Small Business Public Liability Insurance: Everything You Need to Know

Small businesses venture on a journey full of both opportunities and risks. A company will always aim for growth and customer satisfaction. However, it is equally essential to ensure that the business is protected against unexpected claims. Public liability insurance for small businesses is among the most significant protective measures that any small business owner should consider.

Such a policy provides protection against legal fees, claims from third parties, and unexpected financial difficulties. In this blog, we will explore the components of public liability insurance, its importance for small businesses, and how to select the right policy for your specific insurance needs.

Key Takeaways

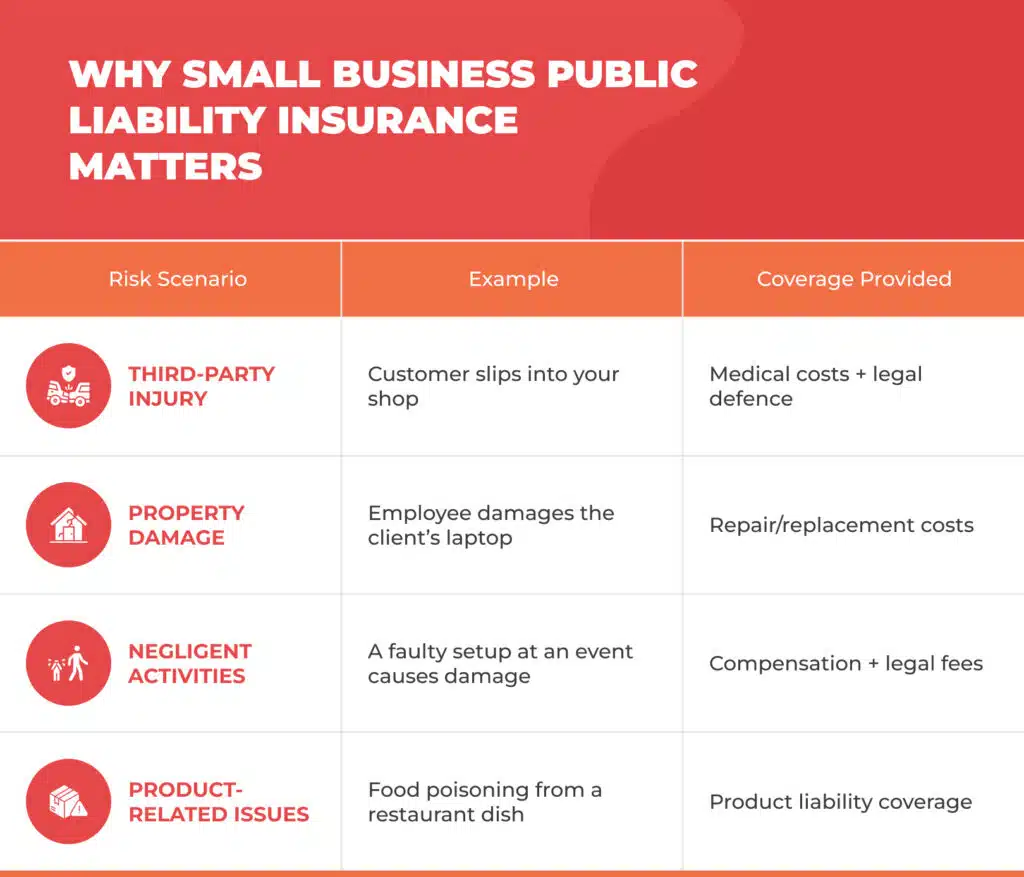

- Small business public liability insurance covers third-party injury and property damage.

- It includes compensation, defence costs, and related legal fees.

- Different from Professional Indemnity Insurance, it focuses on physical damage.

- Brokers and tailored insurance packages help small businesses get flexible cover.

Table of Contents

ToggleWhat is Small Business Public Liability Insurance?

Small business public liability insurance covers your company if third parties make a complaint that they have suffered personal injury, property damage, or have received another type of loss due to your business operations.

To illustrate, if a customer falls on uneven flooring in your store and sustains an injury, your public liability insurance may provide coverage for their treatment costs, as well as any legal expenses incurred if they file a lawsuit.

No doubt, even the most careful business owners can be hit by accidents. This insurance protects you from having to pay massive compensation claims on your own.

Why Public Liability Cover is Essential

Though the safest method is always preferred, accidents are sometimes inevitable. The aftermath of an incident for small businesses can be so huge and suffocating that it may be hard for them to recover. It is therefore not surprising that public and products liability insurance is regarded as one of the most essential types of insurance.

Protects Against Third-Party Injury and Property Damage Claims

Accidents can occur in any location, even if a person is extremely cautious. If someone slips, falls, or the property is damaged, and these incidents are related to your work, then the responsibility lies with your company.

Covers Legal Costs and Defence Expenses

Legal proceedings can be costly, no doubt. A policy of public liability insurance covers the expenses of the lawyer who will defend a case. It also provides coverage when the issue is not with you.

Supports Business Stability

Public liability insurance is often required when dealing with local authorities, landlords, or contractors, though requirements may vary by industry and region. Public Liability cover can afford you financial security, but it also creates a good impression of you.

How it Differs from Other Insurance Products

Business owners are often confused about the differences between public liability insurance and other types of policies. Recognising these differences will help you avoid being overwhelmed by extra coverage or losing the protection of your rights.

Public Liability vs Professional Indemnity Insurance

Public liability insurance covers only cases of physical injury and property damage directly caused to third parties. In contrast, professional indemnity insurance serves as a shield against financial losses resulting from the provision of professional advice, services, or negligence.

Consider a situation where a consultant gives incorrect advice. In this case, the consultant will then require an indemnity insurance policy. On the other hand, a café owner is required to have a public liability insurance policy to ensure the safety of customers.

Specialised Coverage for Premises and Negligent Activities

Public liability insurance typically includes coverage for events occurring at your location or resulting from your business’s carelessness, which is often excluded from other types of insurance.

Product Liability and Recalls

Few auto insurance policies cover product liability resulting from claims due to a product that was sold or made by the insured that caused harm. This option is generally the most important one in the mentioned industries, such as food and electronics.

Key Features of Business Insurance Packages

A smaller business rarely requires just one policy. On the other hand, business insurance cover can be more effective when combined with other insurances that match their field of work, such as public liability insurance.

Types of Cover for Business Needs

- Sole traders typically pair public liability insurance with product liability insurance.

- Commercial car insurance is just the right solution for work vans, delivery trucks, and cars.

- Business premises insurance protects against the destruction of buildings.

For example, the hospitality sector might have packaged cover for food poisoning or injuries that occur during the administration of first aid.

Flexible Business Insurance Solutions

Insurers offer a range of cover options in terms of payments, policy details, and target audience identification. Not only can the cover be tailored to the client’s specific requirements, but it can also be tailored to the client’s particular compliance aspects and financial situations.

Common Public Liability Claims and Coverage

It is only after examining real-world instances that the significance of insurance sometimes becomes evident. Small businesses in various industries often face similar types of claims, and understanding these claims highlights the benefits of public liability insurance.

Examples of Typical Claims for Small Businesses

- Customer injuries on your premises: A shopper falls on a wet floor, a café customer is burned by spilled hot coffee, or a gym member trips over equipment.

- Damage to third-party property: A tradesperson destroys a client’s driveway by unloading the heavy equipment, or a contractor breaks a window during renovations.

- Negligent business activities: A defective product injures a consumer, or an employee’s careless performance leads to the injury or loss of a person outside the business.

Although these situations may appear minor, they have the potential to escalate into compensation claims of thousands of dollars quite rapidly.

Understanding Legal Fees and Defence Costs

It is surprisingly one of the small businesses for which the cost of a legal defence, even in a minor legal case, is a significant financial burden. Legal bills can grow large very quickly, and if you don’t have insurance, they can be very costly. Small businesses often underestimate the number of legal processes they must follow.

- Coverage for Legal Liability: Public liability insurance provides coverage for lawyer fees, court costs, and settlements.

- Financial Loss Prevention: It eliminates the risk that your business may experience a cash flow issue due to the specified event.

- Extra Disbursements: Heavy industries may incur additional disbursements, such as safety investigations or regulatory penalties for non-compliance with safety standards.

How to Choose the Right Business Insurance Policy

Finding the right insurance policy for your business is more than just meeting the legal requirements. Such a business cover will guarantee your company’s uninterrupted operation in times of unexpected events. The large number of insurance products has made it necessary for small business proprietors to perform a complete evaluation of what fits their businesses the best, including the potential risks and available amounts of money.

Factors to Consider for Your Business Type and Size

Every business must deal with unique types of risks that are specific to that particular business. A small café faces the risk of the disappearance of the coffee it sells. On the other hand, an IT consultancy has a completely different risk profile. A sole trader’s specific needs are entirely different from those of a multi-staffed company that is growing. When going through policies, it is essential to consider a number of factors, including:

- The type of business: Retail businesses most likely require product liability insurance, whereas more service-oriented companies may need professional indemnity insurance in addition to public liability.

- Business size: The potential risk increases with the number of customers, staff, or locations.

- Cover limits: Choose an amount of cover that represents the worst-case scenario your business can face. For instance, a tradesperson operating in residential homes might be allowed to have lower limits than a contractor working in big commercial spaces.

Working with a Business Insurance Broker

For instance, if you’re unsure where to begin, a business insurance broker can simplify the process for you. Brokers assess your risks, compare policies from various companies, and recommend the most suitable solutions for you. Additionally, they can:

- Get an online quote that reflects the correct pricing for your insurance.

- Speak in simple terms about what is included in the cover.

- Ensure that you are fully covered and have your certificate of insurance ready for contracts or any other obligations.

The advice of a broker is highly beneficial for small businesses, especially when they are in a situation where they cannot afford to lack protection or pay an excessively high premium.

Protect Your Business with Public Liability Cover in 2025

The business environment will undoubtedly become increasingly complex in the future. Every year, rules become stricter, customers expect more, and new risks emerge. Public liability insurance must adapt to these changes.

Business owners of small businesses must ensure that their policies adequately cover the risks associated with their industry, possess the necessary policy documents, such as a certificate of currency, and comply with relevant insurance, tax, and legal requirements. This approach will equip your business to handle upcoming challenges better if adopted.

Not sure which cover best fits your small business? You can obtain tailored quotes from licensed insurance brokers such as VIM Cover and safeguard your business with public liability insurance. Get started today!

FAQs

Q1: Do all small businesses need public liability insurance?

Yes. A business of any size that has dealings with customers, suppliers, or the general public should have this cover.

Q2: How much cover for public liability do I require?

The level of cover is conditioned by your industry and the level of risk you are exposed to. The standard amount of coverage typically ranges from $5 million to $20 million.

Q3: Is public liability insurance a tax-deductible expense?

Yes. The payments for business insurance policies are typically deductible from the business’s taxable income, classified as a business expense.

Q4: Do employees have protection under public liability?

No. Staff injury claims will be satisfied through the workers’ compensation insurance scheme. Public liability is a safety net for the injured third party only.

This article provides general information only and does not take into account your specific circumstances. You should seek advice from a licensed insurance professional before making decisions.