How to Get a Commercial Property Insurance Quote in 2025

Table of Contents

ToggleKey Takeaways

- You can obtain quotes from licensed insurance brokers such as VIM Cover

- VIM Cover offers a range of insurance options designed to meet diverse business needs.

- A commercial property insurance quote helps maintain the safety of your business premises and the things that are valuable to you.

- Firstly, check your cover, Policy Wording, and sum insured thoroughly before making a purchase.

In 2025, the commercial insurance area is still changing due to brand-new property risks, digital tools, and the increasing complexity of business operations. Today, obtaining a commercial property insurance quote is more than just comparing prices. It is about ensuring the policy effectively protects your assets, is financially feasible for you, and aligns with your business goals.

It doesn’t matter whether you are a property investor, a retailer, or a manufacturing company; knowing how to secure the right Commercial Property Insurance coverage is essential for your mental well-being and financial stability. We will figure out how to get you a quote that fits your exact needs and, at the same time, ensure your business is safe from unforeseen losses.

What Is Commercial Property Insurance?

Commercial Property Insurance is designed to safeguard your commercial building, its contents, and related assets from unforeseen events that could lead to financial losses. It typically includes insurance cover for incidents such as accidental damage, theft, storm damage, and water damage, ensuring your property and business operations are not disrupted.

For business owners, this insurance acts as a financial shield. Beyond protecting the office building or commercial premises, it may include compensation for business interruption cover, loss of rental income, or expenses required to repair or replace damaged assets.

Understanding Commercial Property Insurance Cover

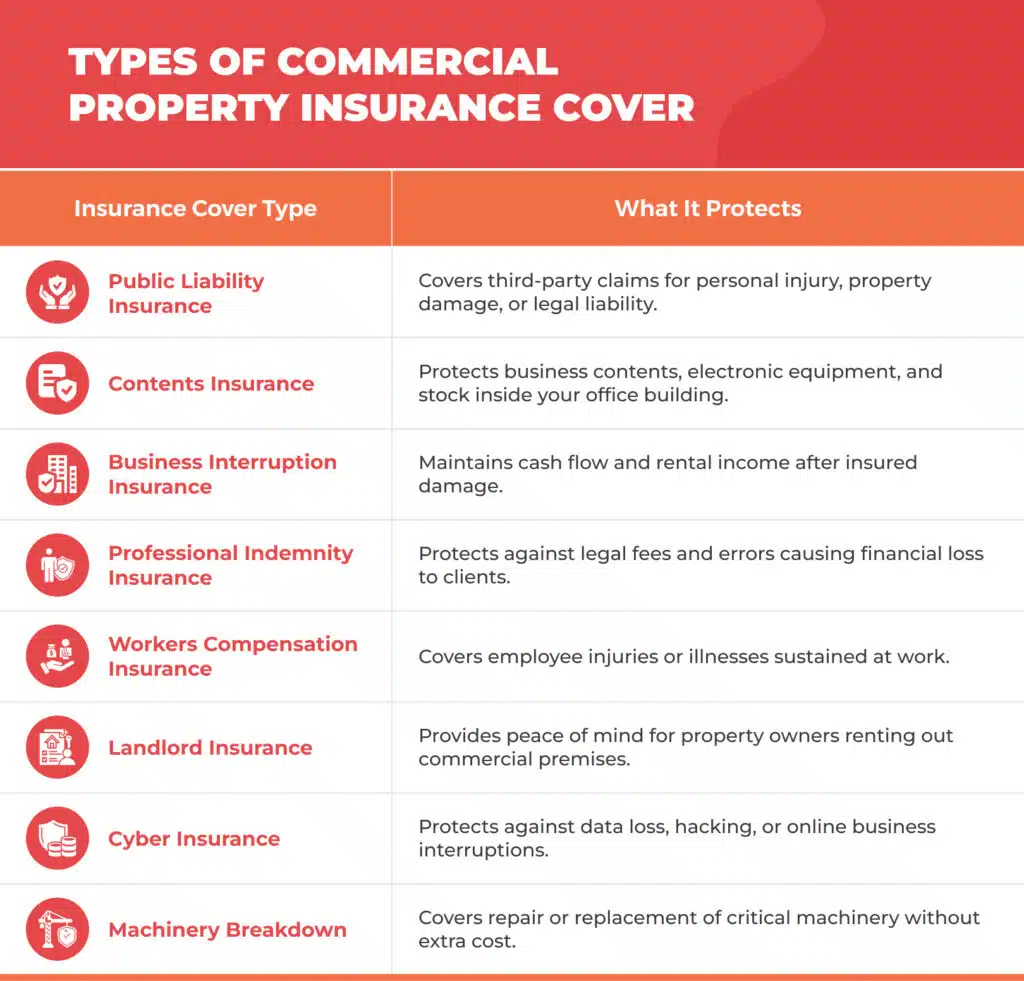

An effectively designed business insurance plan offers safeguards across various risk categories. Your insurance package may consist of:

- Public Liability Insurance – Covers the cost of a third-party claim resulting from personal injury, property damage, or legal liability due to your operations.

- Contents Insurance – Covers the business contents, electronic equipment, and other movable assets in your business premises.

- Business Interruption Insurance – It is a type of insurance that helps maintain cash flow when operations are temporarily halted due to a covered event.

- Professional Indemnity Insurance – This is a must for professionals who provide advice or services, and it covers them against legal fees and negligence claims.

- Workers’ Compensation Insurance – It is the insurance that pays for employee injuries or illnesses caused by work and complies with the law’s requirements.

Certain insurers also offer optional cover for Machinery Breakdown, Cyber Insurance, and landlord insurance. These additions not only broaden the coverage of your Business Insurance pack but also let you feel safe when handling possible interruptions.

Why Business Owners Need It

Having a commercial building is like inviting a series of property risks – fire and vandalism, as well as natural disasters and accidental damage. Just one incident without adequate protection can put your finances under severe pressure and may even disrupt your cash flow.

With a customised policy, Business Insurance is a great tool for business owners to get back on their feet quickly, keep their operations running, and still make a profit in the event of a contingency. Additionally, the coverage package includes a liability shield that protects against lawsuits from the general public, customers, or contractors. In this way, you not only ensure your professional reputation but also the continuity of your business.

How to Request a Commercial Property Insurance Quote

In the year 2025, if you want to get a precise commercial property insurance quote, you will need to have the correct information, be clear and know what level of cover you require. Present-day insurers provide both online quote systems and personalised consultations with a business insurance specialist.

Steps to Get Started

How to start the work:

- Clearly define your business and describe your primary business activities

- Perform a survey of your business premises describing the place, its size, and its intended use.

- Calculate the replacement cost and sum insured for your property and assets.

- Make a list of cover options that you require and possible optional covers that you may want (e.g., Theft cover, Public Liability cover, or business interruption insurance).

With such information at hand, you can contact trustworthy insurance providers. Vim Cover, for instance, provides an online quote form and an option to request a callback if you need personalised assistance.

Essential Information to Prepare

To get a detailed business insurance quote, you will have to provide:

- Details about the property of your commercial building or office building

- The policy documents of the current coverage (if there are any)

- Information on business vehicles, motor vehicles, or the use of commercial vehicles

- Claims history and risk management practices

- Approximate rental income and the business contents and electronic equipment details, if any

It is always a good practice to review the Product Disclosure Statement, Policy Wording, and Terms & Conditions related to your policy before confirming it. These documents describe the exclusions, the legal liability limits, and your policy schedule, thereby providing transparency and complying with the insurer’s requirements.

Features of a Comprehensive Business Insurance Policy

Coverage Options Included

A comprehensive Business Insurance policy will typically cover a combination of different protection areas, including:

- Public Liability Insurance cover for third-party as well as Public & Products Liability claims

- Contents Insurance provides cover for property and electronic equipment

- Business interruption insurance offers the essential ongoing cash flow support

- Cover against storm damage, glass breakage, as well as accidental damage

Additional Cover for Enhanced Protection

Contemporary insurance companies are aware that customers require tailor-made solutions. You can upgrade your insurance plan by adding:

- Workers’ Compensation Insurance to cover the welfare of employees

- Professional Indemnity Insurance to cover the risks associated with client-facing activities

- Cyber Insurance to cover the occurrence of data breaches or damage to the system

- Boat Insurance or Life Insurance to provide a more comprehensive portfolio protection

These optional components constitute a fully-fledged Business Insurance Pack that can be adjusted to your particular requirements and provides you with an extended period of peace of mind.

Comparing Commercial Property Insurance Quotes

When comparing policies from different insurers, focus on the level of cover, exclusions, and claim support, not just price. Be watchful of:

- Policy Wording, terms and conditions, and extent of cover

- Replacement cost and sum insured figures

- Any additional charges for tailor-made cover options

Expert advice from Business Insurance Specialists will assist you in understanding the small print, being in accordance with the rules, and making the process of the claim efficient in case you need to file one.

Why Choose VIM Cover for Your Business Insurance in 2025

VIM Cover is a licensed Insurance broker that business owners, sole traders, and small business insurance customers can depend on. With its comprehensive understanding of risk management and property damage claims, the company can offer you a tailored business insurance policy solution that matches your business needs.

The company’s customer support team is always willing to help you with policy selection, renewal, and paperwork, providing support along the way. In case you are looking for a cover for your Commercial Property Insurance, Public Liability Insurance, or Workers Compensation Insurance, VIM Cover would be your partner in securing affordable protection that would genuinely give you peace of mind.

Property damage or an unpredicted claim should not be the reason that your business is disrupted. Obtain a personalised Commercial Property Insurance quote from VIM Cover now to ensure you are adequately covered. Note: Insurance cover is subject to underwriting approval and policy terms and conditions.

Get Your Free Quote Today. Contact our Business Insurance Specialists to find out the cover options that best fit your business.

FAQs

1. What are the components of a commercial property insurance quote?

The quote provides estimates for the coverage of your structure, its contents, and your liability protection. The estimates are based on your property’s risk profile.

2. Is there a way to cut down the cost of my business insurance?

Keeping a spotless record of claims, enhancing security, and seeking cost-saving changes from Business Insurance Specialists will help you reduce your insurance premiums.

3. Is it possible to combine property and vehicle insurance?

Sure. Many insurers offer packages that combine commercial vehicle, Car, and property coverage.

4. What is the procedure in place for the claims?

The steps include submitting an insurance claim form, providing proof of loss, and collaborating with your insurer to promptly evaluate and resolve the claim.