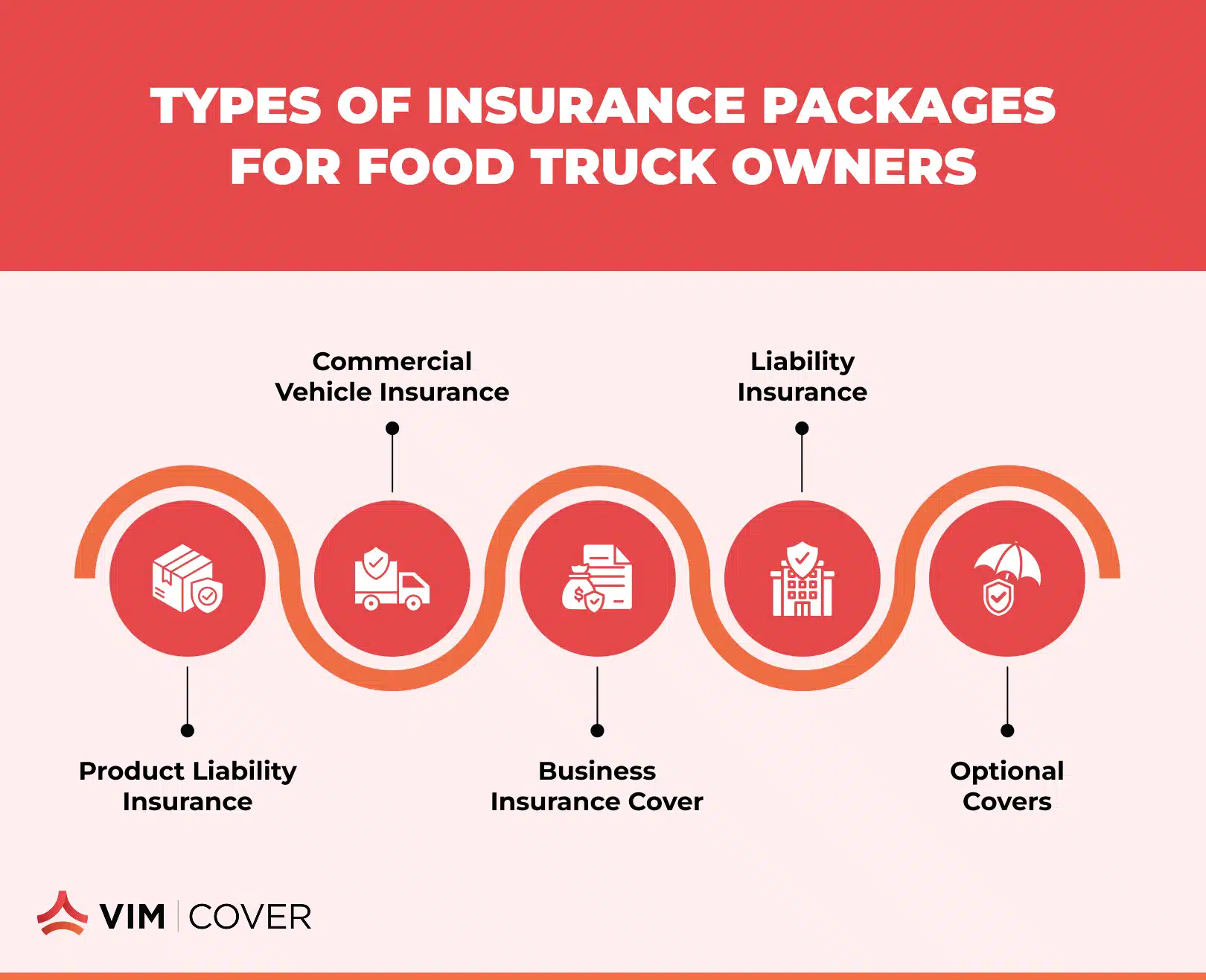

Types of Insurance Packages for Food Truck Owners

Product liability insurance protects against claims of:

- food poisoning

- allergic reactions

- Covering legal fees and compensation.

Commercial vehicle insurance covers:

- the truck itself,

- repairs after accidental damage,

- fit-out and cooking equipment inside.

Business insurance cover extends to:

- stock, cash

- portable equipment

- losses from theft, fire, or food spoilage.

Liability insurance protects against:

- Legal costs if a customer or third party suffers personal injury

- Property damage during the course of business activities.

Optional covers, such as equipment breakdown or downtime protection, help:

- stabilise income when generators fail

- fridges stop working

- You are unable to operate due to an insured event.

It’s advisable to read and understand policy wordings and Product Disclosure Statements before signing up for any particular insurance cover to avoid claim issues.

How VIM Cover Provides Superior Insurance Solutions?

We understand that no two mobile food trucks are alike and have specific business needs. Irrespective of whether you run a coffee van, a gourmet burger truck, or a multi-vehicle fleet, customisable insurance packages allow you to pick and choose the level of accidental loss you would like to cover. We offer a rapid quote for approved applicants. Please fill out the form below to receive a fast quote.

Unlike one-size-fits-all insurance providers, we work through experienced insurance brokers who focus on understanding your day-to-day risks. Based on your business operations, we suggest that you opt for comprehensive cover that extends to business premises, staff, and broader business activities. Our flexible cover options let you choose the best for your business.

What sets us apart from many insurance companies is our fast and transparent claims process. Food truck operators don’t have time for paperwork delays; their streamlined approach ensures you’re back on the road as quickly as possible. The policy terms are written to reflect the realities of mobile businesses, avoiding unnecessary coverage and reducing higher premiums that other providers often charge.

Protect Your Mobile Food Business with the Right Coverage

A tailored business insurance quote from VIM Cover ensures you only pay for what truly matters — no unnecessary extras, just the right cover for the risks your food truck faces daily. Policies are designed around your actual operations, whether you run a coffee van with portable generators, a gourmet burger truck with high-value cooking equipment, or a fleet serving significant events.

Coverage can extend to:

- Breakdowns & spoilage – protection when fridges, freezers, or generators fail.

- Liability claims – cover for food poisoning, personal injury, or property damage caused during service.

- Business interruption – income support when an insured event forces you to stop trading.

By securing a plan built for your business model, you safeguard cash flow, meet legal liability requirements, and keep your mobile business operational with minimal disruption. Protection is not just compliance; it’s a guarantee that you can stay on the road and serve customers with peace of mind.

FAQs About Food Truck Insurance with VIM Cover

- Does food truck insurance cover both the vehicle and kitchen equipment?

Yes. With VIM Cover, policies can bundle commercial vehicle insurance with coverage for cooking equipment, refrigeration, and fit-outs, ensuring your entire mobile setup is protected under one plan.

- What happens if food spoilage occurs due to a power failure?

Food spoilage caused by equipment breakdown or power outages can be included in your policy. VIM Cover helps you recover costs so your cash flow isn’t disrupted.

- Can I insure multiple food trucks under one policy?

Absolutely. VIM Cover offers fleet policies for operators with multiple trucks, making it easier and often more affordable to manage insurance for your mobile business.

- How does VIM Cover handle claims for food poisoning incidents?

If a customer files a claim for food poisoning or personal injury, your liability coverage will take effect. VIM Cover ensures a transparent and fast claims process, minimising downtime and legal costs.

- Are there flexible insurance options if I only operate seasonally?

Yes. VIM Cover can tailor cover options for seasonal food truck operators, so you’re only paying for the protection you need when your business is active.

**This article provides general information only and does not take into account your specific circumstances. You should seek advice from a licensed insurance professional before making decisions.